Intro

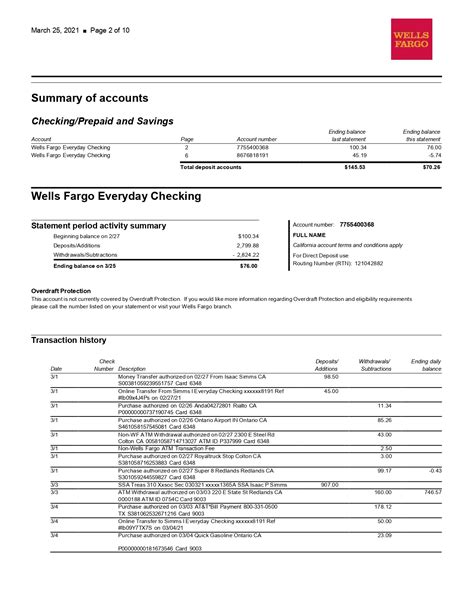

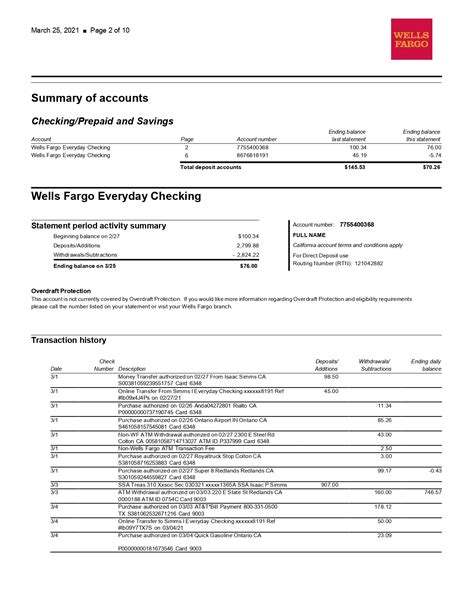

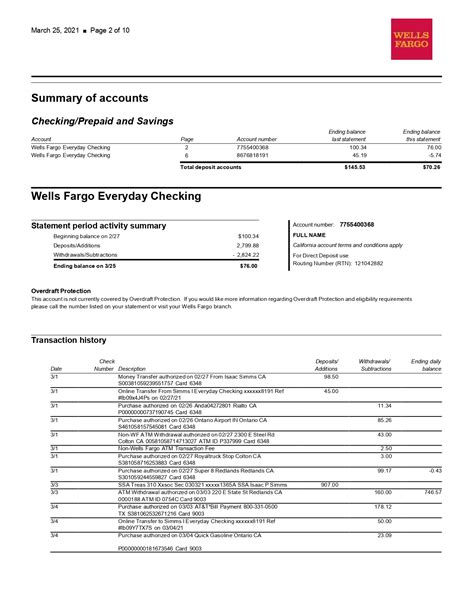

Get a free Wells Fargo bank statement template download to manage your finances efficiently. This customizable template helps track transactions, balance, and account details. Ideal for personal or business use, its a simple solution for budgeting and accounting. Download now and stay organized with your Wells Fargo bank statements.

Managing personal finances effectively requires organization, attention to detail, and a clear understanding of one's financial situation. One of the essential tools for achieving this is a well-structured bank statement. For customers of Wells Fargo, one of the largest banks in the United States, having a template to organize and understand their bank statements can be incredibly beneficial. In this article, we will delve into the specifics of a Wells Fargo bank statement template, its importance, and how to access a free download.

Understanding the Importance of a Bank Statement Template

A bank statement template is a valuable tool for anyone looking to manage their finances better. It allows users to easily track their income, expenses, savings, and loans. By organizing this information, individuals can identify areas where they can cut back on spending, make smarter financial decisions, and work towards achieving their financial goals.

