Intro

Explore the looming threat of economic collapse in the near future. Discover the warning signs, expert predictions, and potential triggers, including inflation, debt, and global market instability. Learn how to prepare and protect your finances from a potential economic downturn and understand the impact on trade, commerce, and your personal wealth.

The question of whether the economy will collapse in the near future is a complex and multifaceted one. Economists, financial experts, and policymakers have been debating this topic for years, and there is no consensus on a definitive answer. However, we can examine some of the key indicators, trends, and factors that could potentially contribute to an economic collapse.

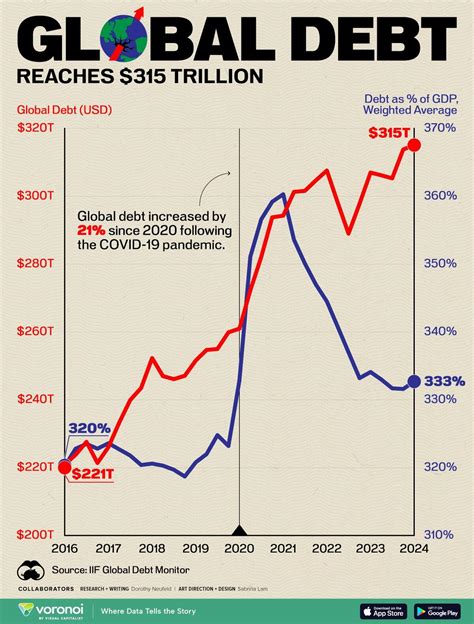

One of the primary concerns is the level of global debt. The world's debt has reached unprecedented levels, with the total debt of governments, corporations, and households exceeding $250 trillion. This has led to concerns about the sustainability of debt levels and the potential for a debt crisis.

Another factor is the increasing wealth inequality. The richest 1% of the population now hold more wealth than the remaining 99%, leading to concerns about the stability of the economy and the potential for social unrest.

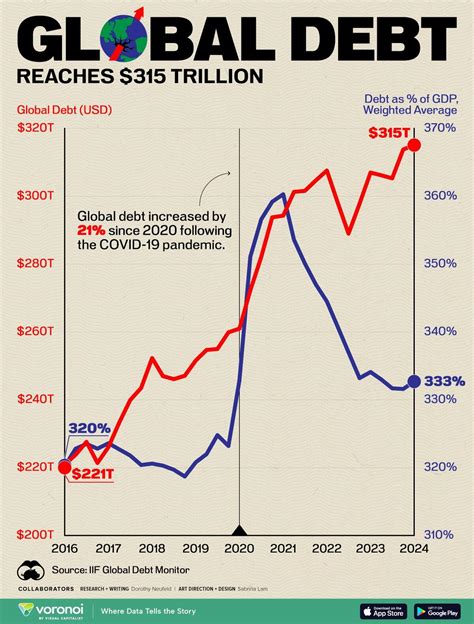

The rise of protectionism and trade tensions is also a concern. The ongoing trade war between the US and China has led to a decline in global trade and investment, and there are fears that this could lead to a recession.

Furthermore, the global economy is facing a number of structural challenges, including the decline of traditional industries, the rise of automation, and the impact of climate change. These challenges will require significant investment and policy changes to address.

Despite these concerns, there are also reasons to be optimistic about the economy. Many countries have made significant progress in reducing poverty and improving living standards, and there are opportunities for growth and investment in areas such as renewable energy and technology.

Understanding the Complexities of the Economy

To better understand the potential for an economic collapse, it's essential to examine the complexities of the economy and the various factors that contribute to its stability.

Global Debt and Financial Instability

The level of global debt is a significant concern, as it can lead to financial instability and even collapse. When governments, corporations, and households take on too much debt, they become vulnerable to changes in interest rates, exchange rates, and other economic shocks.

The global financial system is also highly interconnected, which means that a crisis in one country or sector can quickly spread to others. This interconnectedness can amplify the impact of a crisis and make it more difficult to contain.

Monetary Policy and Central Banks

Central banks play a crucial role in maintaining economic stability, and their actions can have a significant impact on the economy. In recent years, central banks have implemented unconventional monetary policies, such as quantitative easing and negative interest rates, to stimulate economic growth.

However, these policies have also led to concerns about asset bubbles and the distortion of market prices. If central banks are unable to normalize their policies without causing a recession, it could lead to a loss of confidence in the financial system and even a collapse.

Indicators of an Economic Collapse

While it's impossible to predict with certainty whether the economy will collapse, there are several indicators that could suggest a collapse is imminent.

Recession and Economic Contraction

A recession is a significant decline in economic activity, typically defined as a decline in gross domestic product (GDP) for two or more consecutive quarters. If a recession is severe and prolonged, it could lead to a collapse of the financial system.

Financial Market Volatility

Financial market volatility can be a sign of underlying stress in the economy. If markets become highly volatile, it can make it difficult for investors to price assets accurately, leading to a loss of confidence and potentially even a collapse.

Sovereign Debt Crisis

A sovereign debt crisis occurs when a government is unable to pay its debts, either due to a lack of funds or a loss of confidence in its ability to pay. If a sovereign debt crisis were to occur in a major economy, it could lead to a global financial crisis and potentially even a collapse.

Preparing for the Worst-Case Scenario

While it's impossible to predict with certainty whether the economy will collapse, it's essential to be prepared for the worst-case scenario.

Building an Emergency Fund

Having an emergency fund in place can provide a financial safety net in the event of a crisis. This fund should be easily accessible and able to cover at least six months of living expenses.

Diversifying Investments

Diversifying investments can help reduce the risk of losses in the event of a crisis. This can include investing in a range of asset classes, such as stocks, bonds, and commodities.

Reducing Debt and Increasing Resilience

Reducing debt and increasing resilience can help individuals and businesses weather a financial storm. This can include reducing expenses, increasing income, and building a cash reserve.

Economic Collapse Image Gallery

Conclusion

The question of whether the economy will collapse in the near future is a complex and multifaceted one. While there are indicators that suggest a collapse is possible, there are also reasons to be optimistic about the economy.

Ultimately, the future of the economy is uncertain, and it's essential to be prepared for any scenario. By understanding the complexities of the economy, reducing debt, increasing resilience, and diversifying investments, individuals and businesses can help weather a financial storm and ensure a more stable financial future.

We invite you to share your thoughts and opinions on the potential for an economic collapse in the comments section below. What do you think are the most significant risks to the economy, and how can we prepare for the worst-case scenario?