Intro

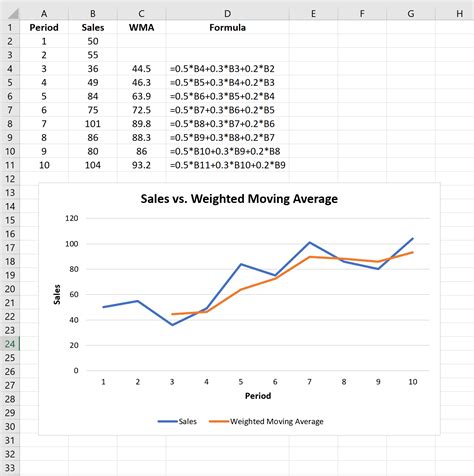

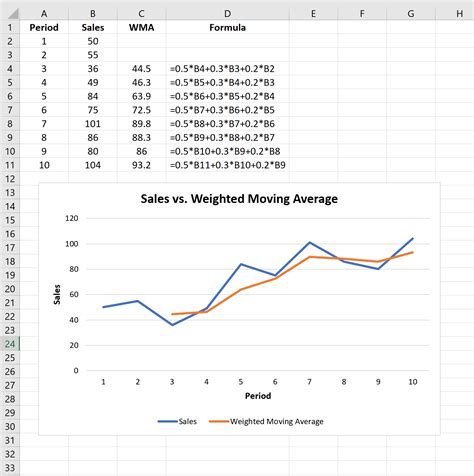

Discover how to use Weighted Moving Average in Excel to improve forecasting accuracy. Learn 5 practical methods to calculate weighted moving averages, including exponential smoothing and linear trends. Master techniques for data analysis, trend analysis, and predictive modeling with this essential Excel skill.

The weighted moving average (WMA) is a powerful tool used in data analysis to smooth out fluctuations in a dataset and highlight trends. In Excel, WMA can be a game-changer for anyone working with large datasets, providing insights that would be difficult to discern from raw data alone. Here are five ways to use weighted moving average in Excel, each with its own strengths and applications.

Understanding Weighted Moving Average

The weighted moving average gives more importance to recent data points than older ones, making it more sensitive to recent changes in the dataset. Unlike the simple moving average (SMA), which gives equal weight to all data points in the period, WMA can better reflect the current trend by emphasizing the most recent values.

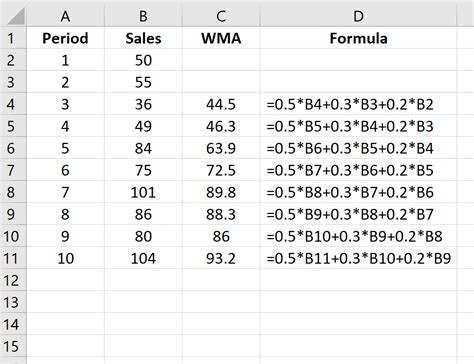

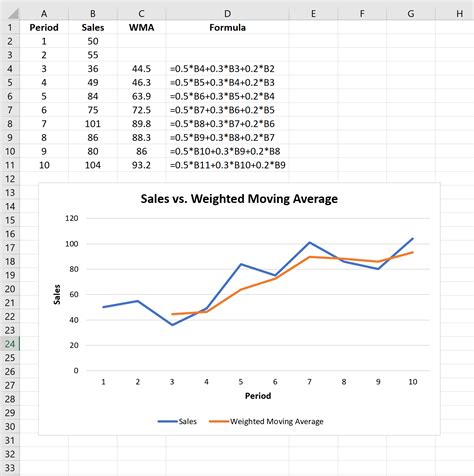

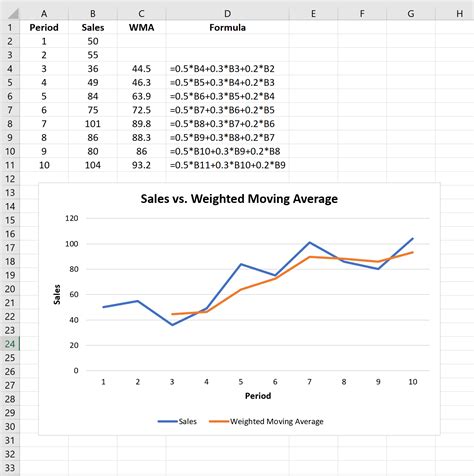

Calculating Weighted Moving Average in Excel

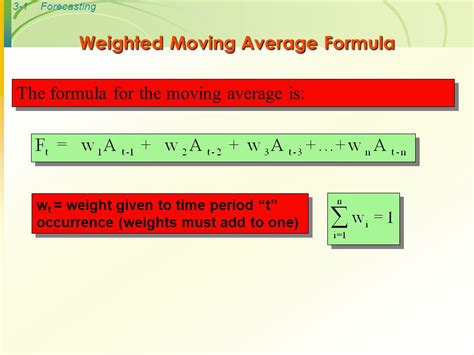

Calculating WMA in Excel can be a bit more complex than SMA, but it's still relatively straightforward. The basic formula for WMA is:

WMA = (A x 1 + B x 2 + C x 3 +... + N x n) / (1 + 2 + 3 +... + n)

Where A, B, C, etc., are the values of the data points, and 1, 2, 3, etc., are the weights. The weights are usually based on the position of the data point, with more recent data points receiving higher weights.

1. Smoothing Out Price Fluctuations in Financial Analysis

One of the most common applications of WMA is in financial analysis, particularly in smoothing out price fluctuations. By applying WMA to stock prices, analysts can identify trends and make predictions about future performance.

To apply WMA in financial analysis:

- Create a table with dates and corresponding stock prices

- Choose a time period for the moving average (e.g., 10 days)

- Calculate the weights for each data point (e.g., 1 for the oldest data point, 2 for the second-oldest, etc.)

- Use the WMA formula to calculate the weighted moving average for each data point

Example:

Suppose we have the following stock prices for the past 10 days:

| Date | Price |

|---|---|

| 2023-02-01 | 100 |

| 2023-02-02 | 102 |

| 2023-02-03 | 105 |

| ... | ... |

| 2023-02-10 | 120 |

Using a 10-day WMA with weights 1 to 10, we can calculate the WMA for each data point:

| Date | Price | Weight | WMA |

|---|---|---|---|

| 2023-02-01 | 100 | 1 | 100 |

| 2023-02-02 | 102 | 2 | 102 |

| 2023-02-03 | 105 | 3 | 105.33 |

| ... | ... | ... | ... |

| 2023-02-10 | 120 | 10 | 118.20 |

The WMA provides a smoother curve than the raw data, making it easier to identify trends.

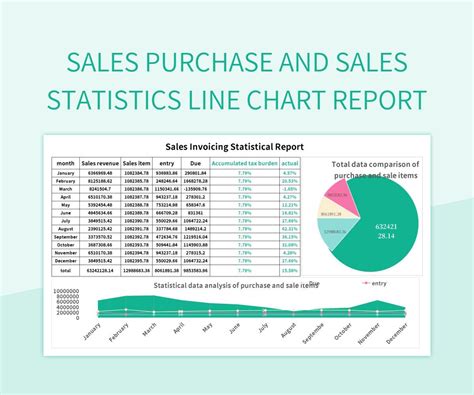

2. Identifying Trends in Sales Data

Weighted moving average can also be applied to sales data to identify trends and patterns. By giving more weight to recent sales data, WMA can help businesses respond to changes in demand and adjust their strategies accordingly.

To apply WMA to sales data:

- Create a table with dates and corresponding sales figures

- Choose a time period for the moving average (e.g., 12 weeks)

- Calculate the weights for each data point (e.g., 1 for the oldest data point, 2 for the second-oldest, etc.)

- Use the WMA formula to calculate the weighted moving average for each data point

Example:

Suppose we have the following sales data for the past 12 weeks:

| Week | Sales |

|---|---|

| 1 | 1000 |

| 2 | 1050 |

| 3 | 1100 |

| ... | ... |

| 12 | 1500 |

Using a 12-week WMA with weights 1 to 12, we can calculate the WMA for each data point:

| Week | Sales | Weight | WMA |

|---|---|---|---|

| 1 | 1000 | 1 | 1000 |

| 2 | 1050 | 2 | 1050 |

| 3 | 1100 | 3 | 1100.33 |

| ... | ... | ... | ... |

| 12 | 1500 | 12 | 1432.50 |

The WMA highlights a steady increase in sales over the past 12 weeks, indicating a positive trend.

3. Analyzing Website Traffic Patterns

Weighted moving average can be used to analyze website traffic patterns, helping webmasters identify trends and optimize their content and marketing strategies.

To apply WMA to website traffic data:

- Create a table with dates and corresponding traffic figures

- Choose a time period for the moving average (e.g., 30 days)

- Calculate the weights for each data point (e.g., 1 for the oldest data point, 2 for the second-oldest, etc.)

