Intro

Learn how to create a valid will in Florida with our 7 essential steps guide. Understand the importance of having a will, how to choose an executor, and what assets to include. Discover the Florida probate process and how to avoid common pitfalls. Get started on securing your legacy and protecting your loved ones futures.

Creating a will in Florida is a crucial step in ensuring that your assets are distributed according to your wishes after you pass away. Without a valid will, the state of Florida will determine how your assets are distributed, which may not align with your intentions. In this article, we will guide you through the 7 essential steps to create a will in Florida.

Understanding the Importance of a Will in Florida

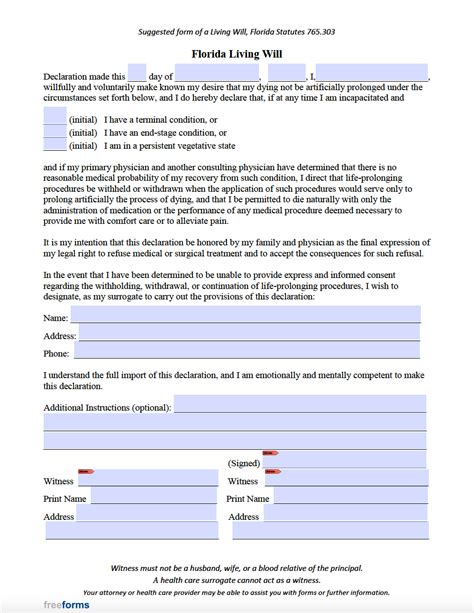

A will is a legal document that outlines how you want your assets to be distributed after your death. It allows you to appoint an executor to manage your estate, name beneficiaries, and make specific bequests. In Florida, a will can also be used to establish a trust, appoint guardians for minor children, and make arrangements for funeral expenses.

Step 1: Determine Your Assets and Liabilities

Before creating a will, it's essential to take stock of your assets and liabilities. This includes:

- Real estate properties

- Bank accounts

- Investments

- Retirement accounts

- Life insurance policies

- Personal property (e.g., jewelry, artwork, vehicles)

- Debts (e.g., mortgages, credit cards, loans)

Make a list of your assets and liabilities to help you determine how you want to distribute them.

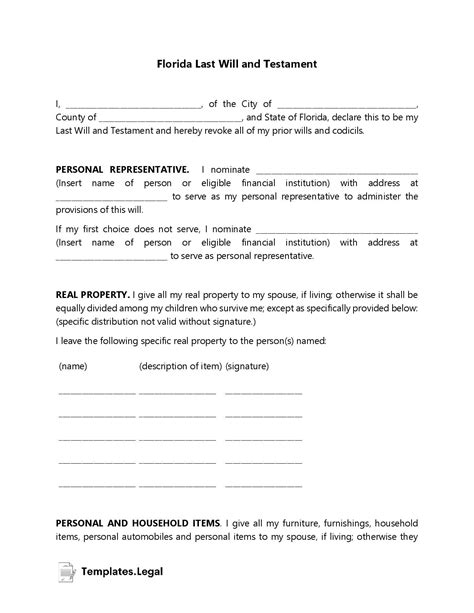

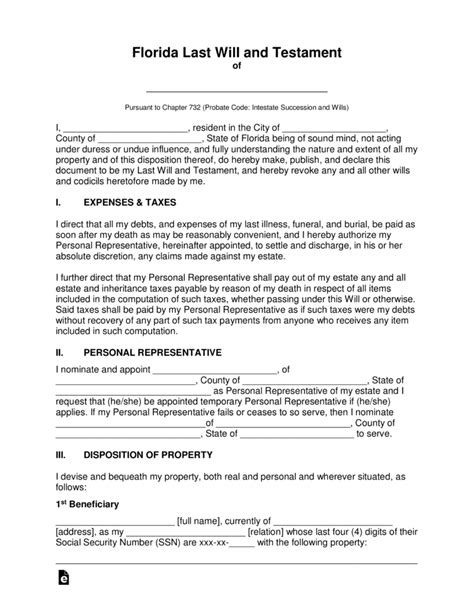

Step 2: Choose an Executor

An executor, also known as a personal representative, is responsible for managing your estate after your death. This includes paying debts, distributing assets, and ensuring that your wishes are carried out. Choose someone you trust, such as a family member, friend, or attorney.

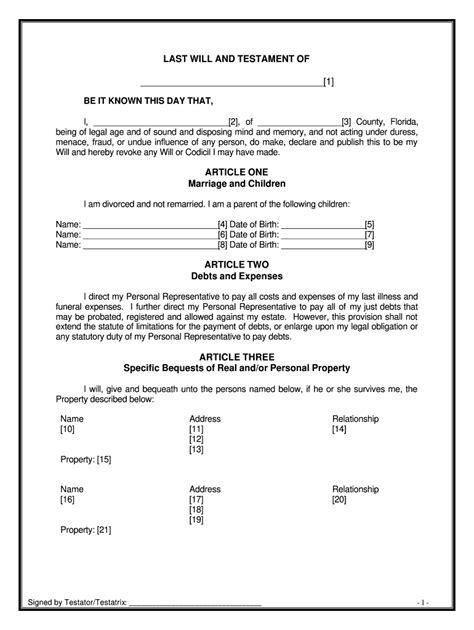

Step 3: Identify Beneficiaries

Beneficiaries are the individuals or organizations that will inherit your assets. You can name beneficiaries for specific assets, such as a life insurance policy or a retirement account. You can also name residual beneficiaries, who will inherit any remaining assets after specific bequests have been made.

