Intro

Creating a capital lease amortization schedule is a crucial step in accounting for leased assets. A capital lease is a type of lease that is treated as a purchase for accounting purposes. In this article, we will guide you through the process of creating a capital lease amortization schedule in 5 easy steps.

Why is a Capital Lease Amortization Schedule Important?

A capital lease amortization schedule is essential for accounting and financial reporting purposes. It helps to allocate the cost of the leased asset over its useful life, providing a clear picture of the asset's value and the lessee's obligations. By creating an amortization schedule, businesses can accurately record the lease expense, interest expense, and asset value, ensuring compliance with accounting standards.

What is a Capital Lease?

A capital lease is a type of lease that meets certain criteria, making it eligible for capitalization. The lessee is considered the owner of the asset for accounting purposes, and the lease is recorded as an asset and a liability on the balance sheet. The criteria for a capital lease include:

- The lease term is equal to or greater than 75% of the asset's useful life.

- The present value of the lease payments is equal to or greater than 90% of the asset's fair value.

- The lessee has a bargain purchase option.

- The lease is cancellable only upon payment of a penalty.

Step 1: Determine the Lease Term and Payment Schedule

The first step in creating a capital lease amortization schedule is to determine the lease term and payment schedule. This includes identifying the commencement date, lease term, and payment frequency. Review the lease agreement to determine the following:

- Lease commencement date

- Lease term (in months or years)

- Lease payment frequency (e.g., monthly, quarterly, annually)

- Lease payment amount

Step 2: Calculate the Present Value of the Lease Payments

The next step is to calculate the present value of the lease payments. This is done using the lease payment amount, payment frequency, and the lessee's incremental borrowing rate (IBR). The IBR is the rate at which the lessee could borrow funds to purchase the asset.

- Calculate the present value of the lease payments using a present value formula or calculator.

- Use the lease payment amount, payment frequency, and IBR to determine the present value.

Step 3: Determine the Asset's Useful Life and Residual Value

The third step is to determine the asset's useful life and residual value. The useful life is the period over which the asset is expected to generate economic benefits. The residual value is the asset's expected value at the end of the lease term.

- Determine the asset's useful life based on the manufacturer's estimate, industry norms, or the lessee's experience.

- Estimate the residual value based on the asset's expected market value at the end of the lease term.

