Intro

Maximize your life insurance benefits with our expert guide on using a whole life insurance calculator Excel. Discover 5 effective ways to optimize your coverage, including calculating premiums, cash value, and dividends. Get insider tips on leveraging Excel formulas to make informed decisions and secure your financial future.

In today's fast-paced world, planning for the future has become a top priority for many individuals. Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire lifetime, as long as premiums are paid. To make informed decisions about whole life insurance, it's essential to utilize a whole life insurance calculator Excel. This tool helps users understand the costs, benefits, and cash value accumulation of a whole life insurance policy.

Using a whole life insurance calculator Excel can be a bit complex, but with the right guidance, users can maximize its potential. Here are five ways to use a whole life insurance calculator Excel to make informed decisions about whole life insurance:

Understanding Whole Life Insurance Basics

Before diving into the calculator, it's essential to understand the basics of whole life insurance. Whole life insurance provides a guaranteed death benefit and a cash value component that grows over time. The cash value can be used to pay premiums, take out loans, or withdraw cash.

1. Calculating Premiums and Death Benefits

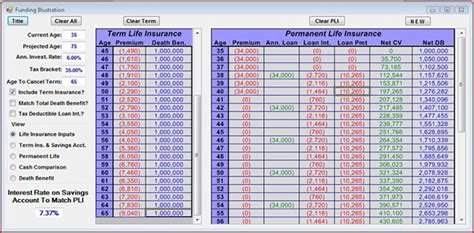

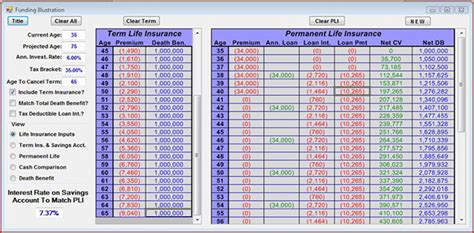

One of the primary uses of a whole life insurance calculator Excel is to calculate premiums and death benefits. Users can input their age, health status, coverage amount, and premium payment frequency to determine their premium costs. The calculator will also provide an estimate of the death benefit, which is the amount paid to beneficiaries in the event of the policyholder's passing.

For example, let's say a 35-year-old male wants to purchase a $500,000 whole life insurance policy with a 20-year payment term. Using the calculator, he can determine that his monthly premium would be approximately $350. The calculator will also estimate the death benefit, which in this case would be $500,000.