Key Benefits of Using a Bank Statement Template

• Financial Clarity: Having all financial transactions in one place provides a clear picture of your financial situation. • Budgeting Made Easy: Identifying income and expenses helps in creating an effective budget. • Reduced Errors: A template minimizes the chances of errors, ensuring accuracy in financial tracking. • Time-Saving: Automatically calculates totals, saving time and effort.

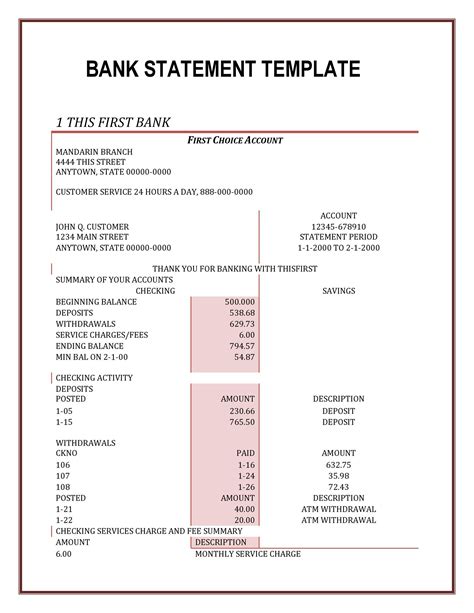

Features of a Wells Fargo Bank Statement Template

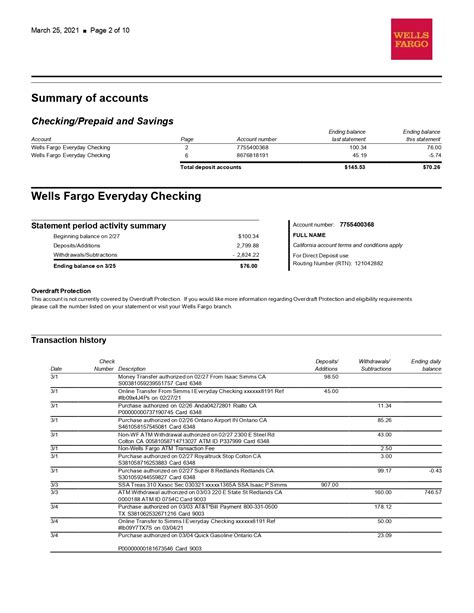

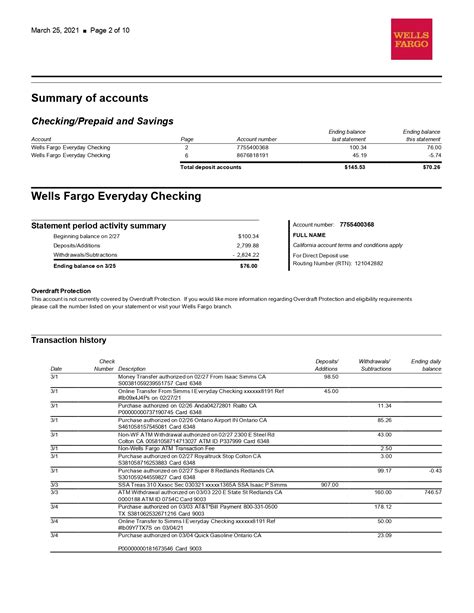

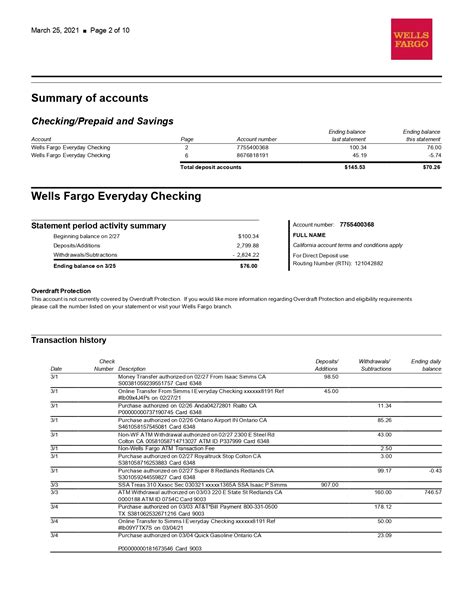

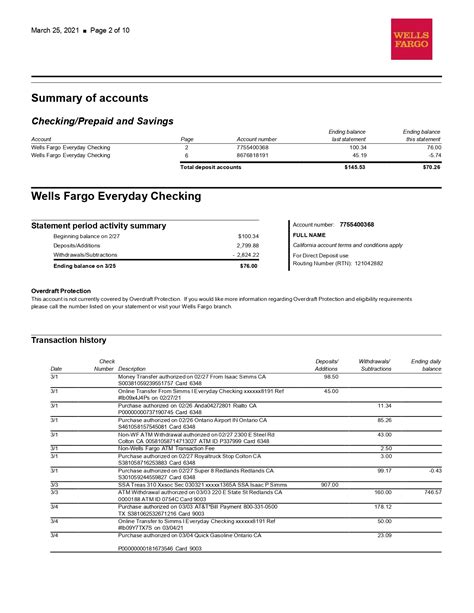

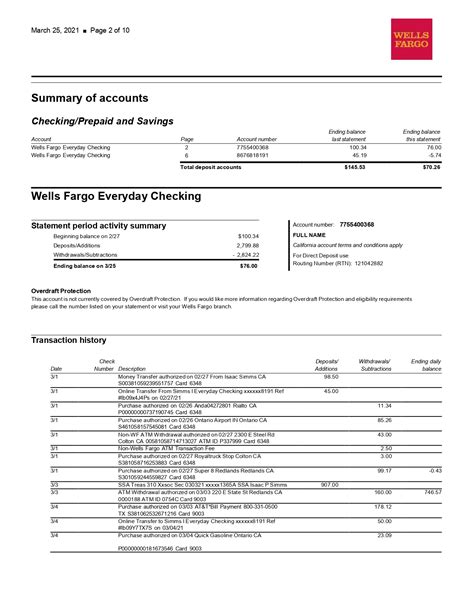

A Wells Fargo bank statement template typically includes the following features:

Essential Components

• Account Information: Includes the account holder's name, account number, and statement period. • Transaction Summary: Lists all transactions, including deposits, withdrawals, and transfers. • Running Balance: Shows the balance after each transaction, helping users keep track of their current balance. • Service Charges: Any fees or charges levied by the bank are detailed here. • Minimum Balance Requirements: Information on the minimum balance required to avoid service charges.

How to Access a Free Wells Fargo Bank Statement Template Download

While Wells Fargo provides digital statements to its customers, a customizable template can offer more flexibility and personalization. Here's how to access a free template:

- Online Search: Use search engines to look for "Wells Fargo bank statement template free download." Be cautious of the source and ensure it's a reputable website.

- Microsoft Templates: Microsoft Office Online offers a range of free templates, including those for bank statements. You can modify these to fit your Wells Fargo statement.

- Spreadsheets: Google Sheets or Microsoft Excel can be used to create a custom template from scratch. This option provides the most flexibility.

Using Your Wells Fargo Bank Statement Template Effectively

To get the most out of your template:

Best Practices

• Regular Updates: Ensure you update your template regularly to reflect all transactions. • Accuracy: Double-check all entries for accuracy to avoid errors. • Analysis: Regularly analyze your statement to identify trends, areas for improvement, and financial goals achievement.

Conclusion and Next Steps

A Wells Fargo bank statement template is a powerful tool for managing your finances. By understanding its importance, features, and how to access and use it effectively, you're well on your way to achieving financial clarity and success. Remember, effective financial management is a continuous process that requires regular attention and adjustments.

We encourage you to share your experiences with using bank statement templates and any tips you might have for our readers. Your insights could help others in their financial journey.

