Creating a personal loan agreement can be a straightforward process with the right tools. Here's a comprehensive guide on how to create a personal loan agreement using a Microsoft Word template:

Why Create a Personal Loan Agreement?

Before we dive into the template, let's discuss the importance of creating a personal loan agreement. A personal loan agreement is a legally binding contract between two parties - the lender and the borrower. It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and any other relevant details. Having a written agreement in place can help prevent misunderstandings and disputes, ensuring a smooth and transparent loan process.

Microsoft Word Template for Personal Loan Agreement

To create a personal loan agreement using a Microsoft Word template, follow these steps:

- Open Microsoft Word and click on the "File" tab.

- Select "New" and then search for "loan agreement template" in the search bar.

- Choose a template that suits your needs. You can also use a blank template and create the agreement from scratch.

- Download the template and open it in Microsoft Word.

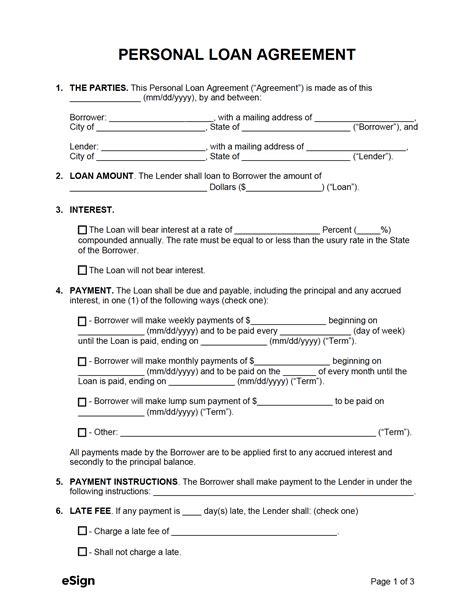

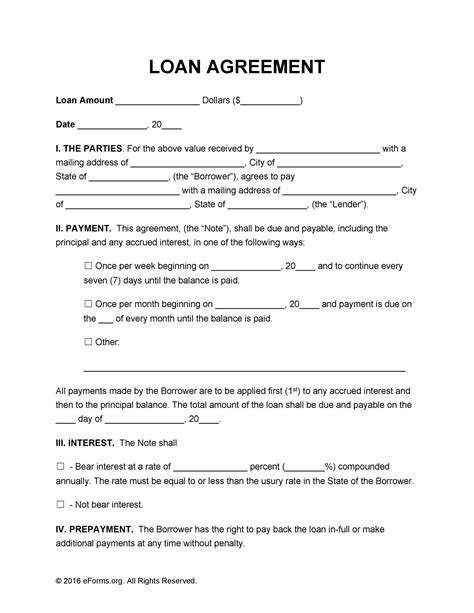

Personal Loan Agreement Template Structure

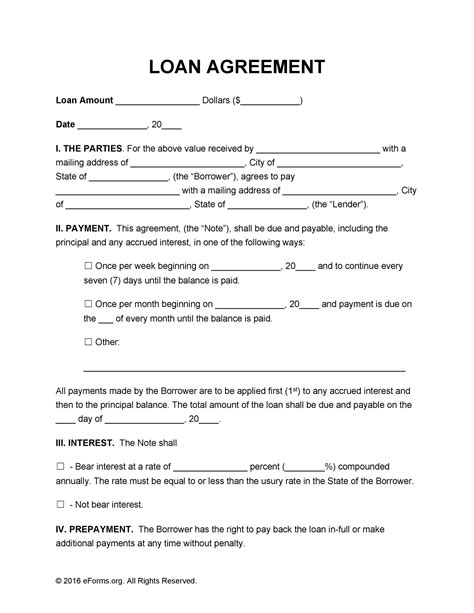

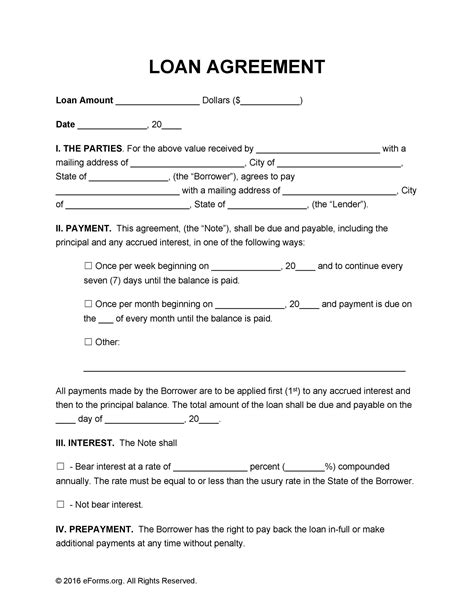

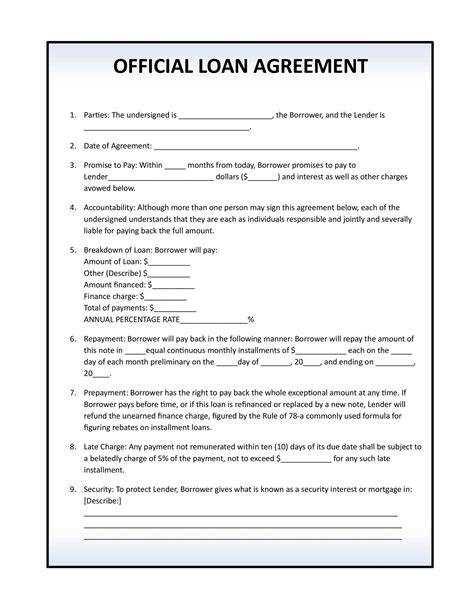

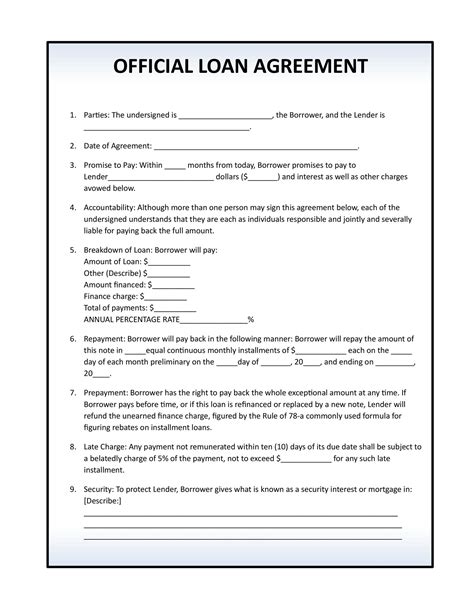

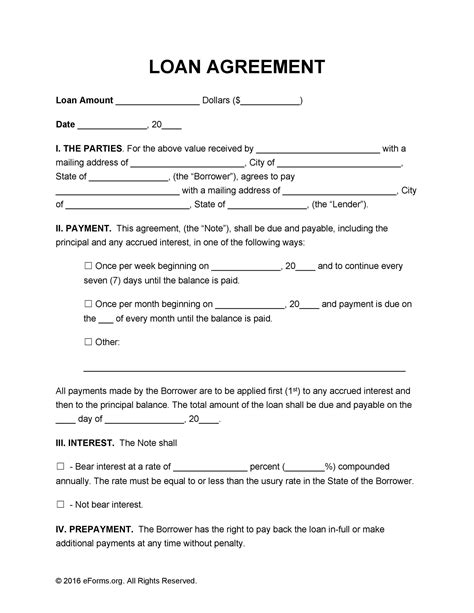

A typical personal loan agreement template should include the following sections:

- Loan Details

- Loan amount

- Interest rate

- Loan term (number of months or years)

- Repayment frequency (monthly, quarterly, etc.)

- Parties Involved

- Lender's name and address

- Borrower's name and address

- Loan Purpose

- Brief description of the loan purpose (optional)

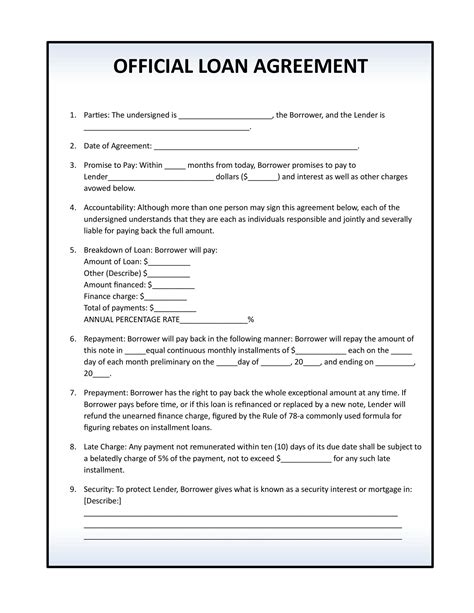

- Repayment Terms

- Repayment schedule

- Payment amount

- Payment method (check, bank transfer, etc.)