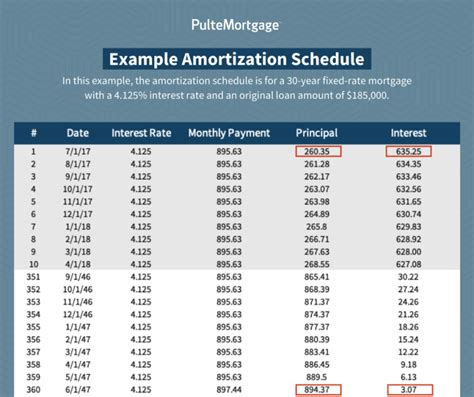

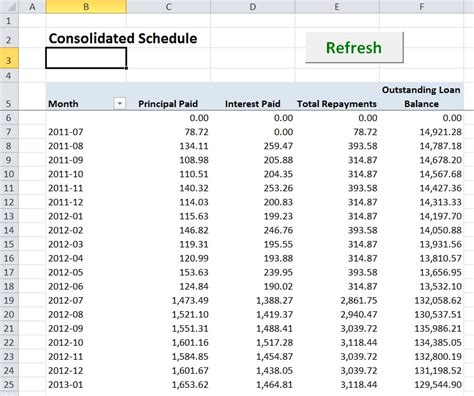

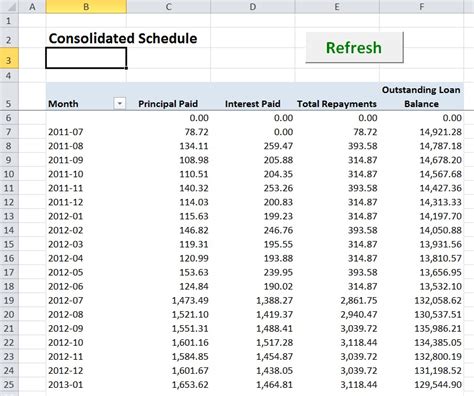

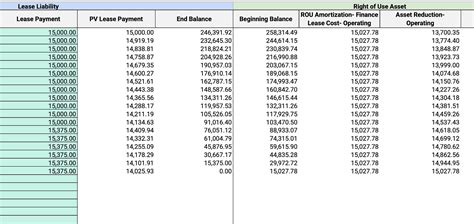

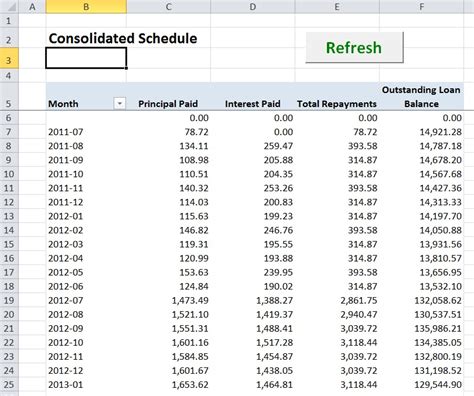

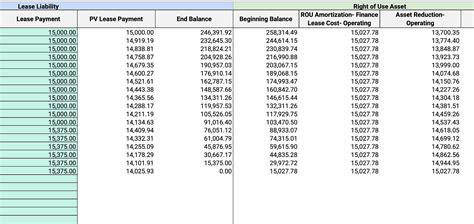

Step 4: Create the Amortization Schedule

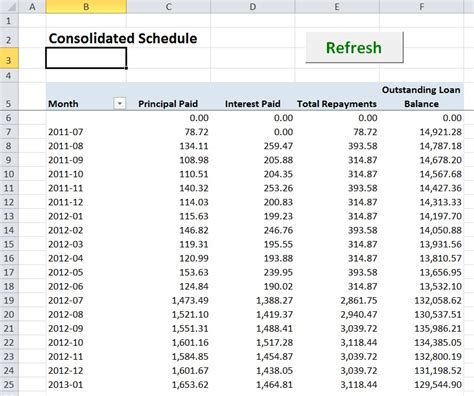

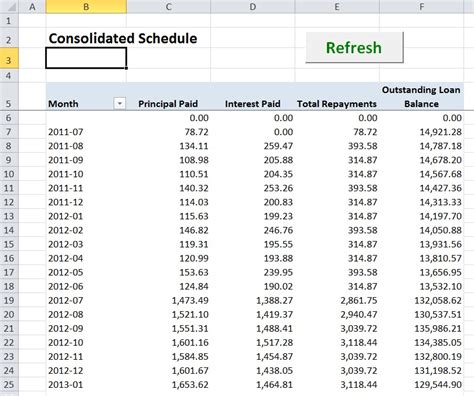

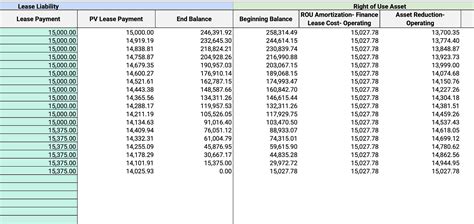

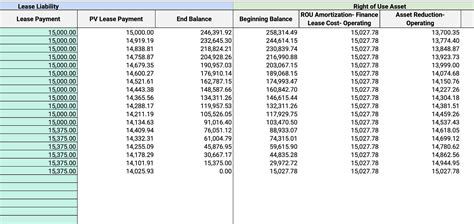

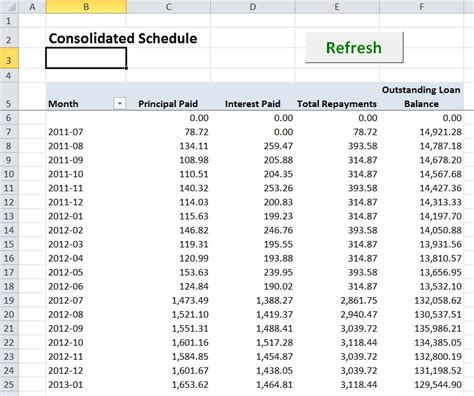

The fourth step is to create the amortization schedule. This involves calculating the annual amortization expense, interest expense, and asset value.

- Use a spreadsheet or calculator to create an amortization schedule.

- Calculate the annual amortization expense using the asset's cost, useful life, and residual value.

- Calculate the interest expense using the lease payment amount, payment frequency, and IBR.

Step 5: Review and Update the Amortization Schedule

The final step is to review and update the amortization schedule periodically. This ensures that the schedule remains accurate and compliant with accounting standards.

- Review the amortization schedule annually or as required by accounting standards.

- Update the schedule to reflect changes in the lease terms, asset value, or residual value.

Gallery of Capital Lease Amortization Schedules

Capital Lease Amortization Schedule Examples

By following these 5 easy steps, you can create a capital lease amortization schedule that accurately reflects the lease terms and asset value. Remember to review and update the schedule periodically to ensure compliance with accounting standards.

Share Your Thoughts

We hope this article has provided you with a comprehensive guide to creating a capital lease amortization schedule. If you have any questions or comments, please share them with us below.