Calculating MACRS (Modified Accelerated Cost Recovery System) depreciation in Excel can be a complex task, but with the right approach, it can be made easy. MACRS is a method of depreciation used for tax purposes in the United States, and it allows businesses to depreciate assets more quickly than other methods. In this article, we will walk you through the steps to calculate MACRS depreciation in Excel.

Understanding MACRS Depreciation

Before we dive into the calculation, it's essential to understand the basics of MACRS depreciation. MACRS is a method of depreciation that allows businesses to depreciate assets over a specific period, known as the recovery period. The recovery period varies depending on the type of asset, and it can range from 3 to 39 years.

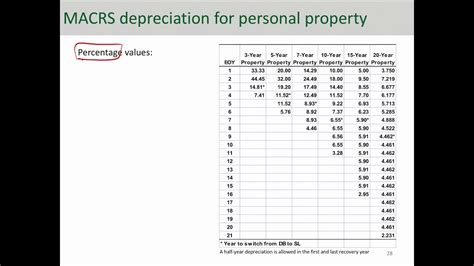

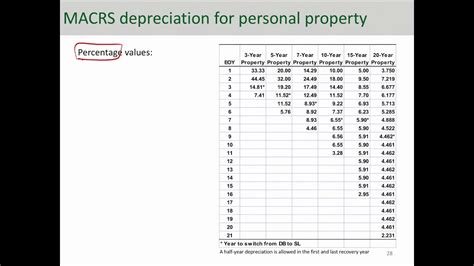

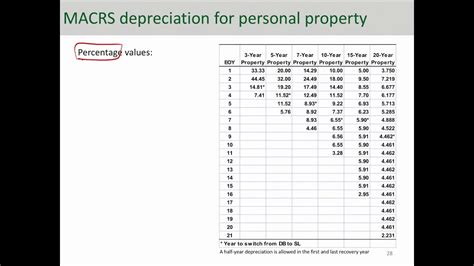

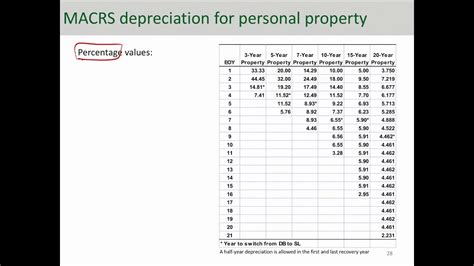

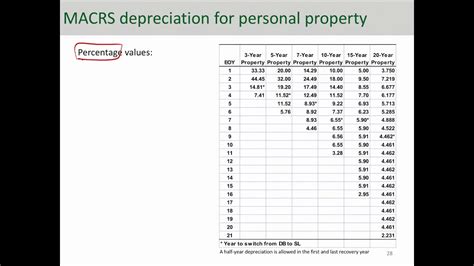

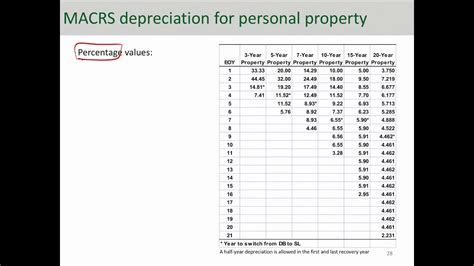

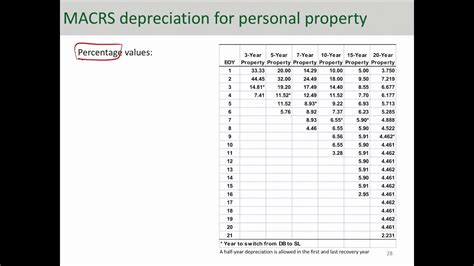

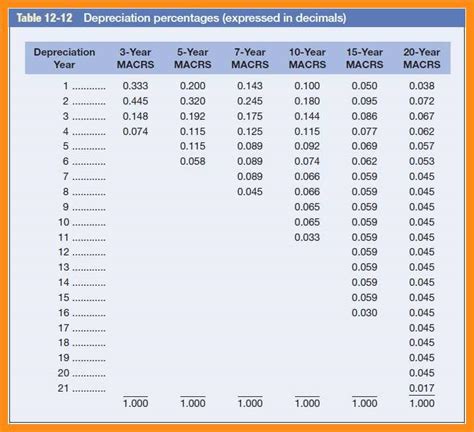

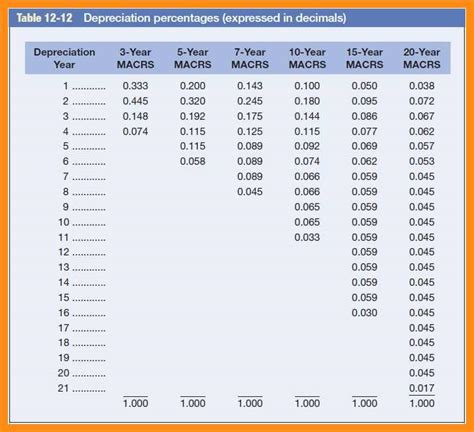

MACRS Depreciation Rates

MACRS depreciation rates are based on the asset's recovery period and are calculated as a percentage of the asset's cost. The rates are as follows:

