Intro

Discover how to calculate payback in Excel with ease. Learn 5 simple methods to determine the return on investment for your projects, including the payback period, net present value, and internal rate of return. Master Excel formulas and functions, such as XNPV, IRR, and PMT, to make informed financial decisions.

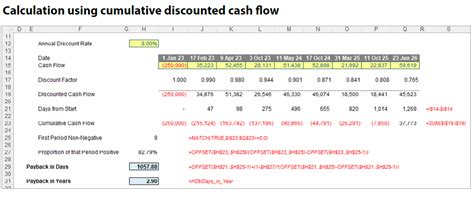

Calculating payback in Excel is a crucial task for investors, businesses, and individuals looking to determine the return on investment (ROI) of a project or investment. Payback is the length of time it takes for an investment to generate cash flows sufficient to recover its initial cost. In this article, we will explore five ways to calculate payback in Excel, including formulas, examples, and best practices.

Why is Payback Important?

Payback is a widely used metric to evaluate the feasibility of a project or investment. It helps investors and businesses determine whether an investment will generate sufficient returns to recover its initial cost. A shorter payback period indicates a more attractive investment, as it means that the investment will generate returns faster.

Method 1: Using the Payback Formula

The payback formula is a simple and straightforward way to calculate payback in Excel. The formula is:

Payback = Initial Investment / Annual Cash Flow

For example, suppose you invest $10,000 in a project that generates $2,000 in annual cash flows. To calculate the payback, you can use the formula:

Payback = $10,000 / $2,000 = 5 years

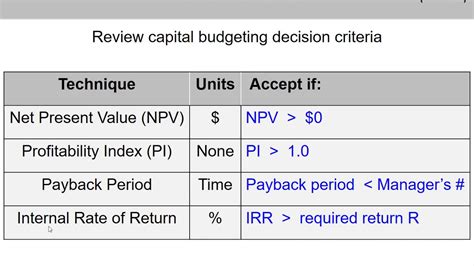

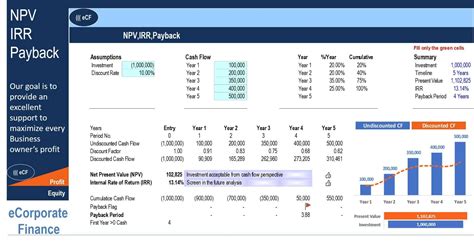

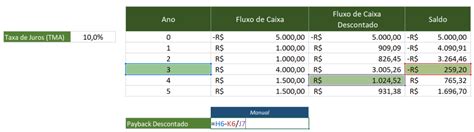

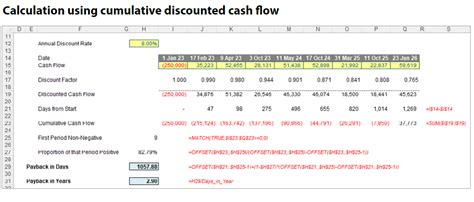

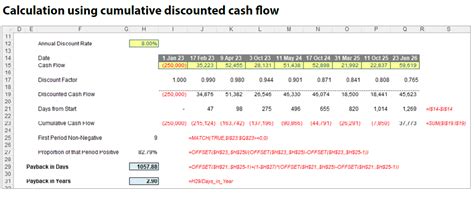

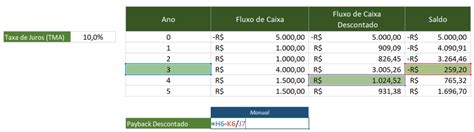

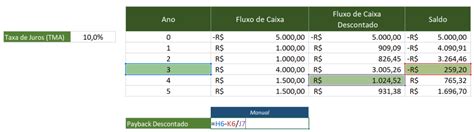

Method 2: Using the NPV Function

The NPV (Net Present Value) function in Excel can be used to calculate payback. The NPV function calculates the present value of a series of cash flows, and by setting the NPV to zero, we can calculate the payback period.

The formula is:

NPV(rate, cash flows) = 0

Where:

- Rate is the discount rate

- Cash flows are the annual cash flows

For example, suppose you invest $10,000 in a project that generates $2,000 in annual cash flows for 5 years, with a discount rate of 10%. To calculate the payback, you can use the NPV function:

NPV(10%, $2,000, $2,000, $2,000, $2,000, $2,000) = $10,000

The NPV function will return the payback period, which in this case is approximately 4.77 years.

