Intro

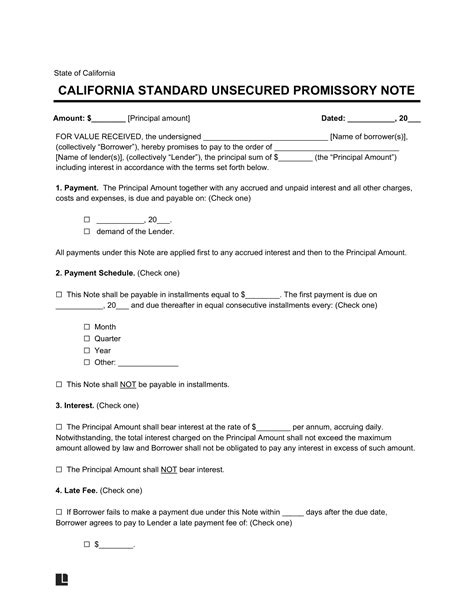

Download a free California Unsecured Promissory Note Template to establish a legally binding loan agreement. This template outlines loan terms, interest rates, and repayment schedules, ensuring borrower and lender protection. Customize for personal or business use, and understand the benefits of using a promissory note in California.

In the world of business and finance, a promissory note is a vital document that outlines the terms of a loan or debt agreement between two parties. A California unsecured promissory note template is a standardized document that provides a framework for lenders and borrowers to establish a clear understanding of their obligations and responsibilities. In this article, we will explore the concept of a promissory note, its importance, and how to access a free California unsecured promissory note template.

Understanding Promissory Notes

A promissory note is a written agreement that outlines the terms of a loan or debt agreement between two parties. It is a binding contract that requires the borrower to repay the loan amount, plus interest and fees, to the lender by a specified date. A promissory note typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral or security required.

In California, a promissory note is governed by the state's Uniform Commercial Code (UCC) and other applicable laws. This ensures that lenders and borrowers have clear guidelines and protections when entering into a loan agreement.

Types of Promissory Notes

There are several types of promissory notes, including:

- Secured promissory notes: These notes require collateral or security, such as property or assets, to secure the loan.

- Unsecured promissory notes: These notes do not require collateral or security and are based solely on the borrower's creditworthiness.

- Demand promissory notes: These notes allow the lender to demand repayment of the loan at any time.

- Installment promissory notes: These notes require the borrower to make regular payments, such as monthly or quarterly, to repay the loan.

Importance of a Promissory Note Template

A promissory note template provides a standardized framework for lenders and borrowers to establish a clear understanding of their obligations and responsibilities. Using a template ensures that all necessary details are included, and the agreement is legally binding.

A California unsecured promissory note template, in particular, is essential for lenders and borrowers in the state, as it complies with California's UCC and other applicable laws.

Benefits of Using a Promissory Note Template

Using a promissory note template offers several benefits, including:

- Ensures compliance with applicable laws and regulations

- Provides a clear understanding of the loan agreement and terms

- Saves time and effort in drafting a customized agreement

- Reduces the risk of disputes and misunderstandings

- Offers a professional and standardized format for loan agreements

Accessing a Free California Unsecured Promissory Note Template

Accessing a free California unsecured promissory note template is easy. There are several online resources and websites that offer free templates and sample forms. Some popular options include:

- Online legal document providers, such as Nolo or Rocket Lawyer

- Business and finance websites, such as Forbes or Entrepreneur

- Government websites, such as the California Secretary of State's website

When using a free template, it's essential to ensure that it complies with California's UCC and other applicable laws. It's also recommended to review and customize the template to suit your specific needs.

