Investing for retirement can be a daunting task, especially with the numerous options available in the market. One popular choice among investors is the American Funds 2030 Target Date Retirement Fund (AFXMX). In this article, we will delve into the insights of this fund, exploring its benefits, working mechanisms, and key information to help you make informed investment decisions.

Understanding Target Date Funds

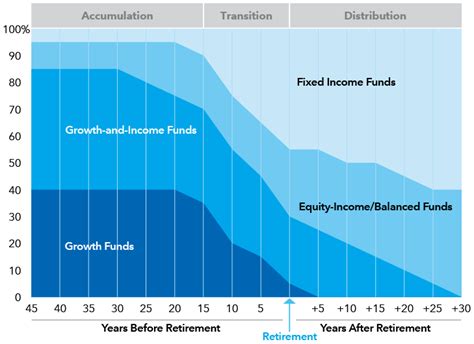

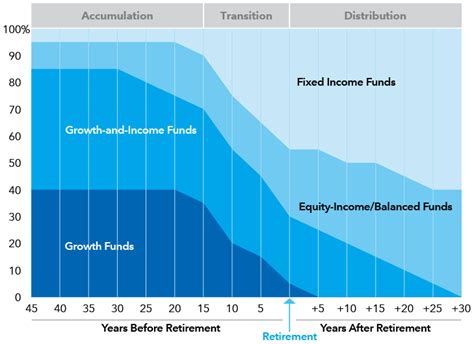

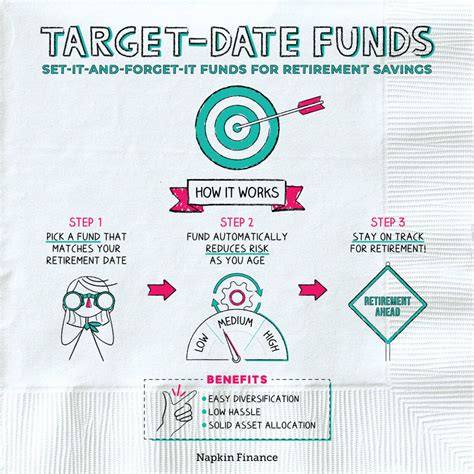

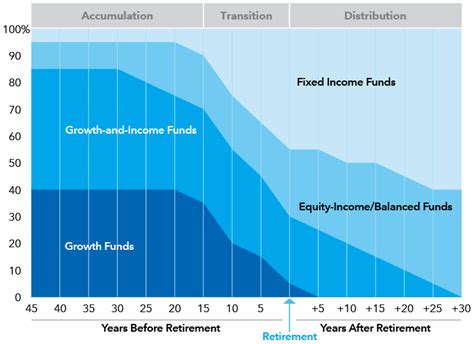

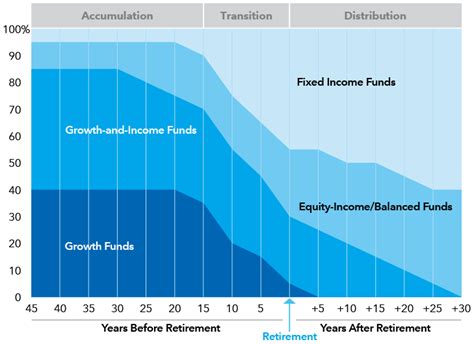

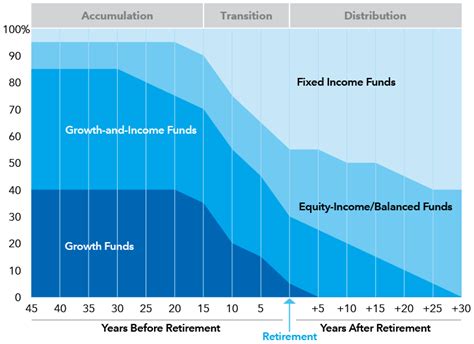

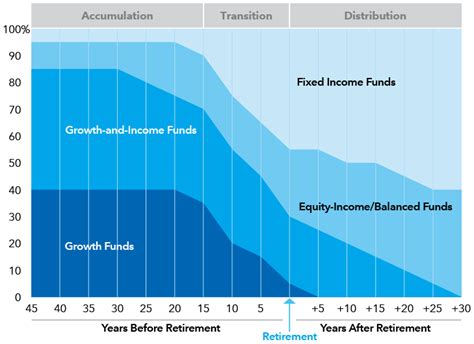

Before we dive into the specifics of the American Funds 2030 Target Date Retirement Fund, it's essential to understand the concept of target date funds (TDFs). TDFs are a type of mutual fund designed to provide a diversified investment portfolio for investors with a specific retirement date in mind. These funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches.

