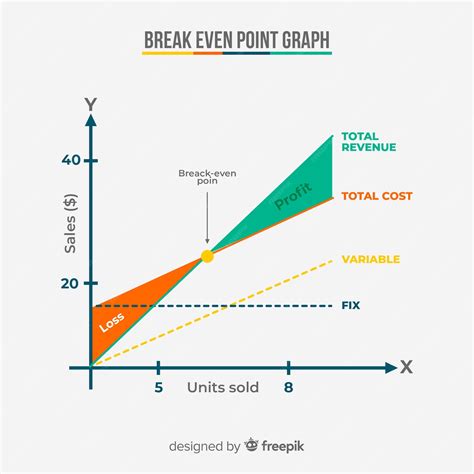

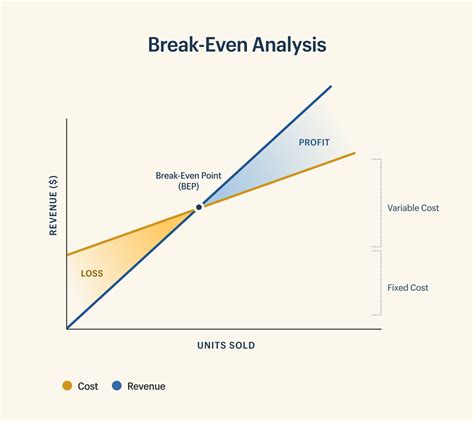

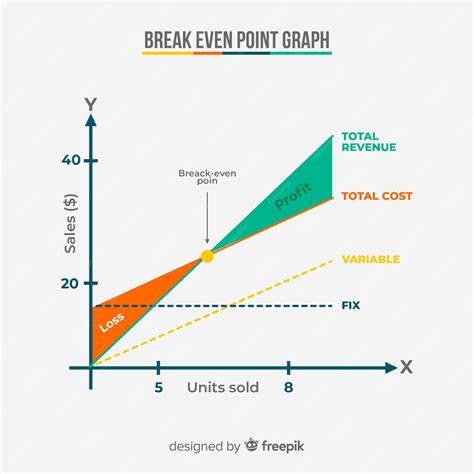

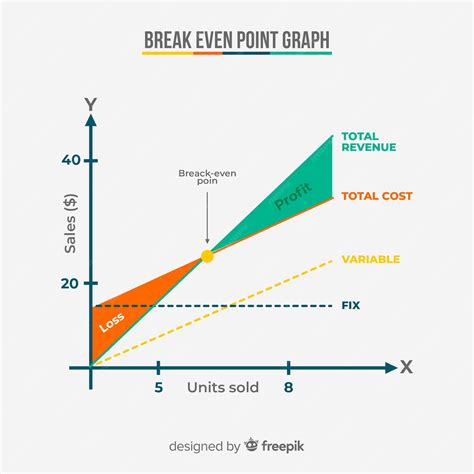

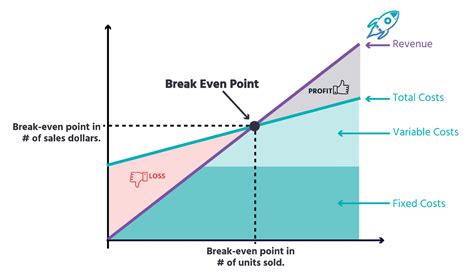

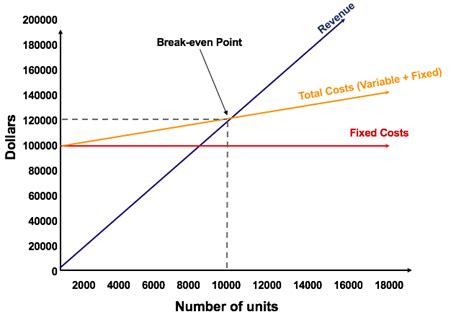

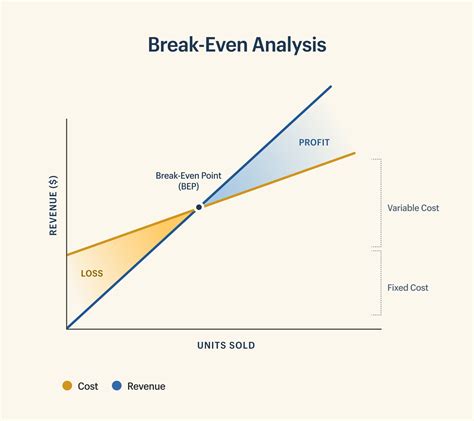

Breaking even is a crucial milestone for any business, as it marks the point where the company's revenue equals its total fixed and variable costs. Conducting a break-even point analysis in Excel can help entrepreneurs and managers determine the minimum sales required to cover their costs and start generating profits. In this article, we'll walk you through the 5 easy steps to break even point analysis in Excel.

