Intro

Streamline your investment management with automated spreadsheets. Discover how to easily track, analyze, and optimize your portfolio with customizable templates and formulas. Say goodbye to manual data entry and hello to data-driven insights. Learn the art of spreadsheet investment management and take your financial planning to the next level.

Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. With so many options available, it can be difficult to know where to start. However, with the help of spreadsheets, automatic investment management can be made easy. In this article, we will explore how spreadsheets can be used to simplify the investment process and provide a stress-free way to manage your investments.

The Benefits of Using Spreadsheets for Investment Management

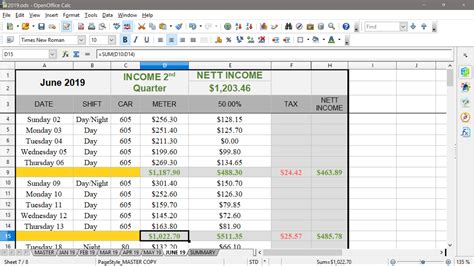

Spreadsheets offer a number of benefits when it comes to investment management. One of the main advantages is that they allow you to track your investments in a clear and concise manner. With a spreadsheet, you can easily see how your investments are performing and make adjustments as needed. Additionally, spreadsheets can help you to identify trends and patterns in the market, which can inform your investment decisions.

Another benefit of using spreadsheets for investment management is that they can help you to automate many of the tasks involved in investing. For example, you can use formulas to calculate your returns and automatically update your portfolio. This can save you a significant amount of time and reduce the risk of human error.

How to Create a Spreadsheet for Investment Management

Creating a spreadsheet for investment management is easier than you might think. Here are the steps to follow:

Step 1: Set Up Your Spreadsheet

To start, you will need to set up a spreadsheet with the following columns:

- Investment name

- Investment type (e.g. stock, bond, ETF)

- Number of shares

- Purchase price

- Current price

- Return on investment (ROI)

Step 2: Enter Your Investment Data

Once you have set up your spreadsheet, you can start entering your investment data. This will include the name of each investment, the type of investment, the number of shares you own, and the purchase price.

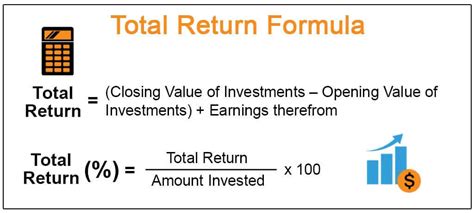

Step 3: Calculate Your Returns

To calculate your returns, you can use formulas in your spreadsheet. For example, you can use the following formula to calculate your ROI:

ROI = (Current Price - Purchase Price) / Purchase Price

Step 4: Automate Your Portfolio Updates

To automate your portfolio updates, you can use formulas to calculate your returns and automatically update your portfolio. For example, you can use the following formula to update your portfolio:

New Portfolio Value = Old Portfolio Value + (Number of Shares x Current Price)

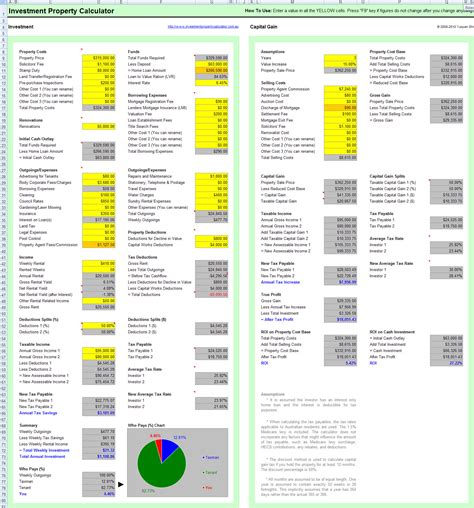

Advanced Investment Management Techniques with Spreadsheets

While the basics of investment management with spreadsheets are relatively straightforward, there are also a number of advanced techniques you can use to take your investment management to the next level.

Using Conditional Formatting to Identify Trends

One advanced technique you can use is conditional formatting to identify trends in the market. This involves using formulas to highlight cells in your spreadsheet that meet certain conditions. For example, you can use conditional formatting to highlight cells that show a stock price that has increased by more than 10% in the past month.

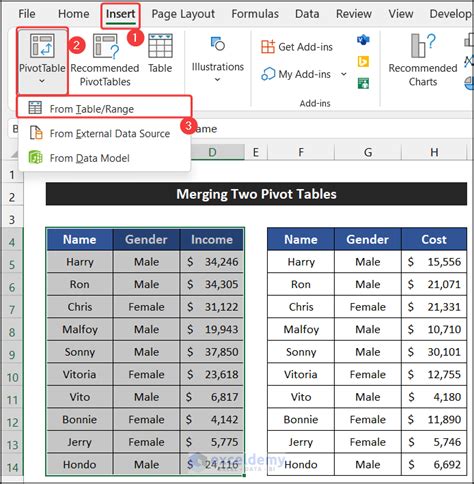

Using PivotTables to Analyze Your Portfolio

Another advanced technique you can use is PivotTables to analyze your portfolio. PivotTables allow you to summarize large datasets and gain insights into your portfolio that would be difficult to see otherwise.

Best Practices for Investment Management with Spreadsheets

While spreadsheets can be a powerful tool for investment management, there are also a number of best practices you should follow to get the most out of your spreadsheet.

Use Clear and Consistent Formatting

One of the most important best practices is to use clear and consistent formatting throughout your spreadsheet. This will make it easier to read and understand your spreadsheet, and will also help to reduce errors.

Use Formulas to Automate Tasks

Another best practice is to use formulas to automate tasks whenever possible. This will save you time and reduce the risk of human error.

Keep Your Spreadsheet Up-to-Date

Finally, it is essential to keep your spreadsheet up-to-date. This will ensure that your spreadsheet remains accurate and reliable, and will also help you to make informed investment decisions.

Investment Management with Spreadsheets Image Gallery

In conclusion, investment management with spreadsheets is a powerful tool that can help you to simplify the investment process and make informed investment decisions. By following the best practices outlined in this article, you can get the most out of your spreadsheet and take your investment management to the next level.