Intro

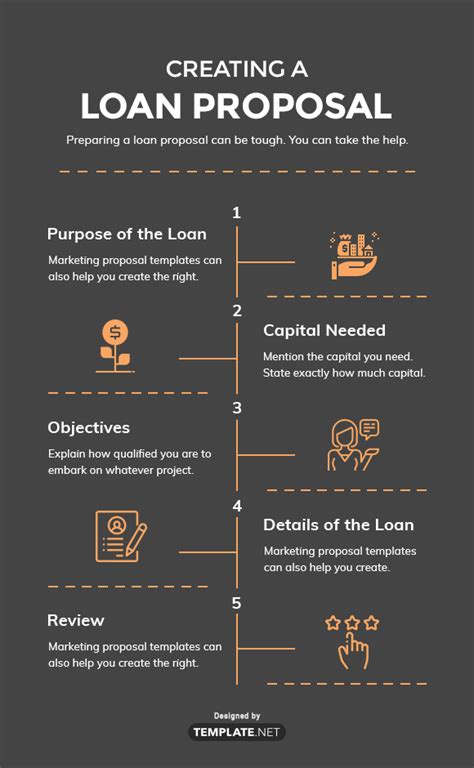

Get approved for the loan you need with a compelling business loan proposal template. Learn the 7 essential tips to craft a persuasive proposal, including executive summary, financial projections, and marketing strategy. Increase your chances of securing funding with a well-structured template, boosting your business growth and success.

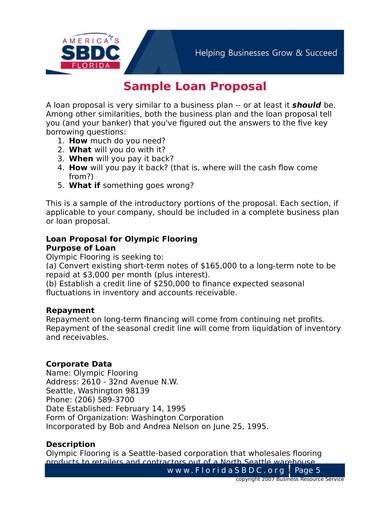

A well-crafted business loan proposal is crucial for securing the necessary funds to take your business to the next level. It's a comprehensive document that outlines your business plan, financial projections, and loan requirements, helping lenders understand the viability of your venture. In this article, we will delve into the essential elements of a business loan proposal template, providing you with the necessary tools to increase your chances of securing the loan you need.

Creating a compelling business loan proposal template requires careful consideration of several key factors. From outlining your business strategy to providing detailed financial projections, each element plays a crucial role in showcasing your venture's potential for growth and profitability. By following these essential tips, you'll be well on your way to crafting a proposal that will capture the attention of potential lenders and help you secure the funding you need.

Understanding the Importance of a Business Loan Proposal Template

A business loan proposal template serves as a roadmap for your business, outlining your goals, objectives, and financial projections. It provides lenders with a comprehensive understanding of your venture, enabling them to assess the risk and potential return on investment. By creating a detailed and well-structured proposal, you can increase your chances of securing the funding you need to drive growth and expansion.

Key Elements of a Business Loan Proposal Template

A typical business loan proposal template includes the following essential elements:

- Executive summary: A brief overview of your business, including your mission statement, products or services, target market, and financial goals.

- Business description: A detailed description of your business, including your company history, management structure, and products or services.

- Market analysis: An analysis of your target market, including industry trends, competitor analysis, and market size.

- Financial projections: Detailed financial projections, including income statements, balance sheets, and cash flow statements.

- Loan requirements: A clear outline of your loan requirements, including the amount of funding needed, loan term, and repayment plan.

