Intro

Optimize your retail operations with a free cash drawer count sheet. Learn how to accurately track daily sales, reconcile cash discrepancies, and streamline your stores cash handling process. Get instant access to our customizable cash count sheet template and improve your financial management, cash flow, and inventory control.

Effective cash management is crucial for any business, especially those that handle a high volume of cash transactions. One of the most important tools for ensuring accuracy and efficiency in cash handling is a cash drawer count sheet. A well-designed cash drawer count sheet can help business owners and managers track their cash flow, identify discrepancies, and maintain transparency in their financial transactions.

In this article, we will explore the importance of using a cash drawer count sheet, its benefits, and provide a free template that you can download and use in your business. We will also discuss how to create a cash drawer count sheet, its components, and best practices for using it effectively.

The Importance of Cash Drawer Count Sheet

A cash drawer count sheet is a vital tool for businesses that handle cash transactions. It helps to ensure that the cash in the drawer is accurately counted and recorded, reducing the risk of errors, theft, and discrepancies. By using a cash drawer count sheet, businesses can:

- Track their cash flow and identify any discrepancies or shortages

- Maintain transparency in their financial transactions

- Reduce the risk of errors and theft

- Improve their cash handling procedures

Benefits of Using a Cash Drawer Count Sheet

Using a cash drawer count sheet can bring numerous benefits to a business, including:

- Improved accuracy: A cash drawer count sheet helps to ensure that the cash in the drawer is accurately counted and recorded, reducing the risk of errors.

- Increased transparency: By using a cash drawer count sheet, businesses can maintain transparency in their financial transactions, reducing the risk of theft and discrepancies.

- Reduced risk: A cash drawer count sheet can help to reduce the risk of errors, theft, and discrepancies, providing a clear record of all cash transactions.

- Improved cash handling procedures: By using a cash drawer count sheet, businesses can improve their cash handling procedures, reducing the risk of errors and theft.

Creating a Cash Drawer Count Sheet

Creating a cash drawer count sheet is a simple process that can be done using a spreadsheet or a word processing software. Here are the components of a cash drawer count sheet:

- Date and time: The date and time of the cash count

- Cashier's name: The name of the cashier responsible for the cash count

- Cash in drawer: The amount of cash in the drawer at the start of the shift

- Cash received: The amount of cash received during the shift

- Cash paid out: The amount of cash paid out during the shift

- Cash in drawer (end of shift): The amount of cash in the drawer at the end of the shift

- Discrepancies: Any discrepancies or shortages identified during the cash count

Components of a Cash Drawer Count Sheet

A cash drawer count sheet typically includes the following components:

- Header: The header section includes the business name, date, and time of the cash count.

- Cash in drawer: This section includes the amount of cash in the drawer at the start of the shift.

- Cash received: This section includes the amount of cash received during the shift.

- Cash paid out: This section includes the amount of cash paid out during the shift.

- Cash in drawer (end of shift): This section includes the amount of cash in the drawer at the end of the shift.

- Discrepancies: This section includes any discrepancies or shortages identified during the cash count.

Best Practices for Using a Cash Drawer Count Sheet

To get the most out of a cash drawer count sheet, businesses should follow these best practices:

- Use a standardized template: Use a standardized template to ensure consistency and accuracy in the cash count.

- Count cash regularly: Count cash regularly to identify any discrepancies or shortages.

- Verify cash counts: Verify cash counts to ensure accuracy and transparency.

- Investigate discrepancies: Investigate any discrepancies or shortages identified during the cash count.

