Intro

Discover expert 5 USAA refinance tips, including loan options, interest rates, and credit score requirements, to help veterans and military personnel navigate mortgage refinancing with ease and secure better financial terms.

Refinancing a mortgage can be a complex and daunting process, especially for those who are not familiar with the intricacies of the financial world. However, with the right guidance and support, it can be a highly beneficial decision that can save homeowners thousands of dollars in interest payments over the life of the loan. For members of the US military and their families, USAA offers a range of refinance options that can help them achieve their financial goals. In this article, we will explore five USAA refinance tips that can help homeowners make the most of their refinance experience.

Refinancing a mortgage can be a great way to take advantage of lower interest rates, reduce monthly payments, and tap into the equity that has built up in a home. However, it's essential to approach the process with caution and carefully consider all the options available. With so many different refinance programs and lenders to choose from, it can be challenging to know where to start. Fortunately, USAA is a well-respected and reputable lender that offers a range of refinance options specifically designed for members of the military and their families.

For those who are considering refinancing their mortgage, it's essential to do their research and understand the different options available. This includes looking at the different types of refinance loans, such as cash-out refinance, rate-and-term refinance, and streamline refinance. It's also crucial to consider the costs associated with refinancing, including closing costs, appraisal fees, and other expenses. By taking the time to carefully evaluate all the options and consider the potential costs and benefits, homeowners can make an informed decision that meets their needs and helps them achieve their financial goals.

Understanding USAA Refinance Options

USAA offers a range of refinance options that are designed to meet the unique needs of military members and their families. These options include cash-out refinance, rate-and-term refinance, and streamline refinance. Each of these options has its own benefits and drawbacks, and it's essential to carefully consider the pros and cons before making a decision. For example, a cash-out refinance can provide homeowners with a lump sum of cash that can be used for a variety of purposes, such as paying off debt, financing home improvements, or covering unexpected expenses. On the other hand, a rate-and-term refinance can help homeowners take advantage of lower interest rates and reduce their monthly payments.

Benefits of USAA Refinance

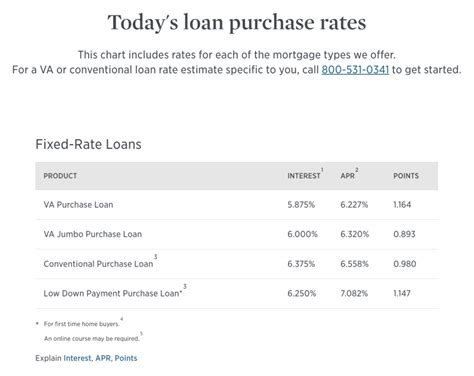

The benefits of refinancing a mortgage with USAA are numerous. For one, USAA offers competitive interest rates and flexible repayment terms that can help homeowners save thousands of dollars in interest payments over the life of the loan. Additionally, USAA's refinance options are designed to be easy to understand and navigate, with a simple and streamlined application process that can be completed online or over the phone. USAA also offers a range of resources and tools to help homeowners make informed decisions about their refinance options, including online calculators, educational articles, and personalized support from experienced loan officers.USAA Refinance Tips

Here are five USAA refinance tips that can help homeowners make the most of their refinance experience:

- Check your credit score: Before applying for a refinance loan, it's essential to check your credit score and make sure it's in good shape. A good credit score can help you qualify for the best interest rates and terms.

- Consider your goals: What do you want to achieve with your refinance? Are you looking to reduce your monthly payments, tap into the equity in your home, or take advantage of lower interest rates? Knowing your goals can help you choose the right refinance option.

- Shop around: While USAA is a well-respected and reputable lender, it's still essential to shop around and compare rates and terms from other lenders. This can help you find the best deal and save thousands of dollars in interest payments over the life of the loan.

- Read the fine print: Before signing on the dotted line, make sure you read the fine print and understand all the terms and conditions of your refinance loan. This includes the interest rate, repayment terms, and any fees or charges associated with the loan.

