Intro

Master Break Even Analysis in Excel with our easy-to-use template. Learn how to calculate break-even point, fixed and variable costs, and contribution margin. Boost business profitability with this simple, step-by-step guide and downloadable template. Understand your financials and make informed decisions with our expert break-even analysis tutorial.

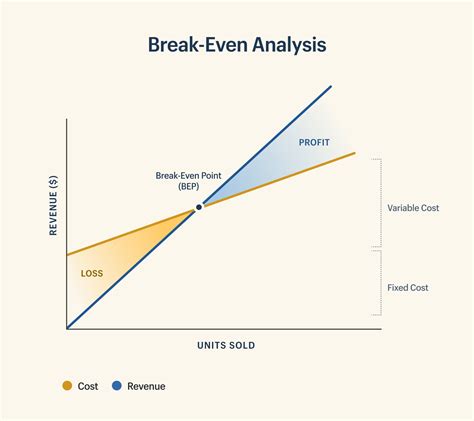

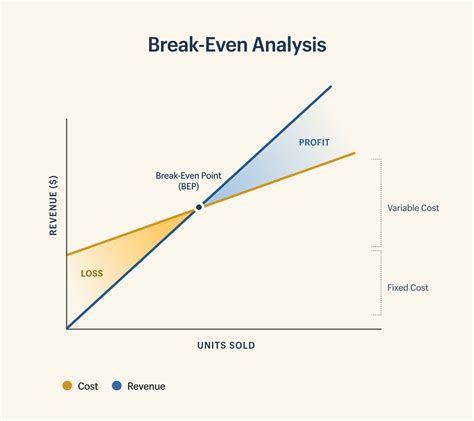

In the world of finance and business, understanding the relationship between costs, revenue, and profitability is crucial for making informed decisions. One of the most fundamental concepts in this realm is the break-even analysis. Conducting a break-even analysis allows businesses to determine the point at which their total revenue equals their total fixed and variable costs, making it a powerful tool for planning, decision-making, and risk assessment. While the concept itself is straightforward, the calculation can become complex, especially when dealing with multiple variables and scenarios. This is where Excel comes into play, offering a robust and flexible platform for performing break-even analyses with ease.

Understanding Break-Even Analysis

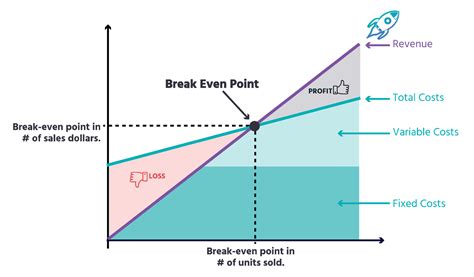

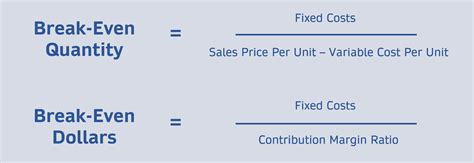

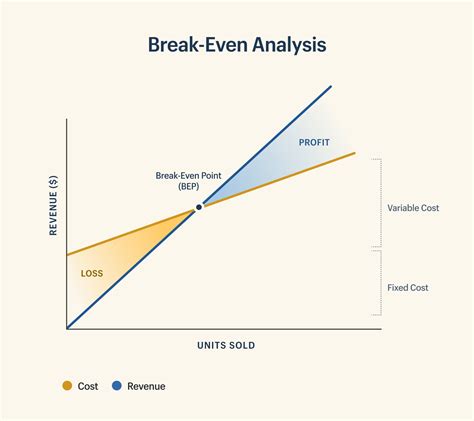

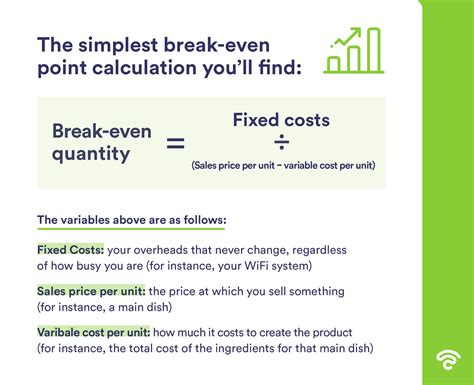

Break-even analysis is a method used by businesses to determine the point at which the revenue from the sales of a product equals the total fixed and variable costs incurred to produce and sell that product. It is a critical concept for businesses, especially for those in the early stages or considering the launch of a new product line. The analysis helps entrepreneurs and managers evaluate the feasibility of a project, identify the factors that influence profitability, and make informed decisions about pricing, production volume, and cost management.

