Optimizing your accounts receivable (AR) forecast template in Excel is crucial for effective financial planning and cash flow management. An accurate forecast enables you to anticipate revenue, manage customer relationships, and make informed decisions about your business. Here, we'll explore five ways to enhance your AR forecast template in Excel.

Understanding the Importance of AR Forecasting

Before diving into the optimization techniques, it's essential to understand the significance of AR forecasting. An accurate forecast allows you to:

- Predict revenue and cash flow

- Identify potential bottlenecks and areas for improvement

- Develop strategies to reduce days sales outstanding (DSO)

- Enhance customer relationships and communication

- Inform business decisions and resource allocation

1. Utilize Historical Data and Trends

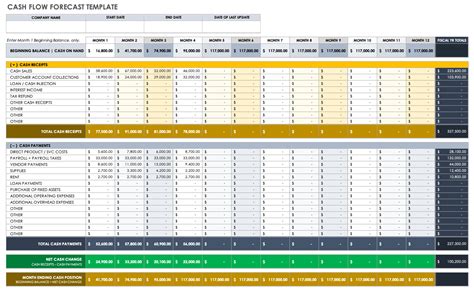

To create an accurate AR forecast, you need to analyze historical data and identify trends. Use Excel's built-in functions, such as the TREND function, to calculate the trend of your AR data over time. This will help you understand patterns and seasonality in your data.

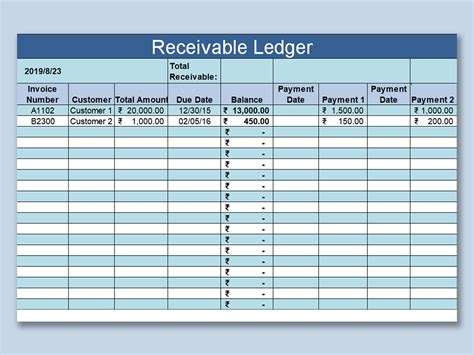

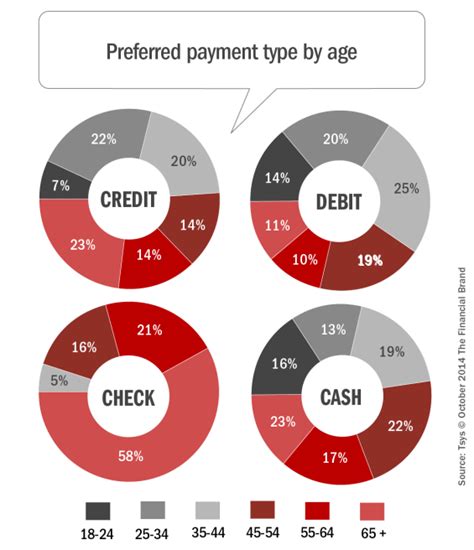

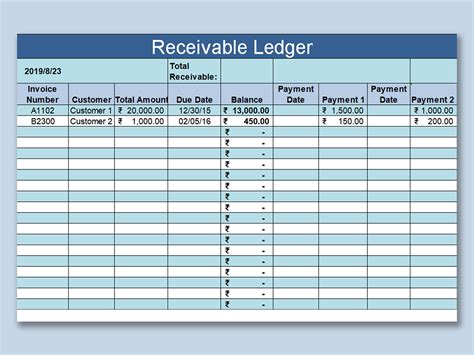

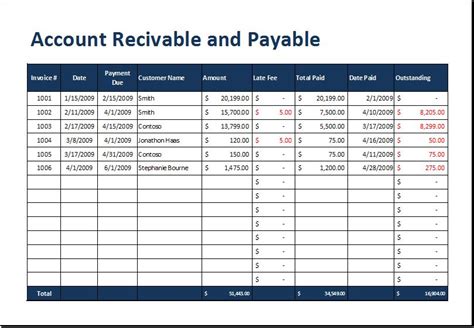

2. Segment Your Customers and Invoices

Segmenting your customers and invoices is crucial for creating a precise AR forecast. Group your customers by industry, location, or payment history to identify patterns and trends. Use Excel's PIVOTTABLE function to summarize and analyze your data.

3. Incorporate Seasonality and Holiday Schedules

Seasonality and holiday schedules can significantly impact your AR forecast. Use Excel's FORECAST function to account for seasonal fluctuations and incorporate holiday schedules into your forecast.

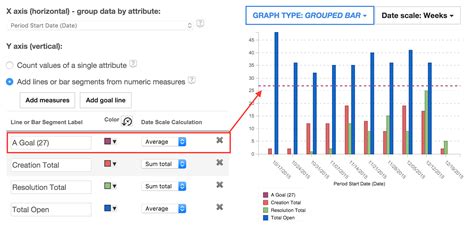

4. Monitor and Adjust for Changes in Payment Behavior

Changes in payment behavior can significantly impact your AR forecast. Monitor your customers' payment history and adjust your forecast accordingly. Use Excel's IF function to create rules-based scenarios for different payment behaviors.

5. Regularly Review and Refine Your Forecast

Regularly reviewing and refining your AR forecast is essential for maintaining accuracy. Use Excel's WHAT-IF analysis to test different scenarios and refine your forecast. Schedule regular reviews to ensure your forecast remains aligned with your business goals.

By implementing these five techniques, you can significantly enhance the accuracy and reliability of your AR forecast template in Excel. Remember to regularly review and refine your forecast to ensure it remains aligned with your business goals.

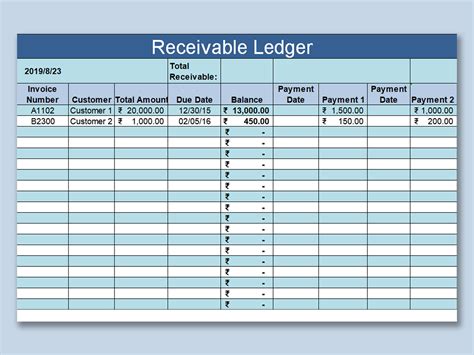

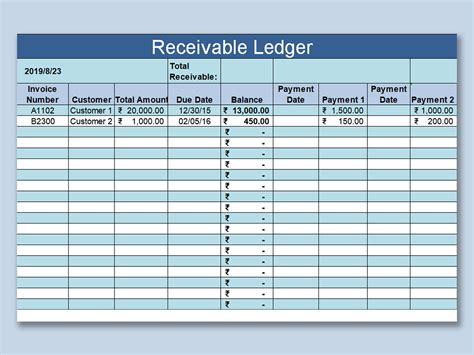

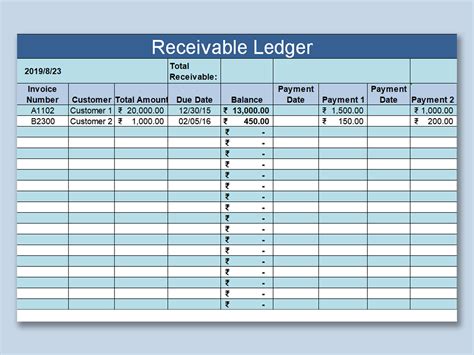

Gallery of Accounts Receivable Forecast Template Excel

Accounts Receivable Forecast Template Excel Image Gallery

We hope this article has provided you with valuable insights and techniques to optimize your AR forecast template in Excel. If you have any questions or need further assistance, please don't hesitate to ask.