Intro

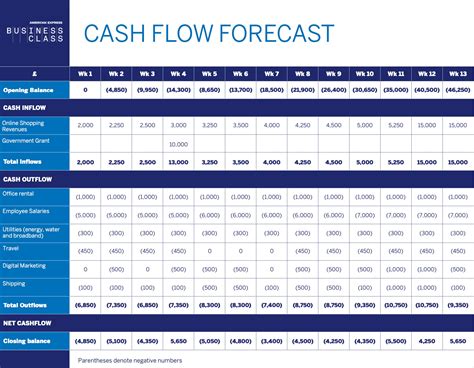

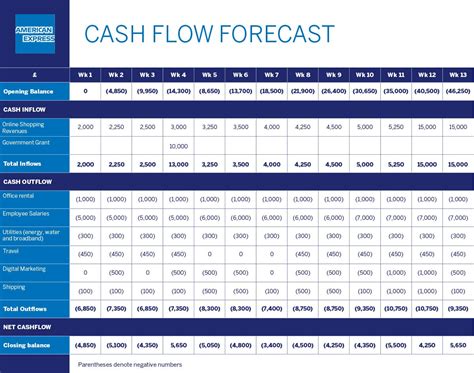

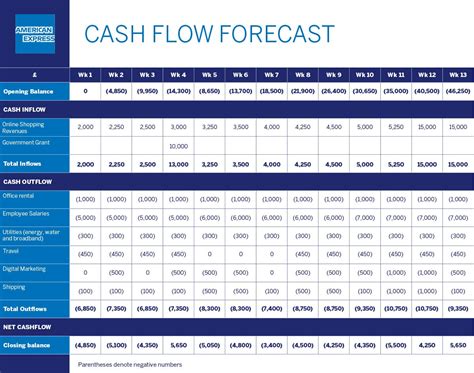

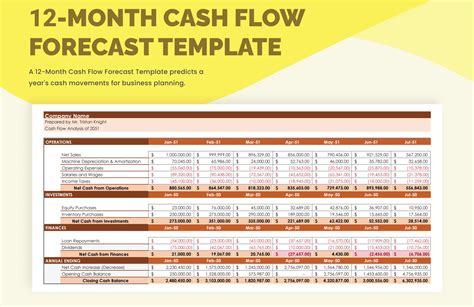

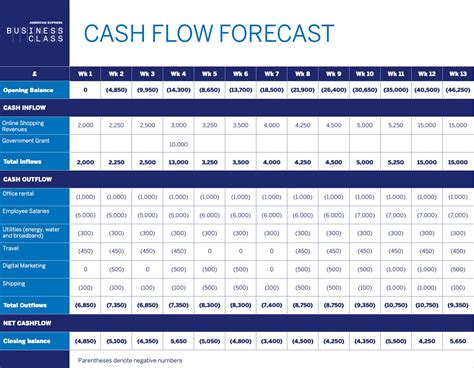

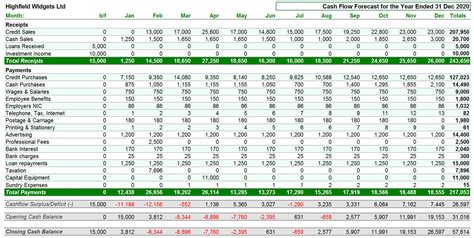

Boost your financial management with our Weekly Cash Flow Forecast Template in Excel. Easily track income and expenses to make informed decisions. This template simplifies cash flow forecasting, helping you manage liquidity, identify trends, and mitigate risks. Download now and take control of your finances with a clear, data-driven outlook.

Managing cash flow is crucial for any business, and having a clear understanding of your company's financial situation is vital for making informed decisions. One of the most effective tools for managing cash flow is a weekly cash flow forecast template in Excel. In this article, we will guide you through the process of creating a weekly cash flow forecast template in Excel, making it easy to manage your company's finances.

Cash flow is the lifeblood of any business, and it's essential to have a clear understanding of your company's financial situation to make informed decisions. A weekly cash flow forecast template in Excel can help you predict your company's cash inflows and outflows, identify potential cash flow problems, and make adjustments to ensure your business remains financially healthy.

Creating a weekly cash flow forecast template in Excel can seem like a daunting task, but it's easier than you think. With a few simple steps, you can create a template that will help you manage your company's cash flow and make informed financial decisions.

Benefits of Using a Weekly Cash Flow Forecast Template in Excel

Using a weekly cash flow forecast template in Excel can have numerous benefits for your business. Some of the most significant advantages include:

- Improved cash flow management: A weekly cash flow forecast template can help you predict your company's cash inflows and outflows, identify potential cash flow problems, and make adjustments to ensure your business remains financially healthy.

- Increased accuracy: Using a template can help reduce errors and improve the accuracy of your cash flow forecasts.

- Enhanced decision-making: With a clear understanding of your company's cash flow, you can make informed decisions about investments, funding, and other financial matters.

