Intro

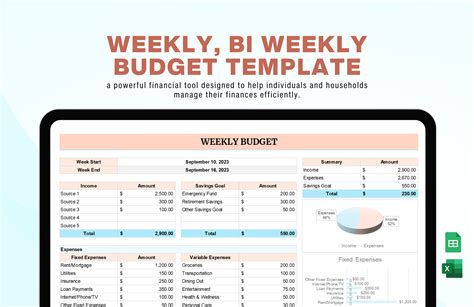

Manage your finances with ease using a biweekly budget template in Google Sheets. Track income and expenses, create a budget plan, and stay on top of your money. Learn how to set up and customize a biweekly budget template, including formulas and automation, to achieve financial stability and make informed decisions.

Managing your finances effectively is crucial for achieving financial stability and security. One of the most effective ways to do this is by creating a budget that outlines your income and expenses. In this article, we will explore the concept of a biweekly budget template in Google Sheets and provide a step-by-step guide on how to create one.

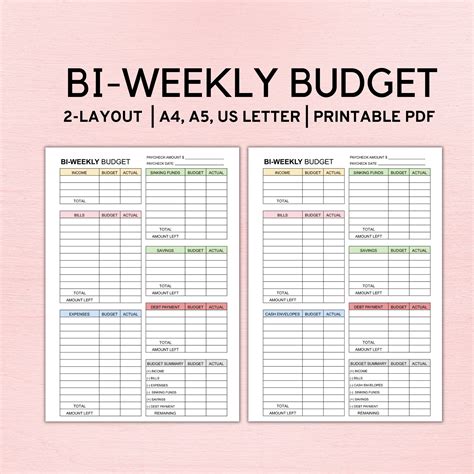

A biweekly budget template is a great way to manage your finances, especially for those who get paid every two weeks. It allows you to track your income and expenses over a two-week period, making it easier to stay on top of your finances. Google Sheets is a free online spreadsheet tool that makes it easy to create and edit budgets.

Why Use a Biweekly Budget Template in Google Sheets?

Using a biweekly budget template in Google Sheets offers several benefits. Here are a few:

- Easy to create and edit: Google Sheets is a user-friendly tool that makes it easy to create and edit budgets.

- Automated calculations: Google Sheets can perform calculations automatically, making it easier to track your income and expenses.

- Collaboration: Google Sheets allows multiple users to collaborate on a budget, making it easier to manage finances with a partner or spouse.

- Accessibility: Google Sheets can be accessed from anywhere, making it easy to track your finances on-the-go.

Benefits of Using a Biweekly Budget Template

Using a biweekly budget template offers several benefits, including:

- Improved financial management: A biweekly budget template helps you track your income and expenses, making it easier to manage your finances.

- Reduced financial stress: By tracking your income and expenses, you can reduce financial stress and anxiety.

- Increased savings: A biweekly budget template can help you identify areas where you can cut back and save money.

How to Create a Biweekly Budget Template in Google Sheets

Creating a biweekly budget template in Google Sheets is easy. Here's a step-by-step guide:

- Create a new spreadsheet: Log in to your Google account and create a new spreadsheet in Google Sheets.

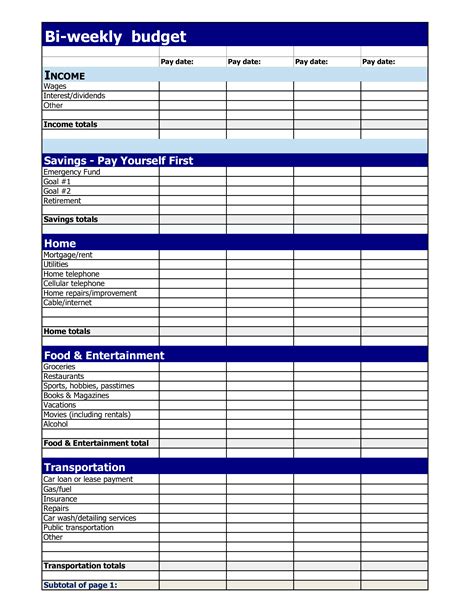

- Set up your budget template: Create a table with the following columns: income, fixed expenses, variable expenses, and savings.

- Enter your income: Enter your biweekly income in the income column.

- Enter your fixed expenses: Enter your fixed expenses, such as rent/mortgage, utilities, and car payment, in the fixed expenses column.

- Enter your variable expenses: Enter your variable expenses, such as groceries, entertainment, and gas, in the variable expenses column.

- Calculate your savings: Calculate your savings by subtracting your fixed and variable expenses from your income.

- Track your expenses: Track your expenses over a two-week period to ensure you're staying within your budget.

Tips for Using a Biweekly Budget Template

Here are a few tips for using a biweekly budget template:

- Track your expenses regularly: Track your expenses regularly to ensure you're staying within your budget.

- Adjust your budget as needed: Adjust your budget as needed to reflect changes in your income or expenses.

- Use the 50/30/20 rule: Allocate 50% of your income towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

Common Mistakes to Avoid When Using a Biweekly Budget Template

Here are a few common mistakes to avoid when using a biweekly budget template:

- Not tracking expenses regularly: Failing to track expenses regularly can lead to overspending and financial stress.

- Not adjusting your budget: Failing to adjust your budget as needed can lead to financial difficulties.

- Not using the 50/30/20 rule: Failing to allocate your income effectively can lead to financial difficulties.