Step 4: Decide on Specific Bequests

Specific bequests are gifts of specific assets or amounts to beneficiaries. For example, you may want to leave a piece of jewelry to a grandchild or a specific sum of money to a friend. Make a list of specific bequests you want to make.

Step 5: Consider Establishing a Trust

A trust is a separate entity that can hold assets on behalf of beneficiaries. Trusts can provide tax benefits, protect assets from creditors, and ensure that assets are distributed according to your wishes. Consider consulting with an attorney to determine if a trust is right for you.

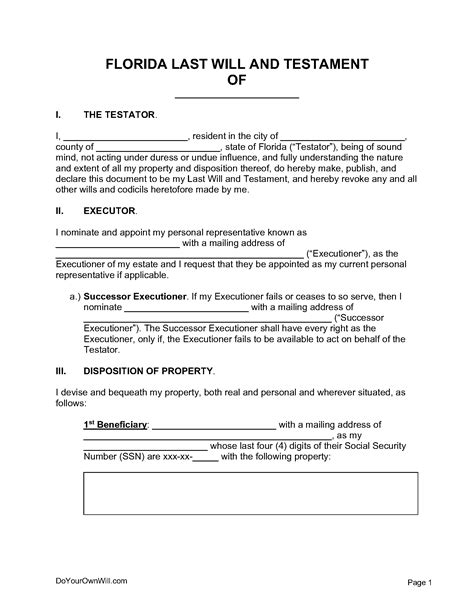

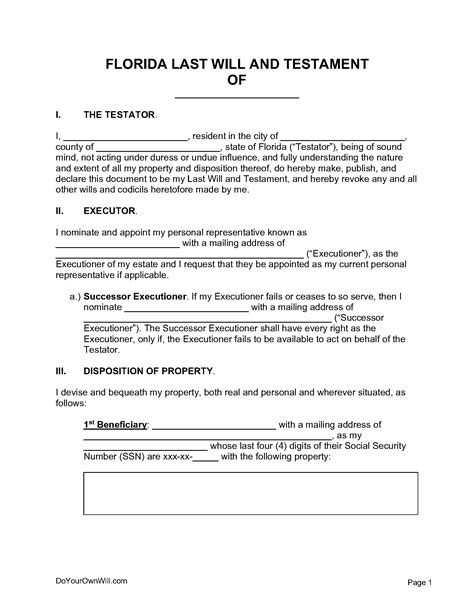

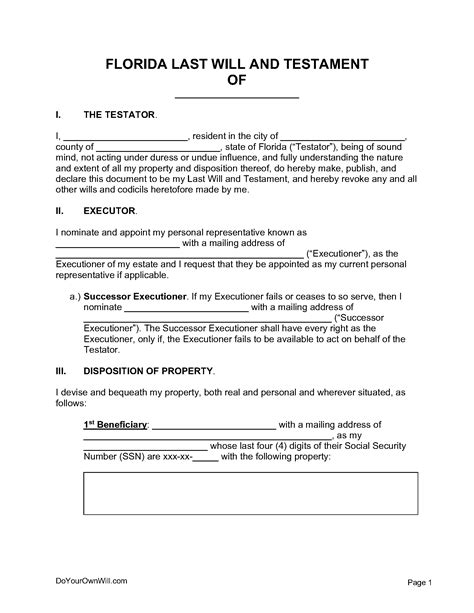

Step 6: Sign and Witness the Will

To be valid in Florida, a will must be signed by the testator (the person creating the will) in the presence of two witnesses. The witnesses must also sign the will and provide their addresses. Ensure that you and your witnesses meet the necessary requirements.

Step 7: Store the Will Safely

Once you've created and signed your will, store it in a safe and accessible location. Consider storing it with your attorney, in a safe deposit box, or in a fireproof safe. Make sure that your executor and beneficiaries know where to find the will.

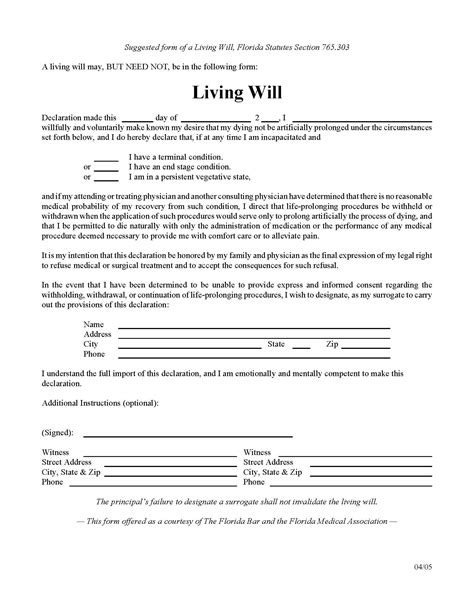

Gallery of Florida Will-Related Images

Florida Will Image Gallery

By following these 7 essential steps, you can create a valid will in Florida that ensures your assets are distributed according to your wishes. Remember to store your will safely and make sure that your executor and beneficiaries know where to find it.