Intro

Boost your trucking business with these 6 essential templates for truck driver profit and loss. Streamline your financial management with our expert-designed templates, covering income statements, expense tracking, and cash flow analysis. Optimize your operations, reduce costs, and increase revenue with our downloadable templates, tailored to the unique needs of trucking professionals.

As a truck driver, managing your finances effectively is crucial to ensure profitability and sustainability in the competitive trucking industry. A profit and loss statement is a vital tool that helps you track your income and expenses, identify areas of improvement, and make informed decisions about your business. In this article, we will discuss six essential templates for truck driver profit and loss statements, providing you with a comprehensive understanding of how to create and use them to optimize your financial performance.

Why Profit and Loss Templates Matter for Truck Drivers

A profit and loss template is a pre-designed spreadsheet that helps you calculate your income and expenses, ensuring accuracy and efficiency in your financial record-keeping. By using a template, you can save time and reduce errors, allowing you to focus on growing your business. A well-structured profit and loss statement provides a clear picture of your financial performance, enabling you to:

- Identify areas of high expenditure and optimize costs

- Monitor revenue trends and adjust your pricing strategy

- Make informed decisions about investments and resource allocation

- Improve your overall financial management and planning

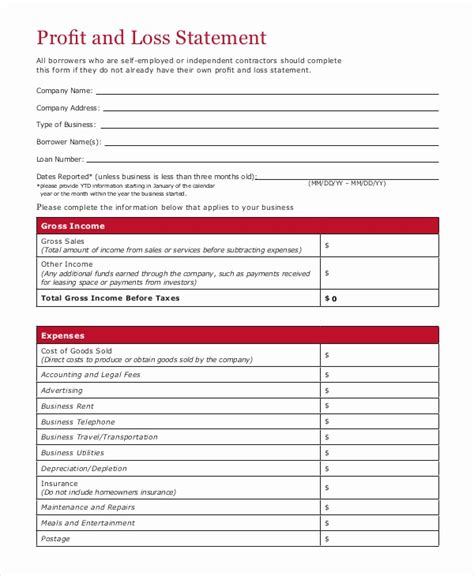

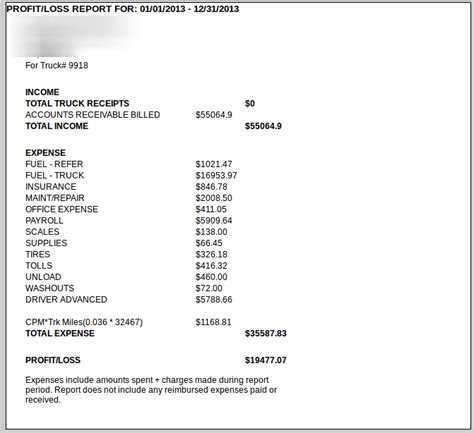

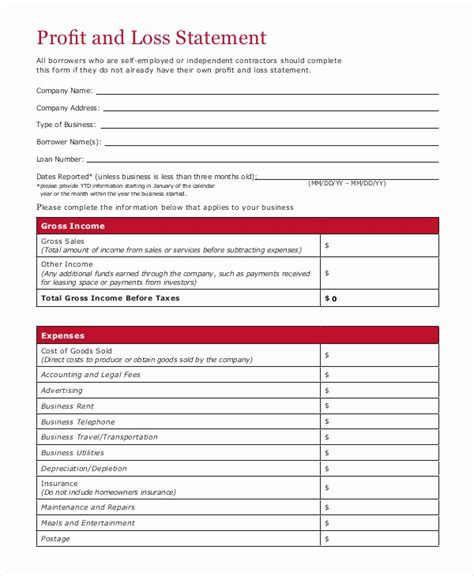

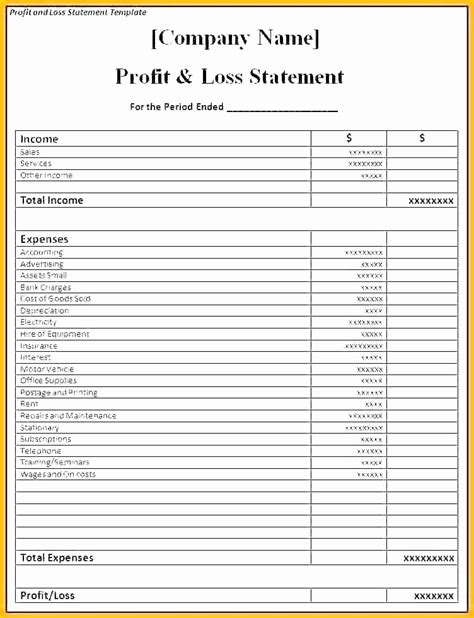

Template 1: Basic Truck Driver Profit and Loss Statement

This template provides a simple and straightforward structure for tracking your income and expenses. It includes sections for:

- Revenue: fuel surcharges, freight revenue, and other income

- Cost of Goods Sold: fuel, maintenance, and other expenses directly related to your trucking operations

- Operating Expenses: insurance, licensing, and other overhead costs

- Net Income: calculated by subtracting total expenses from total revenue

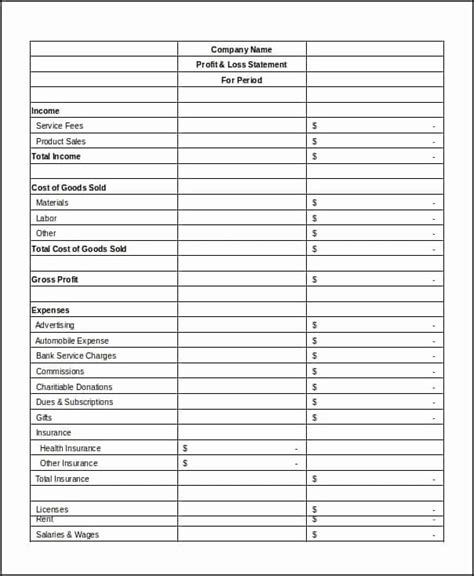

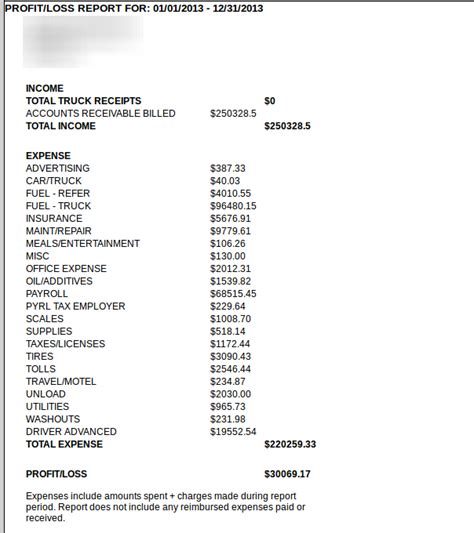

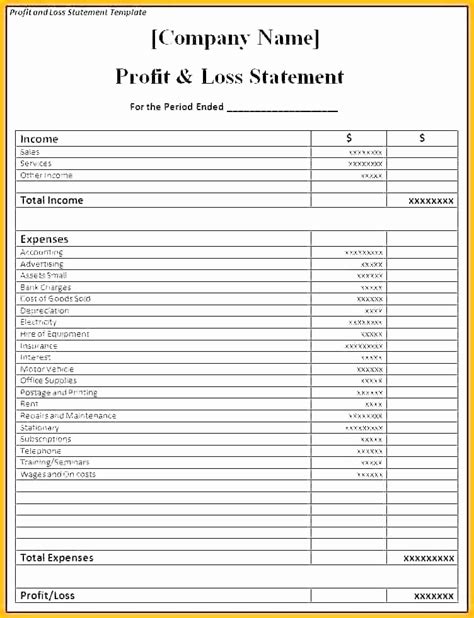

Template 2: Detailed Truck Driver Profit and Loss Statement

This template provides a more comprehensive structure for tracking your income and expenses, including sections for:

- Revenue: broken down by type (e.g., fuel surcharges, freight revenue, and other income)

- Cost of Goods Sold: detailed breakdown of expenses directly related to your trucking operations (e.g., fuel, maintenance, and repairs)

- Operating Expenses: categorized by type (e.g., insurance, licensing, and other overhead costs)

- Net Income: calculated by subtracting total expenses from total revenue

- Additional sections for tracking accounts payable, accounts receivable, and inventory

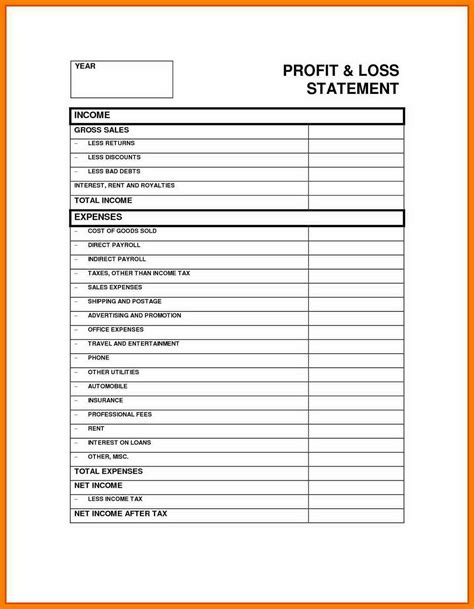

Template 3: Truck Driver Profit and Loss Statement with Depreciation

This template includes sections for tracking depreciation expenses, which are essential for truck drivers who own their vehicles. It includes:

- Revenue: fuel surcharges, freight revenue, and other income

- Cost of Goods Sold: fuel, maintenance, and other expenses directly related to your trucking operations

- Operating Expenses: insurance, licensing, and other overhead costs

- Depreciation: calculated based on the estimated useful life of your vehicle

- Net Income: calculated by subtracting total expenses from total revenue

Template 4: Truck Driver Profit and Loss Statement with Fuel Surcharges

This template includes sections for tracking fuel surcharges, which are essential for truck drivers who need to account for fluctuating fuel costs. It includes:

- Revenue: fuel surcharges, freight revenue, and other income

- Cost of Goods Sold: fuel, maintenance, and other expenses directly related to your trucking operations

- Operating Expenses: insurance, licensing, and other overhead costs

- Fuel Surcharges: calculated based on the number of miles driven and fuel prices

- Net Income: calculated by subtracting total expenses from total revenue

Template 5: Truck Driver Profit and Loss Statement with Multiple Vehicles

This template includes sections for tracking multiple vehicles, which is essential for truck drivers who own multiple trucks. It includes:

- Revenue: fuel surcharges, freight revenue, and other income for each vehicle

- Cost of Goods Sold: fuel, maintenance, and other expenses directly related to each vehicle

- Operating Expenses: insurance, licensing, and other overhead costs for each vehicle

- Net Income: calculated by subtracting total expenses from total revenue for each vehicle

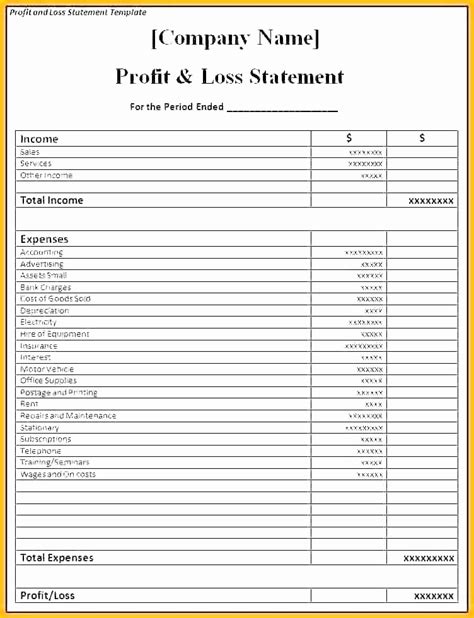

Template 6: Truck Driver Profit and Loss Statement with Accounts Payable and Accounts Receivable