- 3-year property: 33.33%, 44.45%, 14.81%, and 7.41%

- 5-year property: 20%, 32%, 19.2%, 11.52%, and 5.76%

- 7-year property: 14.29%, 24.49%, 17.49%, 12.49%, and 8.93%

- 10-year property: 10%, 18%, 14.4%, 11.52%, and 9.22%

- 15-year property: 5%, 9.5%, 8.75%, 7.37%, and 6.55%

- 20-year property: 3.75%, 7.5%, 6.93%, 6.23%, and 5.71%

Calculating MACRS Depreciation in Excel

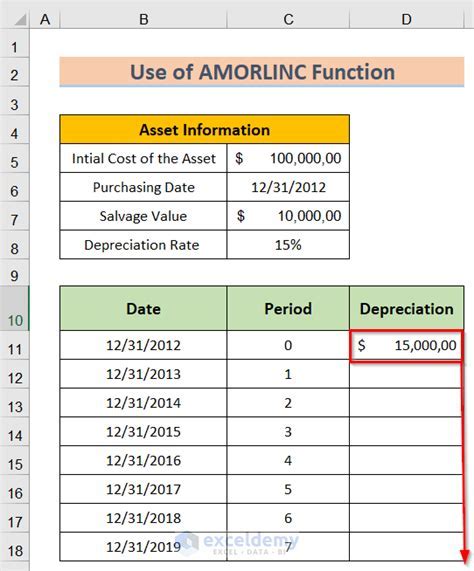

To calculate MACRS depreciation in Excel, you can use the following steps:

- Create a table with the following columns:

- Asset Cost

- Recovery Period

- Depreciation Rate

- Depreciation Amount

- Accumulated Depreciation

- Enter the asset cost and recovery period in the respective columns.

- Calculate the depreciation rate based on the recovery period and MACRS rates.

- Calculate the depreciation amount by multiplying the asset cost by the depreciation rate.

- Calculate the accumulated depreciation by adding the depreciation amount to the previous year's accumulated depreciation.

Using Excel Formulas

To make the calculation easier, you can use Excel formulas. Here's an example:

- Depreciation Rate:

=VLOOKUP(B2,macrs_rates,2,FALSE) - Depreciation Amount:

=A2*C2 - Accumulated Depreciation:

=D2+E2

Where:

A2is the asset costB2is the recovery periodC2is the depreciation rateD2is the depreciation amountE2is the accumulated depreciationmacrs_ratesis a table with the MACRS rates

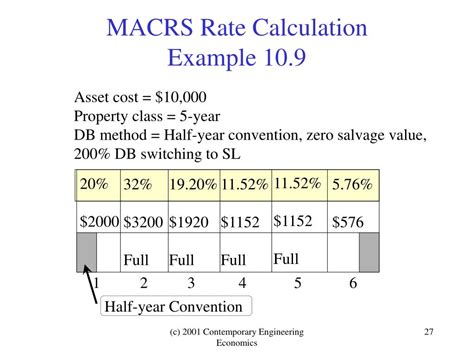

Example MACRS Depreciation Calculation

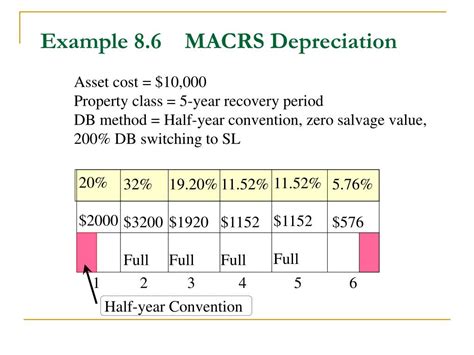

Let's say we have an asset with a cost of $10,000 and a recovery period of 5 years. The MACRS rates for a 5-year property are 20%, 32%, 19.2%, 11.52%, and 5.76%.

Using the Excel formulas above, we can calculate the depreciation amount and accumulated depreciation as follows:

| Year | Depreciation Rate | Depreciation Amount | Accumulated Depreciation |

|---|---|---|---|

| 1 | 20% | $2,000 | $2,000 |

| 2 | 32% | $3,200 | $5,200 |

| 3 | 19.2% | $1,920 | $7,120 |

| 4 | 11.52% | $1,152 | $8,272 |

| 5 | 5.76% | $576 | $8,848 |

Gallery of MACRS Depreciation Examples

MACRS Depreciation Examples

Conclusion

Calculating MACRS depreciation in Excel can be a complex task, but with the right approach, it can be made easy. By using Excel formulas and understanding the MACRS rates, you can calculate the depreciation amount and accumulated depreciation for your assets. We hope this article has helped you understand how to calculate MACRS depreciation in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.