Intro

Master filling out BIR Form 1905 in Excel with ease. Discover 5 expert tips to simplify and streamline your tax compliance process. Learn how to accurately complete the form, avoid common errors, and reduce processing time. Get expert advice on tax compliance, excel templates, and BIR regulations to ensure seamless filing.

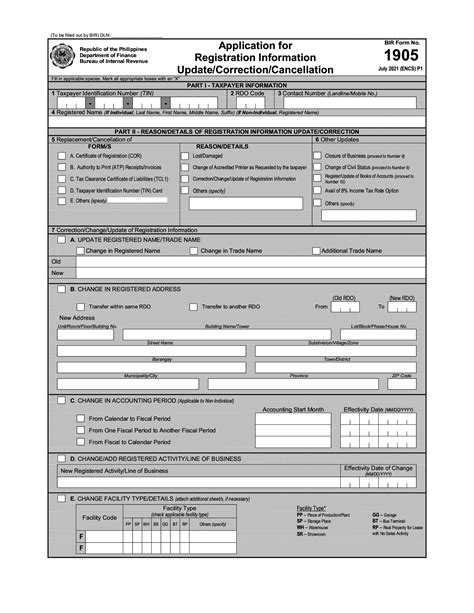

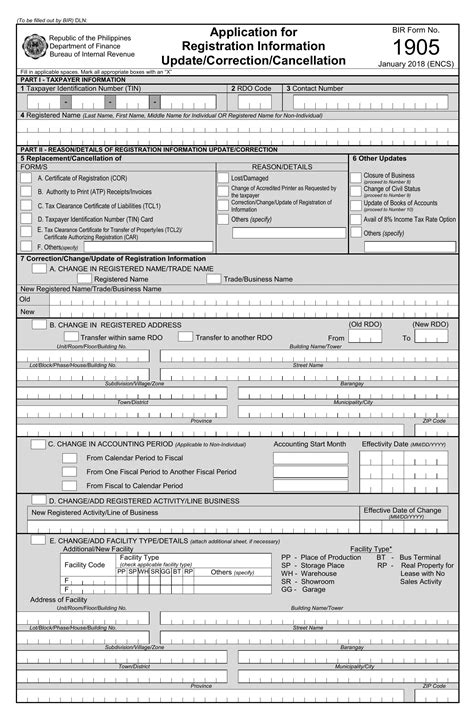

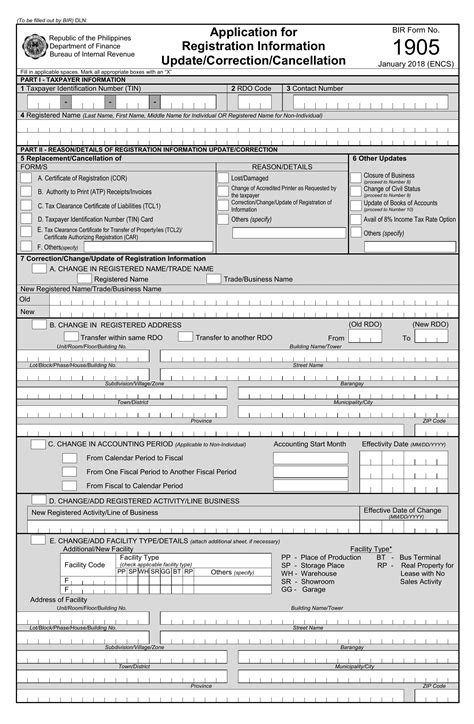

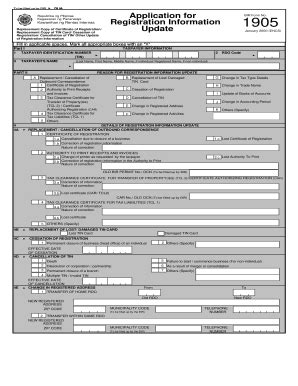

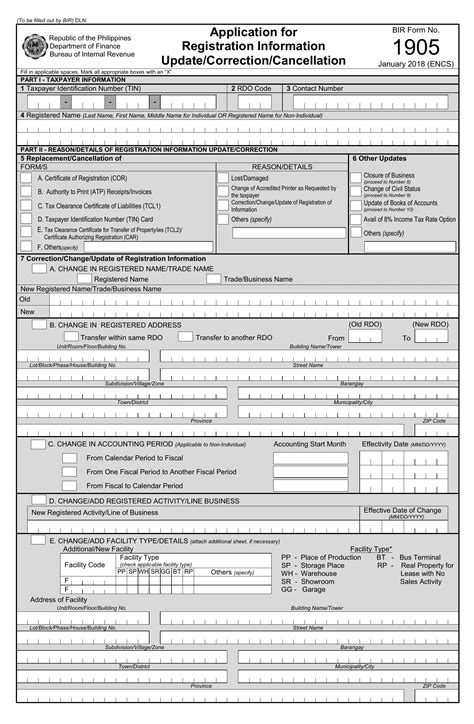

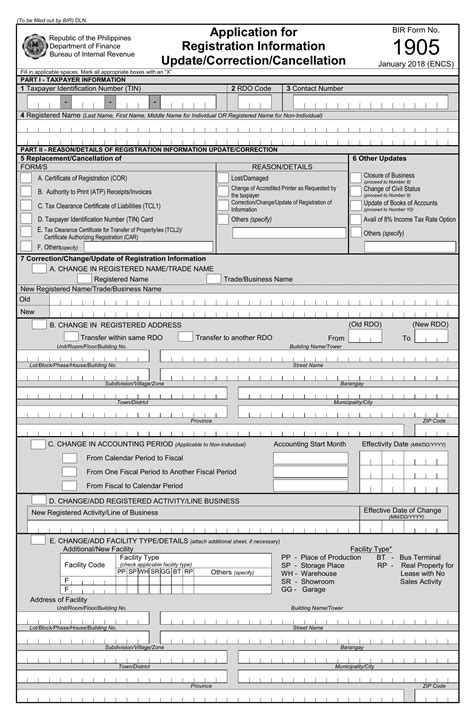

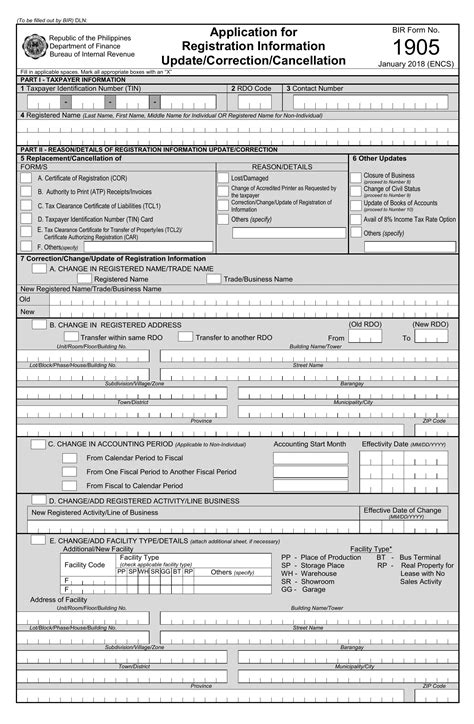

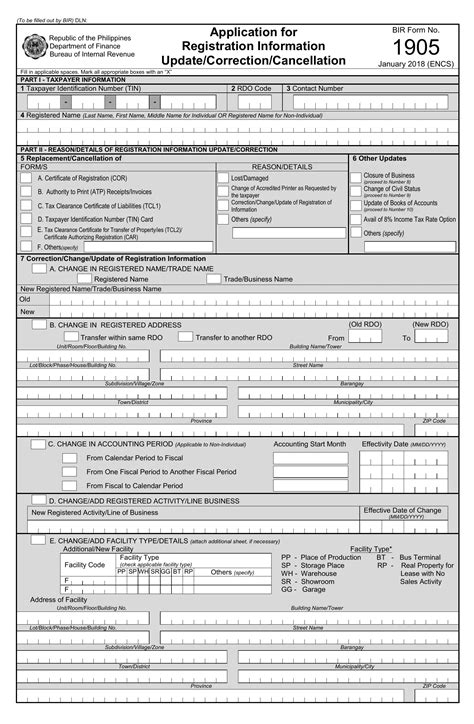

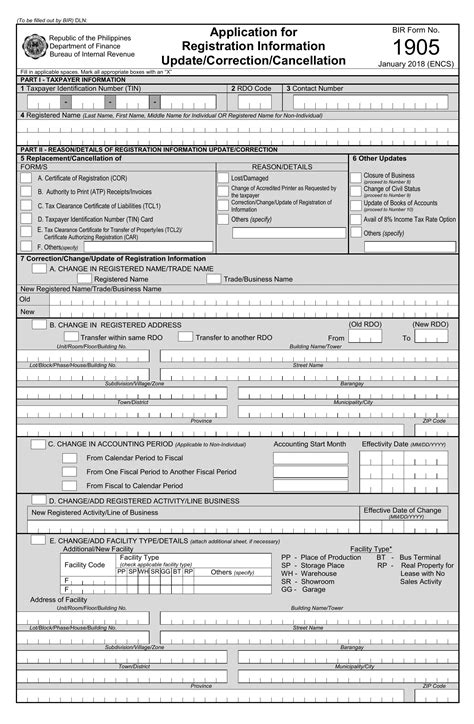

The Bureau of Internal Revenue (BIR) Form 1905 is a crucial document for individuals and businesses in the Philippines to update their registration information with the BIR. With the advancement of technology, filling out this form has become more efficient, especially when done in Excel. However, it can still be a daunting task for many. In this article, we will provide you with 5 valuable tips for filling out BIR Form 1905 in Excel, making the process smoother and less prone to errors.

Understanding the BIR Form 1905

Before we dive into the tips, it's essential to understand the purpose of the BIR Form 1905. This form is used to update the registration information of taxpayers, including their personal details, business information, and tax obligations. The form consists of several sections, including taxpayer information, business details, and certification.

