Intro

Discover the ins and outs of Army pay for deployment in our comprehensive guide. Learn about hazardous duty pay, deployment allowances, and special pays for military personnel serving overseas. Understand how deployment affects your basic pay, allowances, and benefits, and get expert tips on managing your finances during deployment.

Deploying to a combat zone or a hostile area can be a challenging and life-changing experience for members of the United States Armed Forces. In addition to the risks and sacrifices that come with deployment, military personnel also face unique financial challenges. One of the most significant concerns for deploying service members is understanding how their pay will be affected.

Understanding Army Deployment Pay

The US Army provides various forms of compensation to deploying soldiers to help mitigate the financial burdens of deployment. Army deployment pay is designed to support service members and their families during extended periods of time spent away from home. In this comprehensive guide, we will delve into the details of Army deployment pay, including the different types of pay, how it is calculated, and what benefits are available to deploying soldiers.

Types of Army Deployment Pay

There are several types of pay that deploying soldiers may be eligible for, including:

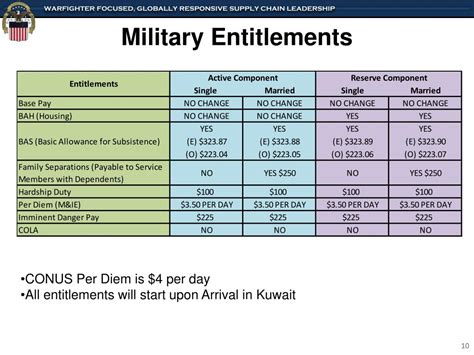

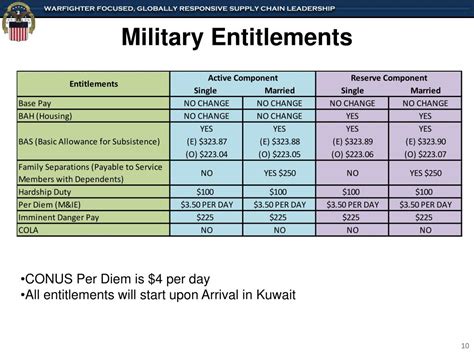

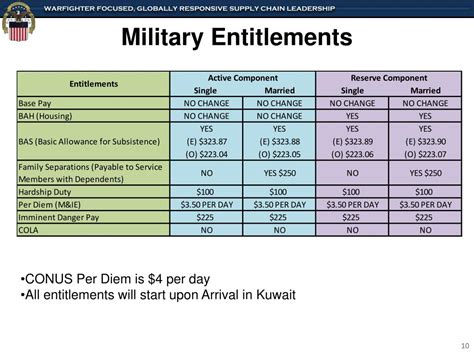

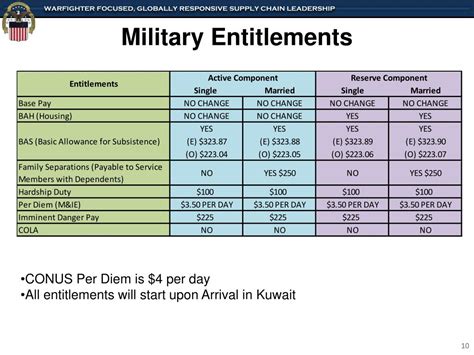

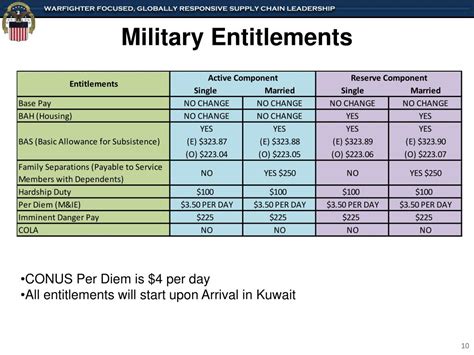

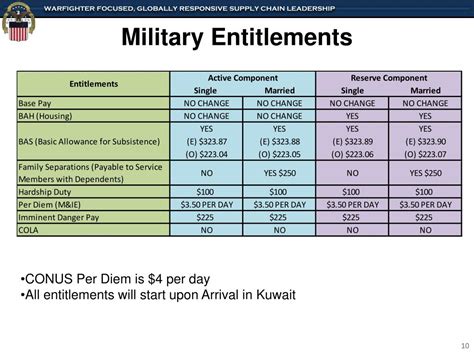

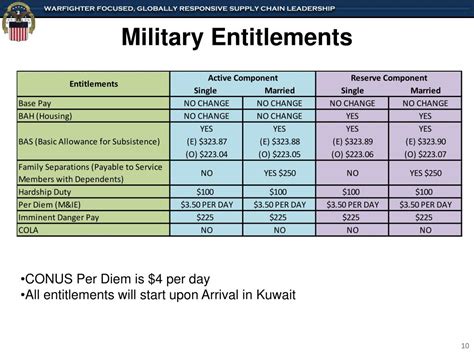

- Basic Allowance for Subsistence (BAS): This is a monthly allowance that covers the cost of food for service members.

- Basic Allowance for Housing (BAH): This is a monthly allowance that covers the cost of housing for service members.

