Intro

Streamline your accounting process with our accrued expense reconciliation template. Easily track and reconcile accrued expenses, ensuring accurate financial statements. Discover how to identify and rectify discrepancies, and explore the benefits of using a template for efficient expense management, accrual accounting, and financial reporting.

Accrued expenses are a common accounting concept that can be tricky to manage, especially for small businesses or individuals who are not familiar with accounting principles. However, with the right tools and templates, reconciling accrued expenses can be a breeze. In this article, we will explore the concept of accrued expenses, its importance in accounting, and provide a comprehensive accrued expense reconciliation template to simplify your accounting process.

Understanding Accrued Expenses

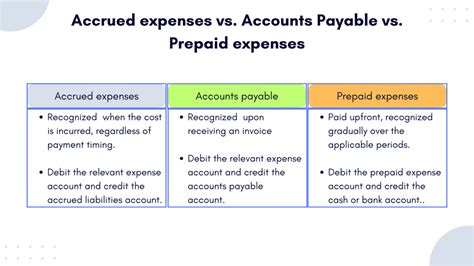

Accrued expenses, also known as accrued liabilities, are expenses that have been incurred by a business but have not yet been paid. These expenses are typically recorded as liabilities on the balance sheet and are expensed on the income statement when they are paid. Examples of accrued expenses include wages payable, interest payable, and utilities payable.

Accrued expenses are an important aspect of accrual accounting, which is a method of accounting that recognizes revenues and expenses when they are earned or incurred, regardless of when payment is made. Accrual accounting provides a more accurate picture of a company's financial position and performance, as it takes into account all expenses incurred during a period, regardless of when payment is made.

Why is Accrued Expense Reconciliation Important?

Accrued expense reconciliation is essential for several reasons:

- Accurate Financial Reporting: Accrued expense reconciliation ensures that a company's financial statements accurately reflect its financial position and performance.

- Compliance with Accounting Standards: Accrued expense reconciliation is required by accounting standards, such as GAAP and IFRS, to ensure that companies accurately report their financial position and performance.

- Cash Flow Management: Accrued expense reconciliation helps companies to manage their cash flow more effectively, as it provides a clear picture of expenses that need to be paid.

