Intro

Unlock the secrets of Advanced Placement Government (APG) with this comprehensive guide. Discover the five essential ways to understand APG, including course structure, exam format, and key concepts. Learn about APG vs. regular government classes, passing scores, and benefits for college-bound students.

When it comes to financial jargon, it's easy to get lost in the sea of acronyms and technical terms. One term that often raises eyebrows is "APG." If you're scratching your head wondering what APG stands for and what it means, you're not alone. In this article, we'll break down the concept of APG in simple terms and provide five ways to understand it.

What is an APG?

An APG, short for Annual Percentage Gain, is a measure of the average annual return of an investment over a given period. It's a way to evaluate the performance of an investment, such as a mutual fund or a stock, by calculating the average return it generates each year.

Why is APG important?

Understanding APG is crucial for investors, as it helps them make informed decisions about their investments. By knowing the APG of an investment, investors can:

- Evaluate the performance of their investment portfolio

- Compare the performance of different investments

- Make informed decisions about whether to buy or sell an investment

- Set realistic expectations for their investment returns

Now, let's dive into five ways to understand APG:

1. Calculating APG: The Basics

Calculating APG involves using a simple formula:

APG = ( Ending Value - Beginning Value ) / Beginning Value

Where:

- Ending Value is the value of the investment at the end of the period

- Beginning Value is the value of the investment at the beginning of the period

For example, let's say you invested $1,000 in a mutual fund and it grew to $1,200 over a year. The APG would be:

APG = ( $1,200 - $1,000 ) / $1,000 = 20%

This means the investment generated a 20% return over the year.

Compounding APG

When calculating APG, it's essential to consider compounding. Compounding is the process of earning returns on returns, which can significantly impact the overall performance of an investment.

To calculate the compounded APG, you can use the following formula:

Compounded APG = ( 1 + APG ) ^ n - 1

Where:

- APG is the annual percentage gain

- n is the number of years

For example, if the APG is 20% and the investment is compounded annually for 5 years, the compounded APG would be:

Compounded APG = ( 1 + 0.20 ) ^ 5 - 1 = 33.86%

This means the investment would have grown to $1,338.60 over the 5-year period, assuming an annual APG of 20%.

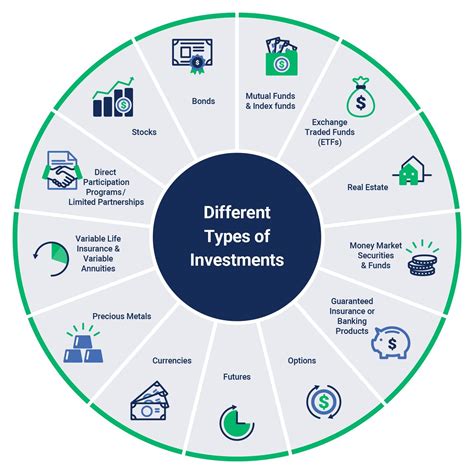

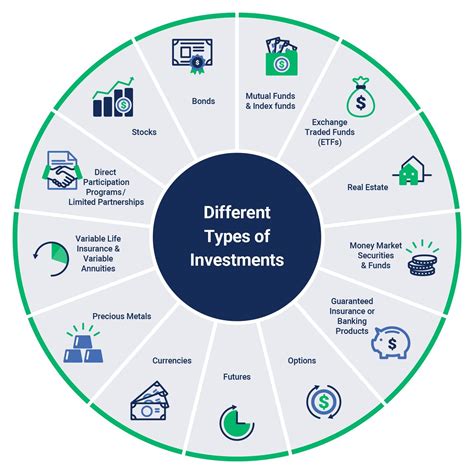

2. Understanding APG in the Context of Investment Types

Different investment types have varying levels of risk and potential returns, which impact their APG. Here are a few examples:

- Stocks: Stocks are considered higher-risk investments, but they also offer the potential for higher returns. The APG for stocks can range from 8% to 12% per annum.

- Bonds: Bonds are generally considered lower-risk investments, with a fixed interest rate. The APG for bonds is typically lower, ranging from 4% to 6% per annum.

- Mutual Funds: Mutual funds are a type of investment that pools money from multiple investors to invest in a diversified portfolio. The APG for mutual funds varies depending on the fund's investment strategy and asset allocation.

APG and Investment Strategies

Investors can use APG to evaluate the performance of different investment strategies, such as:

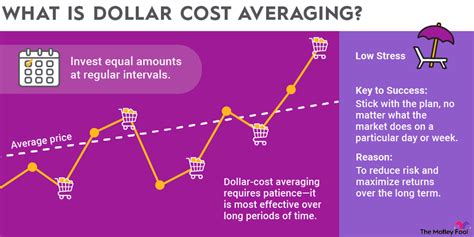

- Dollar-cost averaging: This involves investing a fixed amount of money at regular intervals, regardless of the market's performance. The APG for dollar-cost averaging can help investors evaluate the effectiveness of this strategy.

- Value investing: This involves investing in undervalued assets with the potential for long-term growth. The APG for value investing can help investors evaluate the performance of this strategy.

3. Evaluating APG Across Different Time Frames

APG can be evaluated across different time frames, such as:

- Short-term APG: This evaluates the performance of an investment over a short period, typically 1-3 years.

- Long-term APG: This evaluates the performance of an investment over a longer period, typically 5-10 years.

Why Long-term APG Matters

Long-term APG is essential for investors, as it provides a more accurate picture of an investment's performance. Short-term market fluctuations can be misleading, and long-term APG helps investors ride out market volatility.

4. Comparing APG Across Different Investments

Investors can use APG to compare the performance of different investments, such as:

- Mutual funds vs. ETFs: APG can help investors evaluate the performance of mutual funds and ETFs, which are often used for similar investment purposes.

- Index funds vs. actively managed funds: APG can help investors compare the performance of index funds, which track a market index, with actively managed funds, which try to beat the market.

Why Comparing APG Matters

Comparing APG across different investments helps investors make informed decisions about their investment portfolio. By evaluating the performance of different investments, investors can:

- Identify top-performing investments

- Evaluate the effectiveness of different investment strategies

- Make informed decisions about asset allocation

5. Understanding APG in the Context of Risk and Volatility

APG is closely related to risk and volatility, as investments with higher potential returns often come with higher risk. Investors should consider the following:

- Risk tolerance: Investors should evaluate their risk tolerance and adjust their investment portfolio accordingly.

- Volatility: Investors should understand the potential for market volatility and adjust their investment strategy to minimize risk.

APG and Risk Management

Investors can use APG to manage risk and volatility by:

- Diversifying their portfolio: Spreading investments across different asset classes and sectors can help reduce risk.

- Hedging: Investors can use hedging strategies to reduce potential losses.

Gallery of APG-related Images:

APG Image Gallery

In conclusion, APG is a crucial concept for investors to understand, as it helps them evaluate the performance of their investments and make informed decisions about their investment portfolio. By understanding APG in the context of different investment types, time frames, and risk levels, investors can optimize their investment strategy and achieve their financial goals.