Repaying student loans in the US military just got easier. Discover 5 ways to tackle debt while serving, including military student loan forgiveness programs, income-driven repayment plans, and loan deferment options. Learn how to manage your student loans and maximize military benefits, making it easier to achieve financial freedom.

Repaying student loans can be a daunting task, especially for those serving in the United States Armed Forces. However, there are several options available to help make the process more manageable. In this article, we will discuss five ways to repay student loans in the USAF, highlighting the benefits and eligibility requirements for each option.

Understanding the Context

Before we dive into the repayment options, it's essential to understand the context. Student loan debt has become a significant concern for many military personnel, with the average debt burden exceeding $30,000. The USAF recognizes the importance of addressing this issue and has implemented various programs to help service members manage their debt.

Option 1: Military Service Forgiveness Programs

The USAF offers several forgiveness programs that can help reduce or eliminate student loan debt. These programs include:

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on a borrower's Direct Loans after making 120 qualifying payments while working full-time for a qualifying employer, including the USAF.

- Military Service Forgiveness: Some lenders offer forgiveness programs specifically for military personnel, which can provide a portion of the loan balance.

- Federal Perkins Loan Cancellation: Borrowers with a Federal Perkins Loan may be eligible for loan cancellation if they serve in the military for a specified period.

To be eligible for these programs, service members typically need to meet specific requirements, such as serving for a certain period or completing a qualifying tour of duty.

Eligibility Requirements

To be eligible for military service forgiveness programs, service members typically need to:

- Be actively serving in the USAF

- Have a qualifying student loan (e.g., Direct Loan, Federal Perkins Loan)

- Meet the program's specific requirements, such as serving for a certain period or completing a qualifying tour of duty

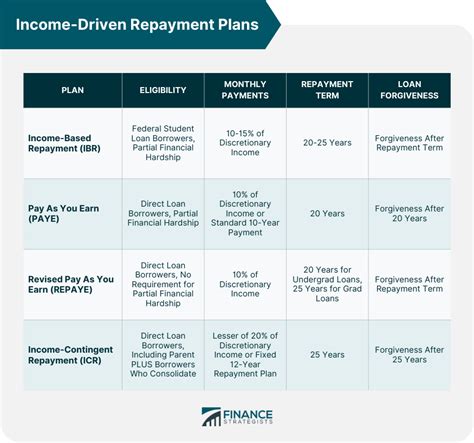

Option 2: Income-Driven Repayment (IDR) Plans

IDR plans can help service members manage their student loan payments by capping monthly payments at a percentage of their income. The USAF offers several IDR plans, including:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

How IDR Plans Work

IDR plans calculate monthly payments based on a borrower's income and family size. Service members can choose from various plans, each with its own set of benefits and eligibility requirements.

Benefits of IDR Plans

- Lower monthly payments: IDR plans can help reduce monthly payments, making it easier to manage debt.

- Forgiveness: Some IDR plans offer forgiveness after a certain period (e.g., 20 or 25 years).

Eligibility Requirements

To be eligible for IDR plans, service members typically need to:

- Have a qualifying student loan (e.g., Direct Loan)

- Meet the plan's income and family size requirements

- Be actively serving in the USAF

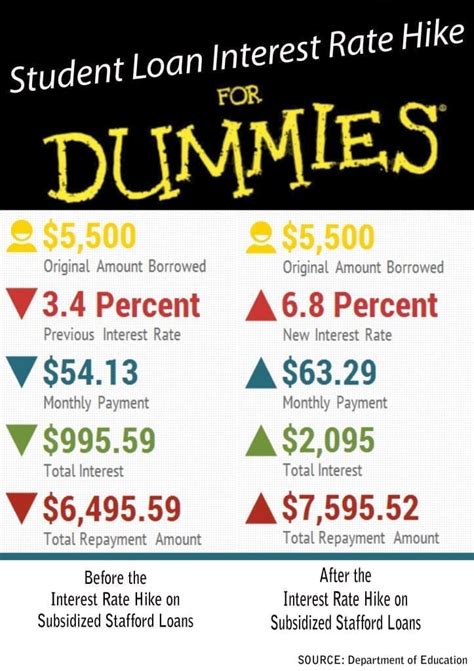

Option 3: Interest Rate Reductions

Service members may be eligible for interest rate reductions on their student loans, which can help reduce the overall cost of the loan.

