Asking for funding can be a daunting task, especially if you're a startup or an entrepreneur with a new business idea. However, it's a crucial step in turning your vision into a reality. Whether you're pitching to investors, applying for a grant, or crowdfunding, there are several ways to ask for funding. Here are five legit ways to ask for funding:

Understanding Your Options

Before you start asking for funding, it's essential to understand your options. You need to know what type of funding you're looking for, how much you need, and what you're willing to offer in return. This will help you tailor your pitch and increase your chances of securing the funding you need.

Funding Options

There are several funding options available, including:

- Investors: This includes venture capitalists, angel investors, and private equity firms.

- Grants: Government agencies, foundations, and corporations offer grants for specific projects or industries.

- Crowdfunding: Platforms like Kickstarter, Indiegogo, and GoFundMe allow you to raise money from a large number of people.

- Loans: Banks, credit unions, and online lenders offer loans with varying interest rates and repayment terms.

- Incubators and Accelerators: These programs provide funding, mentorship, and resources in exchange for equity.

Preparing Your Pitch

Regardless of the funding option you choose, you need to prepare a solid pitch. This includes:

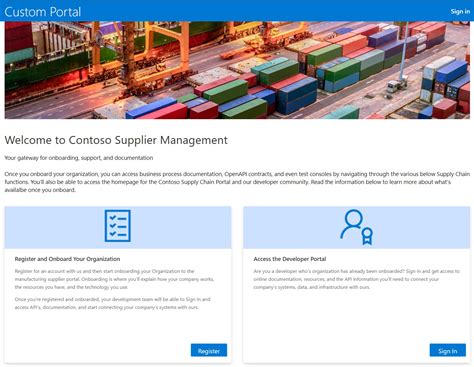

- Developing a Business Plan: Outline your business model, target market, financial projections, and marketing strategy.

- Creating a Financial Model: Develop a detailed financial model that includes revenue projections, expenses, and cash flow.

- Building a Prototype: Create a prototype or a minimum viable product (MVP) to demonstrate your idea.

- Establishing a Team: Assemble a team with the necessary skills and experience to execute your plan.

Pitching to Investors

Pitching to investors can be intimidating, but it's essential to be confident and prepared. Here are some tips:

- Research Potential Investors: Look for investors who have invested in similar companies or industries.

- Develop a Strong Elevator Pitch: Craft a brief and compelling pitch that highlights your unique value proposition.

- Practice Your Pitch: Rehearse your pitch until you can deliver it confidently and concisely.

- Be Prepared to Answer Questions: Anticipate questions and be prepared to answer them.

Applying for Grants

Applying for grants can be a time-consuming process, but it's worth the effort. Here are some tips:

- Research Grant Opportunities: Look for grants that align with your business or project goals.

- Review the Eligibility Criteria: Ensure you meet the eligibility criteria before applying.

- Develop a Strong Proposal: Write a clear and concise proposal that outlines your project goals, budget, and timeline.

- Follow the Application Instructions: Carefully follow the application instructions to avoid rejection.

Crowdfunding

Crowdfunding is a popular way to raise money from a large number of people. Here are some tips:

- Choose the Right Platform: Select a platform that aligns with your project goals and target audience.

- Develop a Strong Campaign: Create a compelling campaign that includes a clear pitch, engaging video, and rewards.

- Promote Your Campaign: Promote your campaign through social media, email marketing, and other channels.

- Engage with Your Backers: Respond to comments and questions from your backers to build trust and credibility.

Loans and Financing Options

Loans and financing options can provide the necessary funding to grow your business. Here are some tips:

- Research Loan Options: Compare loan options from different lenders to find the best rates and terms.

- Review the Loan Terms: Carefully review the loan terms to ensure you understand the repayment terms and interest rates.

- Prepare a Strong Loan Application: Develop a strong loan application that includes a clear business plan and financial projections.

- Consider Alternative Lenders: Consider alternative lenders that offer more flexible terms and lower interest rates.

Incubators and Accelerators

Incubators and accelerators can provide funding, mentorship, and resources to help you grow your business. Here are some tips:

- Research Incubators and Accelerators: Look for programs that align with your business goals and industry.

- Review the Program Terms: Carefully review the program terms to ensure you understand the equity requirements and program duration.

- Develop a Strong Application: Develop a strong application that includes a clear business plan and financial projections.

- Prepare to Pitch: Prepare to pitch your business to the program directors and investors.

Conclusion

Asking for funding can be a challenging task, but it's essential to turn your business idea into a reality. By understanding your options, preparing a solid pitch, and following the tips outlined above, you can increase your chances of securing the funding you need. Remember to stay confident, persistent, and adaptable throughout the process.

Gallery of Funding Ideas

Funding Ideas Image Gallery

We hope this article has provided you with valuable insights on how to ask for funding. Whether you're a startup or an established business, securing funding can be a challenging task. However, with the right approach and preparation, you can increase your chances of success. Share your thoughts and experiences in the comments section below, and don't forget to share this article with your friends and colleagues.