Intro

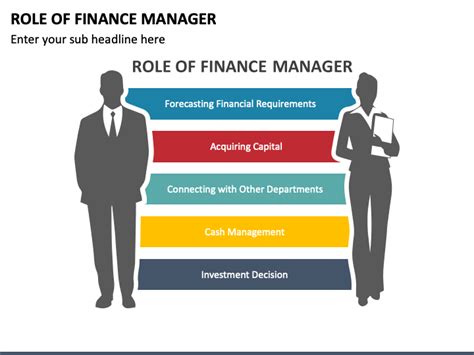

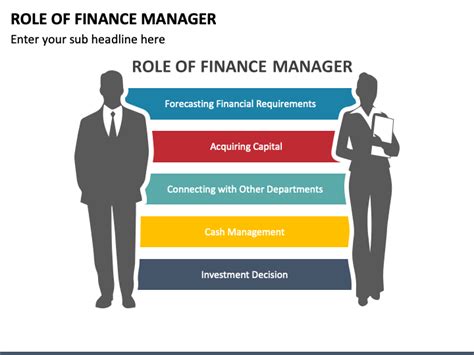

Unlock the role of a financial manager with our expert guide. Discover the 6 key responsibilities, including financial planning, risk management, and investor relations. Learn how financial managers optimize profitability, manage cash flow, and make informed decisions to drive business growth and success.

As the backbone of any organization, financial managers play a vital role in ensuring the financial health and stability of a company. Their expertise and guidance help businesses make informed decisions, mitigate risks, and achieve their goals. In this article, we will delve into the 6 key responsibilities of financial managers and explore the importance of their role in driving business success.

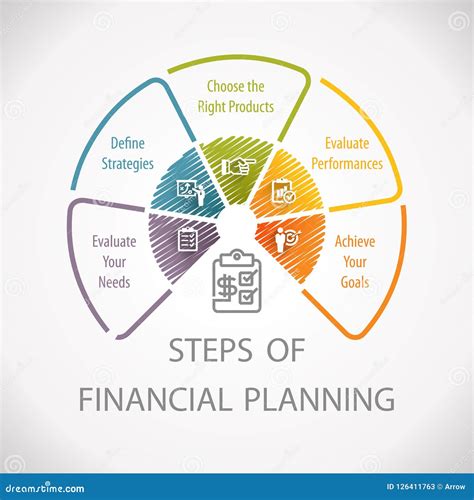

1. Financial Planning and Budgeting

Financial managers are responsible for developing and implementing comprehensive financial plans that align with the company's overall strategy. This involves creating detailed budgets, forecasts, and financial models to guide decision-making and ensure the organization's financial sustainability. They must stay up-to-date with market trends, industry developments, and regulatory changes to ensure that the company's financial plans are robust and adaptable.

Key Activities:

- Developing financial models and forecasts to inform business decisions

- Creating and managing budgets to ensure financial discipline and accountability

- Identifying areas for cost savings and process improvements

- Collaborating with other departments to ensure alignment with financial plans

2. Financial Reporting and Analysis

Financial managers are responsible for preparing and presenting financial reports to stakeholders, including investors, creditors, and regulatory bodies. They must analyze financial data to identify trends, risks, and opportunities, and provide insights to inform business decisions. This involves developing and maintaining financial reporting systems, ensuring compliance with accounting standards and regulatory requirements, and communicating financial results to stakeholders.

Key Activities:

- Preparing and presenting financial reports, including balance sheets, income statements, and cash flow statements

- Analyzing financial data to identify trends, risks, and opportunities

- Developing and maintaining financial reporting systems and processes

- Ensuring compliance with accounting standards and regulatory requirements

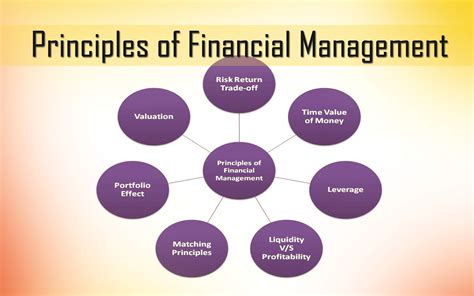

3. Risk Management and Compliance

Financial managers are responsible for identifying and mitigating financial risks that could impact the organization. This involves developing and implementing risk management strategies, ensuring compliance with regulatory requirements, and maintaining internal controls to prevent financial losses. They must stay up-to-date with changes in regulatory requirements and industry developments to ensure that the company's risk management practices are effective and compliant.

