Intro

Unlock accurate multifamily financial projections with our comprehensive pro forma template. Simplify your investment analysis and forecasting with a clear picture of income, expenses, and cash flow. Optimize your multifamily propertys performance and maximize returns with our expert-designed template, streamlining your financial modeling process.

The multifamily pro forma template is a powerful tool for real estate investors and developers, providing a comprehensive framework for financial projections and analysis. A well-crafted pro forma template can help you navigate the complexities of multifamily investing, allowing you to make informed decisions and drive business growth. In this article, we'll delve into the world of multifamily pro forma templates, exploring their importance, key components, and benefits. We'll also provide practical examples and expert tips to help you create a customized template that meets your specific needs.

What is a Multifamily Pro Forma Template?

A multifamily pro forma template is a financial model that outlines projected income and expenses for a multifamily property over a specific period, typically 5-10 years. This template is designed to help investors and developers estimate the potential financial performance of a property, making it an essential tool for decision-making and risk assessment.

Key Components of a Multifamily Pro Forma Template

A comprehensive multifamily pro forma template should include the following key components:

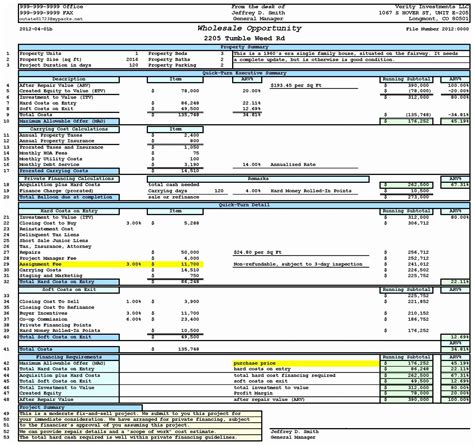

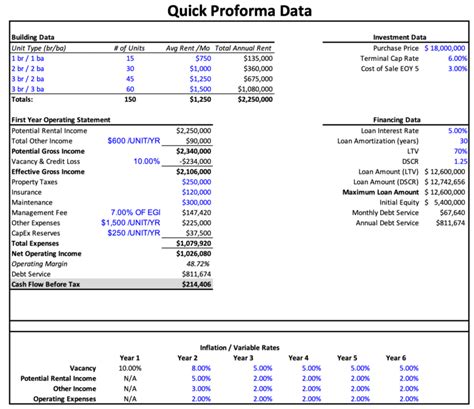

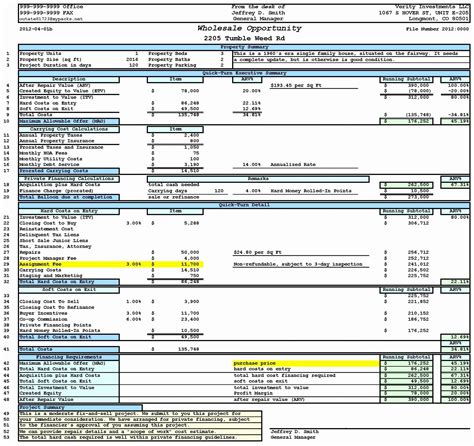

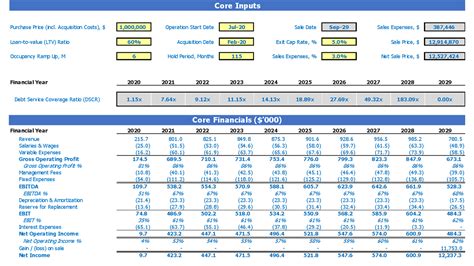

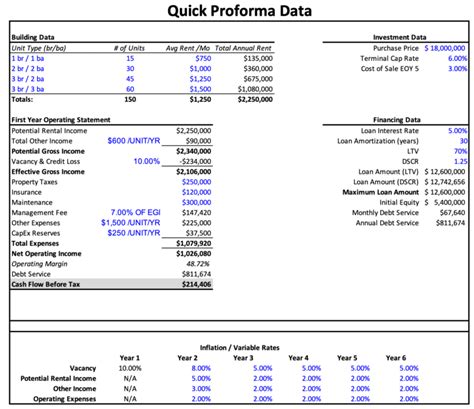

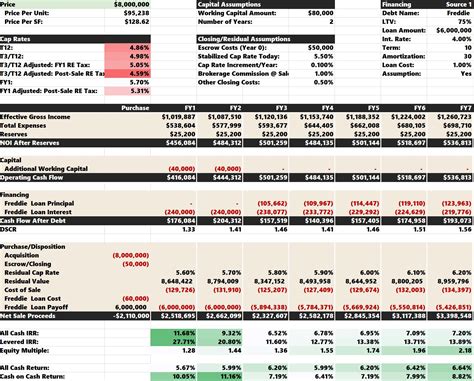

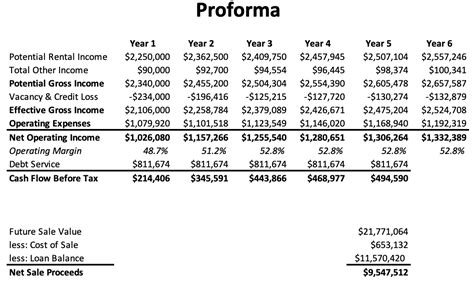

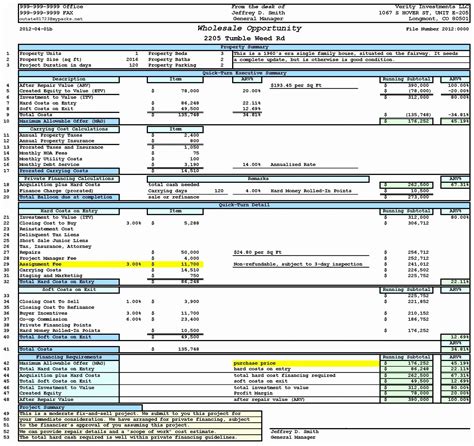

- Income Statement: A detailed breakdown of projected income, including rental revenue, other income, and total income.

- Expense Statement: A comprehensive list of projected expenses, including operating expenses, capital expenditures, and debt service.

- Cash Flow Statement: A statement that outlines projected cash inflows and outflows, including net operating income, capital expenditures, and debt service.

- Assumptions and Sensitivity Analysis: A section that outlines key assumptions and provides sensitivity analysis to test the robustness of the financial projections.

Benefits of Using a Multifamily Pro Forma Template

Using a multifamily pro forma template can provide numerous benefits, including:

- Improved Financial Projections: A well-crafted pro forma template can help you create accurate and reliable financial projections, reducing the risk of errors and omissions.