- Use the WMA formula to calculate the weighted moving average for each data point

Example:

Suppose we have the following website traffic data for the past 30 days:

| Day | Traffic |

|---|---|

| 1 | 100 |

| 2 | 120 |

| 3 | 150 |

| ... | ... |

| 30 | 300 |

Using a 30-day WMA with weights 1 to 30, we can calculate the WMA for each data point:

| Day | Traffic | Weight | WMA |

|---|---|---|---|

| 1 | 100 | 1 | 100 |

| 2 | 120 | 2 | 120 |

| 3 | 150 | 3 | 150.33 |

| ... | ... | ... | ... |

| 30 | 300 | 30 | 275.50 |

The WMA shows a steady increase in website traffic over the past 30 days, indicating a positive trend.

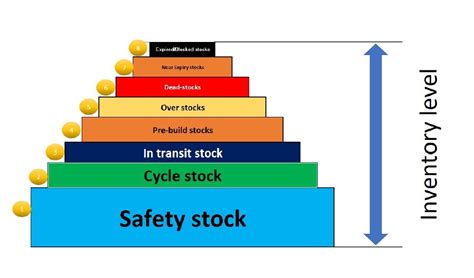

4. Optimizing Inventory Levels

Weighted moving average can be used to optimize inventory levels by identifying trends in demand and adjusting stock levels accordingly.

To apply WMA to inventory data:

- Create a table with dates and corresponding inventory levels

- Choose a time period for the moving average (e.g., 6 months)

- Calculate the weights for each data point (e.g., 1 for the oldest data point, 2 for the second-oldest, etc.)

- Use the WMA formula to calculate the weighted moving average for each data point

Example:

Suppose we have the following inventory data for the past 6 months:

| Month | Inventory |

|---|---|

| 1 | 1000 |

| 2 | 1200 |

| 3 | 1500 |

| ... | ... |

| 6 | 2000 |

Using a 6-month WMA with weights 1 to 6, we can calculate the WMA for each data point:

| Month | Inventory | Weight | WMA |

|---|---|---|---|

| 1 | 1000 | 1 | 1000 |

| 2 | 1200 | 2 | 1200 |

| 3 | 1500 | 3 | 1500.33 |

| ... | ... | ... | ... |

| 6 | 2000 | 6 | 1833.33 |

The WMA highlights a steady increase in inventory levels over the past 6 months, indicating a positive trend.

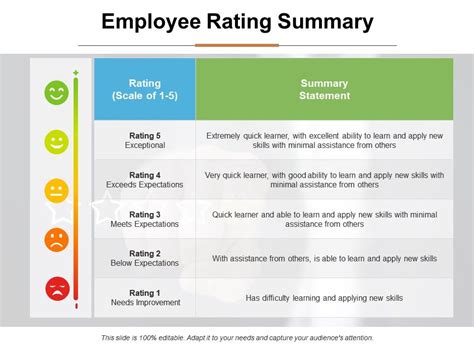

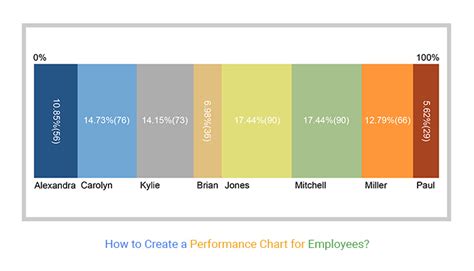

5. Evaluating Employee Performance

Weighted moving average can be used to evaluate employee performance by identifying trends in productivity and adjusting performance goals accordingly.

To apply WMA to employee performance data:

- Create a table with dates and corresponding performance metrics

- Choose a time period for the moving average (e.g., 12 weeks)

- Calculate the weights for each data point (e.g., 1 for the oldest data point, 2 for the second-oldest, etc.)

- Use the WMA formula to calculate the weighted moving average for each data point

Example:

Suppose we have the following employee performance data for the past 12 weeks:

| Week | Performance |

|---|---|

| 1 | 80 |

| 2 | 85 |

| 3 | 90 |

| ... | ... |

| 12 | 100 |

Using a 12-week WMA with weights 1 to 12, we can calculate the WMA for each data point:

| Week | Performance | Weight | WMA |

|---|---|---|---|

| 1 | 80 | 1 | 80 |

| 2 | 85 | 2 | 85 |

| 3 | 90 | 3 | 90.33 |

| ... | ... | ... | ... |

| 12 | 100 | 12 | 95.50 |

The WMA highlights a steady increase in employee performance over the past 12 weeks, indicating a positive trend.

Weighted Moving Average Image Gallery

We hope this article has provided a comprehensive overview of the weighted moving average and its applications in Excel. Whether you're analyzing financial data, optimizing inventory levels, or evaluating employee performance, WMA can be a powerful tool in your data analysis arsenal.