The world of auto loans can be overwhelming, with numerous lenders offering a wide range of interest rates and terms. For those in the market for a new set of wheels, it's essential to do your research and compare rates from various lenders to ensure you're getting the best deal. USAA is a popular choice for auto loans, especially among military members and their families. In this article, we'll delve into USAA auto loan rates, compare them to other lenders, and provide you with the information you need to make an informed decision.

When it comes to auto loans, interest rates play a significant role in determining the overall cost of the loan. A lower interest rate can save you thousands of dollars over the life of the loan, making it crucial to shop around and compare rates from different lenders. USAA is known for offering competitive rates, but how do they stack up against other lenders? In the following sections, we'll explore USAA auto loan rates, their benefits, and how they compare to other lenders in the market.

USAA Auto Loan Rates Overview

USAA auto loan rates are highly competitive, with rates starting as low as 2.99% APR for new cars and 3.49% APR for used cars. These rates are available for loan terms ranging from 12 to 84 months, giving you the flexibility to choose a term that suits your needs. USAA also offers a 0.25% rate discount for setting up automatic payments, which can help you save even more on your loan.

Benefits of USAA Auto Loans

USAA auto loans offer several benefits that make them an attractive choice for borrowers. These benefits include:

* Competitive interest rates: USAA rates are highly competitive, making them a great option for those looking to save on their auto loan.

* Flexible loan terms: USAA offers loan terms ranging from 12 to 84 months, giving you the flexibility to choose a term that suits your needs.

* No origination fees: USAA does not charge origination fees, which can save you money upfront.

* 0.25% rate discount: Setting up automatic payments can help you save even more on your loan.

* Exclusive membership benefits: USAA members can take advantage of exclusive benefits, such as discounts on insurance and other financial products.

Comparing USAA Auto Loan Rates to Other Lenders

To give you a better understanding of how USAA auto loan rates compare to other lenders, we've compiled a list of rates from popular lenders. Keep in mind that rates can vary depending on your credit score, loan term, and other factors, so it's essential to shop around and compare rates from multiple lenders.

* LightStream: 2.99% - 14.49% APR

* Capital One: 3.99% - 14.99% APR

* Bank of America: 3.99% - 14.99% APR

* Wells Fargo: 3.99% - 14.99% APR

* USAA: 2.99% - 12.99% APR

How to Get the Best Auto Loan Rate

To get the best auto loan rate, it's essential to do your research and compare rates from multiple lenders. Here are some tips to help you get the best rate:

* Check your credit score: Your credit score plays a significant role in determining your interest rate. A good credit score can help you qualify for lower rates.

* Shop around: Compare rates from multiple lenders to ensure you're getting the best deal.

* Consider a shorter loan term: While a longer loan term may lower your monthly payments, it can also increase the overall cost of the loan. Consider a shorter loan term to save on interest.

* Make a larger down payment: A larger down payment can help you qualify for lower rates and reduce the overall cost of the loan.

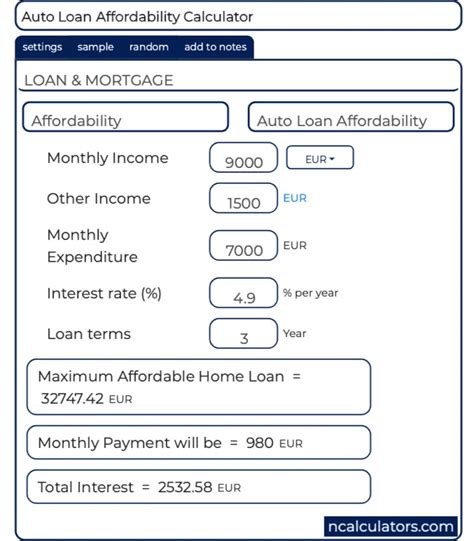

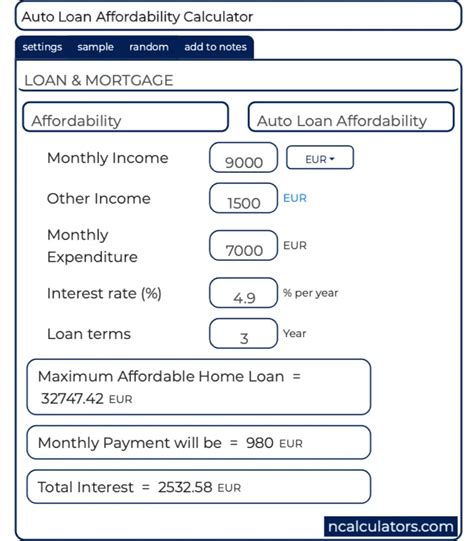

USAA Auto Loan Calculator

To give you a better understanding of how much you can expect to pay for your auto loan, we've included a USAA auto loan calculator. This calculator allows you to input your loan amount, interest rate, and loan term to calculate your monthly payment.

* Loan amount: $20,000

* Interest rate: 4.99% APR

* Loan term: 60 months

* Monthly payment: $377

USAA Auto Loan Reviews

USAA auto loans have received positive reviews from borrowers, with many praising the lender's competitive rates and flexible loan terms. However, some borrowers have reported difficulty with the application process and customer service.

* "I was able to get a great rate on my auto loan through USAA. The application process was easy, and the customer service was helpful." - Emily R.

* "I had some issues with the application process, but the customer service team was able to help me resolve the problem. The rates are competitive, and I'm happy with my loan." - David K.

USAA Auto Loan Requirements

To qualify for a USAA auto loan, you'll need to meet certain requirements. These requirements include:

* Membership: You must be a USAA member to qualify for an auto loan.

* Credit score: You'll need a good credit score to qualify for the best rates.

* Income: You'll need to have a stable income to qualify for a loan.

* Loan amount: The loan amount will depend on the value of the vehicle and your creditworthiness.

USAA Auto Loan FAQs

Here are some frequently asked questions about USAA auto loans:

* Q: What is the minimum credit score required for a USAA auto loan?

A: The minimum credit score required for a USAA auto loan is 620.

* Q: Can I apply for a USAA auto loan online?

A: Yes, you can apply for a USAA auto loan online or over the phone.

* Q: How long does it take to get approved for a USAA auto loan?

A: The approval process typically takes a few minutes to a few hours.

USAA Auto Loan Image Gallery

Final Thoughts

In conclusion, USAA auto loan rates are highly competitive, making them a great option for those looking to save on their auto loan. With flexible loan terms, no origination fees, and a 0.25% rate discount for setting up automatic payments, USAA auto loans offer several benefits that make them an attractive choice for borrowers. By doing your research and comparing rates from multiple lenders, you can ensure you're getting the best deal on your auto loan. We hope this article has provided you with the information you need to make an informed decision and find the best auto loan for your needs.

We invite you to share your thoughts and experiences with USAA auto loans in the comments below. Have you had a positive experience with USAA? Do you have any tips for getting the best auto loan rate? Share your story and help others make informed decisions about their auto loans. Additionally, if you found this article helpful, please share it with your friends and family who may be in the market for a new auto loan.