Intro

Discover 5 ways Zimbabwe dollar affects economy, including inflation, exchange rates, and investment strategies, to navigate financial challenges in Zimbabwes monetary landscape.

The Zimbabwe dollar has been a subject of interest for many years, with its value fluctuating greatly over time. Understanding the Zimbabwe dollar and its implications is crucial for individuals and businesses looking to invest or operate in the country. In this article, we will delve into five ways the Zimbabwe dollar affects the economy and provide insights into its history, benefits, and challenges.

The Zimbabwe dollar was once a stable currency, but it has faced significant challenges in recent years, including hyperinflation and a decline in value. Despite these challenges, the Zimbabwe dollar remains an important part of the country's economy, and its value continues to impact businesses and individuals alike. With the current economic situation in Zimbabwe, it is essential to understand the factors that affect the value of the Zimbabwe dollar and how it impacts the economy.

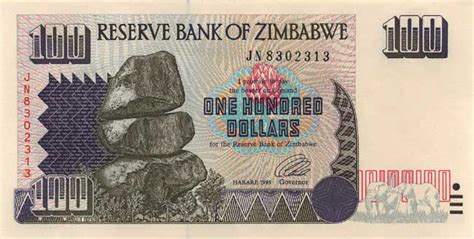

The history of the Zimbabwe dollar is complex, with the currency being introduced in 1980, replacing the Rhodesian dollar. Initially, the Zimbabwe dollar was pegged to the British pound, but it was later allowed to float on the foreign exchange market. The value of the Zimbabwe dollar has fluctuated greatly over the years, with the currency experiencing periods of high inflation and depreciation. Understanding the history of the Zimbabwe dollar is crucial in understanding its current state and the challenges it faces.

Introduction to the Zimbabwe Dollar

History of the Zimbabwe Dollar

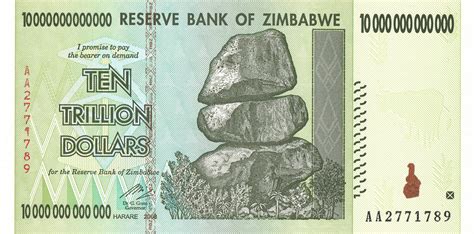

The history of the Zimbabwe dollar is marked by periods of high inflation and depreciation. In the early 2000s, the Zimbabwe dollar experienced a period of hyperinflation, with the inflation rate reaching a peak of 89.7 sextillion percent in mid-November 2008. This period of hyperinflation led to a significant decline in the value of the Zimbabwe dollar, making it one of the weakest currencies in the world.Economic Implications of the Zimbabwe Dollar

Benefits of a Strong Zimbabwe Dollar

A strong Zimbabwe dollar can have several benefits for the economy, including: * Increased economic growth: A strong Zimbabwe dollar can make exports more competitive, leading to an increase in economic growth. * Higher standard of living: A strong Zimbabwe dollar can lead to lower prices for goods and services, resulting in a higher standard of living for individuals and families. * Increased foreign investment: A strong Zimbabwe dollar can attract foreign investment, leading to an increase in economic growth and development.Challenges Facing the Zimbabwe Dollar

Measures to Stabilize the Zimbabwe Dollar

To stabilize the Zimbabwe dollar, the government and the Reserve Bank of Zimbabwe have implemented several measures, including: * Monetary policy: The Reserve Bank of Zimbabwe has implemented monetary policy measures to control inflation and stabilize the value of the Zimbabwe dollar. * Fiscal policy: The government has implemented fiscal policy measures to reduce the budget deficit and stabilize the economy. * Foreign exchange management: The Reserve Bank of Zimbabwe has implemented measures to manage foreign exchange and stabilize the value of the Zimbabwe dollar.Impact of the Zimbabwe Dollar on Businesses

Strategies for Businesses to Manage the Zimbabwe Dollar

To manage the risks associated with the Zimbabwe dollar, businesses can implement several strategies, including: * Hedging: Businesses can hedge against exchange rate risks by using financial instruments such as forward contracts and options. * Diversification: Businesses can diversify their operations to reduce their dependence on the Zimbabwe dollar. * Pricing strategies: Businesses can implement pricing strategies to manage the impact of exchange rate fluctuations on their sales and revenue.Future Outlook for the Zimbabwe Dollar

Recommendations for Investors

For investors looking to invest in Zimbabwe, it is essential to understand the risks associated with the Zimbabwe dollar. Investors can implement several strategies to manage these risks, including: * Diversification: Investors can diversify their investments to reduce their dependence on the Zimbabwe dollar. * Hedging: Investors can hedge against exchange rate risks by using financial instruments such as forward contracts and options. * Research: Investors can conduct thorough research on the economy and the Zimbabwe dollar before making investment decisions.Zimbabwe Dollar Image Gallery

In conclusion, the Zimbabwe dollar is a complex and dynamic currency that plays a critical role in the economy of Zimbabwe. Understanding the history, benefits, and challenges of the Zimbabwe dollar is essential for individuals and businesses looking to invest or operate in the country. By implementing strategies to manage the risks associated with the Zimbabwe dollar, investors and businesses can navigate the challenges and opportunities presented by this unique currency. We invite you to share your thoughts and experiences with the Zimbabwe dollar in the comments section below. Additionally, we encourage you to share this article with others who may be interested in learning more about the Zimbabwe dollar and its implications for the economy of Zimbabwe.