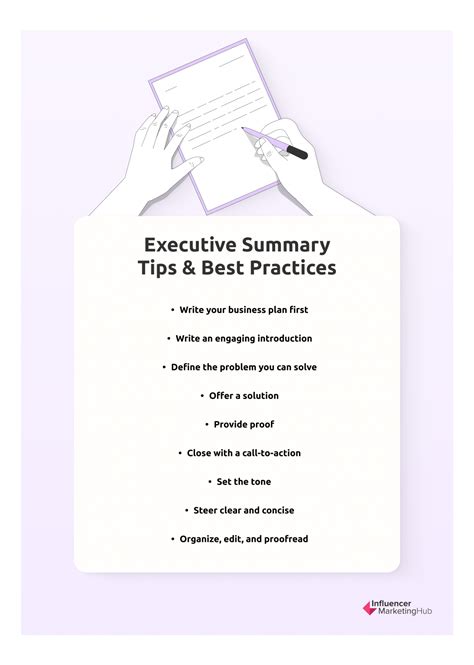

Tip #1: Create a Clear and Concise Executive Summary

Your executive summary should provide a brief overview of your business, highlighting your unique value proposition, target market, and financial goals. This section should be clear, concise, and free of jargon, providing lenders with a quick understanding of your venture's potential.

Best Practices for Writing an Executive Summary

- Keep it brief: Aim for a summary that is no more than two pages in length.

- Focus on key information: Highlight your unique value proposition, target market, and financial goals.

- Use clear language: Avoid using jargon or technical terms that may confuse lenders.

Tip #2: Provide a Detailed Business Description

Your business description should provide a comprehensive overview of your venture, including your company history, management structure, and products or services. This section should help lenders understand your business model, competitive advantage, and growth potential.

Key Elements of a Business Description

- Company history: A brief overview of your company's history, including key milestones and achievements.

- Management structure: A description of your management team, including their experience and qualifications.

- Products or services: A detailed description of your products or services, including their features and benefits.

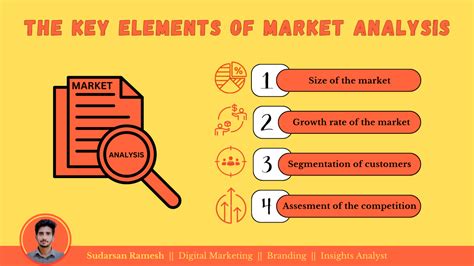

Tip #3: Conduct a Thorough Market Analysis

Your market analysis should provide a comprehensive overview of your target market, including industry trends, competitor analysis, and market size. This section should help lenders understand your business's potential for growth and profitability.

Key Elements of a Market Analysis

- Industry trends: An analysis of current industry trends, including growth rates and emerging opportunities.

- Competitor analysis: A description of your competitors, including their strengths and weaknesses.

- Market size: An estimate of the size of your target market, including the number of potential customers.

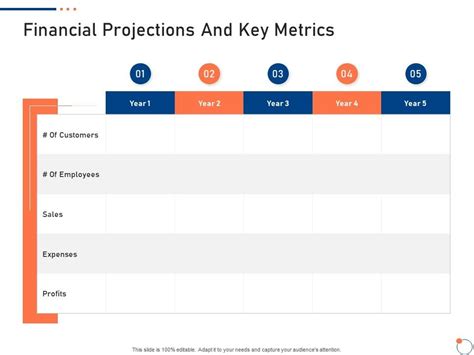

Tip #4: Create Realistic Financial Projections

Your financial projections should provide a comprehensive overview of your business's financial performance, including income statements, balance sheets, and cash flow statements. This section should help lenders understand your business's potential for growth and profitability.

Key Elements of Financial Projections

- Income statement: A detailed description of your business's income, including revenue, expenses, and profits.

- Balance sheet: A description of your business's assets, liabilities, and equity.

- Cash flow statement: A description of your business's cash inflows and outflows.

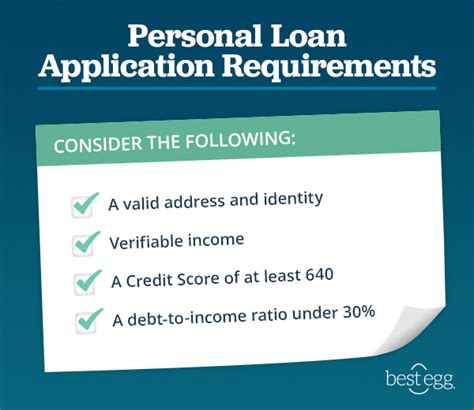

Tip #5: Clearly Outline Your Loan Requirements

Your loan requirements should provide a clear outline of the funding you need, including the amount, loan term, and repayment plan. This section should help lenders understand your business's funding needs and potential for repayment.