Tips for Filling Out BIR Form 1905 in Excel

1. Download the Official Template

The first tip is to download the official BIR Form 1905 template from the BIR website. This ensures that you have the correct format and layout, reducing the risk of errors and rejections. The template is usually available in Excel format, making it easier to fill out and edit.

2. Use the Correct Font and Font Size

When filling out the form, use the correct font and font size to ensure readability. The BIR recommends using Arial font with a size of 12 points. Avoid using fonts that are too decorative or difficult to read, as this may lead to errors or delays in processing.

3. Be Accurate with Your Taxpayer Identification Number (TIN)

Your Taxpayer Identification Number (TIN) is a critical piece of information that must be accurate. Double-check your TIN to ensure it matches the one registered with the BIR. Any errors or discrepancies may lead to delays or rejections.

4. Use the Correct Format for Dates

When filling out dates, use the correct format (MM/DD/YYYY) to avoid any confusion. This applies to all date fields, including birthdates, registration dates, and certification dates.

5. Verify Your Information Before Submission

Before submitting your BIR Form 1905, verify all the information to ensure accuracy and completeness. Check for any errors, inconsistencies, or missing information that may lead to delays or rejections.

BIR Form 1905 Excel Template: A Step-by-Step Guide

To make filling out the BIR Form 1905 in Excel even easier, here is a step-by-step guide:

- Step 1: Download the official template from the BIR website.

- Step 2: Open the template in Excel and fill out the taxpayer information section.

- Step 3: Complete the business details section, including business name, address, and tax obligations.

- Step 4: Certify the accuracy of the information provided.

- Step 5: Verify all the information before submission.

Common Mistakes to Avoid When Filling Out BIR Form 1905 in Excel

When filling out the BIR Form 1905 in Excel, there are several common mistakes to avoid:

- Incorrect TIN

- Inconsistent or missing information

- Incorrect font or font size

- Incorrect date format

- Failure to verify information before submission

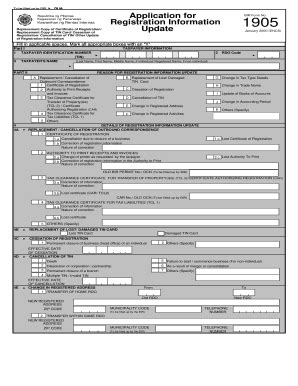

Gallery of BIR Form 1905 Excel Templates

BIR Form 1905 Excel Template Gallery

We hope that these tips and the step-by-step guide have made filling out the BIR Form 1905 in Excel a smoother and less daunting task. Remember to avoid common mistakes and verify all the information before submission. If you have any questions or need further assistance, feel free to ask in the comments below. Don't forget to share this article with others who may find it helpful.