This template includes sections for tracking accounts payable and accounts receivable, which is essential for truck drivers who need to manage their cash flow. It includes:

- Revenue: fuel surcharges, freight revenue, and other income

- Cost of Goods Sold: fuel, maintenance, and other expenses directly related to your trucking operations

- Operating Expenses: insurance, licensing, and other overhead costs

- Accounts Payable: outstanding invoices and bills

- Accounts Receivable: outstanding payments from customers

- Net Income: calculated by subtracting total expenses from total revenue

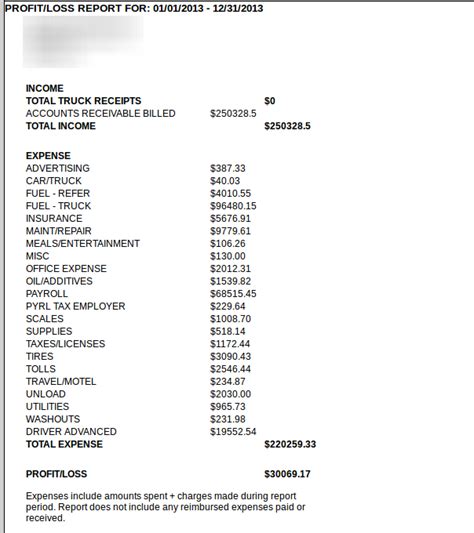

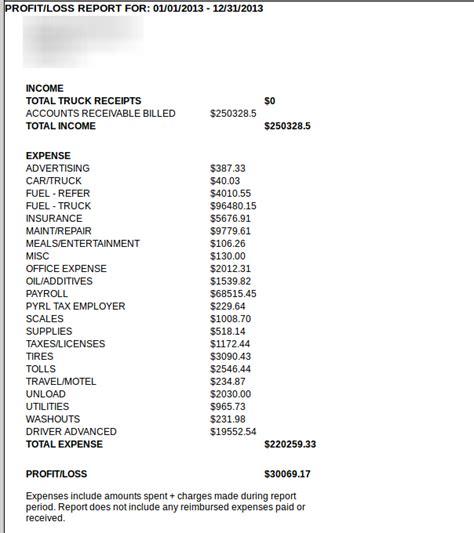

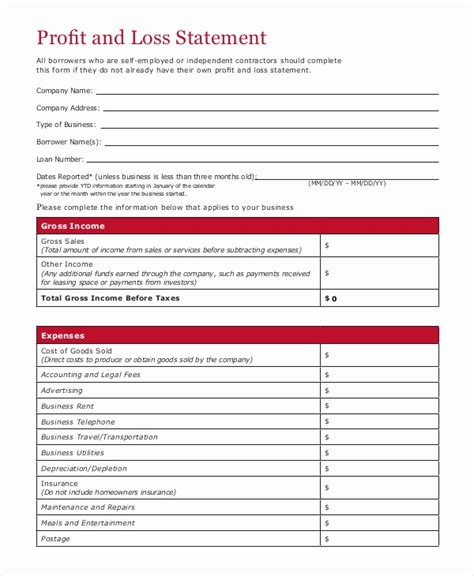

Gallery of Truck Driver Profit and Loss Templates

Truck Driver Profit and Loss Templates Gallery

Final Thoughts

Using a profit and loss template is essential for truck drivers who want to manage their finances effectively and optimize their business performance. By choosing the right template for your needs, you can save time, reduce errors, and make informed decisions about your business. Remember to customize your template to fit your specific needs and track your financial performance regularly to ensure the success of your trucking business.

We hope this article has provided you with valuable insights into the world of truck driver profit and loss templates. If you have any questions or need further assistance, please don't hesitate to comment below.