Intro

Unlock the details of US National Guard pay with our comprehensive guide. Discover the 5 key ways pay works, including Drill Pay, Basic Allowance for Housing, Basic Allowance for Subsistence, and more. Learn about pay scales, benefits, and entitlements for Guard members, and get insider tips on maximizing your compensation package.

For many individuals, joining the US National Guard is a great way to serve their country while also earning a steady income and benefits. However, understanding how National Guard pay works can be a bit complex, especially for those new to the military. In this article, we'll break down the different components of National Guard pay and provide insights into how it works.

Drill Pay: The Foundation of National Guard Pay

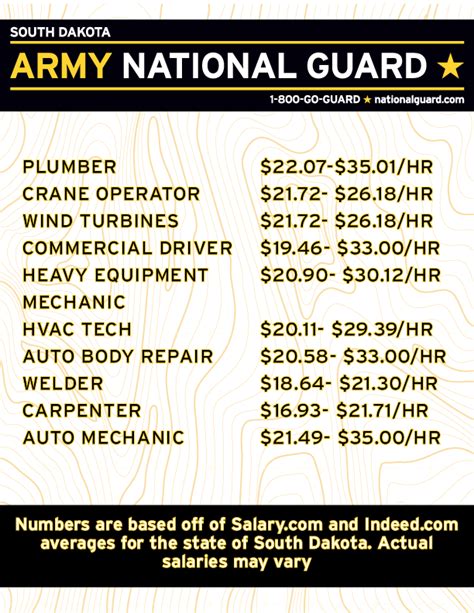

The foundation of National Guard pay is drill pay, which is the compensation members receive for their monthly drill periods and annual training. Drill pay is based on the member's rank and time in service, with higher-ranking members earning more than lower-ranking ones. Drill pay is typically paid on a scale, with the amount increasing as the member gains experience and promotions.

Annual Training (AT) Pay: Additional Income for Extended Training

In addition to drill pay, National Guard members also receive pay for their annual training (AT) periods. AT pay is typically paid at the same rate as drill pay, but it's usually paid for a longer period, typically 14-30 days. This additional income can help supplement a member's regular drill pay and provide a bit of extra financial cushion.

How National Guard Pay Works: A Deeper Dive

So, how exactly does National Guard pay work? Here's a step-by-step explanation:

Step 1: Drill Pay Calculation

The first step in calculating National Guard pay is to determine the member's drill pay. This is based on their rank and time in service, with higher-ranking members earning more than lower-ranking ones. Drill pay is typically paid on a scale, with the amount increasing as the member gains experience and promotions.

Step 2: AT Pay Calculation

The next step is to calculate the member's AT pay. This is typically paid at the same rate as drill pay, but it's usually paid for a longer period. AT pay can provide a significant boost to a member's income, especially if they're able to participate in extended training periods.

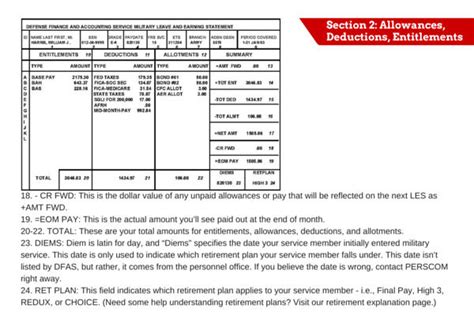

Step 3: Allowances and Benefits

In addition to drill pay and AT pay, National Guard members may also be eligible for various allowances and benefits. These can include things like housing allowance, food allowance, and education benefits. These allowances and benefits can help supplement a member's income and provide additional financial support.

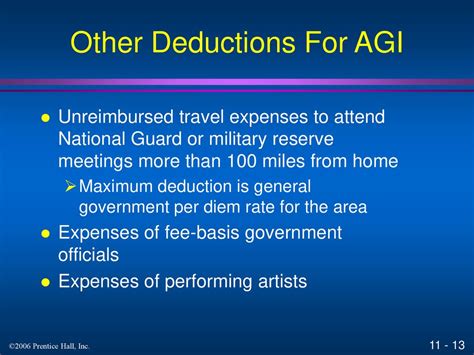

Step 4: Taxes and Deductions

Finally, it's worth noting that National Guard pay is subject to taxes and deductions, just like any other income. Members will need to report their drill pay and AT pay on their tax returns, and may be subject to deductions for things like health insurance and retirement contributions.

Special Pay: Additional Income for Special Duties

In addition to drill pay and AT pay, National Guard members may also be eligible for special pay. This can include things like:

- Hazardous duty pay: Members who perform hazardous duties, such as flying or diving, may be eligible for additional pay.

- Special duty pay: Members who perform special duties, such as serving as a drill instructor or recruiter, may be eligible for additional pay.

- Jump pay: Members who are parachute-qualified may be eligible for additional pay.

National Guard Pay and the GI Bill

One of the most significant benefits of joining the National Guard is the opportunity to use the GI Bill to pay for education expenses. The GI Bill can provide up to 100% tuition coverage for in-state students, as well as a stipend for books and supplies.

How to Use the GI Bill

To use the GI Bill, National Guard members will need to meet certain eligibility requirements, including:

- Serving at least six years in the National Guard

- Completing initial entry training (IET)

- Being in good standing with the Guard

Members who meet these requirements can use the GI Bill to pay for education expenses, including tuition, fees, and books.

Conclusion: Understanding National Guard Pay

National Guard pay can be complex, but it's a critical component of serving in the Guard. By understanding how drill pay, AT pay, and special pay work, members can better plan their finances and make the most of their military service. Whether you're a seasoned veteran or just starting out, it's essential to stay informed about National Guard pay and benefits.

Gallery of National Guard Pay and Benefits

National Guard Pay and Benefits Image Gallery

FAQs

Q: How much do National Guard members get paid? A: National Guard members are paid based on their rank and time in service, with higher-ranking members earning more than lower-ranking ones.

Q: What is drill pay? A: Drill pay is the compensation National Guard members receive for their monthly drill periods.

Q: What is AT pay? A: AT pay is the compensation National Guard members receive for their annual training (AT) periods.

Q: Can National Guard members use the GI Bill to pay for education expenses? A: Yes, National Guard members can use the GI Bill to pay for education expenses, including tuition, fees, and books.

Q: How do I become eligible for the GI Bill? A: To become eligible for the GI Bill, National Guard members must serve at least six years in the Guard, complete initial entry training (IET), and be in good standing with the Guard.