Intro

Learn how to create a W2 format in Excel with our step-by-step guide. Discover 5 easy methods to generate W2 forms, including using templates, formulas, and mail merge. Master Excels W2 reporting features and simplify tax season with our expert tips, tricks, and LSI keywords: W2 form creation, Excel tax reporting, payroll processing.

Creating a W2 format in Excel can be a daunting task, especially for those who are not familiar with the intricacies of the W2 form. However, with the right guidance, you can easily create a W2 format in Excel that meets your needs. In this article, we will explore five different ways to create a W2 format in Excel, along with their respective benefits and drawbacks.

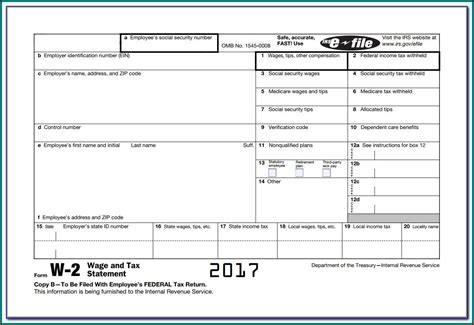

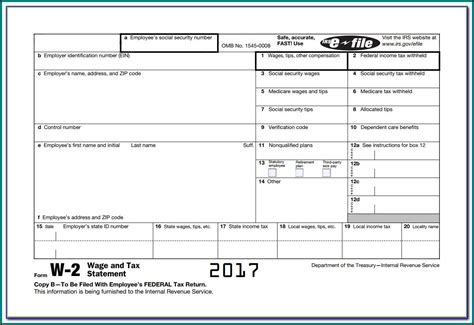

What is a W2 Form?

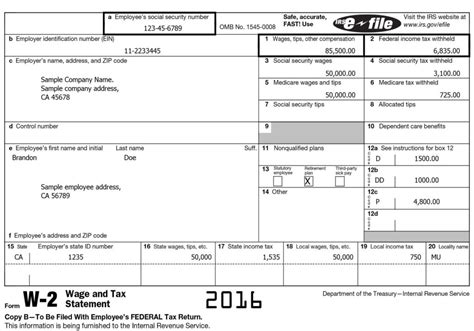

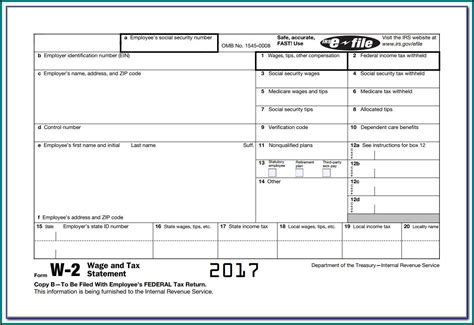

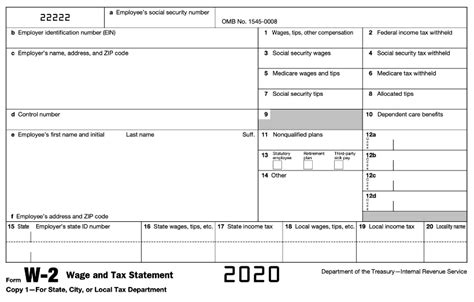

Before we dive into the ways to create a W2 format in Excel, let's first understand what a W2 form is. A W2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the Social Security Administration (SSA) at the end of each year. The form reports an employee's income, taxes withheld, and other relevant tax information.

Method 1: Using Excel Templates

One of the easiest ways to create a W2 format in Excel is to use a pre-designed template. Microsoft offers a range of free W2 templates that you can download and use in Excel. These templates are fully customizable and can be edited to suit your specific needs.

To use an Excel template, follow these steps:

- Go to the Microsoft website and search for "W2 template Excel"

- Download the template that best suits your needs

- Open the template in Excel and customize it as needed

- Enter your employee data and calculate the relevant tax information

Pros: Easy to use, fully customizable, and free Cons: May not be compatible with older versions of Excel

Method 2: Using a W2 Software

Another way to create a W2 format in Excel is to use a W2 software. These software programs are specifically designed to help you create and print W2 forms, and many of them offer Excel integration.

