Unlock the secrets of Earned Pay Reserve, a game-changing concept in employee compensation. Learn how it enables on-demand access to earned wages, reducing financial stress and increasing productivity. Discover the benefits, mechanics, and best practices of implementing an Earned Pay Reserve system, perfect for HR professionals and business owners seeking innovative employee benefits solutions.

The concept of Earned Pay Reserve, also known as Earned Wage Access or On-Demand Pay, has been gaining traction in recent years. This innovative approach to payroll is revolutionizing the way employees receive their wages, providing them with greater financial flexibility and control. In this comprehensive guide, we will delve into the world of Earned Pay Reserve, exploring its benefits, working mechanisms, and everything you need to know to get started.

What is Earned Pay Reserve?

Earned Pay Reserve is a financial technology solution that allows employees to access their earned but unpaid wages before the traditional payday. This means that employees can tap into their accumulated wages at any time, providing them with instant access to their hard-earned money. The Earned Pay Reserve system is designed to help employees manage their finances more effectively, reducing the need for expensive payday loans or overdraft fees.

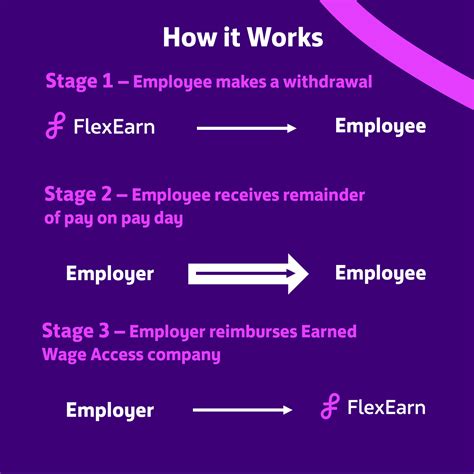

How Does Earned Pay Reserve Work?

The Earned Pay Reserve process is straightforward and easy to understand. Here's a step-by-step explanation of how it works:

- Employer Integration: The employer integrates the Earned Pay Reserve system into their existing payroll infrastructure.

- Employee Enrollment: Employees sign up for the Earned Pay Reserve service, providing necessary information and setting up their account.

- Earnings Tracking: The system tracks the employee's earnings in real-time, taking into account their work hours, pay rate, and any deductions.

- Access to Funds: Employees can access their earned wages at any time, subject to the employer's approval and any applicable rules or regulations.

- Funds Transfer: The requested funds are transferred to the employee's bank account or debit card, usually within minutes.

Benefits of Earned Pay Reserve

The benefits of Earned Pay Reserve are numerous, impacting both employees and employers positively. Some of the key advantages include:

- Financial Flexibility: Employees can access their earned wages at any time, providing them with greater financial flexibility and control.

- Reduced Financial Stress: Earned Pay Reserve helps employees avoid expensive payday loans, overdraft fees, and other financial pitfalls.

- Improved Budgeting: Employees can better manage their finances, making it easier to budget and plan for the future.

- Increased Employee Satisfaction: Earned Pay Reserve demonstrates an employer's commitment to their employees' financial well-being, leading to increased job satisfaction and reduced turnover rates.

- Reduced Administrative Burden: Employers can reduce the administrative burden associated with traditional payroll processing, as Earned Pay Reserve automates many tasks.

Common Misconceptions About Earned Pay Reserve

Despite its growing popularity, Earned Pay Reserve is still a relatively new concept, and some misconceptions persist. Here are a few common myths debunked:

- Earned Pay Reserve is a Loan: Earned Pay Reserve is not a loan; it's simply an advance on earned wages.

- Earned Pay Reserve is Expensive: Earned Pay Reserve is often less expensive than traditional payday loans or overdraft fees.

- Earned Pay Reserve is Only for Low-Income Employees: Earned Pay Reserve is beneficial for employees of all income levels, providing financial flexibility and control.

Implementing Earned Pay Reserve in Your Organization

Implementing Earned Pay Reserve in your organization can be a straightforward process. Here are some steps to get you started:

- Research and Selection: Research different Earned Pay Reserve providers and select the one that best fits your organization's needs.

- Integration and Setup: Integrate the Earned Pay Reserve system into your existing payroll infrastructure and set up the necessary accounts and rules.

- Employee Communication: Communicate the benefits and details of Earned Pay Reserve to your employees, ensuring they understand how to access and use the service.

- Ongoing Support: Provide ongoing support and training to employees, addressing any questions or concerns they may have.

FAQs About Earned Pay Reserve

Here are some frequently asked questions about Earned Pay Reserve:

- What is the cost of Earned Pay Reserve?: The cost of Earned Pay Reserve varies depending on the provider and the specific plan chosen.

- Is Earned Pay Reserve available to all employees?: Earned Pay Reserve is typically available to all employees, but some employers may choose to limit access to certain groups or individuals.

- Can employees access their entire paycheck?: Employees can usually access a portion of their earned wages, subject to the employer's approval and any applicable rules or regulations.

Earned Pay Reserve Image Gallery

In conclusion, Earned Pay Reserve is a game-changing financial technology solution that provides employees with greater financial flexibility and control. By understanding the benefits, working mechanisms, and implementation process, organizations can make informed decisions about incorporating Earned Pay Reserve into their payroll infrastructure. We hope this comprehensive guide has provided you with the necessary information to get started on your Earned Pay Reserve journey.