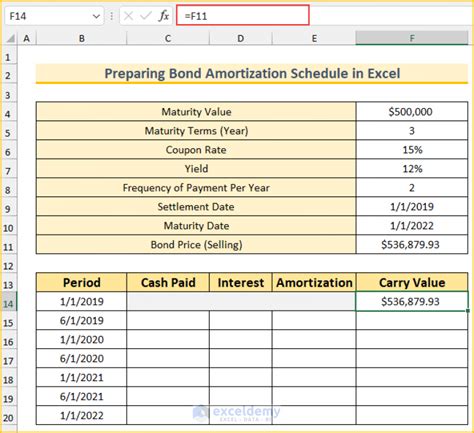

In today's fast-paced financial world, creating a bond payment schedule can be a daunting task, especially for those without extensive experience in finance. Fortunately, with the help of Microsoft Excel, you can create a bond payment schedule in just 5 easy steps. In this article, we will guide you through the process, providing a clear and concise explanation of each step.

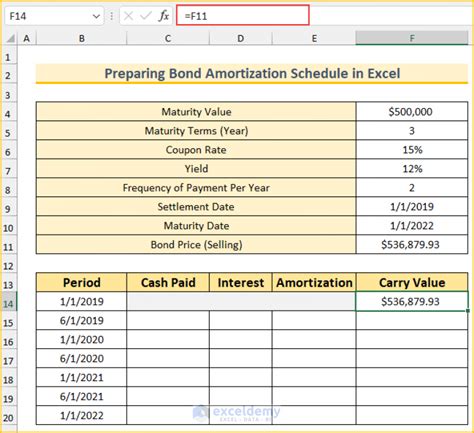

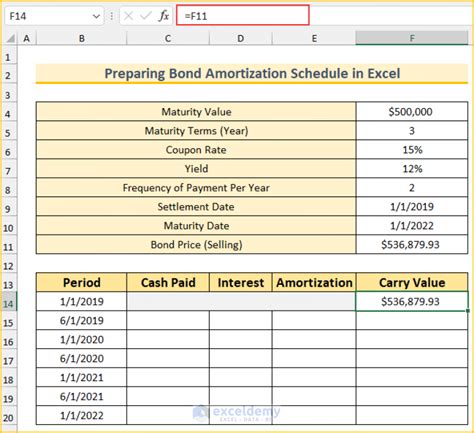

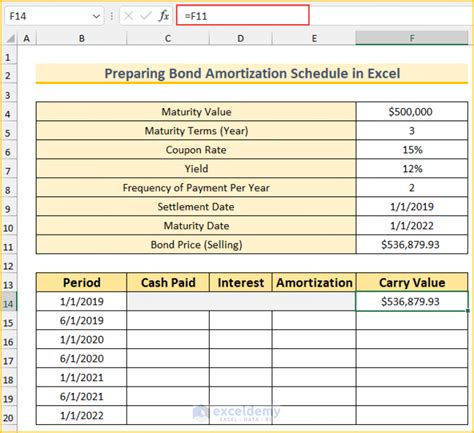

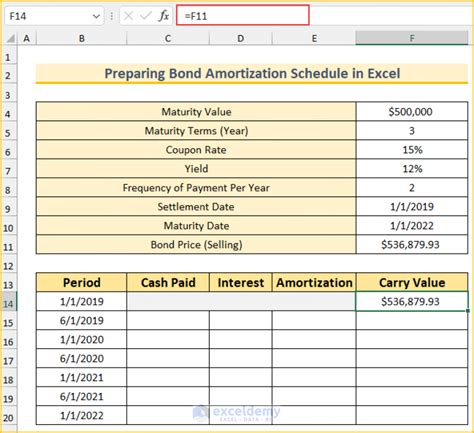

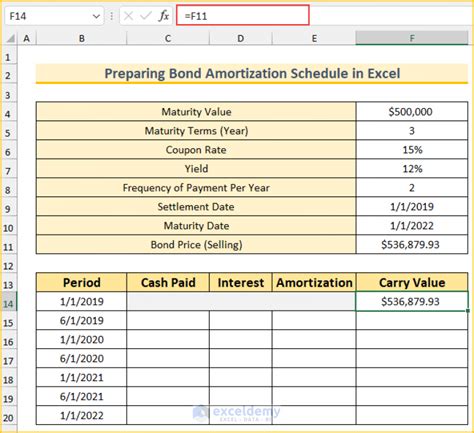

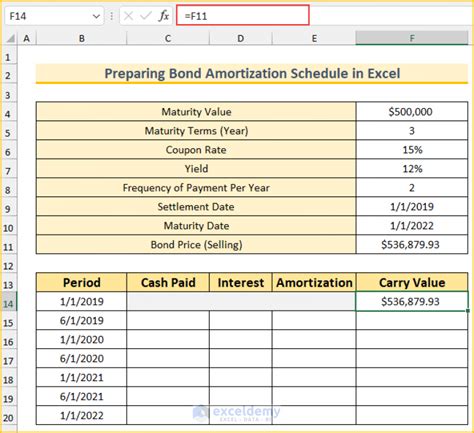

Step 1: Set Up Your Excel Spreadsheet

To start, open a new Excel spreadsheet and set up the following columns:

- Bond Details: This column will store information about the bond, such as the bond's face value, interest rate, and maturity date.