- Enhanced Decision-Making: By providing a comprehensive framework for financial analysis, a pro forma template can help you make informed decisions and drive business growth.

- Increased Efficiency: A pro forma template can save you time and effort, allowing you to focus on high-level analysis and strategic decision-making.

- Better Risk Management: A pro forma template can help you identify potential risks and opportunities, allowing you to develop strategies to mitigate or capitalize on them.

How to Create a Customized Multifamily Pro Forma Template

Creating a customized multifamily pro forma template requires careful planning and attention to detail. Here are some practical steps to follow:

- Define Your Goals and Objectives: Determine the purpose of your pro forma template and the key metrics you want to track.

- Gather Historical Data: Collect historical data on income and expenses for the property, including rental revenue, operating expenses, and capital expenditures.

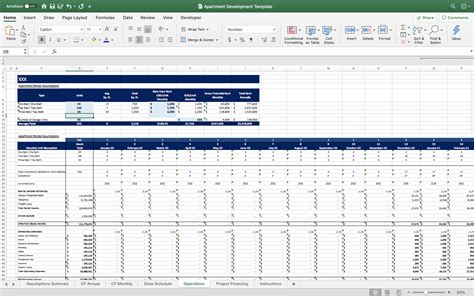

- Develop a Financial Model: Create a comprehensive financial model that outlines projected income and expenses, including assumptions and sensitivity analysis.

- Customize the Template: Tailor the template to meet your specific needs, including the addition of custom fields and formulas.

Practical Examples and Expert Tips

Here are some practical examples and expert tips to help you create a customized multifamily pro forma template:

- Use a Consistent Format: Use a consistent format throughout the template, including font, size, and color.

- Include a Dashboard: Create a dashboard that provides a high-level overview of key metrics, including net operating income, cash flow, and debt service.

- Use Sensitivity Analysis: Use sensitivity analysis to test the robustness of the financial projections, including the impact of changes in rental revenue, operating expenses, and capital expenditures.

- Review and Update Regularly: Review and update the template regularly to ensure that it remains accurate and relevant.

Gallery of Multifamily Pro Forma Templates

Multifamily Pro Forma Template Gallery

In conclusion, a multifamily pro forma template is a powerful tool for real estate investors and developers, providing a comprehensive framework for financial projections and analysis. By following the practical steps and expert tips outlined in this article, you can create a customized template that meets your specific needs and drives business growth. Remember to review and update the template regularly to ensure that it remains accurate and relevant.