Intro

Unlock the power of data-driven AP management with our expert guide to 5 essential Accounts Payable KPIs in Excel. Track vendor performance, payment efficiency, and more with actionable metrics like DPO, DIO, and AP Turnover Rate. Boost financial visibility and optimize your accounts payable process for maximum ROI.

Effective management of accounts payable is crucial for any business to maintain a healthy cash flow, build strong relationships with suppliers, and ensure compliance with regulatory requirements. One way to achieve this is by tracking key performance indicators (KPIs) that provide valuable insights into the accounts payable process. Here, we will discuss five essential accounts payable KPIs that can be tracked using Excel, along with practical examples and tips for implementation.

Why Track Accounts Payable KPIs?

Tracking accounts payable KPIs helps businesses to identify areas for improvement, optimize processes, and make data-driven decisions. By monitoring these KPIs, companies can:

- Reduce late payment fees and penalties

- Improve relationships with suppliers

- Optimize cash flow and working capital

- Enhance financial transparency and accountability

- Identify opportunities for process improvements and automation

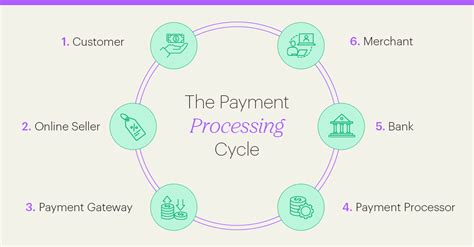

1. Payment Processing Cycle Time

The payment processing cycle time measures the time it takes to process an invoice from receipt to payment. This KPI helps to identify bottlenecks in the payment process and opportunities for improvement.

To calculate this KPI in Excel, you can use the following formula:

= (Payment Date - Invoice Receipt Date)

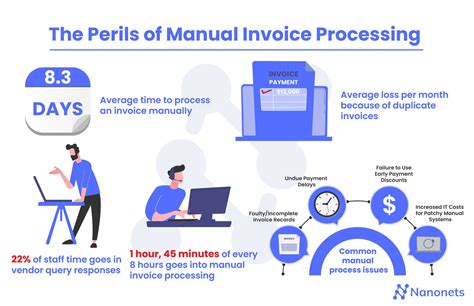

2. Invoice Processing Rate

The invoice processing rate measures the number of invoices processed per day/week/month. This KPI helps to evaluate the productivity and efficiency of the accounts payable team.

To calculate this KPI in Excel, you can use the following formula:

= (Total Invoices Processed / Time Period)

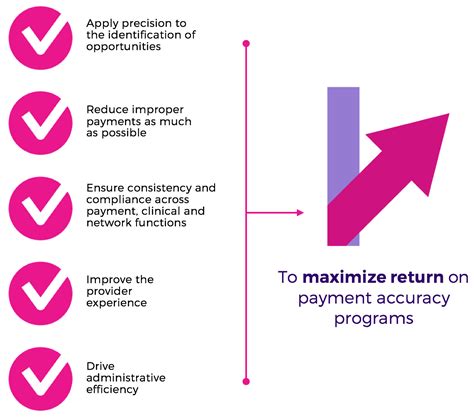

3. Payment Accuracy Rate

The payment accuracy rate measures the percentage of payments made accurately and on time. This KPI helps to evaluate the accuracy and reliability of the payment process.

To calculate this KPI in Excel, you can use the following formula:

= (Total Accurate Payments / Total Payments Made) x 100

4. Supplier Satisfaction Rate

The supplier satisfaction rate measures the percentage of suppliers who are satisfied with the payment process. This KPI helps to evaluate the quality of relationships with suppliers.

To calculate this KPI in Excel, you can use the following formula:

= (Total Satisfied Suppliers / Total Suppliers) x 100

5. Average Payment Days

The average payment days measures the average number of days it takes to pay an invoice. This KPI helps to evaluate the timeliness of payments and identify opportunities for improvement.

