Intro

Learn how to calculate aging of receivables formula with 5 simple methods. Master accounts receivable turnover, average collection period, and receivables aging analysis. Optimize cash flow and identify slow-paying customers with these step-by-step formulas, helping you make informed financial decisions and improve your companys bottom line.

Understanding the aging of receivables is crucial for businesses to manage their cash flow effectively. The aging of receivables formula helps companies to identify the outstanding invoices that are due for payment and prioritize their collection efforts. In this article, we will explore five ways to calculate the aging of receivables formula and provide examples to illustrate each method.

What is Aging of Receivables?

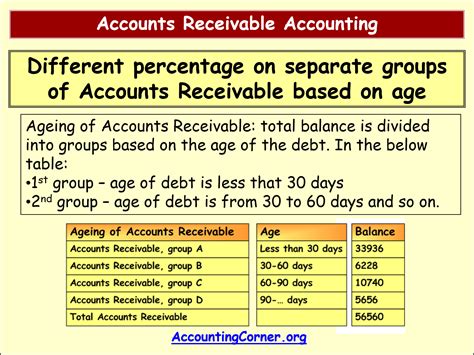

Aging of receivables refers to the process of categorizing outstanding invoices based on the number of days they have been overdue. This helps businesses to identify the invoices that are close to being written off and prioritize their collection efforts. The aging of receivables formula provides a snapshot of the company's outstanding invoices and helps to identify potential cash flow problems.

Method 1: Simple Aging Method

The simple aging method involves categorizing outstanding invoices into different age groups, such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. This method provides a quick snapshot of the company's outstanding invoices and helps to identify potential cash flow problems.

Example:

| Age Group | Outstanding Invoices |

|---|---|

| 0-30 days | $10,000 |

| 31-60 days | $8,000 |

| 61-90 days | $5,000 |

| Over 90 days | $2,000 |

Method 2: Weighted Average Method

The weighted average method takes into account the age of each outstanding invoice and calculates a weighted average age. This method provides a more accurate picture of the company's outstanding invoices and helps to identify potential cash flow problems.

Example:

| Invoice | Age (days) | Amount |

|---|---|---|

| A | 30 | $5,000 |

| B | 60 | $3,000 |

| C | 90 | $2,000 |

| D | 120 | $1,000 |

Weighted Average Age = (30 x $5,000 + 60 x $3,000 + 90 x $2,000 + 120 x $1,000) / ($5,000 + $3,000 + $2,000 + $1,000) Weighted Average Age = 63.33 days

Method 3: Days Sales Outstanding (DSO) Method

The DSO method calculates the average number of days it takes to collect outstanding invoices. This method provides a quick snapshot of the company's cash flow and helps to identify potential problems.

Example:

| Month | Sales | Outstanding Invoices |

|---|---|---|

| January | $100,000 | $20,000 |

| February | $120,000 | $30,000 |

| March | $150,000 | $40,000 |

DSO = (Average Outstanding Invoices / Average Sales) x Number of Days in Period DSO = ($30,000 / $120,000) x 30 DSO = 75 days

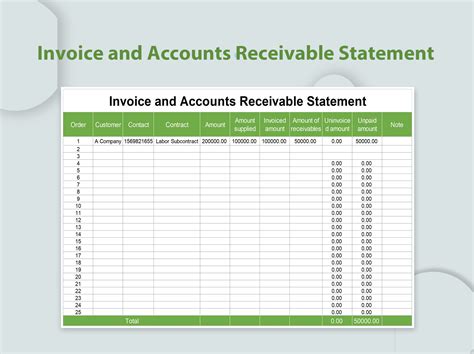

Method 4: Aging Schedule Method

The aging schedule method involves creating a schedule that shows the outstanding invoices by age group. This method provides a detailed picture of the company's outstanding invoices and helps to identify potential cash flow problems.

Example:

| Age Group | Outstanding Invoices |

|---|---|

| 0-30 days | $10,000 |

| 31-60 days | $8,000 |

| 61-90 days | $5,000 |

| Over 90 days | $2,000 |

| Invoice | Age (days) | Amount |

|---|---|---|

| A | 30 | $5,000 |

| B | 60 | $3,000 |

| C | 90 | $2,000 |

| D | 120 | $1,000 |

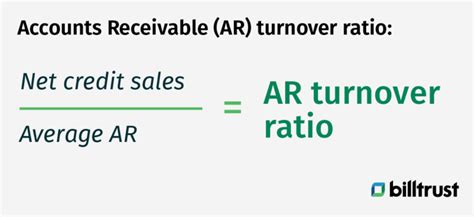

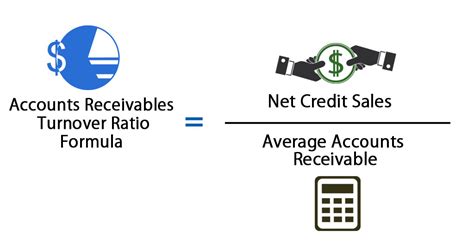

Method 5: Accounts Receivable Turnover Method

The accounts receivable turnover method calculates the number of times the company collects its outstanding invoices during a given period. This method provides a quick snapshot of the company's cash flow and helps to identify potential problems.

Example:

| Period | Sales | Outstanding Invoices |

|---|---|---|

| January | $100,000 | $20,000 |

| February | $120,000 | $30,000 |

| March | $150,000 | $40,000 |

Accounts Receivable Turnover = Average Sales / Average Outstanding Invoices Accounts Receivable Turnover = $120,000 / $30,000 Accounts Receivable Turnover = 4 times

Gallery of Accounts Receivable Aging

Accounts Receivable Aging Image Gallery

Conclusion

The aging of receivables formula is a crucial tool for businesses to manage their cash flow effectively. By using one of the five methods outlined above, companies can identify potential cash flow problems and prioritize their collection efforts. Remember to choose the method that best suits your business needs and use it regularly to monitor your accounts receivable.