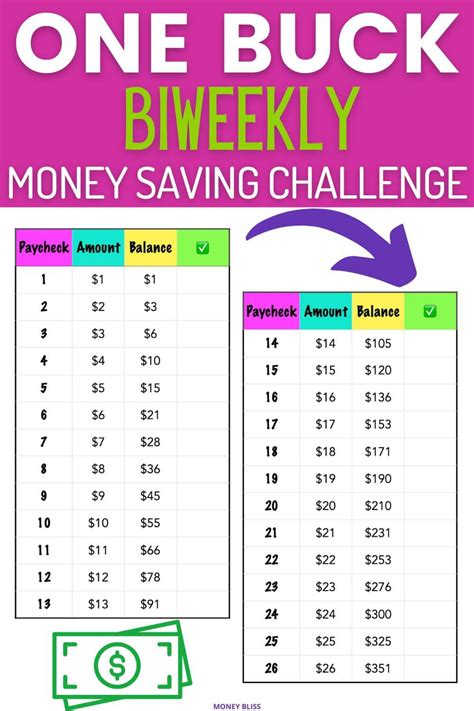

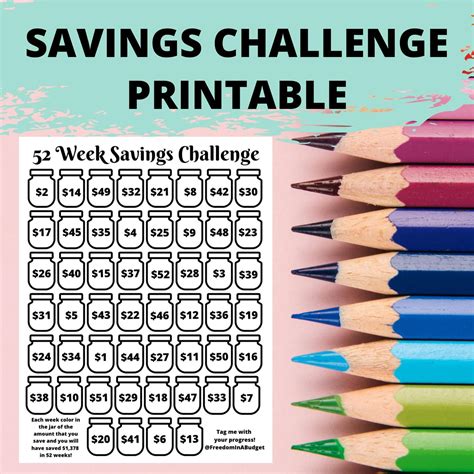

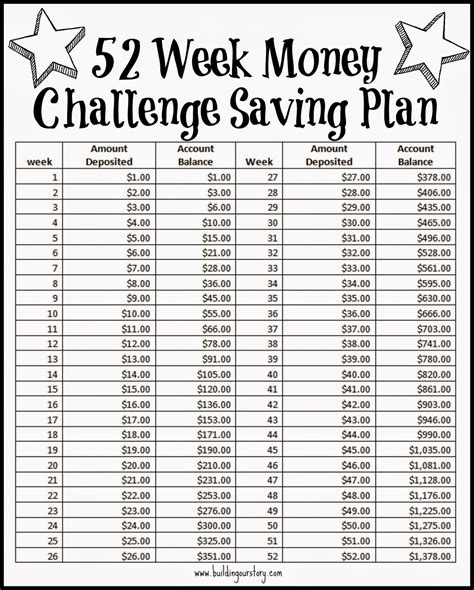

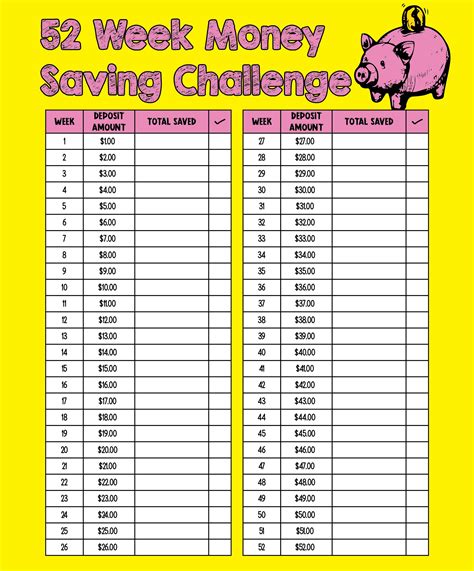

Saving money can be a daunting task, especially for those who are new to managing their finances. However, with a solid plan and a bit of motivation, anyone can start building a safety net and achieving their financial goals. One popular method for saving money is the 52-Week Savings Challenge, which involves saving an amount equal to the number of the week. For example, in week 1, you would save $1, in week 2, you would save $2, and so on.