Accrued Expense Reconciliation Template

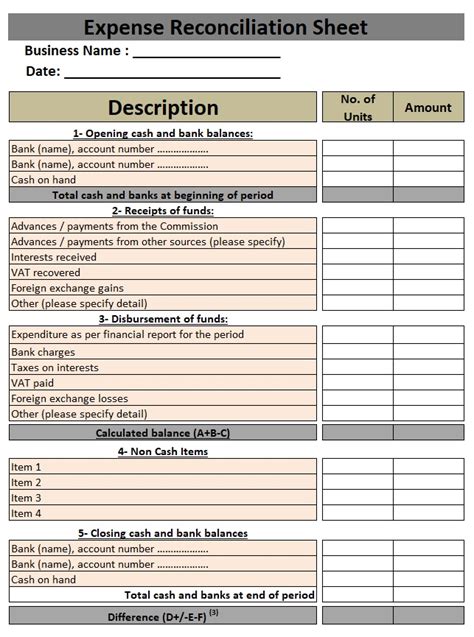

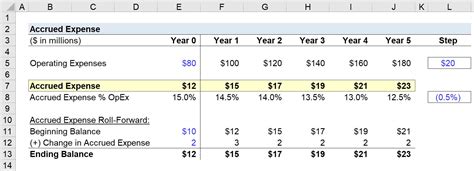

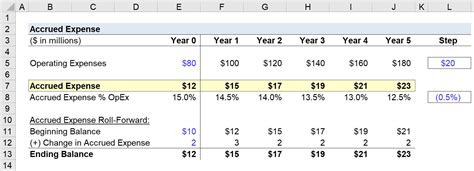

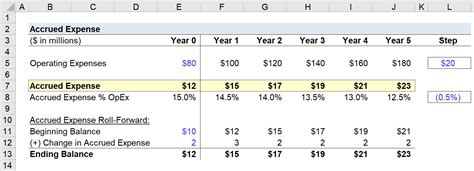

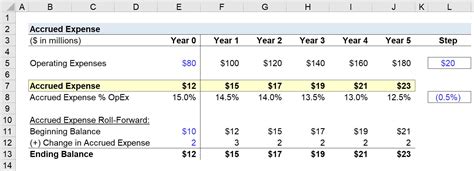

To simplify the accrued expense reconciliation process, we have created a comprehensive template that you can use. The template includes the following sections:

- Accrued Expense Account: This section lists all accrued expense accounts, including wages payable, interest payable, and utilities payable.

- Beginning Balance: This section lists the beginning balance of each accrued expense account.

- Additions: This section lists all additions to each accrued expense account during the period, including expenses incurred and accrued.

- Subtractions: This section lists all subtractions from each accrued expense account during the period, including payments made and expenses reversed.

- Ending Balance: This section lists the ending balance of each accrued expense account.

How to Use the Accrued Expense Reconciliation Template

Using the accrued expense reconciliation template is straightforward. Here are the steps to follow:

- List Accrued Expense Accounts: List all accrued expense accounts, including wages payable, interest payable, and utilities payable.

- Enter Beginning Balance: Enter the beginning balance of each accrued expense account.

- Enter Additions: Enter all additions to each accrued expense account during the period, including expenses incurred and accrued.

- Enter Subtractions: Enter all subtractions from each accrued expense account during the period, including payments made and expenses reversed.

- Calculate Ending Balance: Calculate the ending balance of each accrued expense account.

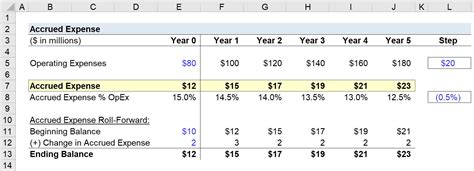

Example of Accrued Expense Reconciliation

To illustrate how to use the accrued expense reconciliation template, let's consider an example. Suppose we have a company that has three accrued expense accounts: wages payable, interest payable, and utilities payable. The beginning balance of each account is as follows:

| Accrued Expense Account | Beginning Balance |

|---|---|

| Wages Payable | $10,000 |

| Interest Payable | $5,000 |

| Utilities Payable | $2,000 |

During the period, the company incurs the following expenses:

| Accrued Expense Account | Additions |

|---|---|

| Wages Payable | $20,000 |

| Interest Payable | $10,000 |

| Utilities Payable | $5,000 |

The company also makes the following payments:

| Accrued Expense Account | Subtractions |

|---|---|

| Wages Payable | $15,000 |

| Interest Payable | $5,000 |

| Utilities Payable | $2,000 |

To reconcile the accrued expense accounts, we would enter the data into the template as follows:

| Accrued Expense Account | Beginning Balance | Additions | Subtractions | Ending Balance |

|---|---|---|---|---|

| Wages Payable | $10,000 | $20,000 | $15,000 | $15,000 |

| Interest Payable | $5,000 | $10,000 | $5,000 | $10,000 |

| Utilities Payable | $2,000 | $5,000 | $2,000 | $5,000 |

Gallery of Accrued Expense Reconciliation

Accrued Expense Reconciliation Image Gallery

Conclusion

Accrued expense reconciliation is an essential process for any business or individual who wants to ensure accurate financial reporting and compliance with accounting standards. By using the accrued expense reconciliation template provided in this article, you can simplify the reconciliation process and ensure that your financial statements accurately reflect your financial position and performance. Remember to regularly review and update your accrued expense accounts to ensure that your financial statements are accurate and up-to-date.

We hope this article has been helpful in understanding the concept of accrued expenses and the importance of accrued expense reconciliation. If you have any questions or comments, please feel free to share them in the comments section below.