Intro

Discover the Hut Tax in NC, a property tax on residential homes, including cabins and cottages, with explanations on tax rates, exemptions, and payment options, helping homeowners understand their obligations and potential relief through tax relief programs and exemptions for eligible properties.

The Hut Tax in North Carolina is a topic of great interest and importance, particularly for homeowners and those in the construction industry. Understanding the intricacies of this tax can help individuals and businesses navigate the complex world of property taxation in the state. In this article, we will delve into the details of the Hut Tax, its history, and its implications for North Carolina residents.

The Hut Tax, also known as the "household tax," has its roots in the early 20th century. Initially, it was designed to tax households based on the number of rooms and occupants. Over time, the tax has evolved, and its application has expanded to include various types of properties, including residential, commercial, and industrial. The Hut Tax is administered by the North Carolina Department of Revenue and is an essential component of the state's property tax system.

The significance of the Hut Tax lies in its impact on property owners and the overall economy of North Carolina. The tax revenue generated from the Hut Tax is used to fund various public services, such as education, infrastructure, and public safety. As a result, understanding the Hut Tax is crucial for individuals and businesses seeking to minimize their tax liability and maximize their investment in the state's real estate market.

History of the Hut Tax in North Carolina

The Hut Tax has continued to evolve, with various amendments and changes made to the tax code over the years. In the 1970s, the state introduced a new tax classification system, which categorized properties into different classes, such as residential, commercial, and industrial. This change allowed for more targeted taxation and enabled the state to better allocate tax revenue to specific areas.

How the Hut Tax Works

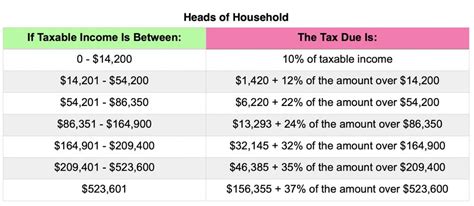

The Hut Tax is calculated by multiplying the assessed value of the property by the applicable tax rate. For example, if a residential property has an assessed value of $200,000 and the tax rate is 0.8%, the Hut Tax would be $1,600. The tax is typically paid annually, with the payment due date varying depending on the county.

Benefits of the Hut Tax

The Hut Tax provides several benefits to the state of North Carolina and its residents. Some of the key benefits include: * Funding for public services: The Hut Tax revenue is used to fund various public services, such as education, infrastructure, and public safety. * Economic growth: The Hut Tax helps to promote economic growth by encouraging investment in the state's real estate market. * Competitive tax rates: North Carolina's Hut Tax rates are competitive with other states, making it an attractive location for businesses and individuals.Exemptions and Deductions

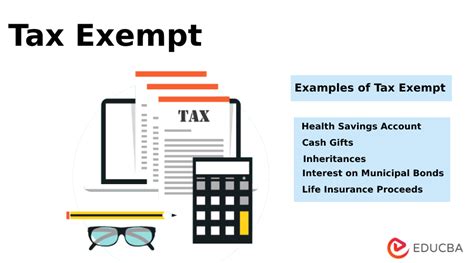

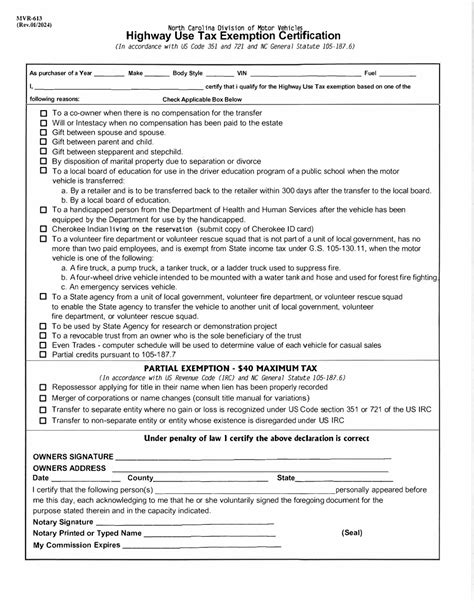

Steps to Apply for Exemptions and Deductions

To apply for exemptions and deductions, property owners must follow these steps: 1. Determine eligibility: Review the eligibility requirements for the exemption or deduction. 2. Gather required documents: Collect the necessary documents, such as proof of income, age, or disability. 3. Submit application: Submit the application to the county assessor's office. 4. Review and approval: The county assessor's office will review the application and approve or deny the exemption or deduction.Impact of the Hut Tax on North Carolina Residents

To minimize the impact of the Hut Tax, property owners can take several steps, such as:

- Reviewing their tax bill: Property owners should review their tax bill to ensure that it is accurate and that they are not being overcharged.

- Applying for exemptions and deductions: Property owners should apply for exemptions and deductions that they are eligible for.

- Considering tax planning strategies: Property owners should consider tax planning strategies, such as investing in tax-deferred accounts or using tax credits.

