Intro

Discover how marriage impacts food stamp benefits. Learn the 5 ways tying the knot can affect your eligibility and benefit amount. Understand the rules on joint income, household size, and resource calculations. Get informed on how marriage can change your Supplemental Nutrition Assistance Program (SNAP) benefits and make informed decisions.

When it comes to food stamp benefits, marriage can have a significant impact on eligibility and the amount of benefits received. In the United States, the Supplemental Nutrition Assistance Program (SNAP) provides financial assistance to low-income individuals and families to purchase food. However, the rules and regulations surrounding SNAP benefits can be complex, and marriage is one of the many factors that can affect an individual's or family's eligibility.

In this article, we will explore the ways in which marriage can affect food stamp benefits, including changes in household income, expenses, and composition. We will also discuss the importance of reporting changes in marital status to the SNAP office and provide tips for navigating the system.

How Marriage Affects Household Income

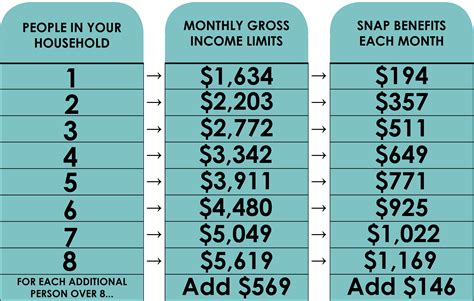

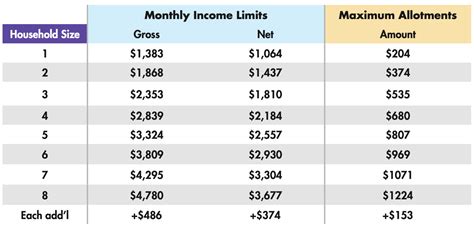

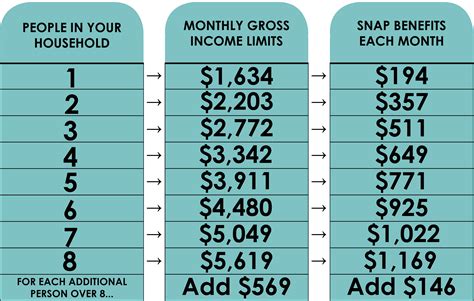

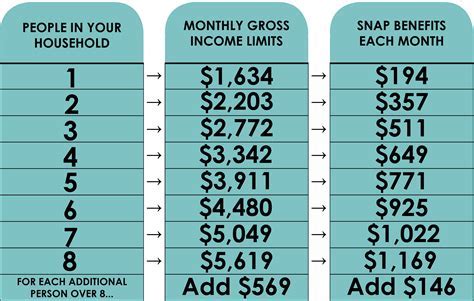

When two individuals get married, their household income is combined, which can affect their eligibility for food stamp benefits. In most states, the SNAP office considers the income of all household members when determining eligibility and benefit amounts. This means that if one spouse has a higher income than the other, it could impact the overall household income and potentially reduce or eliminate food stamp benefits.

For example, let's say John and Jane are both eligible for food stamp benefits as single individuals. John has a monthly income of $1,000, and Jane has a monthly income of $500. If they get married, their combined household income would be $1,500 per month. Depending on the state's income limits and benefit calculation, their combined income could make them ineligible for food stamp benefits or reduce the amount of benefits they receive.

Changes in Expenses

Marriage can also affect household expenses, which can impact food stamp benefits. When two individuals get married, they may experience changes in expenses such as rent, utilities, and food costs. These changes can affect the household's eligibility for food stamp benefits, as the SNAP office considers expenses when determining benefit amounts.

For instance, if John and Jane move in together after getting married, their rent and utility costs may decrease. However, their food costs may increase if they start buying groceries together. Depending on the state's expense calculation, these changes could impact their food stamp benefits.

Changes in Household Composition

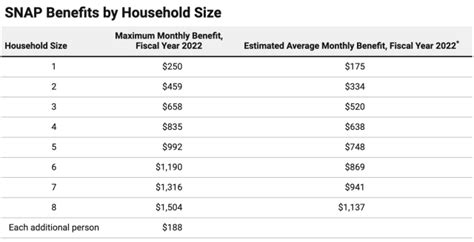

Marriage can also affect the composition of the household, which can impact food stamp benefits. In most states, the SNAP office considers the number of people in the household when determining eligibility and benefit amounts. When two individuals get married, they may become a single household, which can affect their food stamp benefits.

For example, if John and Jane have children from previous relationships, their household composition may change after getting married. If they become a single household with children, their food stamp benefits may increase or decrease depending on the state's benefit calculation.

Reporting Changes in Marital Status

It is essential to report changes in marital status to the SNAP office to ensure accurate benefit calculations. Failing to report changes in marital status can result in overpayments or underpayments of food stamp benefits.

To report changes in marital status, individuals can contact their local SNAP office or submit a written request. The SNAP office will require documentation, such as a marriage certificate, to verify the change in marital status.

Navigating the System

Navigating the food stamp system can be complex, especially when it comes to marriage. Here are some tips for navigating the system:

- Report changes in marital status promptly: Failing to report changes in marital status can result in overpayments or underpayments of food stamp benefits.

- Gather required documentation: The SNAP office may require documentation, such as a marriage certificate, to verify the change in marital status.

- Understand the state's income limits: Each state has its own income limits for food stamp benefits. Understanding these limits can help individuals determine how marriage may affect their eligibility.

- Seek assistance from a SNAP office: If individuals are unsure about how marriage may affect their food stamp benefits, they can seek assistance from a SNAP office.

Conclusion

Marriage can have a significant impact on food stamp benefits, including changes in household income, expenses, and composition. It is essential to report changes in marital status to the SNAP office to ensure accurate benefit calculations. By understanding how marriage affects food stamp benefits and navigating the system, individuals can ensure they receive the correct amount of benefits.

Food Stamp Benefits Gallery

Leave a comment below if you have any questions or concerns about how marriage affects food stamp benefits. Share this article with someone who may benefit from this information.