- Interest and Fees

- Interest rate calculation method

- Late payment fees (if applicable)

- Other fees (if applicable)

- Default and Remedies

- Default conditions (e.g., missed payments)

- Remedies for default (e.g., late fees, loan acceleration)

- Governing Law

- State or country law governing the agreement

- Dispute Resolution

- Method for resolving disputes (e.g., arbitration, mediation)

- Amendments and Waivers

- Conditions for amending or waiving the agreement

- Signatures

- Space for lender and borrower signatures

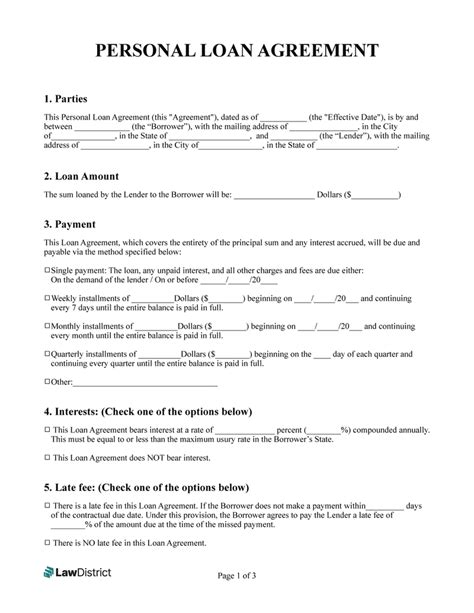

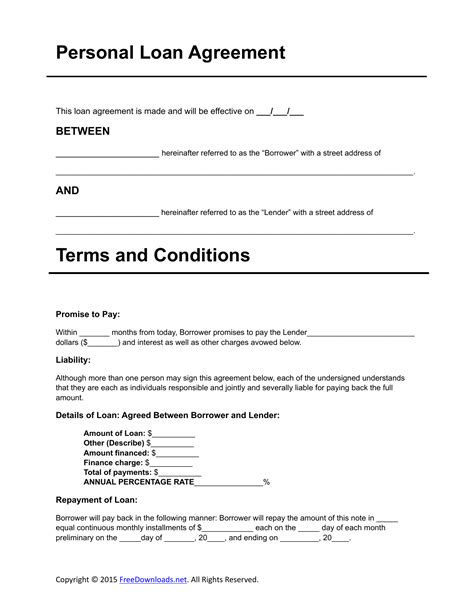

Sample Personal Loan Agreement Template

Here's a sample personal loan agreement template:

Personal Loan Agreement Template (continued)

LOAN DETAILS

- Loan Amount: $10,000

- Interest Rate: 6% per annum

- Loan Term: 36 months

- Repayment Frequency: Monthly

PARTIES INVOLVED

- Lender: John Doe

- Address: 123 Main St, Anytown, USA

- Borrower: Jane Smith

- Address: 456 Elm St, Anytown, USA

LOAN PURPOSE

- This loan is for personal use only.

REPAYMENT TERMS

- Repayment Schedule: Monthly payments of $303.17 for 36 months

- Payment Method: Bank transfer

INTEREST AND FEES

- Interest Rate Calculation Method: Simple interest

- Late Payment Fees: $25 per late payment

DEFAULT AND REMEDIES

- Default Conditions: Failure to make 2 consecutive payments

- Remedies for Default: Late fees, loan acceleration

GOVERNING LAW

- This agreement is governed by the laws of the State of Anytown, USA.

DISPUTE RESOLUTION

- Any disputes arising from this agreement will be resolved through arbitration.

AMENDMENTS AND WAIVERS

- This agreement may be amended or waived only in writing signed by both parties.

SIGNATURES

- Lender: _____________________________________

- Borrower: _____________________________________

Gallery of Personal Loan Agreement Templates

Personal Loan Agreement Templates

We hope this article has provided you with a comprehensive guide on creating a personal loan agreement using a Microsoft Word template. Remember to customize the template according to your specific needs and seek legal advice if necessary.