Assessing Cash Value Accumulation

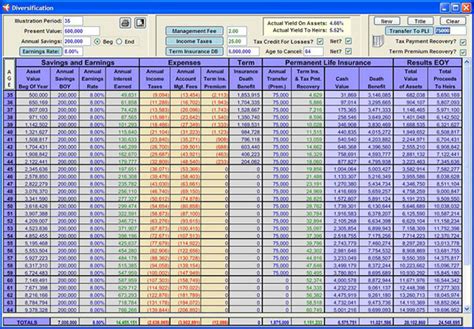

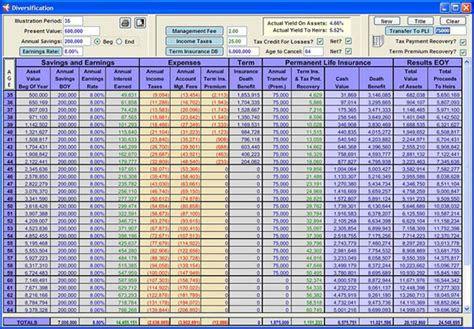

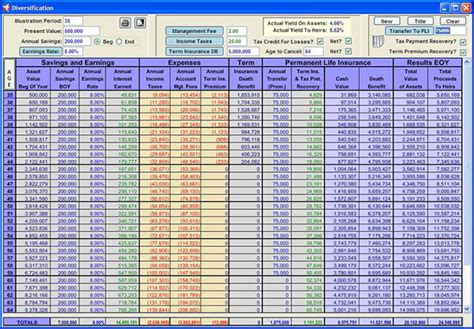

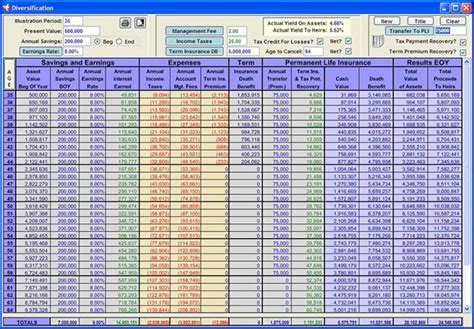

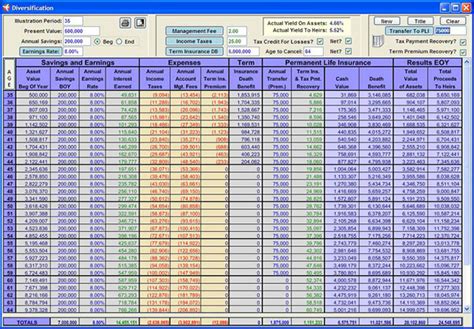

Another essential aspect of whole life insurance is the cash value accumulation. The calculator can help users understand how the cash value grows over time, based on the premium payments and interest rates.

Using the same example as above, the calculator can estimate that the cash value of the policy will grow to approximately $200,000 after 20 years, assuming a 4% interest rate. This means that the policyholder can borrow against the cash value or withdraw cash to supplement their retirement income.

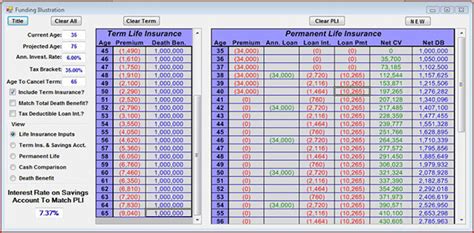

2. Comparing Policies and Riders

A whole life insurance calculator Excel can also be used to compare different policies and riders. Users can input various policy options, such as term lengths, coverage amounts, and rider types, to determine which policy best suits their needs.

For instance, a user may want to compare a whole life insurance policy with a 10-year term rider versus a policy with a 20-year term rider. The calculator can help them determine which policy provides the best coverage and cash value accumulation.

Evaluating Tax Implications

Whole life insurance policies have tax implications that users should consider. The calculator can help users evaluate the tax implications of their policy, including the tax-deferred growth of the cash value.

Using the calculator, users can determine how the cash value growth will be taxed, as well as any potential tax implications of borrowing against the policy or withdrawing cash.

3. Determining Loan and Withdrawal Options

Whole life insurance policies often allow policyholders to borrow against the cash value or withdraw cash. The calculator can help users determine the loan and withdrawal options available to them.

For example, a user may want to determine how much they can borrow against their policy or how much cash they can withdraw without affecting the policy's performance. The calculator can provide estimates based on the policy's cash value and interest rates.

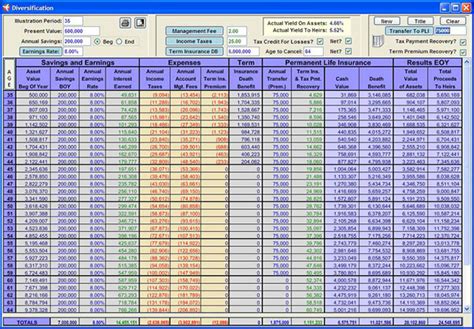

Creating a Retirement Income Strategy

Whole life insurance can be a valuable component of a retirement income strategy. The calculator can help users determine how to use their policy to supplement their retirement income.

Using the calculator, users can estimate how much cash they can withdraw from their policy each year, based on the cash value accumulation and interest rates. This can help them create a sustainable retirement income strategy.

4. Evaluating Estate Planning Options

Whole life insurance can also be used as part of an estate planning strategy. The calculator can help users evaluate how to use their policy to transfer wealth to beneficiaries or pay estate taxes.

For example, a user may want to determine how to use their policy to pay estate taxes or create a trust for their beneficiaries. The calculator can provide estimates based on the policy's death benefit and cash value.

5. Analyzing Policy Performance

Finally, a whole life insurance calculator Excel can be used to analyze policy performance over time. Users can input their policy details and track the policy's performance, including the cash value accumulation and death benefit.

This can help users determine if their policy is performing as expected and make adjustments as needed.

Gallery of Whole Life Insurance Calculator Excel:

Whole Life Insurance Calculator Excel Gallery

By following these five ways to use a whole life insurance calculator Excel, users can make informed decisions about their whole life insurance policy and create a comprehensive financial plan. Whether you're looking to calculate premiums and death benefits, assess cash value accumulation, or evaluate tax implications, a whole life insurance calculator Excel is an essential tool for anyone considering whole life insurance.

We hope this article has provided you with valuable insights into the world of whole life insurance and the benefits of using a whole life insurance calculator Excel. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them make informed decisions about their whole life insurance policy.