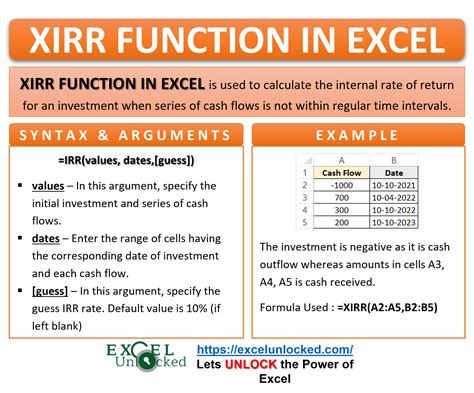

XIRR (eXponential Internal Rate of Return) is a powerful financial formula in Excel that helps you calculate the internal rate of return of a series of cash flows that occur at irregular intervals. Unlike the IRR formula, which assumes that cash flows occur at regular intervals, XIRR can handle cash flows that occur at any time. In this article, we'll explore the XIRR formula in Excel, its syntax, and some examples to help you get started.

What is the XIRR Formula?

The XIRR formula in Excel is a financial function that calculates the internal rate of return of a series of cash flows that occur at irregular intervals. It's a more flexible and powerful version of the IRR formula, which assumes that cash flows occur at regular intervals. The XIRR formula takes into account the timing and amount of each cash flow to calculate the internal rate of return.

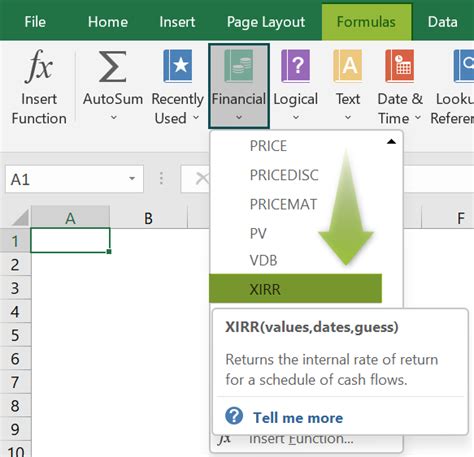

Syntax of the XIRR Formula

The syntax of the XIRR formula is as follows:

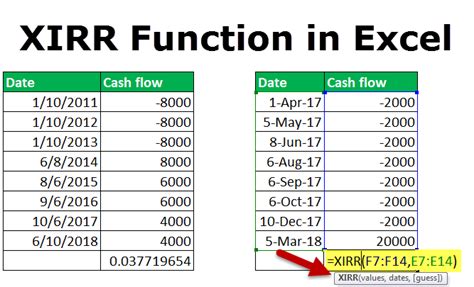

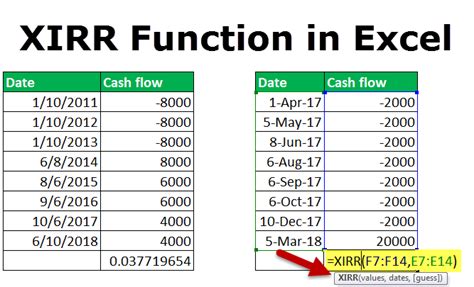

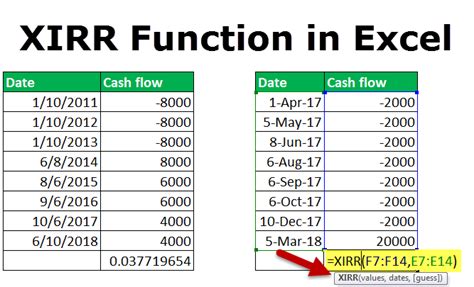

XIRR(values, dates, [guess])

valuesis an array of cash flows, including the initial investment and subsequent inflows and outflows.datesis an array of dates corresponding to each cash flow.[guess]is an optional argument that specifies the initial guess for the internal rate of return.

How to Use the XIRR Formula in Excel

To use the XIRR formula in Excel, follow these steps:

- Enter the cash flows in a column, including the initial investment and subsequent inflows and outflows.

- Enter the corresponding dates in another column.

- Select the cell where you want to display the XIRR result.

- Type

=XIRR(and select the range of cash flows. - Select the range of dates.

- Press Enter.