Key Elements of Loan Requirements

- Loan amount: A clear description of the amount of funding you need.

- Loan term: A description of the loan term, including the number of years and repayment schedule.

- Repayment plan: A description of your repayment plan, including the amount and frequency of payments.

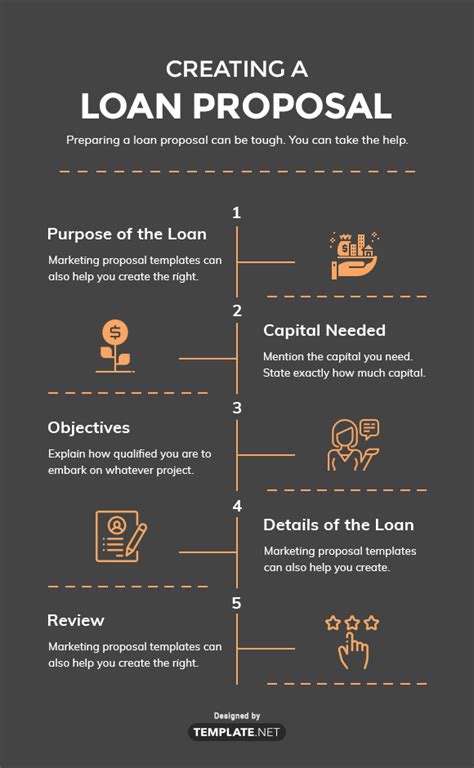

Tip #6: Use Visual Aids to Enhance Your Proposal

Using visual aids such as charts, graphs, and images can help to enhance your proposal and make it more engaging for lenders. This section should provide a clear and concise overview of your business's financial performance and growth potential.

Best Practices for Using Visual Aids

- Use clear and concise labels: Avoid using jargon or technical terms that may confuse lenders.

- Use color effectively: Use color to highlight key information and make your proposal more engaging.

- Keep it simple: Avoid using complex charts or graphs that may confuse lenders.

Tip #7: Edit and Proofread Your Proposal

Finally, it's essential to edit and proofread your proposal carefully to ensure that it is free of errors and flows smoothly. This section should provide a clear and concise overview of your business's potential for growth and profitability.

Best Practices for Editing and Proofreading

- Use a clear and concise writing style: Avoid using jargon or technical terms that may confuse lenders.

- Use proper grammar and spelling: Ensure that your proposal is free of errors and flows smoothly.

- Get feedback from others: Ask colleagues or mentors to review your proposal and provide feedback.

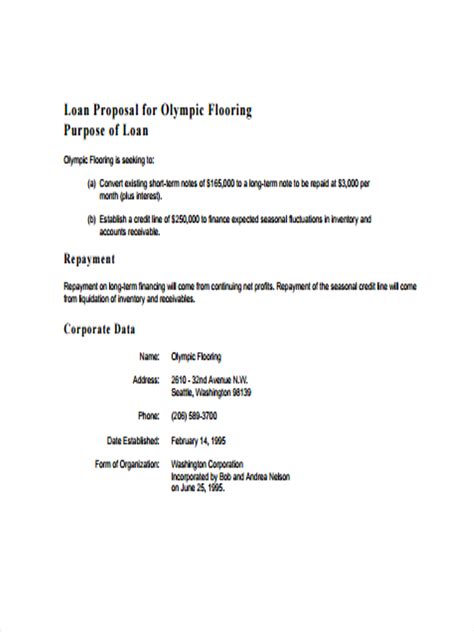

Business Loan Proposal Template Image Gallery

By following these essential tips, you can create a comprehensive business loan proposal template that showcases your venture's potential for growth and profitability. Remember to keep your proposal clear, concise, and free of errors, and to use visual aids to enhance your proposal and make it more engaging for lenders. With a well-crafted proposal, you'll be well on your way to securing the funding you need to take your business to the next level.