To calculate this KPI in Excel, you can use the following formula:

= (Total Payment Days / Total Invoices Paid)

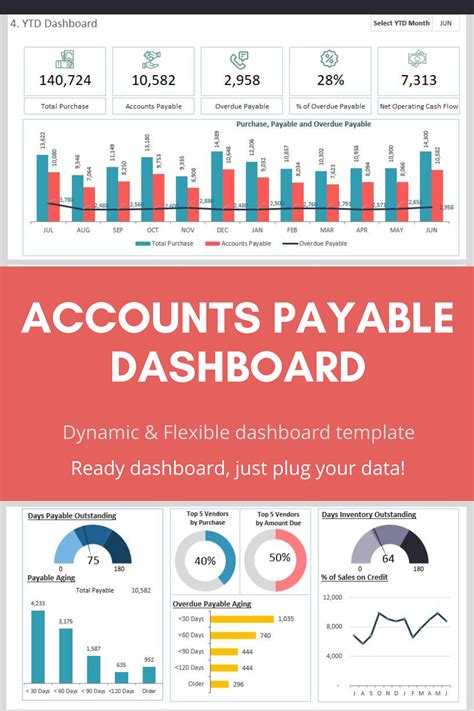

Tracking Accounts Payable KPIs in Excel

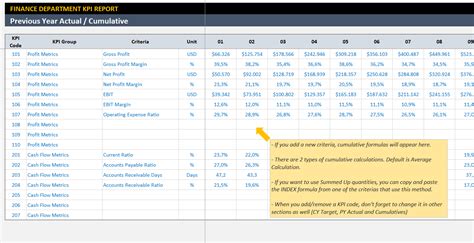

To track these KPIs in Excel, you can create a dashboard with the following components:

- A table to input data for each KPI

- A chart to visualize the data and track trends

- A formula to calculate each KPI

- A dashboard to display the KPIs and trends

Best Practices for Tracking Accounts Payable KPIs

To get the most out of tracking accounts payable KPIs, follow these best practices:

- Set clear goals and targets for each KPI

- Use accurate and timely data

- Track KPIs regularly and consistently

- Analyze and interpret the data to identify trends and opportunities for improvement

- Use the insights to make data-driven decisions and optimize processes

Conclusion

Tracking accounts payable KPIs is essential for businesses to optimize their payment processes, build strong relationships with suppliers, and ensure compliance with regulatory requirements. By using Excel to track these KPIs, companies can gain valuable insights into their accounts payable process and make data-driven decisions to improve efficiency, productivity, and accuracy.

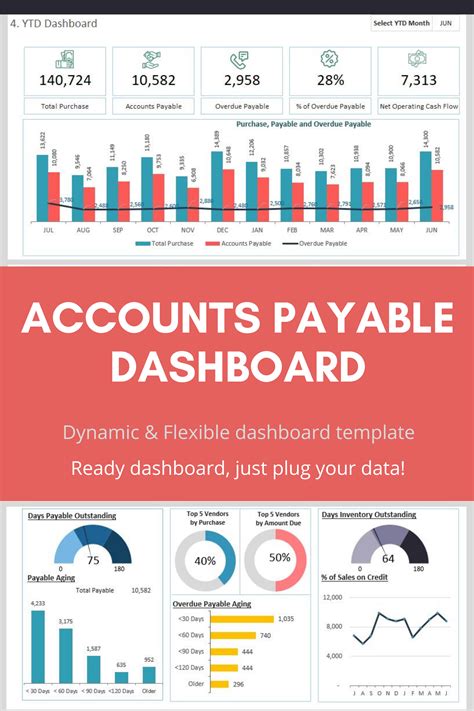

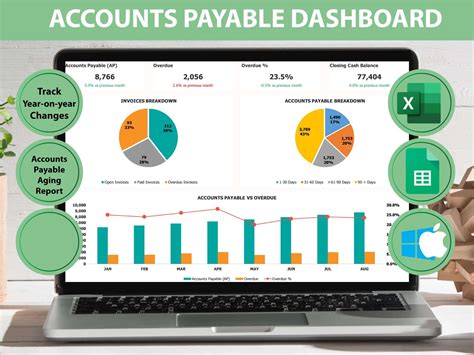

Gallery of Accounts Payable KPIs in Excel

Accounts Payable KPIs in Excel Image Gallery

We hope this article has provided you with valuable insights into tracking accounts payable KPIs in Excel. By implementing these KPIs and best practices, you can optimize your payment processes and achieve greater efficiency, productivity, and accuracy.