Key Activities:

- Identifying and assessing financial risks, including market risk, credit risk, and operational risk

- Developing and implementing risk management strategies to mitigate financial risks

- Ensuring compliance with regulatory requirements, including anti-money laundering and know-your-customer regulations

- Maintaining internal controls to prevent financial losses and ensure accountability

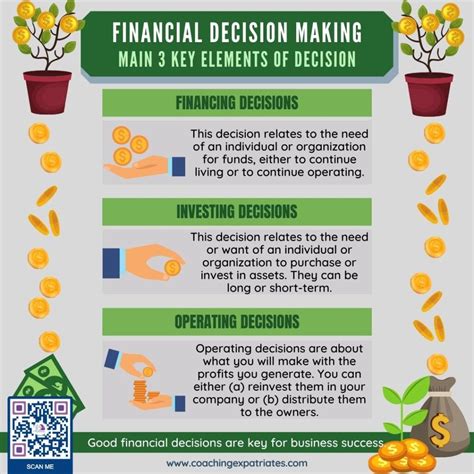

4. Funding and Investment

Financial managers are responsible for securing funding and investment to support the company's growth and development. This involves developing and implementing funding strategies, managing relationships with investors and creditors, and ensuring that the company's funding needs are met. They must stay up-to-date with market trends and industry developments to ensure that the company's funding strategies are effective and competitive.

Key Activities:

- Developing and implementing funding strategies to support business growth and development

- Managing relationships with investors and creditors to ensure access to funding

- Ensuring that the company's funding needs are met, including managing cash flow and liquidity

- Identifying and evaluating investment opportunities to drive business growth and returns

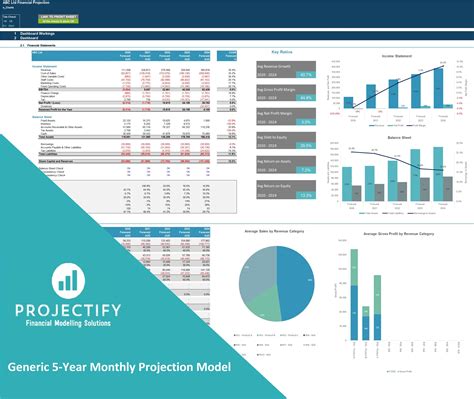

5. Financial Modeling and Forecasting

Financial managers are responsible for developing and maintaining financial models and forecasts to inform business decisions. This involves creating detailed financial models, including revenue projections, expense forecasts, and cash flow models, to help the company make informed decisions about investments, funding, and resource allocation. They must stay up-to-date with market trends and industry developments to ensure that the company's financial models are robust and adaptable.

Key Activities:

- Developing and maintaining financial models, including revenue projections, expense forecasts, and cash flow models

- Creating detailed forecasts to inform business decisions and drive growth

- Analyzing financial data to identify trends, risks, and opportunities

- Collaborating with other departments to ensure alignment with financial models and forecasts

6. Leadership and Collaboration

Financial managers are responsible for leading and collaborating with other departments to ensure that financial plans and strategies are aligned with business objectives. This involves providing financial guidance and support to other departments, including sales, marketing, and operations, to ensure that financial decisions are informed and effective. They must also collaborate with other finance professionals, including accountants, auditors, and financial analysts, to ensure that financial practices are robust and compliant.

Key Activities:

- Providing financial guidance and support to other departments to ensure alignment with business objectives

- Collaborating with other finance professionals to ensure robust and compliant financial practices

- Leading and managing finance teams to ensure effective financial management and planning

- Communicating financial results and insights to stakeholders, including investors, creditors, and regulatory bodies

Financial Managers Roles Image Gallery

In conclusion, financial managers play a critical role in driving business success by ensuring the financial health and stability of an organization. Their responsibilities span financial planning and budgeting, financial reporting and analysis, risk management and compliance, funding and investment, financial modeling and forecasting, and leadership and collaboration. By understanding these key responsibilities, businesses can better appreciate the importance of effective financial management and the role that financial managers play in achieving their goals. We hope this article has provided valuable insights into the world of financial management and the critical role that financial managers play in driving business success.