- Payment Period: This column will store the payment period, which is the frequency at which interest payments are made.

- Payment Amount: This column will store the amount of each interest payment.

- Payment Date: This column will store the date of each interest payment.

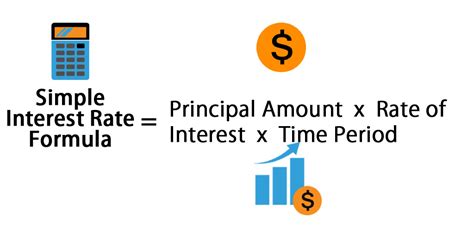

Step 2: Calculate the Interest Rate

Next, calculate the interest rate for the bond. This can be done using the following formula:

- Interest Rate = (Annual Interest Rate / Number of Payments per Year)

For example, if the annual interest rate is 5% and the bond makes quarterly payments, the interest rate would be:

- Interest Rate = (5% / 4) = 1.25%

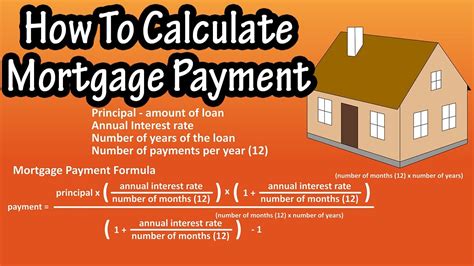

Step 3: Calculate the Payment Amount

Now that we have the interest rate, we can calculate the payment amount using the following formula:

- Payment Amount = (Bond Face Value x Interest Rate)

For example, if the bond face value is $1,000 and the interest rate is 1.25%, the payment amount would be:

- Payment Amount = ($1,000 x 1.25%) = $12.50

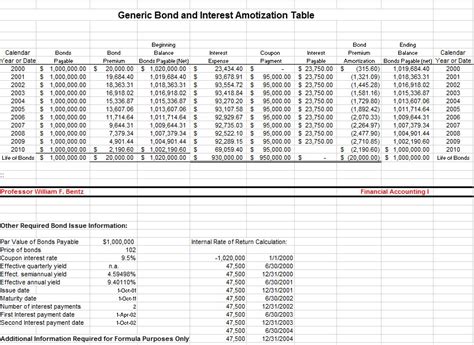

Step 4: Create a Payment Schedule

Using the payment amount and payment period, create a payment schedule that outlines each payment date and amount. This can be done using a simple table or chart.

For example:

| Payment Date | Payment Amount |

|---|---|

| 2023-03-15 | $12.50 |

| 2023-06-15 | $12.50 |

| 2023-09-15 | $12.50 |

| 2023-12-15 | $12.50 |

Step 5: Review and Refine

Finally, review your bond payment schedule to ensure it is accurate and complete. Refine the schedule as needed to reflect any changes in interest rates or payment periods.

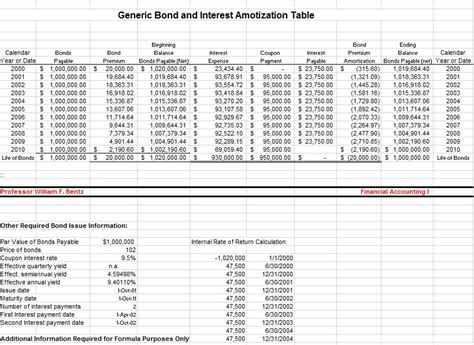

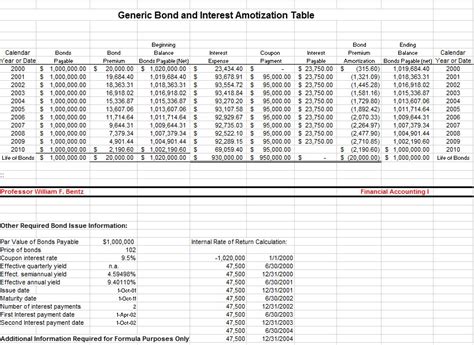

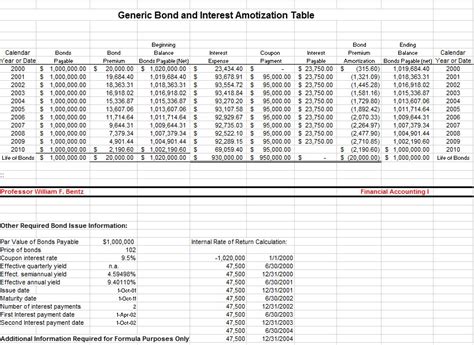

Bond Payment Schedule Example

Here is an example of a bond payment schedule created using the steps outlined above:

Conclusion

Creating a bond payment schedule in Excel is a straightforward process that can be completed in just 5 easy steps. By following these steps, you can create a comprehensive payment schedule that outlines each payment date and amount, helping you to better manage your bond investments.

Gallery of Bond Payment Schedules

Bond Payment Schedule Images

We hope this article has been informative and helpful in creating a bond payment schedule in Excel. If you have any questions or need further assistance, please don't hesitate to ask.