Intro

Discover 5 USAA loan rates for military members, including auto, personal, and mortgage loans, with competitive APRs, flexible terms, and exclusive benefits.

The world of loans can be overwhelming, especially when it comes to navigating interest rates and repayment terms. For members of the military and their families, USAA offers a range of loan options designed to provide affordable and flexible financing solutions. In this article, we'll delve into the world of USAA loan rates, exploring the various types of loans available, their corresponding interest rates, and what you need to know to make informed decisions about your financial future.

USAA, or the United Services Automobile Association, is a financial services company that caters specifically to the military community. With a mission to provide top-notch financial products and services, USAA has established itself as a trusted partner for those serving in the armed forces, veterans, and their families. One of the key benefits of USAA membership is access to competitive loan rates, which can help make borrowing more affordable and manageable.

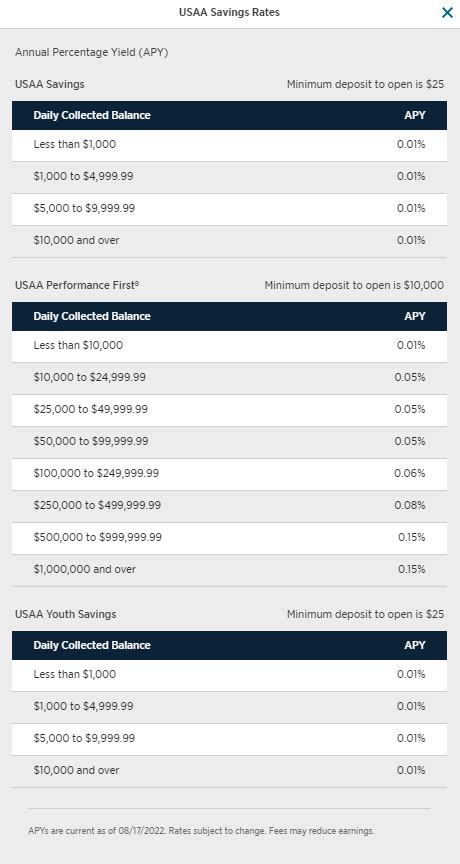

When it comes to USAA loan rates, there are several factors to consider. The type of loan you're applying for, your credit score, and the loan term all play a role in determining the interest rate you'll qualify for. USAA offers a range of loan products, including personal loans, auto loans, home loans, and more. Each of these loan types has its own set of interest rates and repayment terms, which we'll explore in more detail below.

USAA Personal Loan Rates

Benefits of USAA Personal Loans

Some of the benefits of USAA personal loans include: * No origination fees or prepayment penalties * Competitive interest rates * Flexible loan terms * Quick application and funding process * Access to financial counseling and resourcesUSAA Auto Loan Rates

Benefits of USAA Auto Loans

Some of the benefits of USAA auto loans include: * Competitive interest rates * No origination fees or prepayment penalties * Flexible loan terms * Quick application and funding process * Access to financial counseling and resourcesUSAA Home Loan Rates

Benefits of USAA Home Loans

Some of the benefits of USAA home loans include: * Competitive interest rates * No origination fees or prepayment penalties * Flexible loan terms * Quick application and funding process * Access to financial counseling and resourcesUSAA Loan Application Process

USAA Loan Requirements

To qualify for a USAA loan, you'll need to meet certain requirements, such as: * Being a USAA member * Having a good credit score * Having a stable income * Meeting the loan's debt-to-income ratio requirementsUSAA Loan Repayment Options

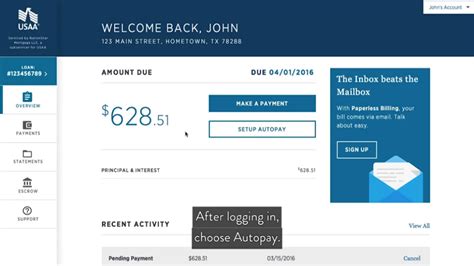

USAA Loan Repayment Benefits

Some of the benefits of USAA loan repayment options include: * Flexible repayment terms * No prepayment penalties * Ability to make extra payments * Access to financial counseling and resourcesUSAA Loan Customer Service

USAA Loan Customer Service Benefits

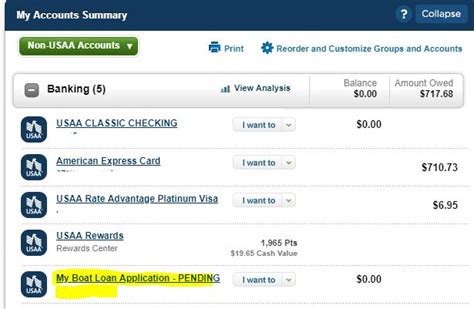

Some of the benefits of USAA loan customer service include: * 24/7 customer support * Access to financial counseling and resources * Ability to manage your loan online or by phone * Quick and easy application and funding processUSAA Loan Image Gallery

In conclusion, USAA loan rates offer a range of competitive and flexible financing options for members of the military and their families. With a variety of loan products, including personal loans, auto loans, and home loans, USAA provides affordable and manageable financing solutions. By understanding the USAA loan application process, repayment options, and customer service benefits, you can make informed decisions about your financial future. Whether you're looking to consolidate debt, finance a large purchase, or achieve your long-term financial goals, USAA loan rates are definitely worth considering. We invite you to share your thoughts and experiences with USAA loans in the comments below, and don't forget to share this article with anyone who may benefit from USAA's financial services.