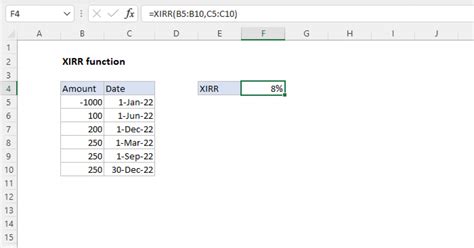

Example 1: Simple XIRR Calculation

Suppose you invest $1,000 on January 1, 2022, and receive $500 on June 30, 2022, and $600 on December 31, 2022. You want to calculate the internal rate of return using the XIRR formula.

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$1,000 |

| 06/30/2022 | $500 |

| 12/31/2022 | $600 |

To calculate the XIRR, select the cell where you want to display the result and type:

=XIRR(B2:B4, A2:A4)

Press Enter, and the result will be 12.35%.

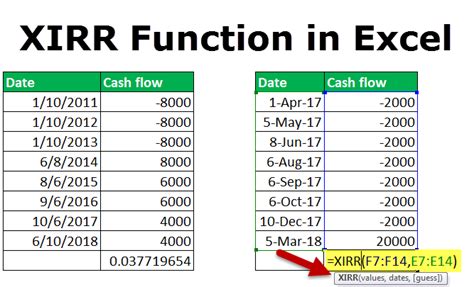

Example 2: XIRR Calculation with Multiple Cash Flows

Suppose you invest $5,000 on January 1, 2022, and receive the following cash flows:

| Date | Cash Flow |

|---|---|

| 03/31/2022 | $1,000 |

| 06/30/2022 | $1,500 |

| 09/30/2022 | $2,000 |

| 12/31/2022 | $2,500 |

To calculate the XIRR, select the cell where you want to display the result and type:

=XIRR(B2:B6, A2:A6)

Press Enter, and the result will be 15.12%.

Common Errors and Troubleshooting

Here are some common errors and troubleshooting tips when using the XIRR formula:

- Error #VALUE!: This error occurs when the dates are not in chronological order. Make sure to sort the dates in ascending order before using the XIRR formula.

- Error #NUM!: This error occurs when the initial guess is not valid or when the cash flows are not consistent. Try changing the initial guess or checking the cash flows for errors.

- XIRR result is not accurate: This may occur when the cash flows are not consistent or when the initial guess is not valid. Try changing the initial guess or checking the cash flows for errors.

XIRR Formula Best Practices

Here are some best practices to keep in mind when using the XIRR formula:

- Use a consistent format for dates: Use a consistent format for dates, such as MM/DD/YYYY, to avoid errors.

- Sort dates in chronological order: Sort the dates in ascending order before using the XIRR formula.

- Use a valid initial guess: Use a valid initial guess, such as 0.1 or 0.2, to ensure that the XIRR formula converges.

- Check cash flows for errors: Check the cash flows for errors, such as inconsistent or missing values.

XIRR Formula vs. IRR Formula

The XIRR formula and IRR formula are both used to calculate the internal rate of return, but they differ in their assumptions and applications:

- IRR formula: The IRR formula assumes that cash flows occur at regular intervals and calculates the internal rate of return based on those intervals.

- XIRR formula: The XIRR formula assumes that cash flows occur at irregular intervals and calculates the internal rate of return based on those intervals.

When to use the XIRR formula:

- Irregular cash flows: Use the XIRR formula when cash flows occur at irregular intervals, such as when investments have different maturity dates.

- Non-periodic cash flows: Use the XIRR formula when cash flows are not periodic, such as when investments have irregular income streams.

When to use the IRR formula:

- Regular cash flows: Use the IRR formula when cash flows occur at regular intervals, such as when investments have consistent income streams.

- Periodic cash flows: Use the IRR formula when cash flows are periodic, such as when investments have regular income streams.

XIRR Formula Image Gallery

Conclusion

The XIRR formula is a powerful financial function in Excel that helps you calculate the internal rate of return of a series of cash flows that occur at irregular intervals. With its flexibility and accuracy, the XIRR formula is a valuable tool for financial analysts, investors, and anyone who needs to calculate the internal rate of return of an investment. By following the best practices and troubleshooting tips outlined in this article, you can master the XIRR formula and make informed investment decisions.

Share Your Thoughts

Do you have any experience with the XIRR formula? Share your thoughts, tips, and experiences in the comments section below. Have you ever encountered any errors or difficulties when using the XIRR formula? Let us know, and we'll do our best to help you troubleshoot.

Related Articles