Intro

Implementing the Black Scholes model in Excel can be a valuable skill for anyone interested in finance, as it allows for the calculation of option prices and Greeks. In this article, we will explore five ways to implement Black Scholes in Excel, each with its own strengths and weaknesses.

What is the Black Scholes Model?

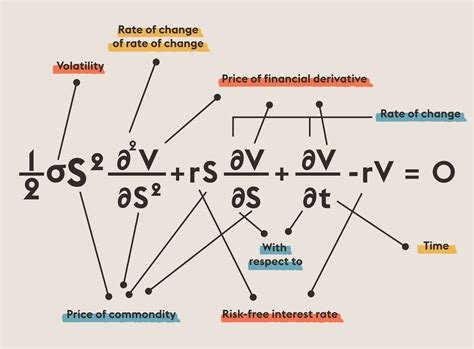

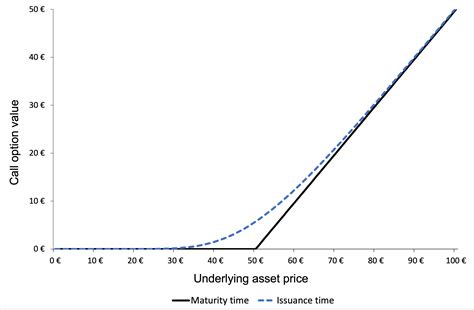

Before we dive into the implementation, let's briefly review what the Black Scholes model is. The Black Scholes model is a mathematical model used to estimate the value of a European call option or a European put option. The model takes into account the current stock price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

Method 1: Using the Black Scholes Formula

One way to implement Black Scholes in Excel is to use the formula directly. The formula for the value of a European call option is:

C = S * N(d1) - X * e^(-r*T) * N(d2)

Where:

- C is the value of the call option

- S is the current stock price

- X is the strike price

- r is the risk-free interest rate

- T is the time to expiration

- N(d1) and N(d2) are the cumulative distribution functions of the standard normal distribution

- d1 and d2 are calculated using the following formulas:

d1 = (ln(S/X) + (r + σ^2/2) * T) / (σ * sqrt(T)) d2 = d1 - σ * sqrt(T)

Image:

Using this formula, we can create a simple Excel spreadsheet that calculates the value of a European call option.

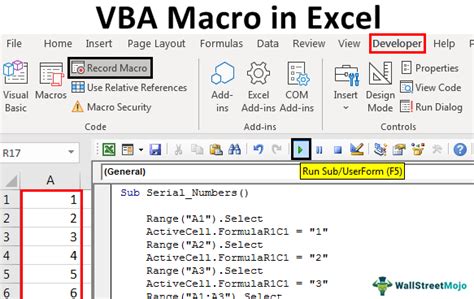

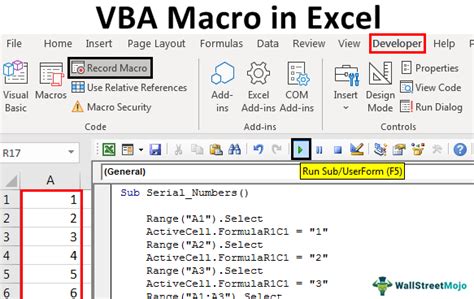

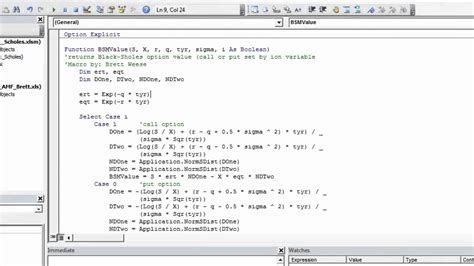

Method 2: Using VBA Macros

Another way to implement Black Scholes in Excel is to use VBA macros. VBA (Visual Basic for Applications) is a programming language used to create and automate tasks in Excel.

By creating a VBA macro, we can encapsulate the Black Scholes formula and make it easier to use. We can also add additional functionality, such as calculating Greeks and creating charts.

Image:

To create a VBA macro, we need to open the Visual Basic Editor in Excel and create a new module. Then, we can write the code to calculate the Black Scholes formula and assign it to a button or a shortcut.

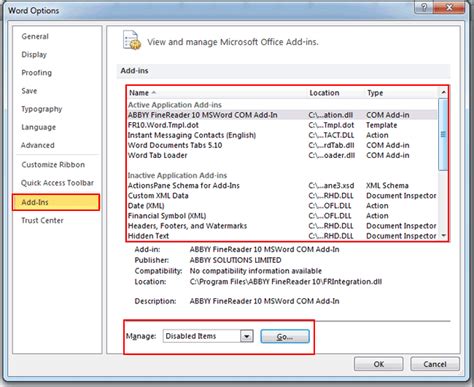

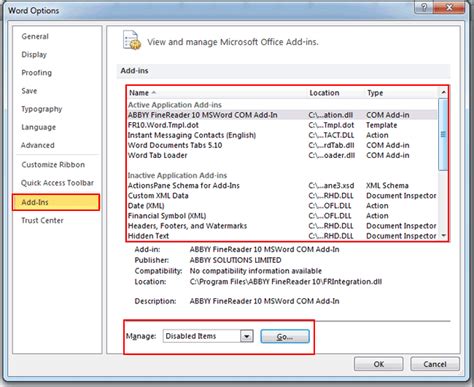

Method 3: Using Add-ins

There are several add-ins available for Excel that can calculate Black Scholes, such as the Analysis ToolPak and the XLSTAT add-in. These add-ins provide a user-friendly interface and can save time and effort.

Image:

To use an add-in, we need to install it and then access it through the Excel menu. Once installed, we can use the add-in to calculate Black Scholes and other financial formulas.

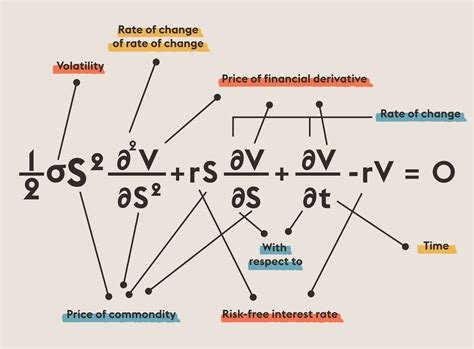

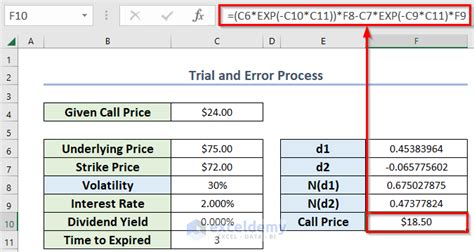

Method 4: Using a Black Scholes Template

Another way to implement Black Scholes in Excel is to use a pre-built template. There are several templates available online that can be downloaded and used.

Image:

Using a template can save time and effort, as it already includes the formulas and formatting. We can simply enter the inputs and get the results.

Method 5: Using a Third-Party Library

Finally, we can use a third-party library, such as the Finlib library, to calculate Black Scholes in Excel. These libraries provide a set of pre-built functions that can be used to calculate financial formulas.

Image:

To use a third-party library, we need to install it and then access it through the Excel menu. Once installed, we can use the library to calculate Black Scholes and other financial formulas.

Gallery of Black Scholes Images

Black Scholes Image Gallery

Conclusion

In this article, we explored five ways to implement Black Scholes in Excel, each with its own strengths and weaknesses. Whether you use the formula directly, VBA macros, add-ins, a template, or a third-party library, implementing Black Scholes in Excel can be a valuable skill for anyone interested in finance.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.