Conclusion

Creating a biweekly budget template in Google Sheets is a great way to manage your finances effectively. By following the steps outlined above and avoiding common mistakes, you can create a budget that helps you achieve financial stability and security.

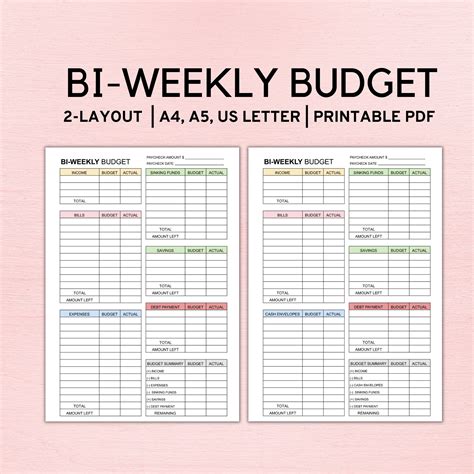

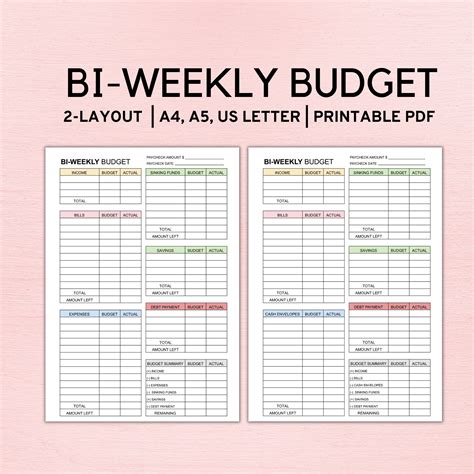

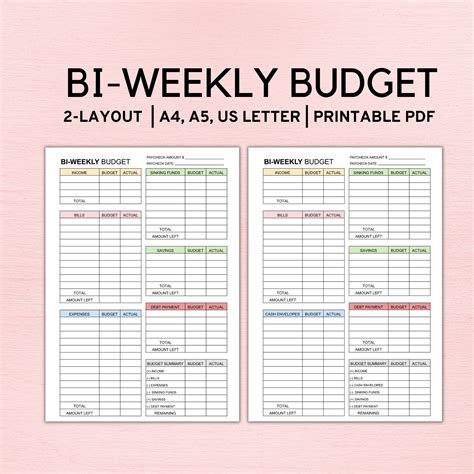

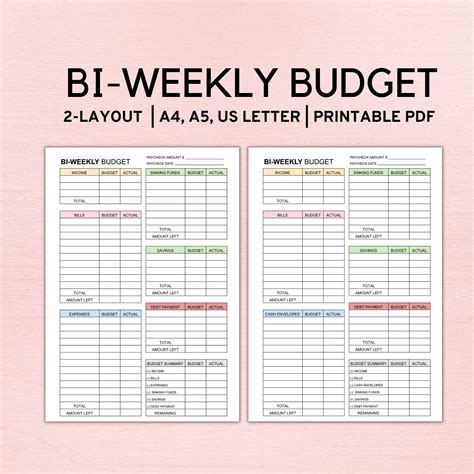

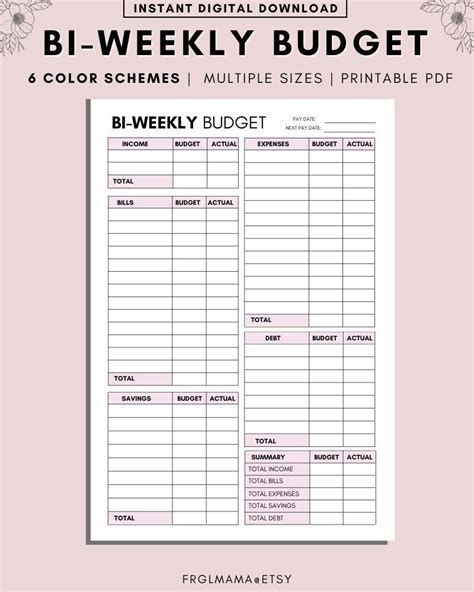

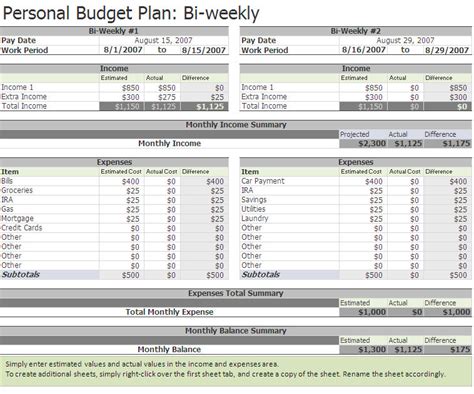

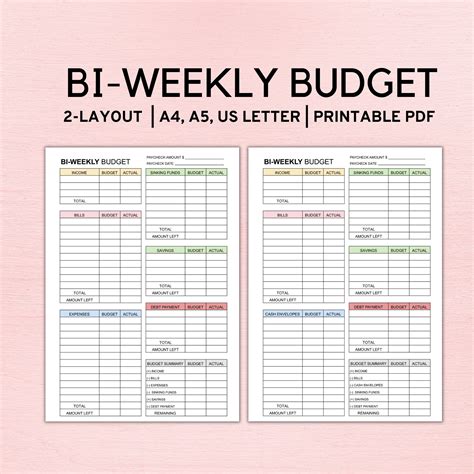

Biweekly Budget Template Images