Method 3: Using the IRR Function

The IRR (Internal Rate of Return) function in Excel can also be used to calculate payback. The IRR function calculates the internal rate of return of a series of cash flows, and by setting the IRR to zero, we can calculate the payback period.

The formula is:

IRR(cash flows, guess) = 0

Where:

- Cash flows are the annual cash flows

- Guess is an initial estimate of the IRR

For example, suppose you invest $10,000 in a project that generates $2,000 in annual cash flows for 5 years. To calculate the payback, you can use the IRR function:

IRR($2,000, $2,000, $2,000, $2,000, $2,000, 0.1) = 19.4%

The IRR function will return the internal rate of return, which in this case is approximately 19.4%. To calculate the payback period, we can use the formula:

Payback = Initial Investment / (Annual Cash Flow x IRR)

Payback = $10,000 / ($2,000 x 19.4%) ≈ 4.77 years

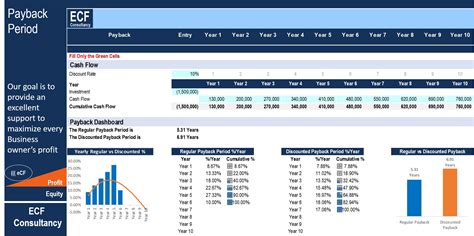

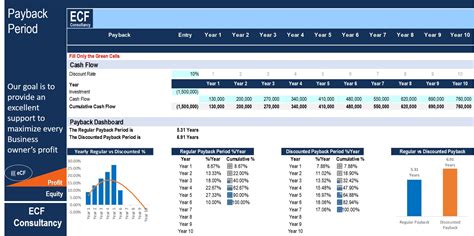

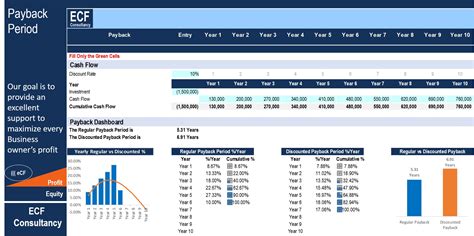

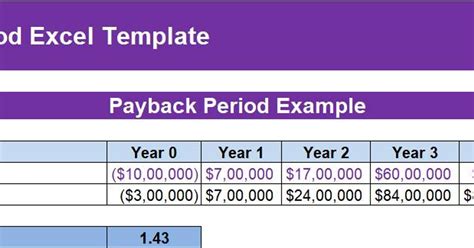

Method 4: Using a Payback Template

A payback template can be used to calculate payback in Excel. A payback template is a pre-built spreadsheet that calculates the payback period based on the input values.

For example, suppose you invest $10,000 in a project that generates $2,000 in annual cash flows for 5 years. To calculate the payback, you can use a payback template:

| Year | Cash Flow |

|---|---|

| 1 | $2,000 |

| 2 | $2,000 |

| 3 | $2,000 |

| 4 | $2,000 |

| 5 | $2,000 |

The payback template will calculate the payback period based on the input values.

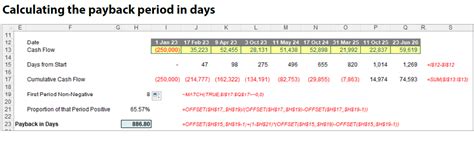

Method 5: Using a Payback Calculator

A payback calculator is a tool that calculates the payback period based on the input values. A payback calculator can be used to calculate payback in Excel.

For example, suppose you invest $10,000 in a project that generates $2,000 in annual cash flows for 5 years. To calculate the payback, you can use a payback calculator:

Payback Calculator:

| Initial Investment | Annual Cash Flow | Payback Period |

|---|---|---|

| $10,000 | $2,000 | 5 years |

The payback calculator will calculate the payback period based on the input values.

Gallery of Payback Excel Formulas

Payback Excel Formulas Gallery

We hope this article has provided you with a comprehensive understanding of how to calculate payback in Excel using different methods. Whether you use the payback formula, NPV function, IRR function, payback template, or payback calculator, calculating payback is an essential task for investors and businesses looking to evaluate the feasibility of a project or investment.

What is your favorite method for calculating payback in Excel? Share your thoughts and experiences in the comments section below.