Benefits of the American Funds 2030 Target Date Retirement Fund

The American Funds 2030 Target Date Retirement Fund offers several benefits to investors, including:

- Diversification: The fund invests in a broad range of asset classes, including domestic and international stocks, bonds, and real estate.

- Professional Management: The fund is managed by a team of experienced investment professionals who actively monitor and adjust the portfolio to ensure it remains aligned with its target date.

- Automatic Rebalancing: The fund automatically rebalances its portfolio over time, becoming more conservative as the target date approaches.

- Low Costs: The fund has a competitive expense ratio, making it an attractive option for cost-conscious investors.

How the Fund Works

The American Funds 2030 Target Date Retirement Fund is designed for investors who plan to retire around 2030. The fund's asset allocation is based on a glide path, which is a predetermined schedule for adjusting the portfolio's asset mix over time.

Key Holdings and Asset Allocation

The fund's portfolio is composed of a mix of American Funds' equity and fixed income funds. The top holdings include:

- American Funds Growth Fund of America: 23.1%

- American Funds Investment Company of America: 14.5%

- American Funds Capital Income Builder: 10.3%

- American Funds Bond Fund of America: 8.5%

- American Funds International Growth and Income Fund: 6.2%

In terms of asset allocation, the fund is currently invested:

- 63% in domestic stocks

- 21% in international stocks

- 10% in bonds

- 4% in real estate

- 2% in cash and equivalents

Performance and Risk

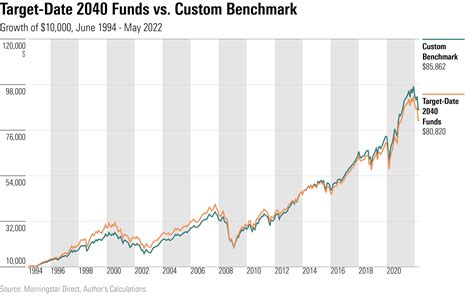

The American Funds 2030 Target Date Retirement Fund has delivered competitive returns over the long-term, with a 10-year annualized return of 8.5%. However, it's essential to remember that past performance is not a guarantee of future results.

In terms of risk, the fund has a moderate risk profile, with a beta of 0.83 relative to the S&P 500 Index. This means that the fund's returns have been less volatile than the overall market.

Fees and Expenses

The fund has a net expense ratio of 0.69%, which is competitive with other target date funds in the market. However, it's essential to note that the fund's fees and expenses can eat into your returns over time.

Tax Efficiency

The American Funds 2030 Target Date Retirement Fund has a tax efficiency ratio of 0.83, which indicates that the fund's tax liability is relatively low. This is due to the fund's diversified portfolio and the use of tax-loss harvesting strategies.

Investor Suitability

The American Funds 2030 Target Date Retirement Fund is suitable for investors who:

- Plan to retire around 2030: The fund is designed for investors who plan to retire in the year 2030.

- Seek a diversified portfolio: The fund offers a diversified portfolio of stocks, bonds, and real estate.

- Want professional management: The fund is managed by a team of experienced investment professionals.

However, the fund may not be suitable for investors who:

- Seek high returns: The fund's returns may not be as high as those of more aggressive investments.

- Are sensitive to market volatility: The fund's returns can be affected by market fluctuations.

Alternatives to the American Funds 2030 Target Date Retirement Fund

If you're considering alternative target date funds, some options include:

- Vanguard Target Retirement 2030 Fund (VTHRX)

- Fidelity Freedom 2030 Fund (FFFHX)

- T. Rowe Price Retirement 2030 Fund (TRRLX)

Gallery of American Funds 2030 Target Date Retirement Fund

American Funds 2030 Target Date Retirement Fund Image Gallery

Conclusion

The American Funds 2030 Target Date Retirement Fund is a popular choice among investors seeking a diversified portfolio and professional management. While the fund has delivered competitive returns over the long-term, it's essential to remember that past performance is not a guarantee of future results. Investors should carefully consider their individual circumstances and goals before investing in this or any other fund.

FAQs

- What is the American Funds 2030 Target Date Retirement Fund?: The fund is a type of mutual fund designed to provide a diversified investment portfolio for investors with a specific retirement date in mind.

- How does the fund work?: The fund's asset allocation is based on a glide path, which is a predetermined schedule for adjusting the portfolio's asset mix over time.

- What are the benefits of the fund?: The fund offers diversification, professional management, automatic rebalancing, and low costs.

- Who is the fund suitable for?: The fund is suitable for investors who plan to retire around 2030, seek a diversified portfolio, and want professional management.

We hope this article has provided valuable insights into the American Funds 2030 Target Date Retirement Fund. If you have any further questions or would like to discuss your investment options, please don't hesitate to comment below.