- Seek professional advice: Refinancing a mortgage can be a complex and daunting process, especially for those who are not familiar with the intricacies of the financial world. Seeking professional advice from a financial advisor or loan officer can help you make informed decisions and avoid costly mistakes.

Common USAA Refinance Mistakes

While refinancing a mortgage with USAA can be a great way to save money and achieve your financial goals, there are some common mistakes that homeowners should avoid. These include: * Not checking your credit score: A good credit score is essential for qualifying for the best interest rates and terms. Failing to check your credit score can result in higher interest rates and less favorable terms. * Not considering all your options: USAA offers a range of refinance options, each with its own benefits and drawbacks. Failing to consider all your options can result in choosing a loan that doesn't meet your needs or goals. * Not reading the fine print: Before signing on the dotted line, it's essential to read the fine print and understand all the terms and conditions of your refinance loan. This includes the interest rate, repayment terms, and any fees or charges associated with the loan. * Not seeking professional advice: Refinancing a mortgage can be a complex and daunting process, especially for those who are not familiar with the intricacies of the financial world. Seeking professional advice from a financial advisor or loan officer can help you make informed decisions and avoid costly mistakes.USAA Refinance Process

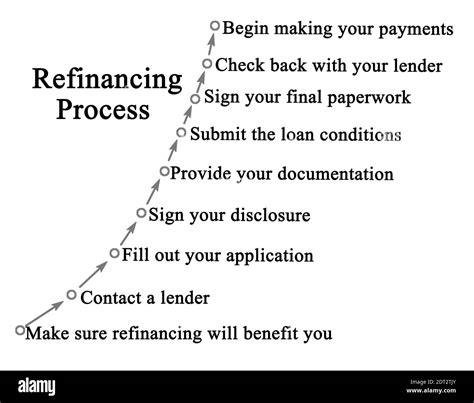

The USAA refinance process is designed to be easy to understand and navigate, with a simple and streamlined application process that can be completed online or over the phone. Here are the steps involved in the USAA refinance process:

- Check your eligibility: Before applying for a refinance loan, you'll need to check your eligibility. This includes meeting USAA's membership requirements and having a good credit score.

- Gather your documents: Once you've checked your eligibility, you'll need to gather your documents, including your pay stubs, bank statements, and tax returns.

- Apply for your loan: With your documents in hand, you can apply for your loan online or over the phone. USAA's loan officers will guide you through the application process and help you choose the right refinance option.

- Lock in your rate: Once your loan is approved, you'll need to lock in your interest rate. This can help you avoid any potential rate increases and ensure that you get the best deal.

- Close on your loan: The final step in the USAA refinance process is closing on your loan. This involves signing the final documents and transferring the funds to your account.

USAA Refinance FAQs

Here are some frequently asked questions about USAA refinance: * What are the benefits of refinancing a mortgage with USAA? * How do I check my eligibility for a USAA refinance loan? * What documents do I need to gather to apply for a USAA refinance loan? * How long does the USAA refinance process take? * Can I refinance my mortgage with USAA if I have a low credit score?USAA Refinance Image Gallery

Final Thoughts on USAA Refinance

Refinancing a mortgage with USAA can be a great way to save money and achieve your financial goals. By following the five USAA refinance tips outlined in this article, homeowners can make informed decisions and avoid costly mistakes. Whether you're looking to reduce your monthly payments, tap into the equity in your home, or take advantage of lower interest rates, USAA's refinance options are designed to meet your needs and help you achieve your goals. So why not start exploring your options today and see how USAA can help you refinance your mortgage and start saving money?

We hope this article has provided you with a comprehensive overview of the USAA refinance process and helped you make informed decisions about your refinance options. If you have any further questions or would like to learn more about USAA's refinance options, please don't hesitate to comment below or share this article with your friends and family. By working together, we can help each other achieve our financial goals and create a brighter future for ourselves and our loved ones.