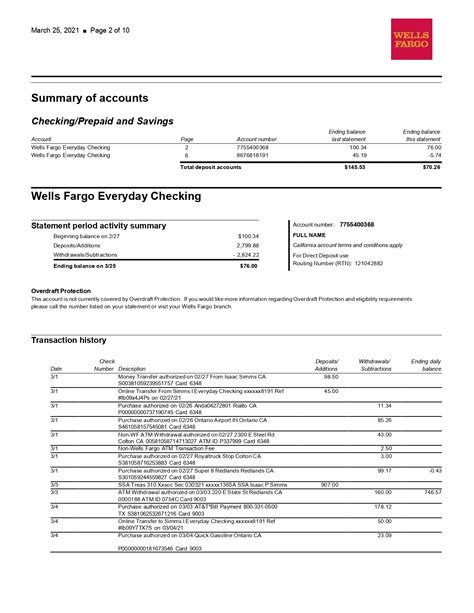

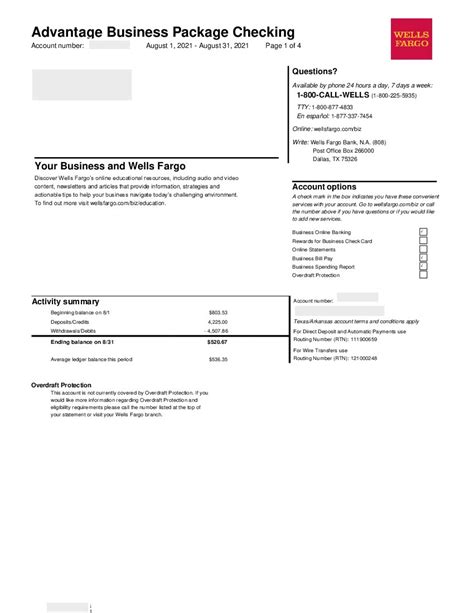

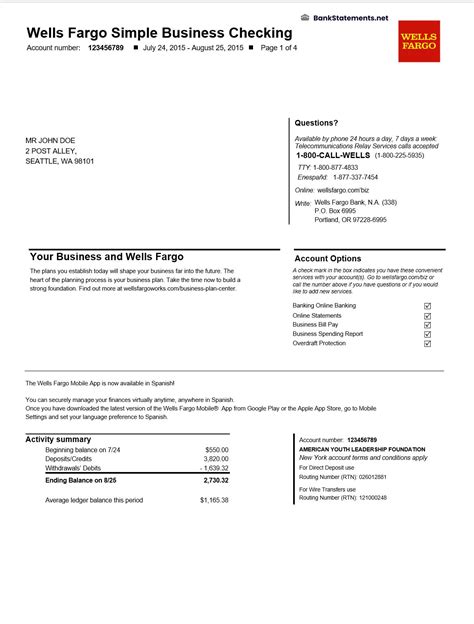

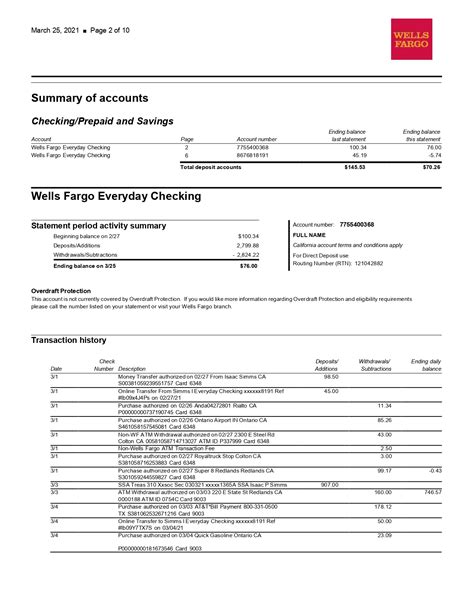

Wells Fargo Bank Statement Template Gallery