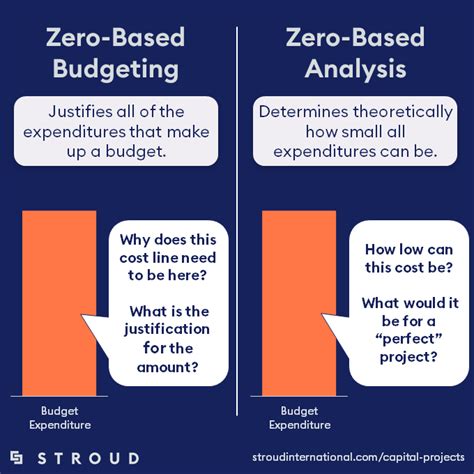

Creating a budget can be a daunting task, but with the right tools and techniques, it can be a breeze. Zero-based budgeting is a popular method that involves allocating every single dollar towards a specific expense or savings goal. In this article, we'll show you how to implement zero-based budgeting using Excel in 5 easy steps.

What is Zero-Based Budgeting?

Benefits of Zero-Based Budgeting

- Increased financial clarity and transparency

- Reduced unnecessary expenses

- Improved savings and investment rates

- Enhanced budgeting accuracy and efficiency

- Better financial goal achievement

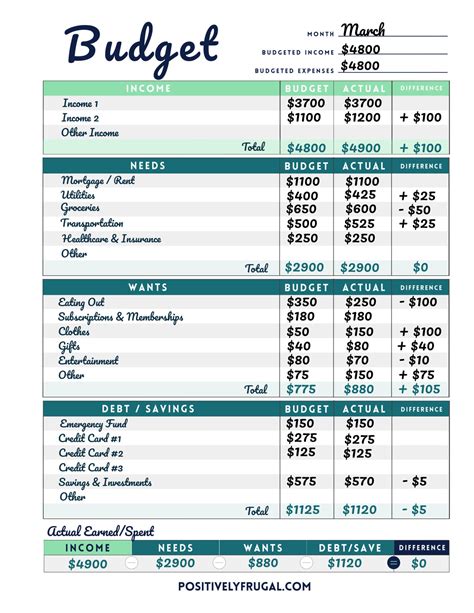

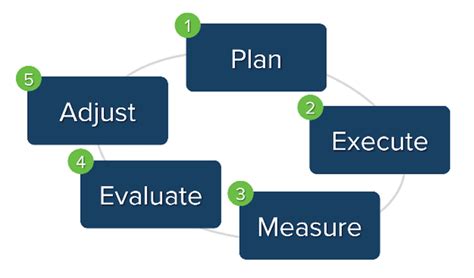

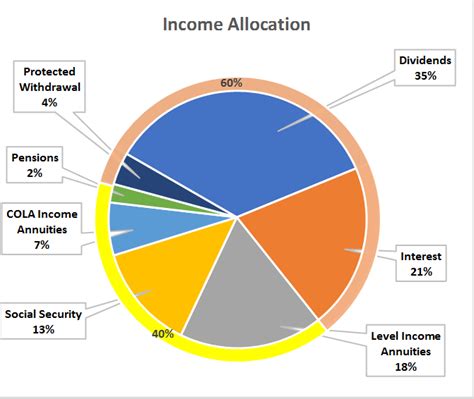

Step 1: Gather Your Financial Data

- Income statements

- Expense reports

- Bank statements

- Credit card statements

- Investment accounts

Make sure to include all sources of income and expenses, no matter how small they may seem.

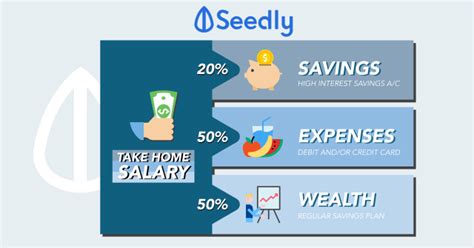

Tip: Use the 50/30/20 Rule

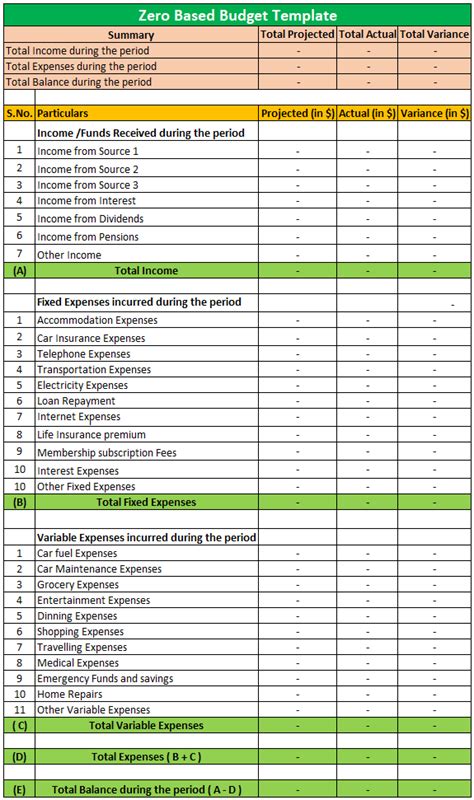

Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.Step 2: Create a Budget Template in Excel

- Income

- Fixed Expenses (rent, utilities, etc.)

- Variable Expenses (groceries, entertainment, etc.)

- Savings

- Debt Repayment

- Miscellaneous

Make sure to include all categories and subcategories relevant to your financial situation.

Tip: Use Formulas to Automate Calculations

Use Excel formulas to automate calculations and make budgeting easier. For example, you can use the =SUM formula to calculate total income or expenses.Step 3: Allocate Your Income

Remember to follow the 50/30/20 rule and allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

Tip: Use Zero-Based Budgeting Principles

Make sure to allocate every single dollar towards a specific expense or savings goal. If you have any leftover funds, consider allocating them towards savings or debt repayment.Step 4: Track Your Expenses

You can use Excel to track expenses by creating a separate sheet or using a budgeting app.

Tip: Use Budgeting Apps to Simplify Tracking

Consider using budgeting apps like Mint, Personal Capital, or YNAB (You Need a Budget) to simplify expense tracking and make budgeting easier.Step 5: Review and Adjust

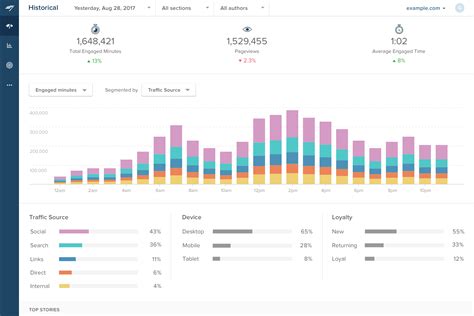

Consider reviewing your budget monthly or quarterly to ensure you're meeting your financial goals.

Tip: Use Historical Data to Inform Future Budgets

Use historical data to inform future budgets and make adjustments as needed. This will help you identify areas for improvement and make more accurate budgeting decisions.Zero-Based Budgeting Image Gallery

We hope this article has helped you understand the basics of zero-based budgeting and how to implement it using Excel. Remember to track your expenses regularly, review and adjust your budget, and make adjustments as needed. Happy budgeting!