To use a W2 software, follow these steps:

- Research and purchase a W2 software that meets your needs

- Install the software on your computer and launch it

- Enter your employee data and calculate the relevant tax information

- Export the data to Excel and customize the format as needed

Pros: Easy to use, accurate calculations, and compatible with multiple versions of Excel Cons: May require a purchase or subscription, and some software may have limitations

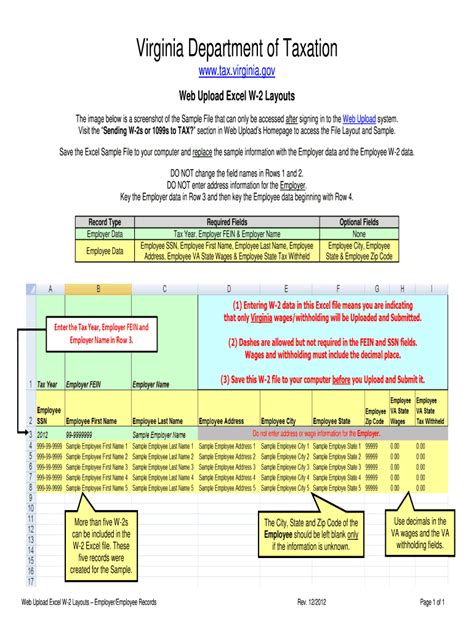

Method 3: Creating a W2 Format from Scratch

If you prefer to create a W2 format from scratch, you can do so using Excel's built-in tools and functions. This method requires some knowledge of Excel formulas and formatting, but can be a cost-effective and customizable solution.

To create a W2 format from scratch, follow these steps:

- Create a new Excel spreadsheet and set up the columns and rows to match the W2 form

- Enter the relevant formulas and functions to calculate the tax information

- Format the cells and columns to match the W2 form

- Enter your employee data and calculate the relevant tax information

Pros: Cost-effective, fully customizable, and can be used with any version of Excel Cons: Requires knowledge of Excel formulas and formatting, and can be time-consuming

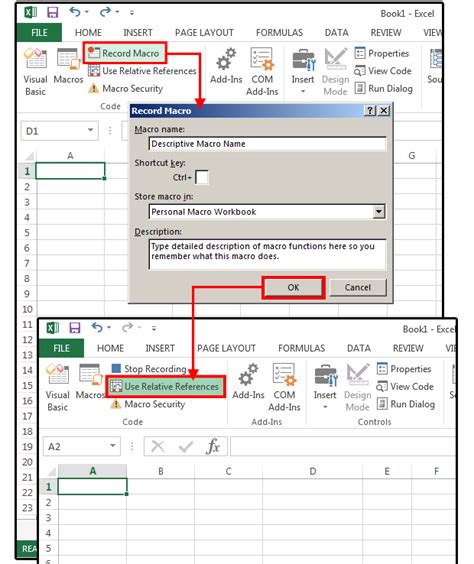

Method 4: Using Excel Macros

If you have a large number of employees and need to create multiple W2 forms, you can use Excel macros to automate the process. Macros are pre-recorded sets of instructions that can be executed with a single click.

To use Excel macros, follow these steps:

- Create a new Excel spreadsheet and set up the columns and rows to match the W2 form

- Record a macro that performs the necessary calculations and formatting

- Save the macro and run it each time you need to create a new W2 form

Pros: Can automate the process, reduce errors, and increase efficiency Cons: Requires knowledge of Excel macros, and may not be compatible with all versions of Excel

Method 5: Using a Third-Party Add-In

Finally, you can use a third-party add-in to create a W2 format in Excel. These add-ins are specifically designed to help you create and print W2 forms, and many of them offer advanced features and functionality.

To use a third-party add-in, follow these steps:

- Research and purchase a W2 add-in that meets your needs

- Install the add-in on your computer and launch it

- Enter your employee data and calculate the relevant tax information

- Export the data to Excel and customize the format as needed

Pros: Easy to use, advanced features, and compatible with multiple versions of Excel Cons: May require a purchase or subscription, and some add-ins may have limitations

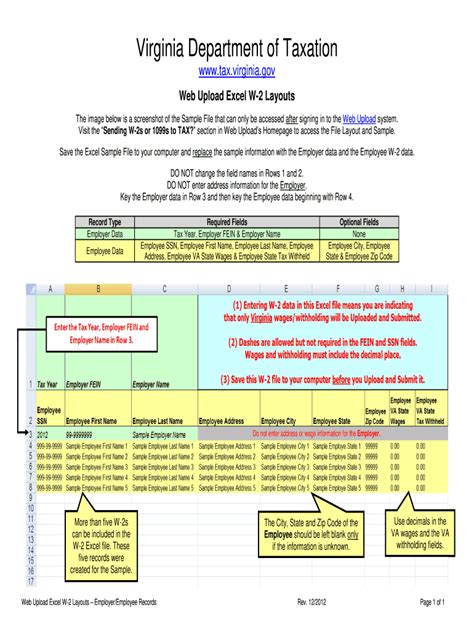

W2 Format in Excel Image Gallery

Conclusion

Creating a W2 format in Excel can be a daunting task, but with the right guidance, you can easily create a W2 format that meets your needs. Whether you choose to use a pre-designed template, a W2 software, create a format from scratch, use Excel macros, or a third-party add-in, the key is to find a method that works for you and your organization. By following the steps outlined in this article, you can create a W2 format in Excel that is accurate, efficient, and compliant with IRS regulations.

We hope this article has been helpful in guiding you through the process of creating a W2 format in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.