Components of Break-Even Analysis

- Fixed Costs: These are expenses that remain the same even if the level of production or sales changes. Examples include rent, salaries, and insurance premiums.

- Variable Costs: These are costs that vary directly with the level of production or sales. Examples include raw materials, direct labor, and marketing expenses.

- Selling Price: This is the price at which a product is sold.

- Contribution Margin: This is the amount of money available to cover fixed costs after variable costs are deducted from the selling price.

Performing Break-Even Analysis in Excel

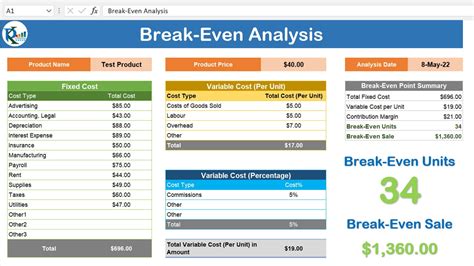

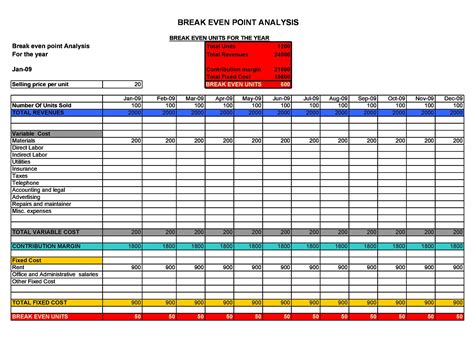

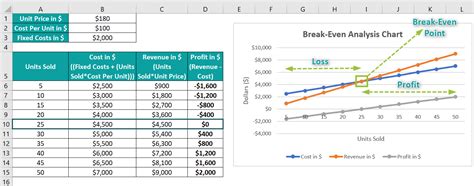

Excel offers a powerful and flexible platform for performing break-even analysis. Here's a step-by-step guide to creating a basic break-even analysis template in Excel:

-

Set Up the Template: Open a new Excel spreadsheet and set up a table with the following columns: Sales Revenue, Variable Costs, Fixed Costs, Total Costs, Profit/Loss, and Break-Even Point (in units and dollars).

-

Enter Formulas: Use formulas to calculate the total costs, profit/loss, and break-even point. For example, the formula for total costs might be

=Variable Costs + Fixed Costs. -

Create a Chart: Use Excel's charting tools to visualize your break-even analysis. A line chart can be particularly useful for showing the relationship between sales revenue and total costs.

-

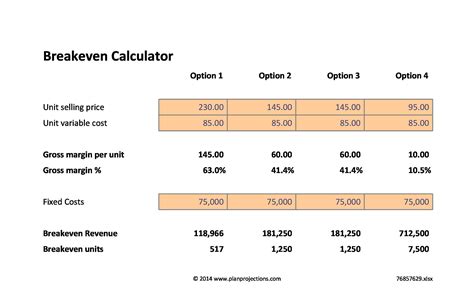

Sensitivity Analysis: One of the advantages of using Excel for break-even analysis is the ease with which you can perform sensitivity analysis. This involves adjusting variables like selling price, fixed costs, and variable costs to see how they impact the break-even point.

Break-Even Analysis Template

For those looking to dive straight into performing a break-even analysis without building a template from scratch, there are numerous pre-designed Excel templates available online. These templates can save time and offer a structured approach to conducting your analysis.

When selecting a template, ensure it aligns with your specific needs and can accommodate the complexities of your business or project. Key features to look for include:

- Flexibility: The ability to easily adjust inputs such as selling price, fixed and variable costs.

- Visualization Tools: Charts or graphs that help visualize the break-even point and the relationship between costs and revenue.

- Sensitivity Analysis Tools: Features that allow for quick adjustments of variables to test different scenarios.

Benefits of Using a Template

- Saves Time: Pre-designed templates save you the time and effort of setting up a break-even analysis model from scratch.

- Enhances Accuracy: By using established formulas and structures, templates reduce the risk of errors in your analysis.

- Promotes Consistency: Templates ensure consistency in your analysis and reporting, making it easier to track changes over time or compare different projects.

Conclusion and Future Steps

Break-even analysis is a fundamental tool for businesses, offering insights into the financial dynamics of a project or product line. By leveraging Excel for this analysis, businesses can gain a deeper understanding of their financials and make more informed decisions. Whether by building your own template or utilizing a pre-designed one, the key is to find a method that works for you and to continually refine your approach as your business grows.

For those who have made it through the article, we invite you to share your experiences with break-even analysis and Excel templates in the comments section below. Your insights can be invaluable to others navigating similar challenges.

Break Even Analysis Image Gallery