Discover who qualifies for stimulus checks in 2023. Learn about eligibility criteria, income limits, and requirements for receiving a stimulus payment. Find out if youre eligible for a tax credit, rebate, or refund in the new year. Get the latest updates on COVID-19 relief, economic stimulus, and government assistance programs.

The COVID-19 pandemic has caused significant economic disruption, and many individuals and families are still feeling the effects. To provide relief, the US government has implemented several stimulus packages, including direct payments to eligible citizens. In 2023, the rules and qualifications for receiving a stimulus check may have changed. Here's what you need to know.

To qualify for a stimulus check in 2023, you'll need to meet specific requirements, which may vary depending on your individual circumstances. Here are the general guidelines:

Income Limits

One of the primary qualifications for a stimulus check is income level. In 2023, individuals with an adjusted gross income (AGI) below a certain threshold may be eligible for a full or partial payment. The exact income limits have not been announced, but they may be similar to those in previous stimulus packages.

Family Size and Dependents

Another factor that affects stimulus check eligibility is family size and the number of dependents. Larger families with more dependents may be eligible for a larger payment.

Citizenship and Residency

To qualify for a stimulus check, you must be a US citizen or resident, or be a qualifying resident alien. This includes:

- US citizens

- Resident aliens

- Qualifying widows and widowers

- Social Security recipients

- Supplemental Security Income (SSI) recipients

- Veterans

- Railroad Retirement recipients

Social Security Recipients and Supplemental Security Income (SSI)

Social Security recipients and SSI recipients may be eligible for a stimulus check, even if they don't file taxes. These individuals will typically receive their payment through the Social Security Administration or the SSI program.

Veterans and Railroad Retirement Recipients

Veterans and railroad retirement recipients may also be eligible for a stimulus check. These individuals will typically receive their payment through the Department of Veterans Affairs or the Railroad Retirement Board.

How to Claim Your Stimulus Check

If you're eligible for a stimulus check, here's what you need to do to claim your payment:

- File Your Taxes: The IRS will use your 2022 tax return to determine your eligibility for a stimulus check. If you haven't filed your taxes yet, do so as soon as possible.

- Update Your Address: Make sure the IRS has your correct address on file. If you've moved recently, update your address with the IRS to ensure you receive your payment.

- Wait for Your Payment: If you're eligible, you'll receive your stimulus check automatically. You don't need to apply or take any further action.

Additional Resources

For more information on stimulus checks and eligibility, visit the official IRS website or contact the IRS directly.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about stimulus checks:

- Q: Who is eligible for a stimulus check? A: US citizens, resident aliens, qualifying widows and widowers, Social Security recipients, SSI recipients, veterans, and railroad retirement recipients may be eligible.

- Q: How do I claim my stimulus check? A: If you're eligible, you'll receive your payment automatically. You don't need to apply or take any further action.

- Q: Can I receive a stimulus check if I don't file taxes? A: If you're a Social Security recipient or SSI recipient, you may be eligible for a stimulus check, even if you don't file taxes.

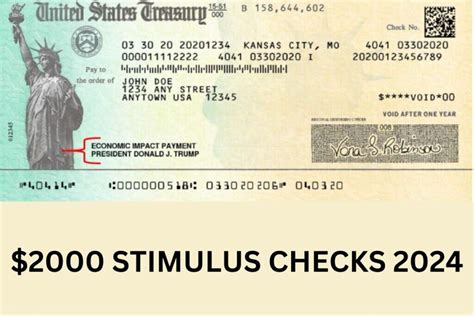

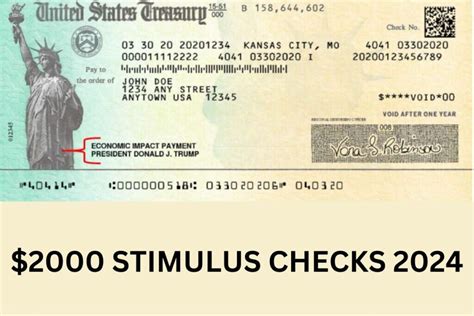

Stimulus Check Gallery

Conclusion

In conclusion, stimulus checks are a vital part of the US government's efforts to provide relief to individuals and families affected by the COVID-19 pandemic. If you're eligible, you can claim your payment by filing your taxes and updating your address with the IRS. Remember to check the official IRS website for the latest information on stimulus checks and eligibility.

We hope this article has provided you with the information you need to claim your stimulus check. If you have any further questions or concerns, please don't hesitate to comment below or contact the IRS directly.