Intro

The Nebraska tax return filing start date is a crucial piece of information for residents and non-residents alike who need to file their taxes with the Nebraska Department of Revenue. In this article, we will explore the significance of the filing start date, the benefits of early filing, and the necessary steps to take to ensure a smooth and successful tax filing experience.

Why is the Filing Start Date Important?

The filing start date marks the beginning of the tax filing season, during which taxpayers can submit their tax returns to the state. In Nebraska, the filing start date typically falls in late January or early February. This date is important because it determines when taxpayers can begin filing their returns, and it sets the clock ticking for the deadline to file.

Benefits of Early Filing

Filing your taxes early can have several benefits. For one, it allows you to receive your refund sooner, which can be a welcome boost to your finances. Additionally, filing early can help you avoid the last-minute rush and reduce the likelihood of errors or missed deadlines. Furthermore, early filing can also help you stay ahead of potential identity theft and ensure that your return is processed before any fraudulent activity can occur.

Nebraska Tax Filing Requirements

To file your taxes in Nebraska, you will need to meet certain requirements. These include:

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- Filing a federal tax return

- Meeting the state's filing requirements, which include filing a Nebraska Form 1040N

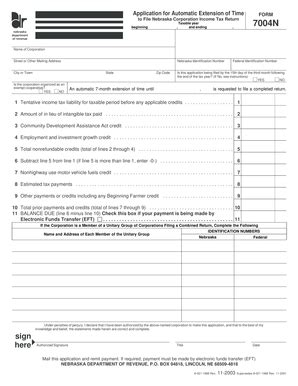

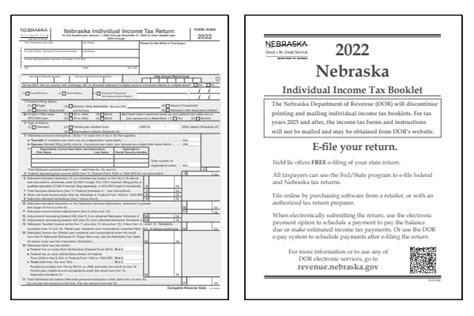

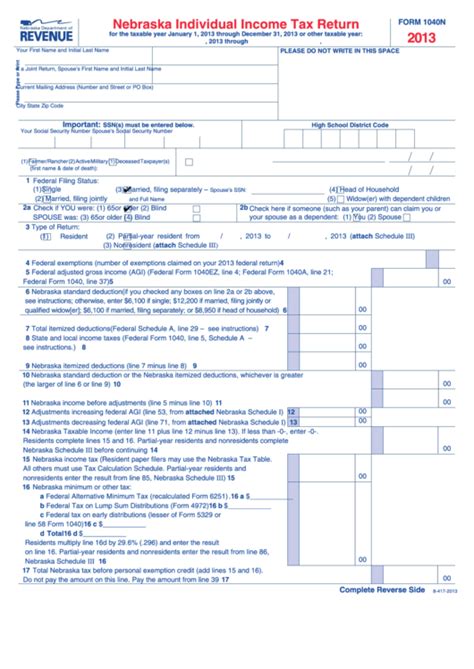

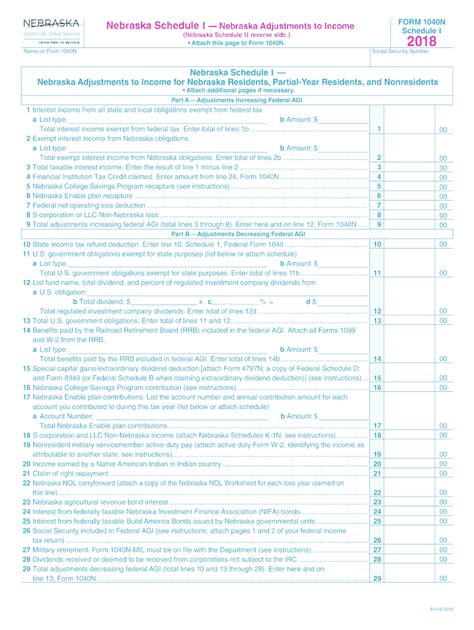

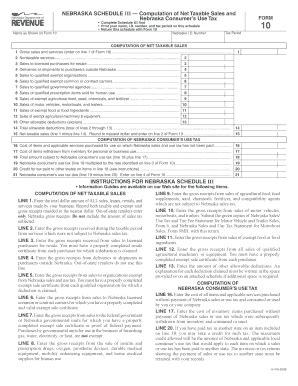

Nebraska Tax Forms and Schedules

Nebraska offers several tax forms and schedules to help you file your return accurately. These include:

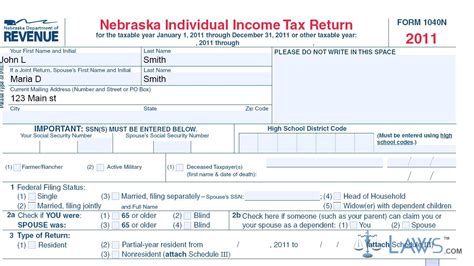

- Form 1040N: Nebraska Individual Income Tax Return

- Schedule I: Nebraska Adjustments to Income

- Schedule II: Nebraska Itemized Deductions

- Schedule III: Nebraska Credits

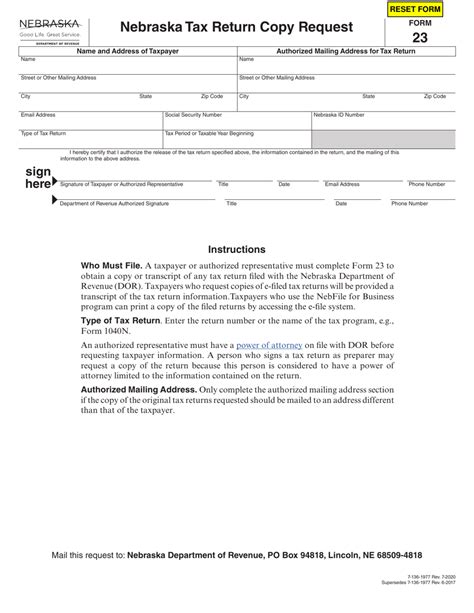

How to File Your Nebraska Tax Return

Filing your Nebraska tax return is a straightforward process that can be completed online or by mail. Here are the steps to follow:

- Gather your tax documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose your filing status and determine if you need to file a joint or separate return.

- Complete your tax forms and schedules, making sure to sign and date your return.

- If you are filing electronically, submit your return through the Nebraska Department of Revenue's website or through a tax preparation software.

- If you are filing by mail, send your return to the Nebraska Department of Revenue at the address listed on the instructions.

Tips for a Smooth Tax Filing Experience

To ensure a smooth tax filing experience, follow these tips:

- File early to avoid the last-minute rush

- Double-check your math and ensure accuracy

- Use tax preparation software or consult a tax professional if you are unsure about any aspect of the filing process

- Keep a copy of your return and supporting documents for your records

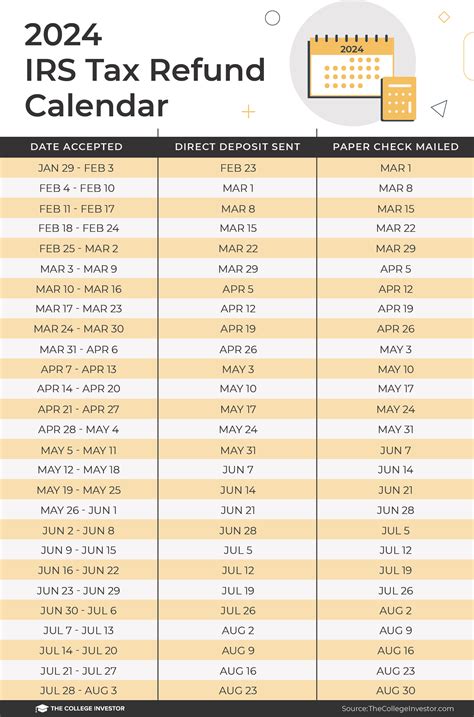

Nebraska Tax Refund Information

If you are due a refund, you can expect to receive it within 6-8 weeks after filing your return. You can check the status of your refund online or by calling the Nebraska Department of Revenue.

Gallery of Nebraska Tax Forms and Schedules

Nebraska Tax Forms and Schedules

We hope this article has provided you with valuable information about the Nebraska tax return filing start date and the steps to take to ensure a smooth and successful tax filing experience. If you have any questions or concerns, feel free to comment below or share this article with others who may find it helpful.