Intro

Explore the potential extensions of the Tax Cuts and Jobs Act (TCJA) under Trumps administration. Discover five key ways the TCJA may be prolonged, including modifications to individual and corporate tax rates, deductions, and credits. Learn about the implications of these extensions on businesses and individuals, including tax savings and economic growth.

The Tax Cuts and Jobs Act (TCJA) has been a cornerstone of the Trump administration's economic policy, providing significant tax cuts for individuals and corporations. As the TCJA's provisions begin to sunset, President Trump may explore ways to extend or make permanent certain aspects of the law. Here are five possible ways Trump may extend the TCJA:

The TCJA's Impact on the Economy

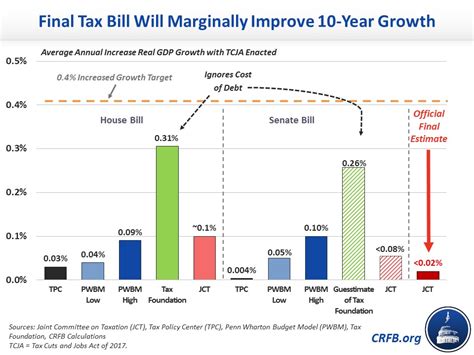

The TCJA has had a profound impact on the US economy, leading to significant economic growth, job creation, and increased competitiveness. The law's provisions, including the reduction in corporate tax rates and the doubling of the standard deduction, have put more money in the pockets of American families and businesses.

1. Making the Individual Tax Cuts Permanent

Individual Tax Cuts

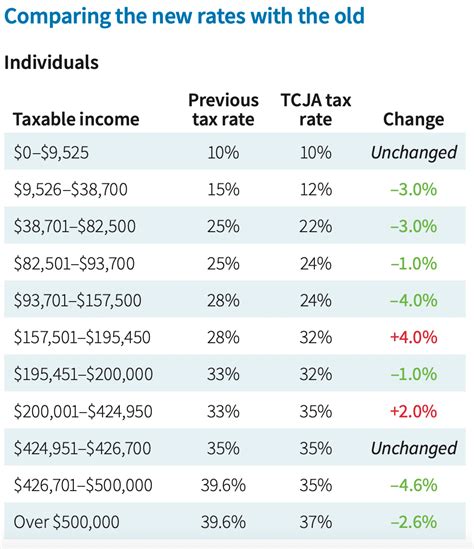

One way Trump may extend the TCJA is by making the individual tax cuts permanent. The TCJA's individual tax cuts are set to expire in 2025, which could lead to a significant tax increase for many Americans. By making these cuts permanent, Trump can ensure that American families continue to benefit from lower tax rates.

- The TCJA's individual tax cuts have led to an average tax cut of $1,400 for American families.

- Making these cuts permanent could lead to increased economic growth and job creation.