- Reduced stress: Managing cash flow can be stressful, but with a weekly cash flow forecast template, you can stay on top of your finances and reduce stress.

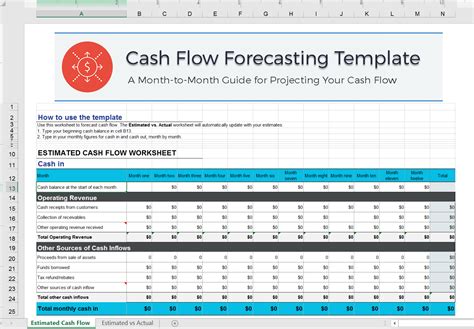

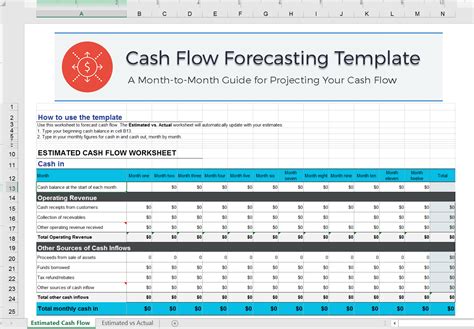

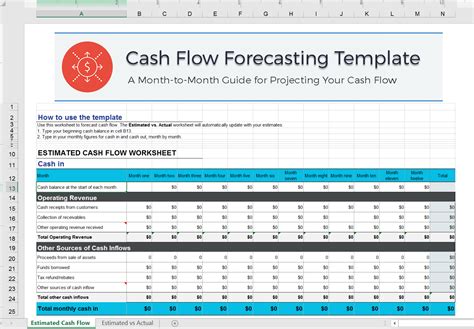

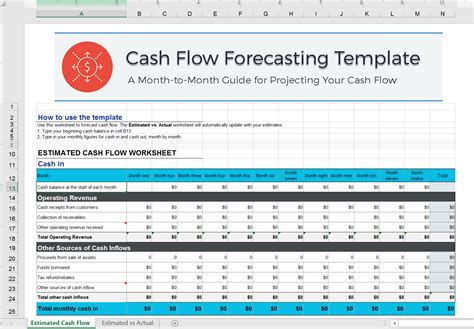

Step-by-Step Guide to Creating a Weekly Cash Flow Forecast Template in Excel

Creating a weekly cash flow forecast template in Excel is a straightforward process. Here's a step-by-step guide to help you get started:

- Open Excel and create a new spreadsheet.

- Set up your template by creating columns for the following:

- Date

- Cash inflows

- Cash outflows

- Net cash flow

- Cumulative cash flow

- Enter your company's historical cash flow data into the template.

- Use formulas to calculate the net cash flow and cumulative cash flow for each week.

- Use charts and graphs to visualize your cash flow data.

- Review and update your template regularly to ensure it remains accurate and effective.

Understanding Cash Flow Forecasting

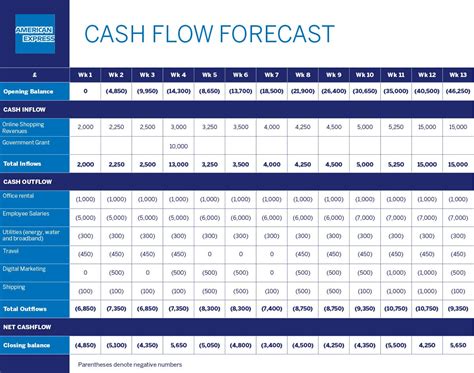

Cash flow forecasting is the process of predicting a company's future cash inflows and outflows. It's an essential tool for managing cash flow and making informed financial decisions. Here are some key concepts to understand:

- Cash inflows: Cash received by the business, such as sales revenue, accounts receivable, and loans.

- Cash outflows: Cash paid out by the business, such as accounts payable, salaries, and rent.

- Net cash flow: The difference between cash inflows and cash outflows.

- Cumulative cash flow: The total net cash flow over a period of time.

Common Cash Flow Forecasting Mistakes

Cash flow forecasting can be complex, and it's easy to make mistakes. Here are some common errors to avoid:

- Overestimating cash inflows

- Underestimating cash outflows

- Failing to account for seasonal fluctuations

- Not regularly reviewing and updating the forecast

Best Practices for Cash Flow Forecasting

To ensure accurate and effective cash flow forecasting, follow these best practices:

- Use historical data to inform your forecast

- Account for seasonal fluctuations

- Regularly review and update your forecast

- Use multiple scenarios to test different assumptions

- Communicate with stakeholders to ensure everyone is on the same page

Conclusion

Creating a weekly cash flow forecast template in Excel can seem daunting, but it's easier than you think. By following the steps outlined in this article, you can create a template that will help you manage your company's cash flow and make informed financial decisions. Remember to regularly review and update your template, and follow best practices to ensure accurate and effective cash flow forecasting.

Cash Flow Forecasting Image Gallery

We hope this article has been informative and helpful in creating a weekly cash flow forecast template in Excel. If you have any questions or comments, please feel free to share them below.