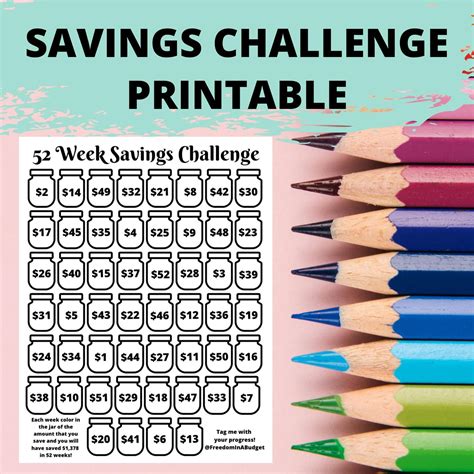

This challenge is a great way to get started with saving because it starts small and gradually increases the amount you need to save each week. It's also a good way to build discipline and make saving a habit. However, it can be hard to keep track of your progress and stay motivated without a clear plan. That's where a printable template comes in handy.

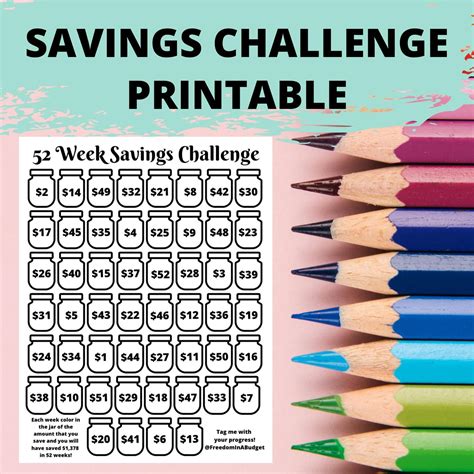

Using a printable template, you can track your progress, see how much you've saved, and stay motivated to continue the challenge. In this article, we'll provide you with a free printable template for the 52-Week Savings Challenge, as well as some tips and tricks for completing the challenge successfully.

How to Use the 52-Week Savings Challenge Printable Template

The 52-Week Savings Challenge printable template is designed to be easy to use and understand. Here's how to get started:

- Print out the template and place it in a spot where you'll see it every day, such as on your fridge or next to your computer.

- Each week, write down the date and the amount you need to save in the corresponding box.

- As you deposit the money into your savings account, check off the box to mark it as complete.

- At the end of each month, add up the total amount you've saved and write it down in the "Total Saved" section.

Using this template, you'll be able to track your progress and see how much you've saved over time. It's also a good idea to review your budget and adjust as needed to make sure you're on track to meet your savings goals.

Tips for Completing the 52-Week Savings Challenge

Completing the 52-Week Savings Challenge requires discipline and motivation, but with the right mindset and strategies, you can succeed. Here are some tips to help you get started:

- Start small: The first few weeks of the challenge may seem easy, but it's essential to start small and build up your savings habit.

- Make it automatic: Set up an automatic transfer from your checking account to your savings account to make saving easier and less prone to being neglected.

- Find ways to cut back: Look for ways to cut back on unnecessary expenses and allocate that money towards your savings.

- Stay motivated: Share your progress with a friend or family member and ask them to hold you accountable.

- Be consistent: Make saving a priority and try to save at the same time every week.

The Benefits of the 52-Week Savings Challenge

The 52-Week Savings Challenge is an excellent way to build a safety net and achieve your financial goals. Here are some benefits of completing the challenge:

- Builds discipline: Saving money regularly helps build discipline and makes it easier to stick to your financial goals.

- Creates a safety net: Having a savings cushion can provide peace of mind and help you avoid going into debt when unexpected expenses arise.

- Helps you prioritize: The challenge helps you prioritize your spending and make conscious financial decisions.

- Boosts confidence: Completing the challenge can give you a sense of accomplishment and boost your confidence in your ability to manage your finances.

By completing the 52-Week Savings Challenge, you'll be able to achieve your financial goals and build a brighter financial future.

Common Mistakes to Avoid When Doing the 52-Week Savings Challenge

While the 52-Week Savings Challenge is a great way to save money, there are some common mistakes to avoid to ensure you succeed. Here are some common mistakes to watch out for:

- Not starting small: Don't try to save too much too soon. Start small and gradually increase the amount you save each week.

- Not being consistent: Make saving a priority and try to save at the same time every week.

- Not tracking progress: Use a printable template or a budgeting app to track your progress and stay motivated.

- Not adjusting as needed: Review your budget regularly and adjust as needed to make sure you're on track to meet your savings goals.

Conclusion

The 52-Week Savings Challenge is a great way to build a safety net and achieve your financial goals. By using a printable template and following the tips and tricks outlined in this article, you'll be able to stay on track and complete the challenge successfully. Remember to start small, be consistent, and track your progress to ensure you achieve your financial goals.

52-Week Savings Challenge Image Gallery