2. Extending the Corporate Tax Rate Reduction

Corporate Tax Rate Reduction

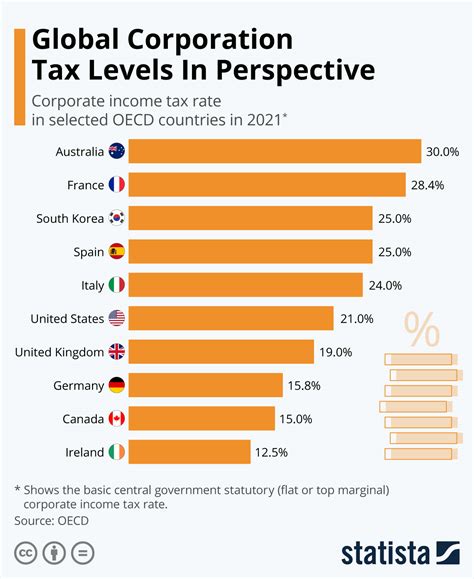

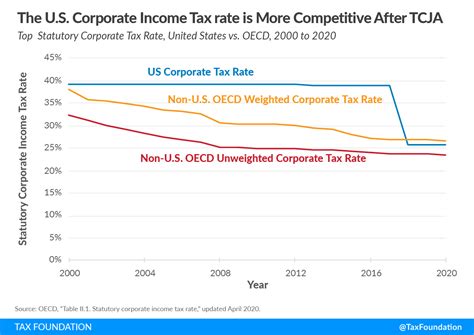

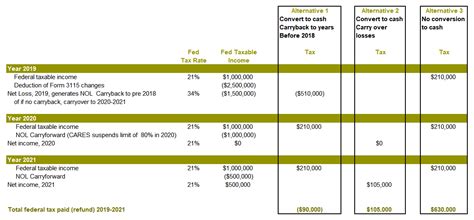

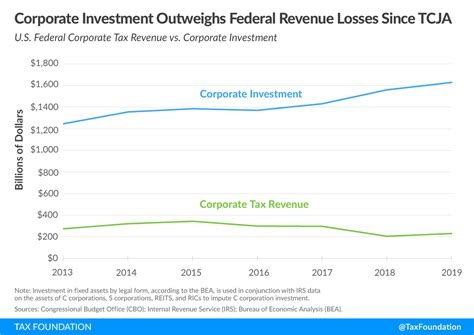

Another way Trump may extend the TCJA is by making the corporate tax rate reduction permanent. The TCJA reduced the corporate tax rate from 35% to 21%, making American businesses more competitive globally. By extending this provision, Trump can ensure that American businesses continue to benefit from a lower corporate tax rate.

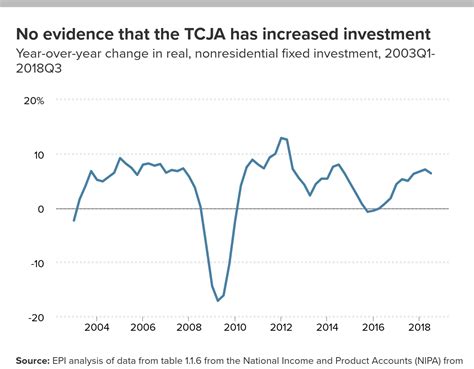

- The TCJA's corporate tax rate reduction has led to increased business investment and job creation.

- Extending this provision could lead to continued economic growth and competitiveness.

3. Expanding the Standard Deduction

Standard Deduction

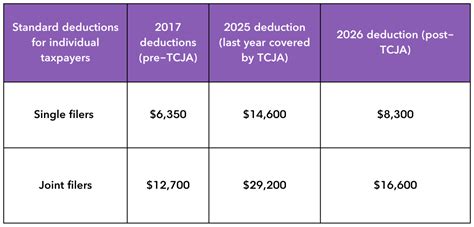

Trump may also extend the TCJA by expanding the standard deduction. The TCJA doubled the standard deduction, reducing the number of Americans who itemize their taxes. By expanding the standard deduction, Trump can simplify the tax code and reduce the tax burden on American families.

- The TCJA's expansion of the standard deduction has led to increased tax simplicity and reduced the number of Americans who itemize their taxes.

- Expanding the standard deduction could lead to increased tax savings for American families.

4. Enhancing the Opportunity Zone Program

Opportunity Zone Program

The Opportunity Zone program, created by the TCJA, provides tax incentives for investors who invest in low-income communities. Trump may extend the TCJA by enhancing this program, providing additional tax incentives for investors who invest in these communities.

- The Opportunity Zone program has led to increased investment in low-income communities.

- Enhancing this program could lead to increased economic growth and job creation in these communities.

5. Reducing Taxes on Pass-Through Entities

Pass-Through Entities

Trump may also extend the TCJA by reducing taxes on pass-through entities. The TCJA provided a 20% deduction for pass-through entities, such as sole proprietorships and S corporations. By reducing taxes on these entities, Trump can increase the competitiveness of American businesses.

- The TCJA's deduction for pass-through entities has led to increased tax savings for American businesses.

- Reducing taxes on pass-through entities could lead to increased economic growth and job creation.

Gallery of TCJA Provisions

TCJA Provisions

Conclusion

The TCJA has been a significant success, providing tax cuts for American families and businesses. By extending or making permanent certain provisions of the law, Trump can ensure that the economy continues to grow and prosper. Whether through making individual tax cuts permanent, extending the corporate tax rate reduction, or enhancing the Opportunity Zone program, Trump has several options for extending the TCJA. As the TCJA's provisions begin to sunset, it will be important for Trump to act quickly to ensure that American families and businesses continue to benefit from lower tax rates.