FAQs

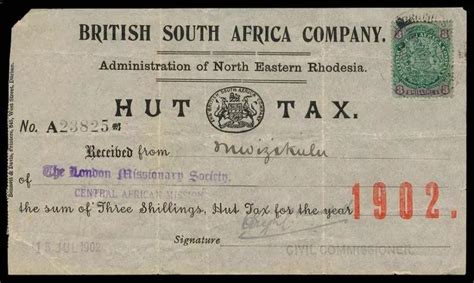

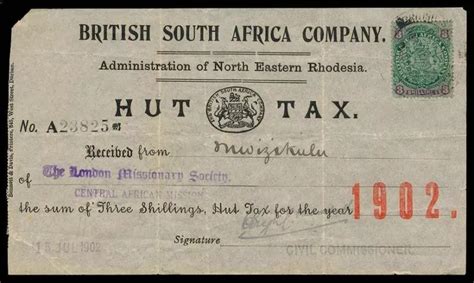

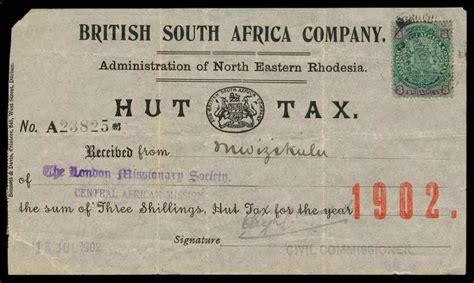

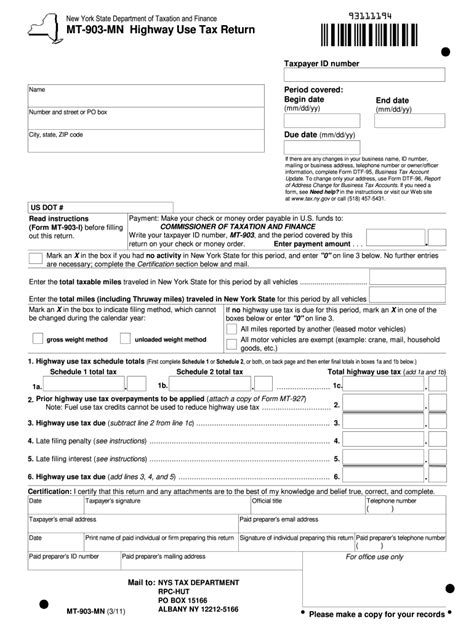

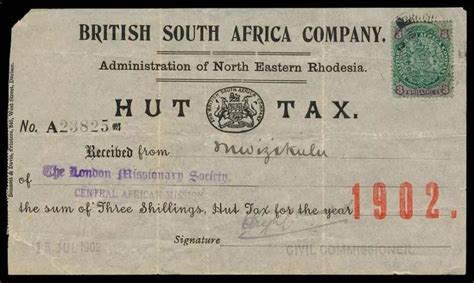

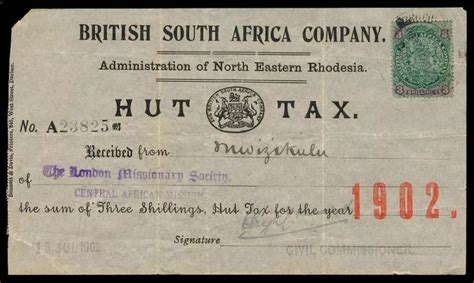

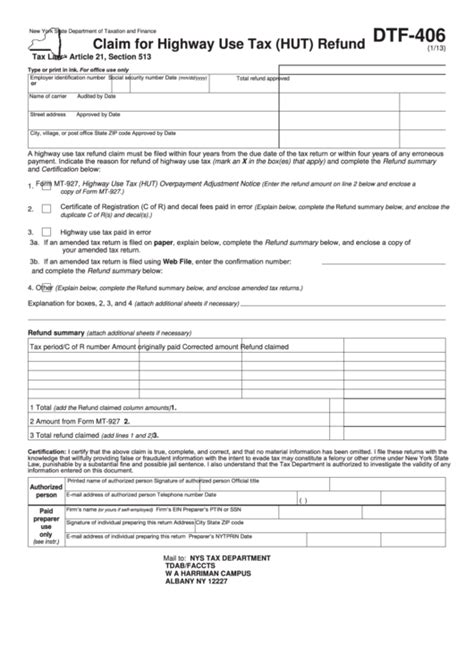

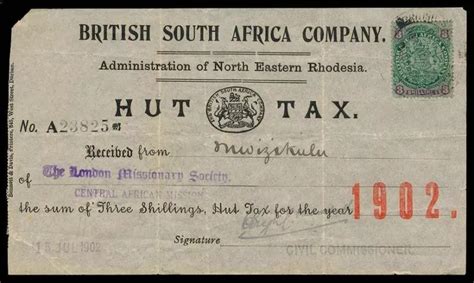

Some frequently asked questions about the Hut Tax in North Carolina include: * What is the Hut Tax? * How is the Hut Tax calculated? * What are the benefits of the Hut Tax? * How can I minimize my Hut Tax liability?Gallery of Hut Tax Images

Hut Tax Image Gallery

In conclusion, the Hut Tax in North Carolina is a complex and multifaceted topic that requires careful consideration and planning. By understanding the history, mechanism, and implications of the Hut Tax, property owners can make informed decisions about their tax liability and take steps to minimize their tax burden. We invite readers to share their thoughts and experiences with the Hut Tax in the comments section below. Additionally, we encourage readers to share this article with others who may be interested in learning more about the Hut Tax in North Carolina.