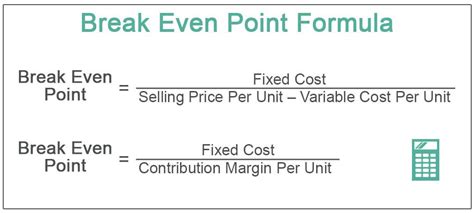

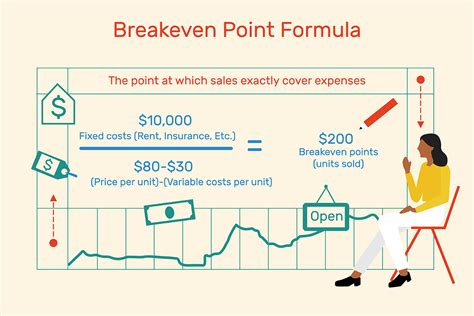

Understanding the Break-Even Point Formula

Before we dive into the steps, let's quickly review the break-even point formula:

Break-Even Point (BEP) = Fixed Costs / (Selling Price - Variable Costs)

This formula calculates the point at which the business's revenue equals its total costs.

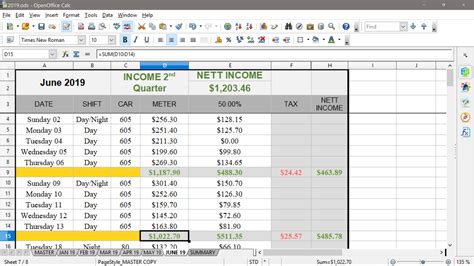

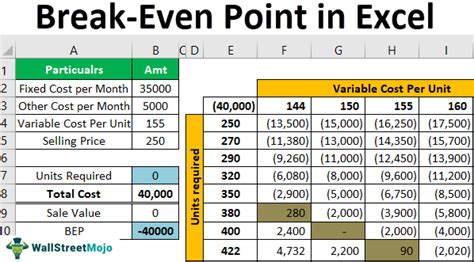

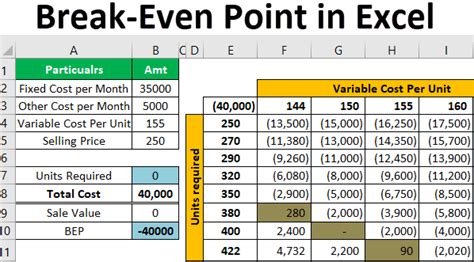

Step 1: Gather Data and Set Up Your Excel Sheet

To begin, gather the necessary data, including:

- Fixed costs (salaries, rent, equipment, etc.)

- Variable costs (raw materials, labor, etc.)

- Selling price per unit

- Expected sales volume

Create an Excel sheet and set up the following columns:

| Column A | Column B | Column C | Column D |

|---|---|---|---|

| Fixed Costs | Variable Costs | Selling Price | Sales Volume |

Enter the relevant data into each column.

Step 1.1: Calculate Total Costs

In a new column (Column E), calculate the total costs by adding the fixed costs and variable costs:

Total Costs = Fixed Costs + Variable Costs

Step 2: Calculate the Contribution Margin

The contribution margin represents the amount of money available to cover fixed costs and generate profits. Calculate the contribution margin as follows:

Contribution Margin = Selling Price - Variable Costs

Enter this formula in a new column (Column F).

Step 2.1: Calculate the Contribution Margin Ratio

To simplify the calculations, calculate the contribution margin ratio:

Contribution Margin Ratio = Contribution Margin / Selling Price

Enter this formula in a new column (Column G).

Step 3: Calculate the Break-Even Point

Using the break-even point formula, calculate the break-even point in units:

Break-Even Point (BEP) = Fixed Costs / Contribution Margin

Enter this formula in a new cell.

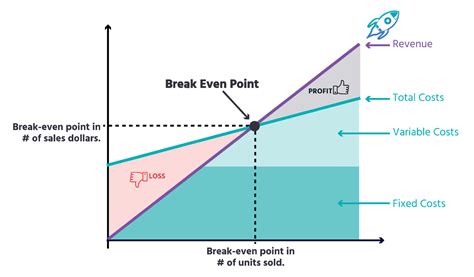

Step 4: Calculate the Break-Even Point in Sales Revenue

To express the break-even point in sales revenue, multiply the break-even point in units by the selling price:

Break-Even Point (BEP) in Sales Revenue = BEP x Selling Price

Enter this formula in a new cell.

Step 5: Analyze and Refine Your Results

Review your results and refine your analysis by:

- Examining the sensitivity of the break-even point to changes in fixed costs, variable costs, and selling price

- Considering the impact of different sales volumes and pricing strategies on the break-even point

- Using the break-even point analysis to inform business decisions and optimize operations

Conclusion: Putting It All Together

By following these 5 easy steps, you can perform a break-even point analysis in Excel and gain valuable insights into your business's financial performance. Remember to refine your analysis and use the results to inform business decisions.

Break-Even Point Analysis Gallery

We hope this article has helped you understand the break-even point analysis in Excel. If you have any questions or need further clarification, please don't hesitate to ask. Share your thoughts and experiences with break-even point analysis in the comments section below.