Intro

Unlock the power of Excel with our 360/365 loan calculator guide. Learn how to accurately calculate loan interest and payments using the 360-day or 365-day year convention. Master loan amortization, interest rates, and payment schedules with our easy-to-follow Excel templates and tutorials.

As a business owner or individual looking to manage your finances effectively, having the right tools at your disposal is crucial. One such tool is a 360/365 loan calculator, which can help you calculate the interest on your loans accurately. In this article, we will explore how to create a 360/365 loan calculator in Excel, making it easy for you to manage your finances.

The importance of accurate interest calculations cannot be overstated. Incorrect calculations can lead to financial losses, damaged credit scores, and even legal issues. With a 360/365 loan calculator, you can ensure that you are calculating your interest correctly, taking into account the actual number of days in a year. This is particularly important for businesses that operate on a 365-day calendar, as it ensures that their financial calculations are accurate and compliant with accounting standards.

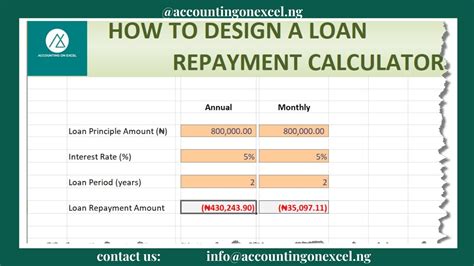

Creating a 360/365 loan calculator in Excel is relatively straightforward. To get started, you will need to create a new spreadsheet and set up the necessary columns and formulas.

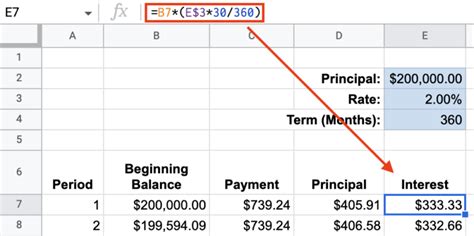

Setting Up the Spreadsheet

To set up the spreadsheet, follow these steps:

- Create a new spreadsheet in Excel and give it a title, such as "360/365 Loan Calculator".

- Set up the following columns:

- Loan Amount

- Interest Rate

- Loan Term (in years)

- Actual Days in Year (360 or 365)

- Daily Interest Rate

- Total Interest

- Total Amount Repaid

- Format the columns to display the correct data types (e.g., currency for loan amount and interest rate).