- Servicemembers Civil Relief Act (SCRA): The SCRA provides a 6% interest rate cap on student loans for service members on active duty.

- USAF Interest Rate Reduction Program: The USAF offers an interest rate reduction program that can lower the interest rate on student loans.

How Interest Rate Reductions Work

Interest rate reductions can help reduce the overall cost of a student loan by lowering the interest rate. Service members can apply for these programs through the USAF or their lender.

Benefits of Interest Rate Reductions

- Lower interest rates: Interest rate reductions can help reduce the overall cost of a student loan.

- Savings: Lower interest rates can result in significant savings over the life of the loan.

Eligibility Requirements

To be eligible for interest rate reductions, service members typically need to:

- Be actively serving in the USAF

- Have a qualifying student loan (e.g., Direct Loan)

- Meet the program's specific requirements

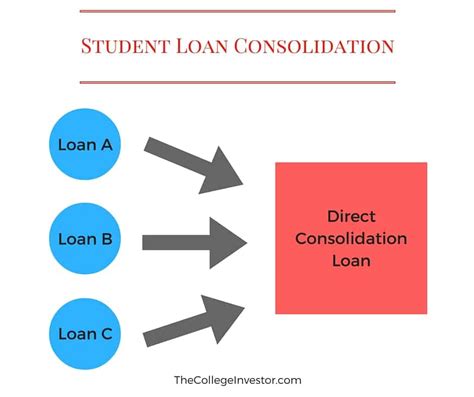

Option 4: Loan Consolidation

Loan consolidation can help service members simplify their student loan payments by combining multiple loans into a single loan with a single interest rate and monthly payment.

- Federal Direct Consolidation Loan: The USAF offers a federal direct consolidation loan that can help service members combine their student loans.

How Loan Consolidation Works

Loan consolidation involves combining multiple student loans into a single loan with a single interest rate and monthly payment. Service members can apply for loan consolidation through the USAF or their lender.

Benefits of Loan Consolidation

- Simplified payments: Loan consolidation can help simplify student loan payments by combining multiple loans into a single loan.

- Lower monthly payments: Loan consolidation can result in lower monthly payments.

Eligibility Requirements

To be eligible for loan consolidation, service members typically need to:

- Have multiple qualifying student loans (e.g., Direct Loans)

- Be actively serving in the USAF

- Meet the program's specific requirements

Option 5: Deferment or Forbearance

Deferment or forbearance can provide temporary relief from student loan payments, allowing service members to focus on their military service.

- Deferment: Deferment allows service members to temporarily postpone their student loan payments.

- Forbearance: Forbearance allows service members to temporarily suspend their student loan payments.

How Deferment or Forbearance Works

Deferment or forbearance provides temporary relief from student loan payments, allowing service members to focus on their military service. Service members can apply for deferment or forbearance through the USAF or their lender.

Benefits of Deferment or Forbearance

- Temporary relief: Deferment or forbearance can provide temporary relief from student loan payments.

- Reduced financial burden: Deferment or forbearance can help reduce the financial burden on service members.

Eligibility Requirements

To be eligible for deferment or forbearance, service members typically need to:

- Be actively serving in the USAF

- Have a qualifying student loan (e.g., Direct Loan)

- Meet the program's specific requirements

Student Loans in the USAF Image Gallery

We hope this article has provided valuable insights into the various options available for repaying student loans in the USAF. If you're a service member struggling with student loan debt, we encourage you to explore these options and find the best solution for your situation.