- Hazardous Duty Pay: This is a monthly allowance that is paid to service members who are deployed to combat zones or other hazardous areas.

- Hardship Duty Pay: This is a monthly allowance that is paid to service members who are deployed to areas with extreme hardship conditions.

- Family Separation Allowance: This is a monthly allowance that is paid to service members who are separated from their families for extended periods of time.

Calculating Army Deployment Pay

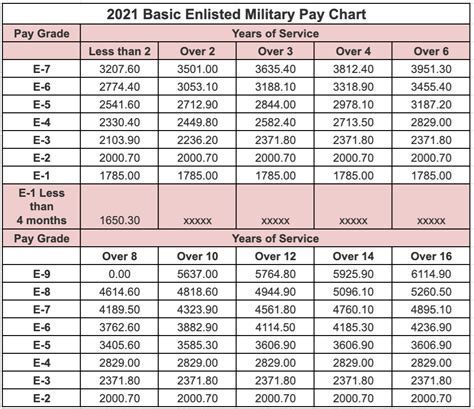

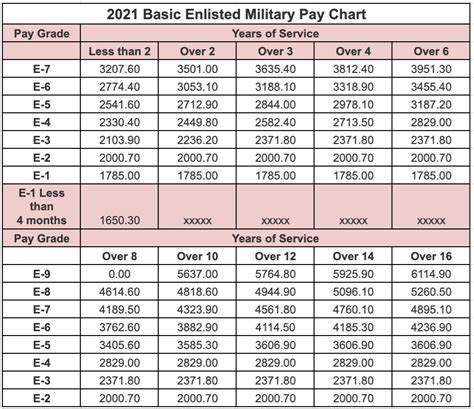

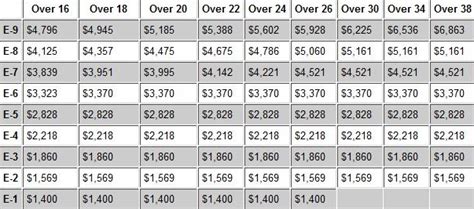

Calculating Army deployment pay can be complex, as it depends on a variety of factors, including the service member's rank, time in service, and deployment location. The following steps can help service members estimate their deployment pay:

- Determine the service member's basic pay based on their rank and time in service.

- Calculate the service member's BAS and BAH based on their deployment location.

- Determine the service member's eligibility for Hazardous Duty Pay, Hardship Duty Pay, and Family Separation Allowance.

- Add the service member's basic pay, BAS, BAH, and any additional allowances to calculate their total deployment pay.

Benefits for Deploying Soldiers

In addition to deployment pay, the US Army provides various benefits to deploying soldiers, including:

- Tax-free allowances: Many deployment allowances are tax-free, which can help reduce the service member's tax liability.

- Increased special pay: Deploying soldiers may be eligible for increased special pay, such as jump pay or dive pay.

- Education benefits: Deploying soldiers may be eligible for education benefits, such as the Post-9/11 GI Bill.

- Health insurance: Deploying soldiers and their families are eligible for health insurance through TRICARE.

Special Pay for Deploying Soldiers

In addition to deployment pay, the US Army provides various special pays to deploying soldiers, including:

- Hostile Fire Pay: This is a monthly allowance that is paid to service members who are deployed to areas where they are exposed to hostile fire.

- Imminent Danger Pay: This is a monthly allowance that is paid to service members who are deployed to areas where they are at risk of imminent danger.

- Jump Pay: This is a monthly allowance that is paid to service members who are qualified as parachutists.

- Dive Pay: This is a monthly allowance that is paid to service members who are qualified as divers.

Tax Implications of Deployment Pay

Deployment pay can have significant tax implications for service members. Many deployment allowances are tax-free, which can help reduce the service member's tax liability. However, some allowances may be subject to taxation. Service members should consult with a tax professional to understand the tax implications of their deployment pay.

Preparing for Deployment: Financial Tips

Preparing for deployment can be challenging, both financially and emotionally. The following financial tips can help service members prepare for deployment:

- Create a budget: Service members should create a budget that accounts for their deployment pay and any changes in their expenses.

- Pay off debt: Service members should try to pay off any high-interest debt before deploying.

- Build an emergency fund: Service members should build an emergency fund to cover any unexpected expenses.

- Take advantage of tax benefits: Service members should take advantage of tax benefits, such as the Military Spouses Residency Relief Act.

Resources for Deploying Soldiers

The US Army provides various resources to support deploying soldiers, including:

- Army Finance and Accounting Services: This website provides information on Army deployment pay and benefits.

- Defense Finance and Accounting Service: This website provides information on military pay and benefits.

- Military OneSource: This website provides information and resources on military benefits and support.

Army Deployment Pay Gallery

In conclusion, understanding Army deployment pay is crucial for service members who are preparing for deployment. By knowing what to expect and how to calculate their deployment pay, service members can better plan for their financial future. Additionally, taking advantage of tax benefits and resources can help reduce the financial burden of deployment. We hope this comprehensive guide has provided valuable information and insights to help service members navigate the complexities of Army deployment pay.