Customizing a Promissory Note Template

When customizing a promissory note template, consider the following:

- Review and update the template to ensure compliance with applicable laws and regulations

- Include all necessary details, such as loan amount, interest rate, and repayment schedule

- Add or remove sections as needed to suit your specific needs

- Use clear and concise language to avoid misunderstandings

- Have the template reviewed by an attorney or financial expert to ensure its accuracy and effectiveness

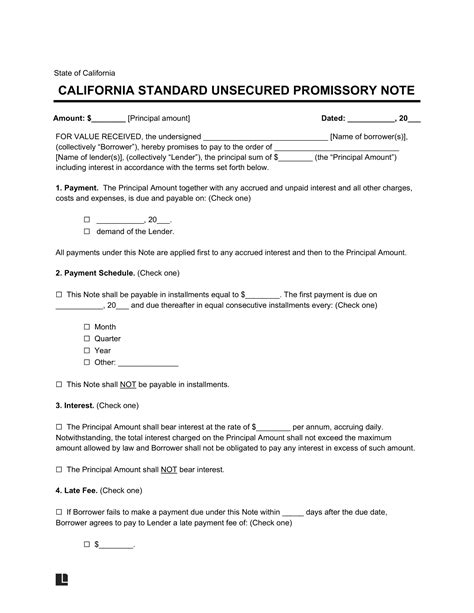

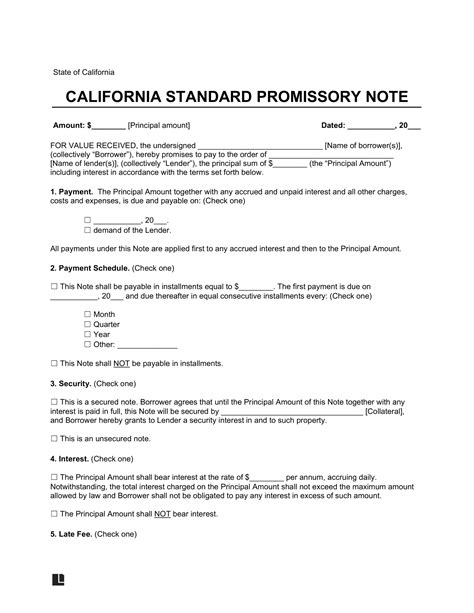

