Intro

Explore USAA student loan options, including private loans, refinancing, and repayment plans, with competitive rates and flexible terms for students and parents, offering financial aid and education funding solutions.

The United Services Automobile Association (USAA) is a well-established financial services company that provides a wide range of products and services to its members, including banking, insurance, and investment solutions. For students and families looking to finance higher education, USAA offers various student loan options that can help make college more affordable. In this article, we will delve into the world of USAA student loans, exploring the benefits, features, and requirements of each option.

Pursuing higher education can be a significant investment, and the cost of tuition, fees, and living expenses can be overwhelming. According to the College Board, the average cost of tuition and fees for the 2022-2023 academic year was over $21,000 for in-state students at public four-year colleges and over $53,000 for private non-profit four-year colleges. With these costs in mind, it's essential for students and families to explore all available financing options, including federal student loans, private student loans, and other forms of financial aid. USAA student loans can be an attractive option for those who are eligible, offering competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members.

USAA has a long history of serving the financial needs of military personnel, veterans, and their families. Founded in 1922, the company has grown to become one of the largest and most respected financial institutions in the United States. With a strong commitment to customer service and a wide range of financial products, USAA has become a trusted partner for many individuals and families. For students and families looking to finance higher education, USAA offers a variety of student loan options that can help make college more affordable. From undergraduate and graduate loans to parent loans and consolidation options, USAA has a range of products designed to meet the unique needs of its members.

Types of USAA Student Loans

USAA offers several types of student loans, each with its own set of benefits and features. These include undergraduate loans, graduate loans, parent loans, and consolidation loans. Undergraduate loans are designed for students pursuing a bachelor's degree, while graduate loans are available for students pursuing a master's or doctoral degree. Parent loans, on the other hand, allow parents to borrow on behalf of their dependent undergraduate students. Consolidation loans, meanwhile, enable borrowers to combine multiple student loans into a single loan with a single interest rate and monthly payment.

Undergraduate Loans

USAA undergraduate loans are designed for students pursuing a bachelor's degree at an accredited college or university. These loans offer competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members. Borrowers can choose from a range of repayment options, including deferred payments, interest-only payments, and full payments. USAA also offers a 0.25% interest rate reduction for borrowers who enroll in automatic payments.Graduate Loans

USAA graduate loans are available for students pursuing a master's or doctoral degree at an accredited college or university. These loans offer competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members. Borrowers can choose from a range of repayment options, including deferred payments, interest-only payments, and full payments. USAA also offers a 0.25% interest rate reduction for borrowers who enroll in automatic payments.

Parent Loans

USAA parent loans allow parents to borrow on behalf of their dependent undergraduate students. These loans offer competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members. Borrowers can choose from a range of repayment options, including deferred payments, interest-only payments, and full payments. USAA also offers a 0.25% interest rate reduction for borrowers who enroll in automatic payments.Consolidation Loans

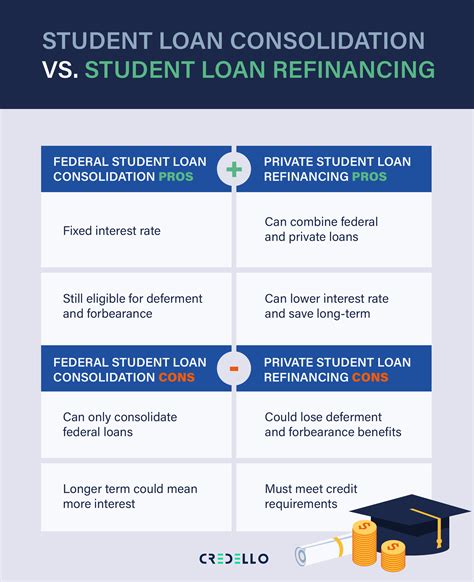

USAA consolidation loans enable borrowers to combine multiple student loans into a single loan with a single interest rate and monthly payment. This can simplify the repayment process, reduce monthly payments, and potentially save borrowers money on interest. USAA consolidation loans offer competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members.

Benefits of USAA Student Loans

USAA student loans offer a range of benefits that can make them an attractive option for students and families. These benefits include competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members. USAA also offers a 0.25% interest rate reduction for borrowers who enroll in automatic payments. Additionally, USAA student loans have no origination fees, no prepayment penalties, and a range of repayment options to choose from.Eligibility Requirements

To be eligible for a USAA student loan, borrowers must meet certain requirements. These requirements include being a USAA member, being enrolled at least half-time at an accredited college or university, and meeting certain credit and income requirements. USAA also requires borrowers to have a valid Social Security number, a valid driver's license, and a valid email address.

Application Process

The application process for USAA student loans is relatively straightforward. Borrowers can apply online, by phone, or by mail. To apply, borrowers will need to provide certain information, including their name, address, Social Security number, and financial information. USAA will also require borrowers to provide documentation, such as pay stubs, tax returns, and proof of enrollment.Repayment Options

USAA offers a range of repayment options for its student loans. These options include deferred payments, interest-only payments, and full payments. Borrowers can choose from a range of repayment terms, including 5-year, 10-year, and 15-year terms. USAA also offers a 0.25% interest rate reduction for borrowers who enroll in automatic payments.

Customer Service

USAA is known for its excellent customer service, and its student loan department is no exception. Borrowers can contact USAA by phone, email, or online chat to ask questions, request assistance, or report issues. USAA also offers a range of online resources, including FAQs, tutorials, and webinars, to help borrowers manage their student loans.Conclusion and Next Steps

In conclusion, USAA student loans can be a great option for students and families who are eligible. With competitive interest rates, flexible repayment terms, and exclusive benefits for USAA members, these loans can help make college more affordable. To learn more about USAA student loans and to apply, borrowers can visit the USAA website or contact a USAA representative.

USAA Student Loans Image Gallery

We hope this article has provided you with a comprehensive overview of USAA student loans and their benefits. If you have any questions or would like to learn more, please don't hesitate to comment below. Additionally, if you found this article helpful, please share it with others who may be interested in learning more about USAA student loans. By sharing your knowledge and experience, you can help others make informed decisions about their financial futures.