Intro

Discover how inheritance impacts food stamp eligibility. Learn the 5 key facts about inheritance and food stamps, including how lump sums, trusts, and inheritances are treated. Understand the effects on SNAP benefits and explore resources for managing inheritances while maintaining food assistance.

Receiving an inheritance can be a life-changing event, bringing financial stability and a sense of security. However, for individuals or families relying on government assistance programs, such as food stamps, an inheritance can have unintended consequences. In this article, we will explore how inheritance affects food stamps, highlighting five key facts that you should know.

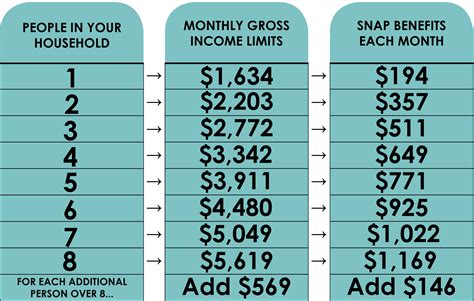

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a vital lifeline for many low-income households. The program provides essential financial assistance to purchase food, helping families and individuals meet their basic nutritional needs. However, when an inheritance is received, it can impact eligibility for food stamps, potentially reducing or even eliminating benefits.

Understanding the Impact of Inheritance on Food Stamps

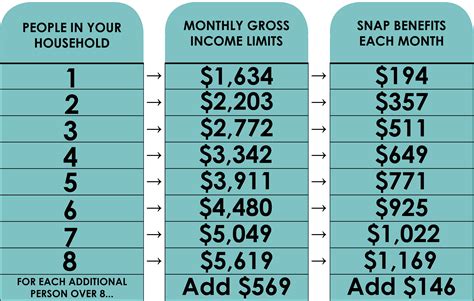

To understand how inheritance affects food stamps, it's essential to grasp the basics of SNAP eligibility. The program is designed to support low-income households, with eligibility determined by income, expenses, and assets. When an inheritance is received, it can alter the household's financial situation, potentially affecting their eligibility for food stamps.

Fact #1: Inheritance is Considered Income

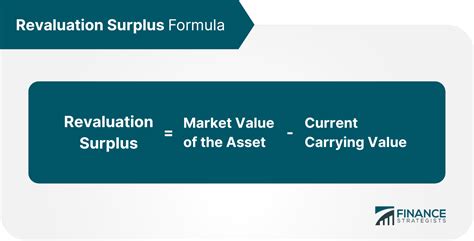

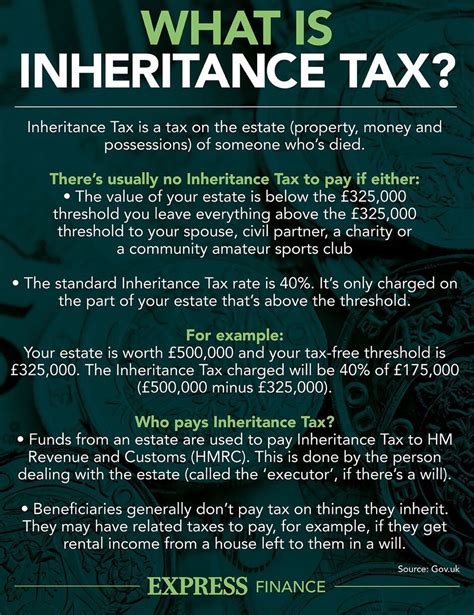

When an individual receives an inheritance, it is considered income for SNAP purposes. This means that the inherited amount will be counted as part of the household's income, potentially affecting their eligibility for food stamps. However, it's essential to note that not all inheritances are treated equally. For example, inheritances received in the form of a trust or annuity may be treated differently than a lump-sum payment.

Fact #2: Assets are Also a Consideration

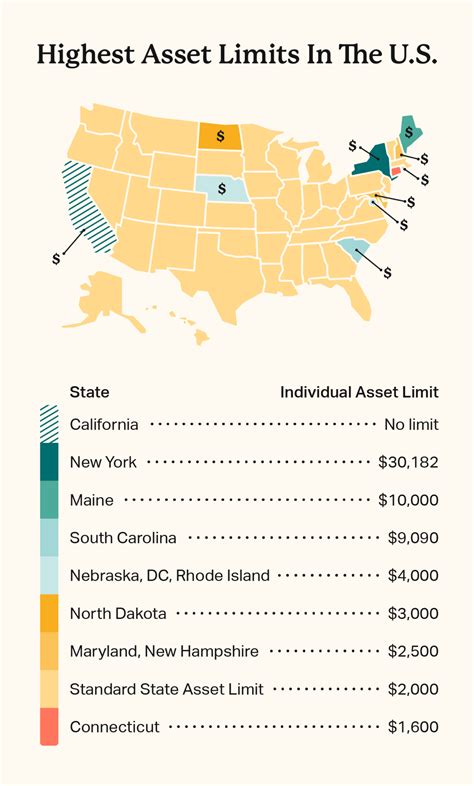

In addition to income, SNAP eligibility also considers a household's assets. When an inheritance is received, it can increase the household's assets, potentially affecting their eligibility for food stamps. However, some assets, such as a primary residence or retirement accounts, are exempt from consideration.

Fact #3: Excess Assets Can Disqualify Benefits

If an inheritance increases a household's assets above the allowable limit, they may be disqualified from receiving food stamps. The excess assets limit varies by state, but generally ranges from $2,000 to $3,000. If a household's assets exceed this limit, they may be required to spend down their assets before reapplying for benefits.

Fact #4: Timing of Inheritance Matters

The timing of an inheritance can also impact food stamp eligibility. If an inheritance is received during the SNAP certification period, it may affect the household's eligibility for the remainder of the certification period. However, if the inheritance is received after the certification period has ended, it may not affect eligibility until the next certification period.

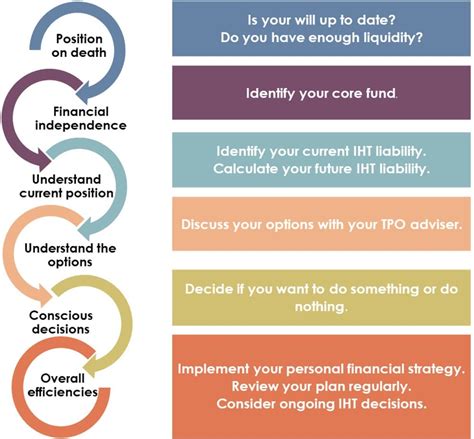

Fact #5: Planning Ahead is Crucial

For individuals or families receiving food stamps, it's essential to plan ahead when anticipating an inheritance. This may involve seeking the advice of a financial advisor or attorney to explore options for managing the inherited assets. By planning ahead, households can minimize the impact of an inheritance on their food stamp benefits.

Food Stamps and Inheritance Image Gallery

In conclusion, receiving an inheritance can have a significant impact on food stamp eligibility. By understanding the five key facts outlined above, individuals and families can better navigate the complexities of inheritance and food stamps. It's essential to plan ahead, seek professional advice, and explore options for managing inherited assets to minimize the impact on food stamp benefits. Share your thoughts and experiences in the comments below, and don't forget to share this article with others who may be affected by the intersection of inheritance and food stamps.