Free Cash Drawer Count Sheet Template

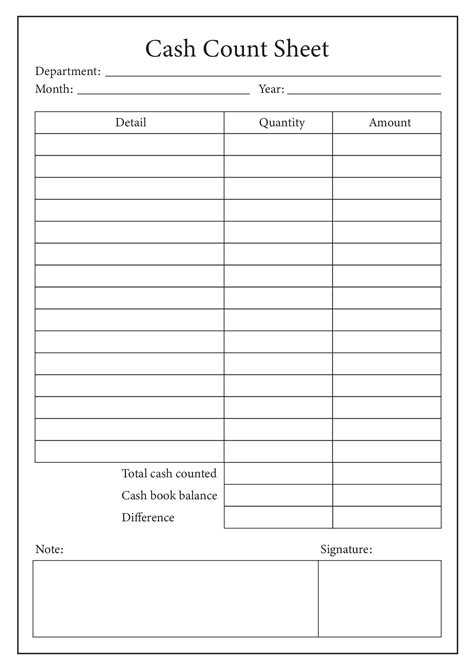

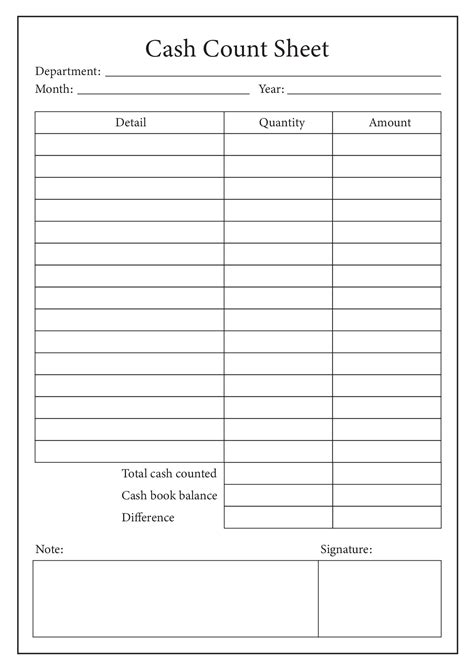

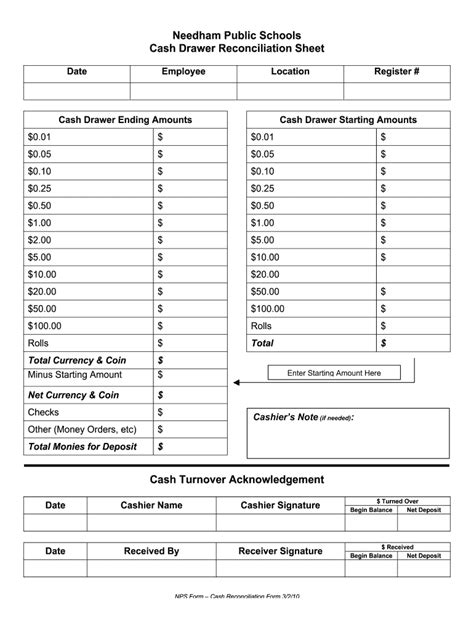

Here is a free cash drawer count sheet template that you can download and use in your business:

You can download the template by clicking on the image above.