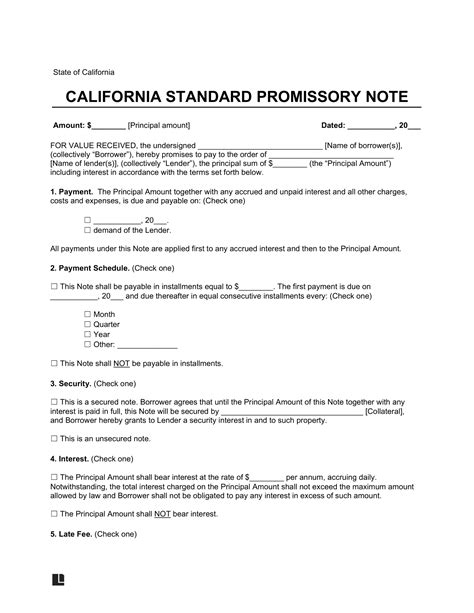

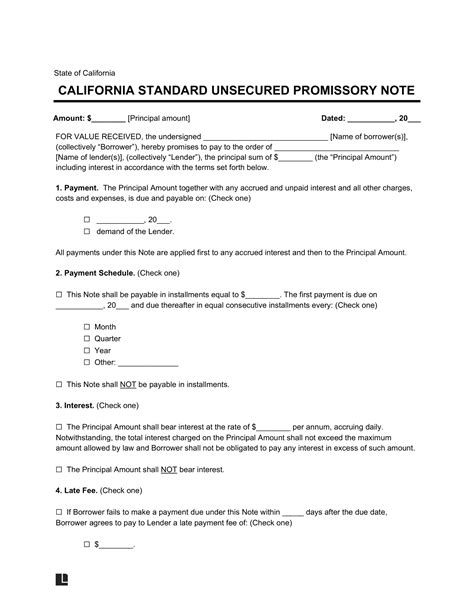

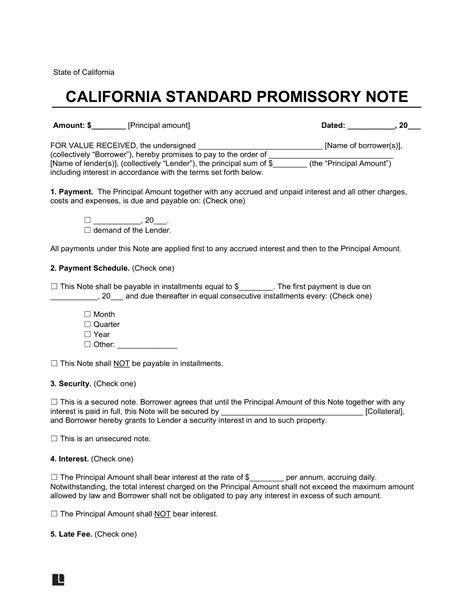

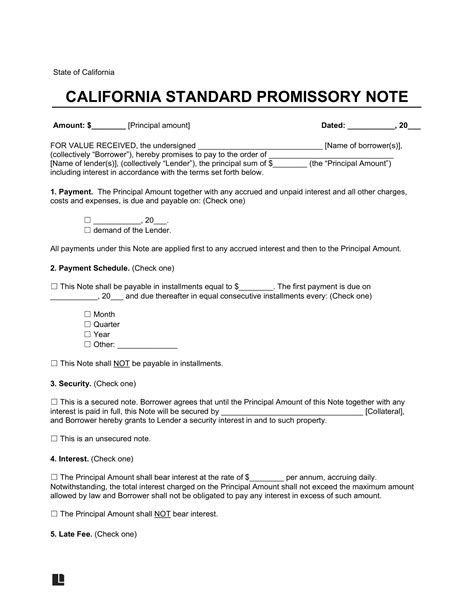

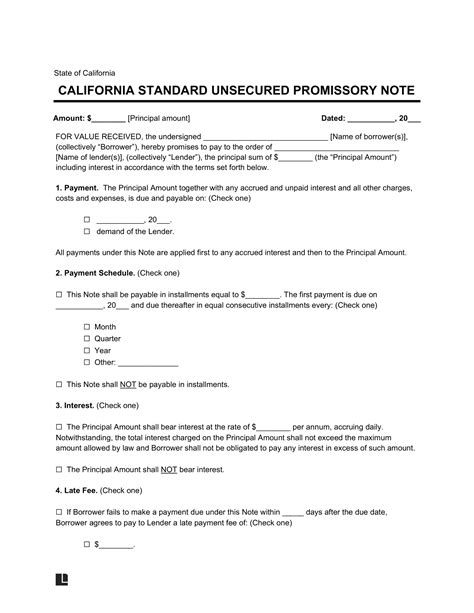

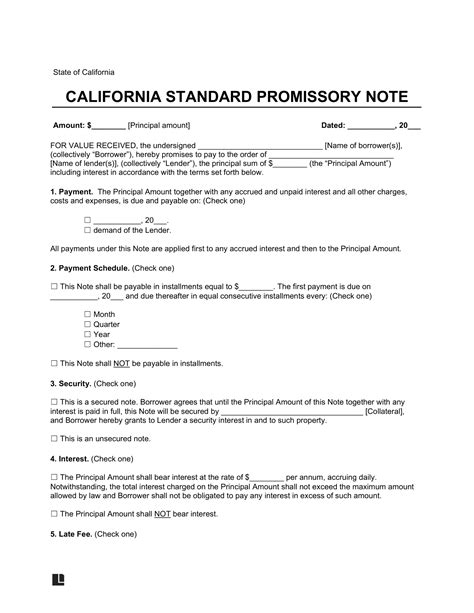

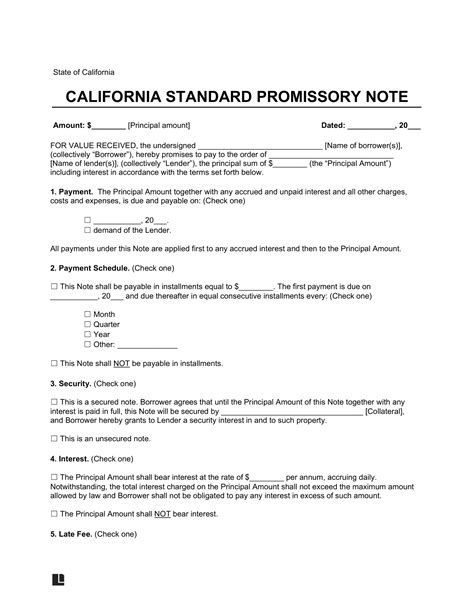

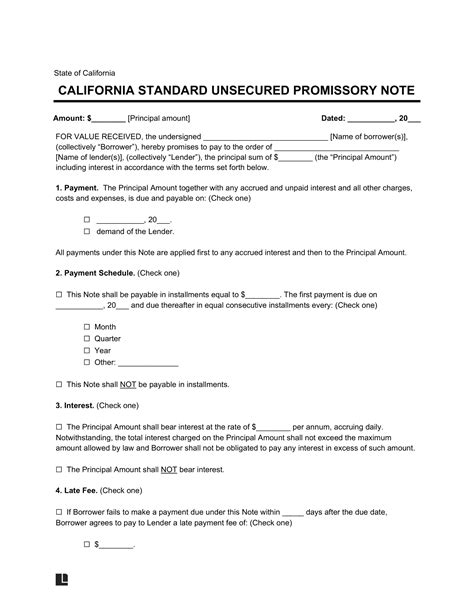

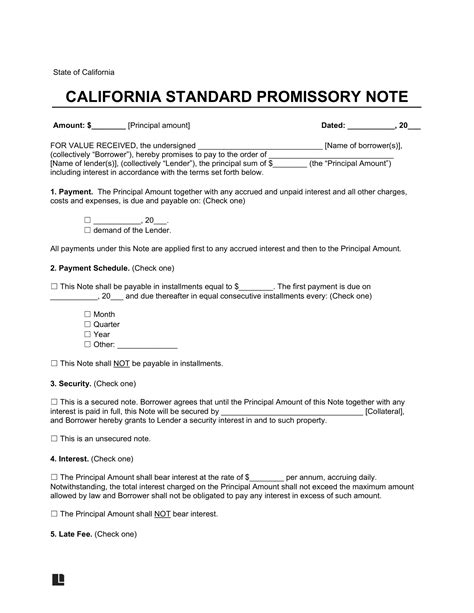

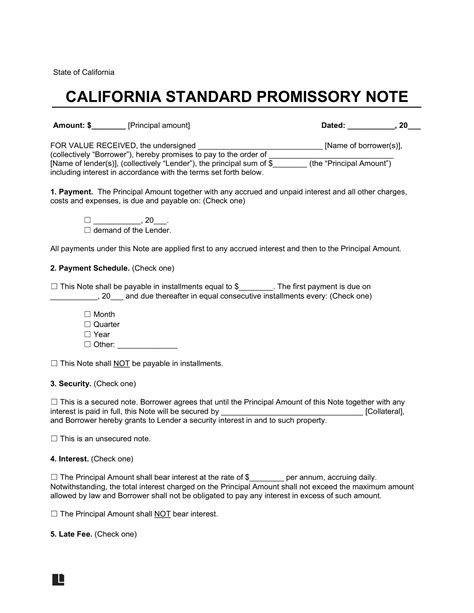

Gallery of California Unsecured Promissory Note Templates

California Unsecured Promissory Note Templates

Final Thoughts

A California unsecured promissory note template is an essential document for lenders and borrowers in the state. It provides a clear understanding of the loan agreement and terms, ensures compliance with applicable laws and regulations, and saves time and effort in drafting a customized agreement. By accessing a free template and customizing it to suit your specific needs, you can establish a strong foundation for a successful loan agreement.

We hope this article has provided valuable insights and information on California unsecured promissory note templates. If you have any questions or comments, please feel free to share them below.