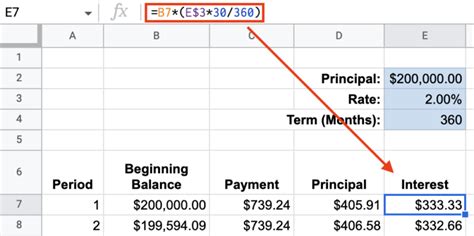

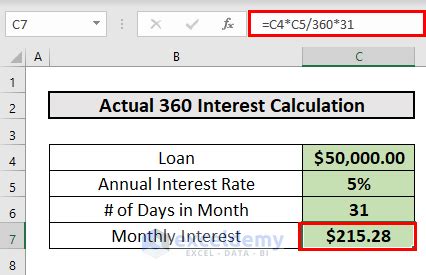

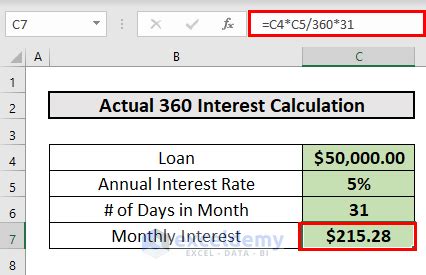

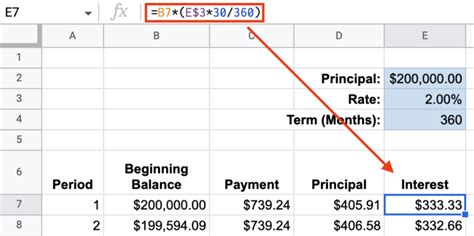

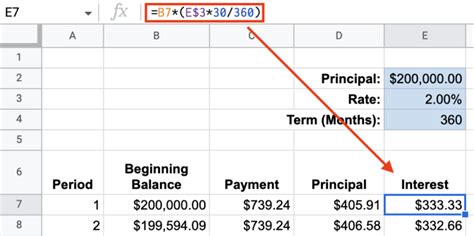

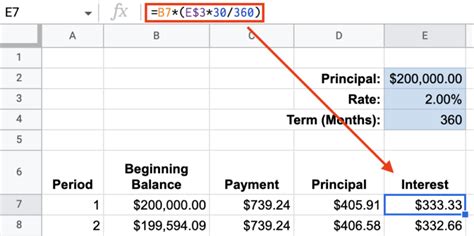

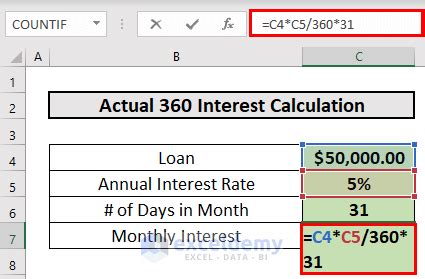

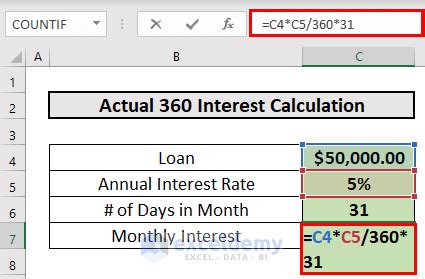

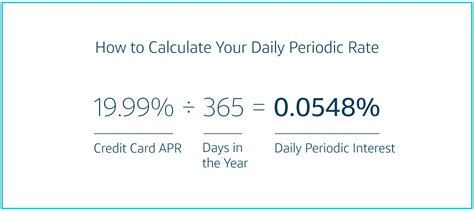

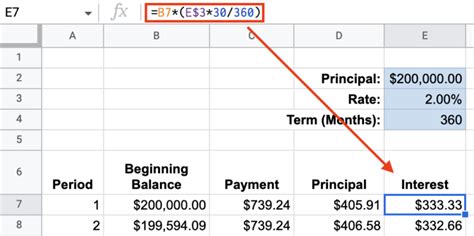

Calculating the Daily Interest Rate

To calculate the daily interest rate, you will need to divide the annual interest rate by the actual number of days in the year. You can use the following formula:

Daily Interest Rate = (Interest Rate / Actual Days in Year)

For example, if the interest rate is 6% and the actual number of days in the year is 365, the daily interest rate would be:

Daily Interest Rate = (6% / 365) = 0.0164

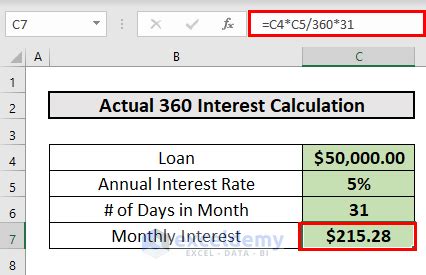

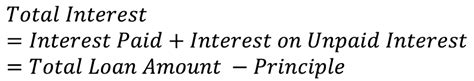

Calculating the Total Interest

To calculate the total interest, you will need to multiply the daily interest rate by the loan amount and the loan term. You can use the following formula:

Total Interest = (Daily Interest Rate x Loan Amount x Loan Term)

For example, if the daily interest rate is 0.0164, the loan amount is $10,000, and the loan term is 5 years, the total interest would be:

Total Interest = (0.0164 x $10,000 x 5) = $8,200

Calculating the Total Amount Repaid

To calculate the total amount repaid, you will need to add the loan amount and the total interest. You can use the following formula:

Total Amount Repaid = Loan Amount + Total Interest

For example, if the loan amount is $10,000 and the total interest is $8,200, the total amount repaid would be:

Total Amount Repaid = $10,000 + $8,200 = $18,200

Benefits of Using a 360/365 Loan Calculator

Using a 360/365 loan calculator can provide several benefits, including:

- Accurate interest calculations: By taking into account the actual number of days in a year, you can ensure that your interest calculations are accurate and compliant with accounting standards.

- Improved financial management: With a 360/365 loan calculator, you can better manage your finances and make informed decisions about your loan repayments.

- Increased transparency: A 360/365 loan calculator can provide transparency into your loan repayments, making it easier to understand how much you are paying in interest and principal.

Common Mistakes to Avoid

When using a 360/365 loan calculator, there are several common mistakes to avoid, including:

- Not taking into account the actual number of days in a year

- Using an incorrect interest rate or loan term

- Not formatting the columns correctly

By avoiding these mistakes, you can ensure that your 360/365 loan calculator is accurate and reliable.

Conclusion

Creating a 360/365 loan calculator in Excel is a straightforward process that can provide several benefits, including accurate interest calculations and improved financial management. By following the steps outlined in this article, you can create a 360/365 loan calculator that meets your needs and helps you manage your finances effectively.

Next Steps

If you want to learn more about creating a 360/365 loan calculator or have questions about the process, please comment below. We would be happy to help.

Additionally, if you found this article helpful, please share it with your friends and colleagues who may be interested in learning more about 360/365 loan calculators.

360/365 Loan Calculator Excel Gallery