Gallery of Cash Drawer Count Sheet Templates

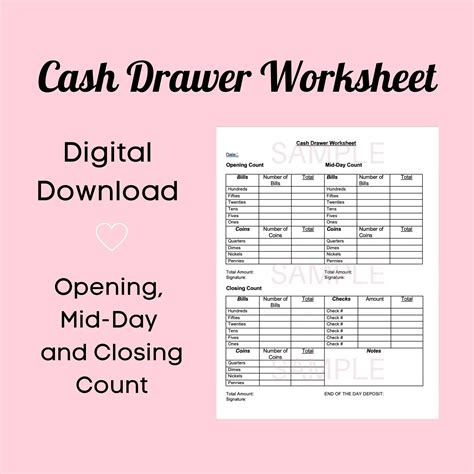

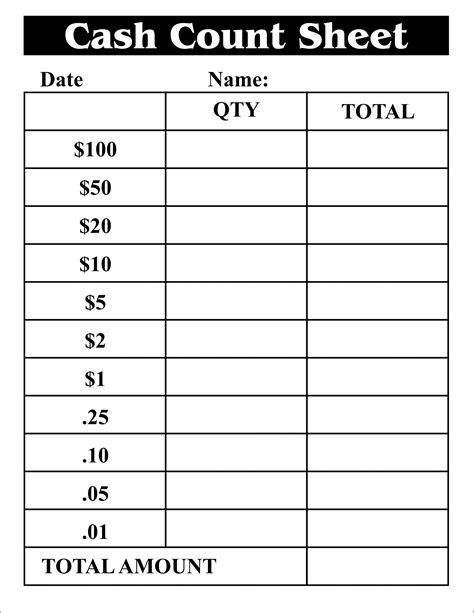

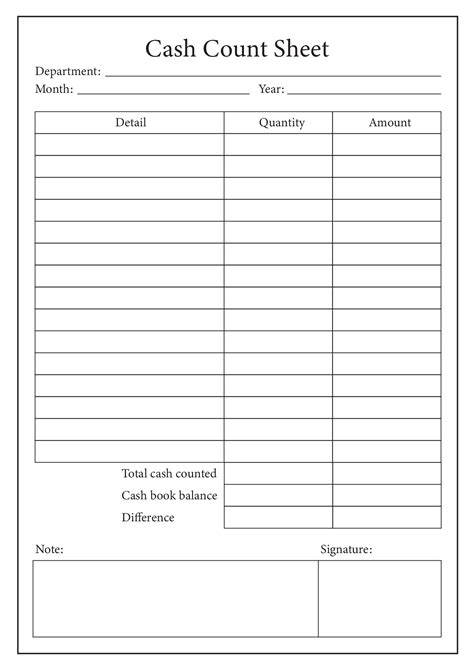

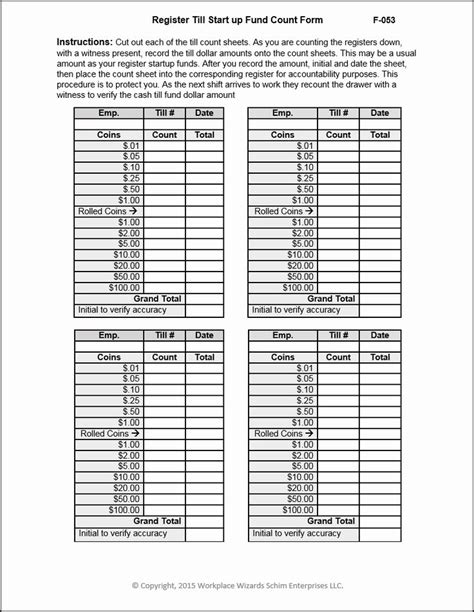

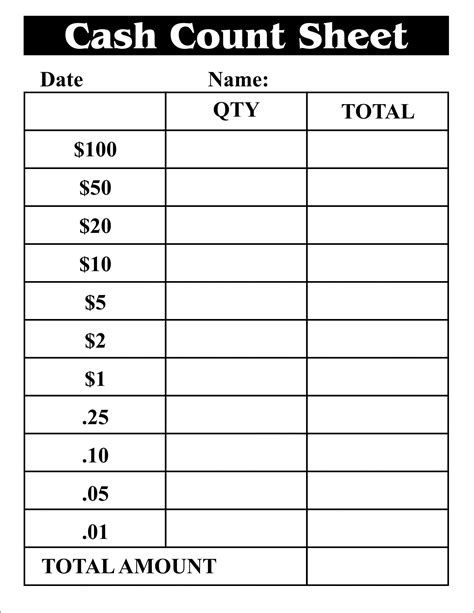

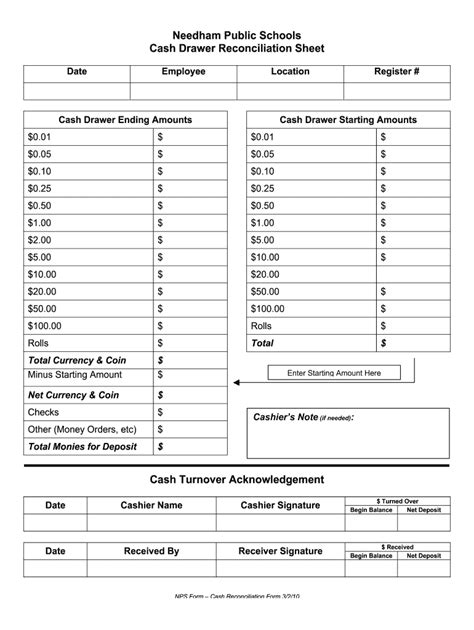

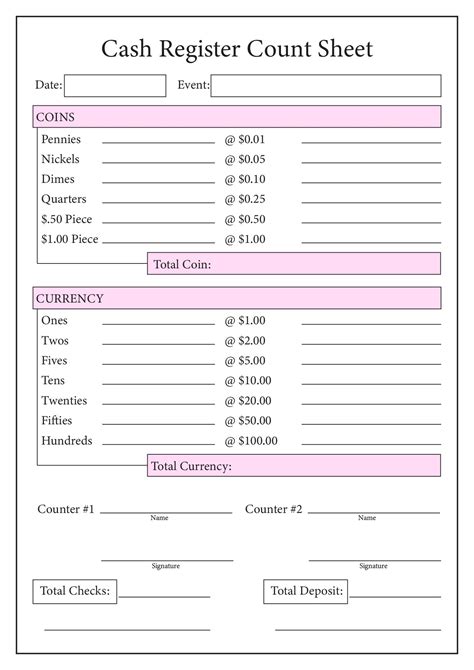

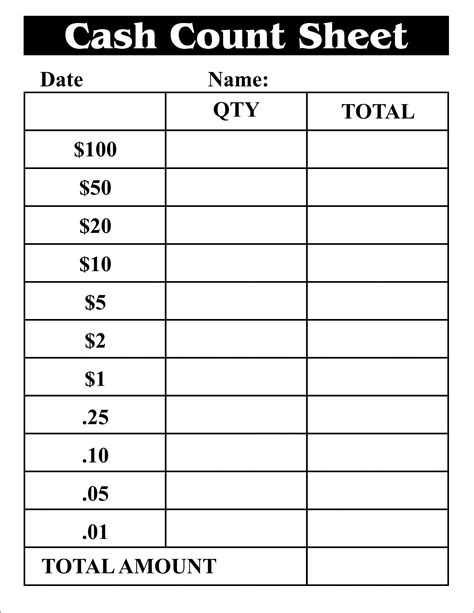

Here are some additional cash drawer count sheet templates that you can use in your business:

Cash Drawer Count Sheet Templates Gallery

We hope this article has provided you with valuable information on the importance of using a cash drawer count sheet in your business. By following the best practices outlined in this article, you can improve your cash handling procedures, reduce the risk of errors and theft, and maintain transparency in your financial transactions.